Featured image for does norwegian cruise line stock pay dividends

Image source: media.ycharts.com

Norwegian Cruise Line (NCLH) does not currently pay dividends, as the company has suspended its dividend program since 2020 to prioritize debt reduction and recovery from pandemic-related losses. This focus on financial stability over shareholder payouts reflects the broader challenges in the cruise industry, making NCLH stock a growth-focused, non-income investment for now.

Key Takeaways

- No current dividends: Norwegian Cruise Line suspended payouts since 2020.

- Focus on recovery: Reinvesting profits to stabilize post-pandemic operations.

- Future potential: Dividends may resume once financial health improves.

- Monitor earnings reports: Check quarterly updates for dividend policy changes.

- Compare alternatives: Consider other cruise stocks with active dividends.

- High risk, high reward: NCLH offers growth potential, not income.

📑 Table of Contents

- Does Norwegian Cruise Line Stock Pay Dividends? Find Out Now

- Historical Dividend Performance of Norwegian Cruise Line

- Why Norwegian Cruise Line Suspended Its Dividend (And Why It Hasn’t Restored It)

- Current Financial Health and Dividend Outlook (2024)

- Alternative Ways to Generate Income from Norwegian Cruise Line Stock

- Should You Invest in Norwegian Cruise Line for Dividends?

- Conclusion: The Bottom Line on Norwegian Cruise Line Dividends

Does Norwegian Cruise Line Stock Pay Dividends? Find Out Now

Investing in the stock market is a journey filled with choices, risks, and rewards. Among the many sectors investors explore, the cruise industry stands out due to its cyclical nature, high volatility, and significant exposure to global economic and health-related disruptions. Norwegian Cruise Line Holdings Ltd. (NCLH), one of the “Big Three” cruise operators alongside Carnival Corporation and Royal Caribbean Group, has long been a point of interest for both growth and income-focused investors. But one critical question often arises: Does Norwegian Cruise Line stock pay dividends?

For years, dividend-paying stocks have been a cornerstone of conservative and income-generating portfolios. Dividends provide shareholders with a tangible return on investment, often viewed as a sign of financial health and corporate confidence. However, the cruise industry has faced unprecedented challenges, especially during the global pandemic, which disrupted operations, halted revenue, and forced companies to reevaluate their financial strategies. Norwegian Cruise Line, like its peers, suspended its dividend program in early 2020—and has not reinstated it as of 2024. This blog post dives deep into the history, rationale, current status, and future outlook of Norwegian Cruise Line’s dividend policy. Whether you’re a current shareholder, a potential investor, or simply curious about the cruise industry’s financial dynamics, this guide will equip you with everything you need to know about NCLH dividends.

Historical Dividend Performance of Norwegian Cruise Line

When Did Norwegian Cruise Line First Pay Dividends?

Norwegian Cruise Line Holdings began paying dividends to shareholders in 2013, shortly after its initial public offering (IPO) in 2013. The company initiated a quarterly dividend of $0.10 per share, signaling confidence in its long-term profitability and commitment to returning capital to shareholders. This move was part of a broader strategy to attract income-focused investors and compete with other publicly traded cruise operators.

Visual guide about does norwegian cruise line stock pay dividends

Image source: suredividend.com

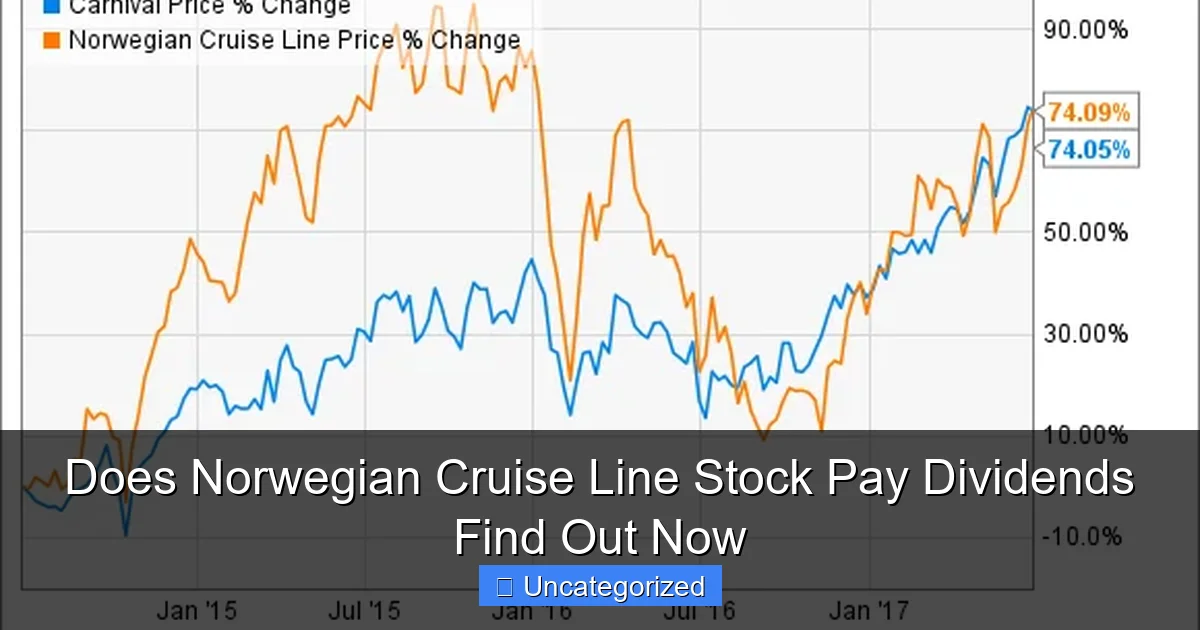

Over the next several years, the company maintained a consistent dividend schedule. From 2013 to 2019, Norwegian Cruise Line paid dividends without interruption, reflecting strong pre-pandemic financial performance. The company reported growing revenues, increasing passenger volumes, and expanding fleet capacity, which contributed to stable cash flows and investor confidence.

Dividend Growth and Yield Trends (2013–2019)

During its dividend-paying era, Norwegian Cruise Line demonstrated moderate but steady dividend growth. Here’s a breakdown of key data points:

- 2013: $0.10 per share (quarterly) → Annual yield: $0.40

- 2014: $0.10 per share (quarterly) → No change

- 2015: $0.12 per share (quarterly) → 20% increase

- 2016: $0.12 per share (quarterly) → No change

- 2017: $0.15 per share (quarterly) → 25% increase

- 2018: $0.15 per share (quarterly) → No change

- 2019: $0.15 per share (quarterly) → Annual yield: $0.60

At its peak in 2019, the dividend yield hovered around 1.8% to 2.2%, depending on the stock price. While not exceptionally high compared to traditional dividend aristocrats, it was competitive within the cruise sector and appealing to investors seeking exposure to a growing leisure industry.

The Pandemic Pivot: Dividend Suspension in 2020

The turning point came in March 2020, when Norwegian Cruise Line announced the suspension of its quarterly dividend due to the global shutdown of cruise operations caused by the COVID-19 pandemic. The company cited the need to preserve liquidity, manage debt obligations, and ensure long-term survival. This decision was not unique to NCLH—both Carnival and Royal Caribbean also suspended their dividends during this period.

The suspension was a necessary financial move. With ships idle, revenue plummeting, and massive fixed costs (fuel, maintenance, labor), the company needed to redirect all available capital toward survival. The dividend suspension saved Norwegian Cruise Line approximately $200 million annually, a critical buffer during one of the most challenging periods in the company’s history.

Why Norwegian Cruise Line Suspended Its Dividend (And Why It Hasn’t Restored It)

Financial Strain During the Pandemic

The cruise industry was among the hardest-hit sectors during the pandemic. Norwegian Cruise Line’s revenue dropped from $6.5 billion in 2019 to just $1.1 billion in 2020, a staggering 83% decline. The company reported a net loss of $4.0 billion in 2020 and $2.3 billion in 2021, highlighting the depth of the crisis.

To stay afloat, Norwegian Cruise Line raised over $6 billion in debt and equity financing during 2020–2022. This included high-interest loans, convertible notes, and dilutive share offerings. With a ballooning debt load and uncertain recovery timelines, reinstating dividends was not a priority. Instead, the focus shifted to:

- Restoring operations safely and gradually

- Rebuilding consumer confidence

- Improving balance sheet strength

- Meeting debt covenants and avoiding default

Debt Management and Balance Sheet Priorities

As of Q1 2024, Norwegian Cruise Line carries a total debt of approximately $13.2 billion, with a debt-to-equity ratio of over 5.0—a level considered high by industry standards. The company has been actively working to deleverage, including through:

- Asset sales (e.g., older ships)

- Cost-cutting initiatives

- Refinancing high-interest debt

- Increasing operating cash flow through strong booking trends

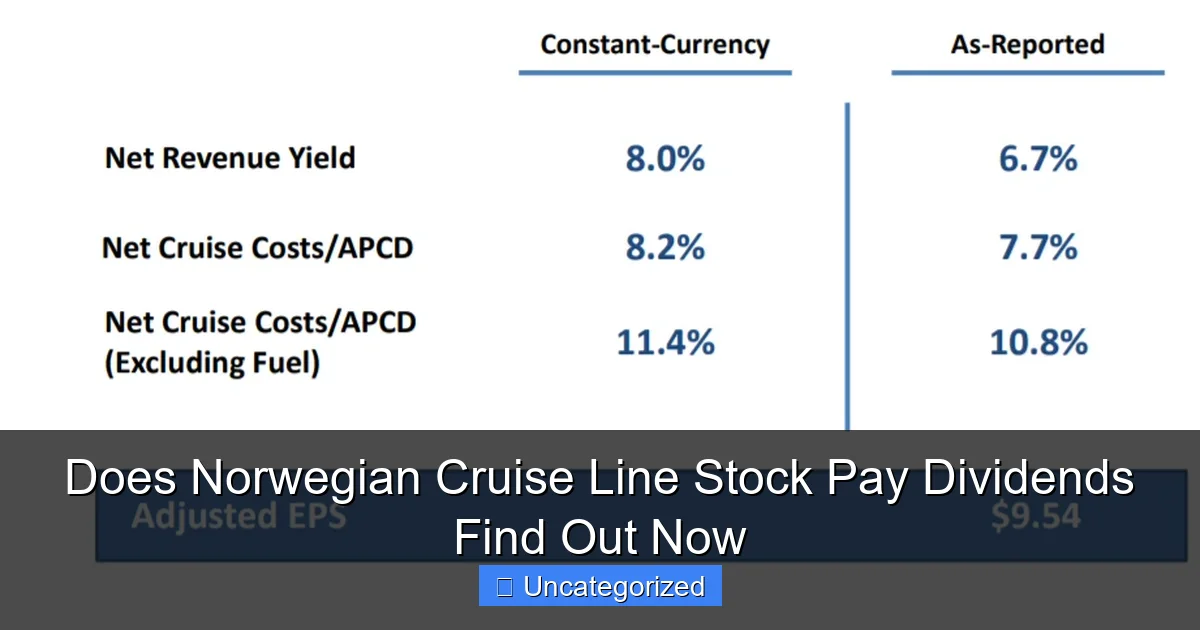

Reinstating dividends would require not only profitability but also a comfortable debt-to-EBITDA ratio and strong free cash flow. While EBITDA has improved—reaching $1.8 billion in 2023—free cash flow remains constrained due to capital expenditures (fleet modernization, new ship deliveries) and debt service obligations.

Industry-Wide Caution and Peer Behavior

Norwegian Cruise Line is not alone in its dividend hiatus. As of mid-2024:

- Carnival Corporation (CCL): Dividend suspended since 2020; no reinstatement announced

- Royal Caribbean Group (RCL): Dividend suspended; management has stated reinstatement is under review but not imminent

This industry-wide pause reflects a shared understanding: cruise companies must first achieve sustainable profitability, reduce leverage, and rebuild financial flexibility before considering shareholder distributions. Norwegian Cruise Line’s management has repeatedly emphasized that dividend reinstatement is not on the near-term agenda, with CFO Mark Kempa stating in a 2023 earnings call: “Our capital allocation priorities remain deleveraging and reinvestment in the business.”

Current Financial Health and Dividend Outlook (2024)

Revenue and Profitability Trends

Norwegian Cruise Line has shown strong recovery momentum. In 2023, the company reported:

- Total revenue: $7.2 billion (up from $1.1 billion in 2020)

- Net income: $255 million (first annual profit since 2019)

- Adjusted EBITDA: $1.8 billion

- Occupancy rates: Averaged 105% in Q4 2023 (above pre-pandemic levels)

Booking trends remain robust, with 2024 and 2025 sailings selling out quickly. The company has also benefited from premium pricing, onboard spending growth, and strong demand for its luxury brands (Oceania Cruises, Regent Seven Seas Cruises).

Free Cash Flow and Capital Allocation

While profitability has returned, free cash flow remains negative or minimal due to high capital expenditures. In 2023, the company spent over $1.2 billion on new ships, including the Norwegian Aqua (scheduled for 2025). These investments are essential for long-term competitiveness but delay dividend reinstatement.

Management has outlined a three-phase capital allocation strategy:

- Phase 1 (2020–2022): Survival – Focus on liquidity, debt, and restart

- Phase 2 (2023–2025): Recovery – Prioritize deleveraging and reinvestment

- Phase 3 (2026+): Return of Capital – Potential for dividends, buybacks, or special payouts

Most analysts believe Norwegian Cruise Line will not consider dividends before 2026, assuming continued profitability and debt reduction.

Analyst Sentiment and Market Expectations

Wall Street analysts remain cautious about near-term dividend reinstatement. According to Bloomberg consensus (as of June 2024):

- 0 out of 18 analysts expect a dividend in 2024

- 3 out of 18 expect a dividend by 2025

- 10 out of 18 believe dividends could return in 2026 or later

- 5 analysts are neutral, citing uncertainty in macroeconomic conditions

Investors should monitor key metrics such as:

- Debt-to-EBITDA ratio (target: below 3.0)

- Free cash flow margin (target: positive and growing)

- Net leverage ratio (target: below 4.0)

Alternative Ways to Generate Income from Norwegian Cruise Line Stock

Stock Buybacks as a Capital Return Mechanism

While dividends are paused, Norwegian Cruise Line has signaled interest in share repurchases as an alternative method of returning capital. Buybacks reduce the number of outstanding shares, increasing earnings per share (EPS) and potentially boosting stock price—benefiting shareholders indirectly.

In 2023, the company authorized a $500 million share repurchase program, though only $75 million was executed due to cash flow constraints. If free cash flow improves, buybacks could become a more active tool. Unlike dividends, buybacks are flexible—companies can pause or resume them without signaling financial distress.

Options Strategy: Covered Calls for Income

For income-focused investors holding NCLH stock, covered calls offer a practical way to generate monthly income, even without dividends. Here’s how it works:

- Own 100+ shares of NCLH

- Sell a call option (e.g., $20 strike, 1-month expiration)

- Receive a premium (e.g., $0.50 per share → $50 income)

- If the stock stays below the strike, keep the premium

- If the stock rises above the strike, shares may be called away (but at a profit)

Example: In May 2024, a $20 strike call option for NCLH (trading at $18.50) had a premium of $0.60. Selling 5 contracts (500 shares) generated $300 in income. This strategy works best in stable or slightly bullish markets.

Tip: Use platforms like Robinhood, E*TRADE, or Fidelity to execute covered calls. Always assess risk tolerance and potential for stock assignment.

Dividend ETFs with Cruise Exposure

If you want cruise industry exposure with dividend income, consider dividend-focused ETFs that hold NCLH alongside other dividend-paying stocks. Examples include:

- First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN): Holds NCLH and other travel/leisure stocks; yield ~1.5%

- Invesco S&P 500 High Dividend Low Volatility ETF (SPHD): Includes some cruise-related consumer discretionary stocks; yield ~4.2%

- Global X U.S. Infrastructure Development ETF (PAVE): Indirect exposure through port and transportation stocks; yield ~1.0%

While these ETFs don’t eliminate NCLH’s lack of dividends, they provide diversified income streams.

Should You Invest in Norwegian Cruise Line for Dividends?

Growth vs. Income: Understanding Your Investment Goals

Investing in Norwegian Cruise Line today is primarily a growth play, not an income play. The company’s value proposition lies in:

- Strong brand recognition (Norwegian, Oceania, Regent)

- Fleet expansion (new ships with higher yields)

- Premium pricing strategy

- Post-pandemic travel boom

If your goal is dividend income, NCLH is not currently suitable. Better alternatives include:

- Consumer staples (e.g., Procter & Gamble, Johnson & Johnson) – Stable, high-yield dividends

- Utilities (e.g., Duke Energy, NextEra Energy) – Reliable payouts

- REITs (e.g., Realty Income, Federal Realty) – High yields, monthly dividends

Risks and Rewards of Holding NCLH Stock

Before investing, consider these key risks:

- High leverage: Debt levels remain a concern

- Economic sensitivity: Demand drops during recessions

- Fuel price volatility: A major cost driver

- Geopolitical risks: Trade tensions, port closures

- No dividend safety net: No regular income if you need cash flow

However, rewards could include:

- Potential for strong capital appreciation

- Future dividend reinstatement (2026+)

- Buyback-driven EPS growth

- Exposure to a rebounding leisure sector

When Might Dividends Return? Expert Predictions

Based on current trends, here’s a realistic timeline:

| Year | Dividend Likelihood | Key Conditions |

|---|---|---|

| 2024 | Very Low | Focus on debt reduction, fleet investments |

| 2025 | Low to Moderate | Free cash flow positive, debt ratio below 4.0 |

| 2026 | Moderate to High | Debt-to-EBITDA under 3.0, stable macroeconomy |

| 2027+ | High | Strong profitability, investor demand for returns |

Note: A special dividend or buyback announcement could precede regular dividends, serving as a signal of confidence.

Conclusion: The Bottom Line on Norwegian Cruise Line Dividends

So, does Norwegian Cruise Line stock pay dividends? As of 2024, the answer is a clear no. The company suspended its dividend in 2020 to survive the pandemic and has not reinstated it due to ongoing debt management, capital reinvestment, and balance sheet repair priorities. While the company has returned to profitability and shows strong growth potential, returning capital to shareholders in the form of dividends remains a distant goal—likely not before 2026.

For investors, this means Norwegian Cruise Line should be viewed through a growth lens, not an income one. The stock offers compelling upside if the cruise industry continues its recovery, but it comes with higher volatility and no dividend safety net. If you’re seeking income, consider alternative strategies like covered calls, dividend ETFs, or other high-yield stocks. For long-term growth investors with a high risk tolerance, NCLH remains a speculative but potentially rewarding opportunity.

Stay informed, monitor key financial metrics, and keep an eye on management’s capital allocation updates. When Norwegian Cruise Line does reinstate its dividend—and it likely will—it will be a strong signal of financial maturity and confidence. Until then, the journey continues, one voyage at a time.

Frequently Asked Questions

Does Norwegian Cruise Line stock pay dividends to shareholders?

No, Norwegian Cruise Line (NCLH) does not currently pay dividends to its shareholders. The company has suspended its dividend since 2020 to preserve capital during the pandemic and has not reinstated it as of 2024.

Why doesn’t Norwegian Cruise Line pay dividends like other stocks?

Norwegian Cruise Line prioritizes reinvesting profits into fleet expansion, debt reduction, and operational recovery post-pandemic. This strategy aligns with most cruise stocks, which rarely pay dividends due to capital-intensive business models.

When will Norwegian Cruise Line stock start paying dividends again?

There is no official timeline for reinstating dividends on Norwegian Cruise Line stock. Investors should monitor the company’s earnings reports and management guidance for updates on future dividend policies.

Is Norwegian Cruise Line a good long-term investment without dividends?

While NCLH doesn’t offer dividend income, its growth potential lies in post-pandemic recovery and revenue expansion. Long-term investors may benefit from stock appreciation if the company achieves sustained profitability.

How do Norwegian Cruise Line’s dividends compare to Carnival or Royal Caribbean?

Like Norwegian Cruise Line, Carnival (CCL) and Royal Caribbean (RCL) also suspended dividends during the pandemic and have not resumed them. All three cruise stocks focus on growth over dividend payouts.

What are the alternatives to Norwegian Cruise Line stock for dividend income?

If you seek dividend-paying travel stocks, consider airline or hospitality REITs (Real Estate Investment Trusts). These sectors often offer higher yields compared to cruise line stocks, which prioritize reinvestment.