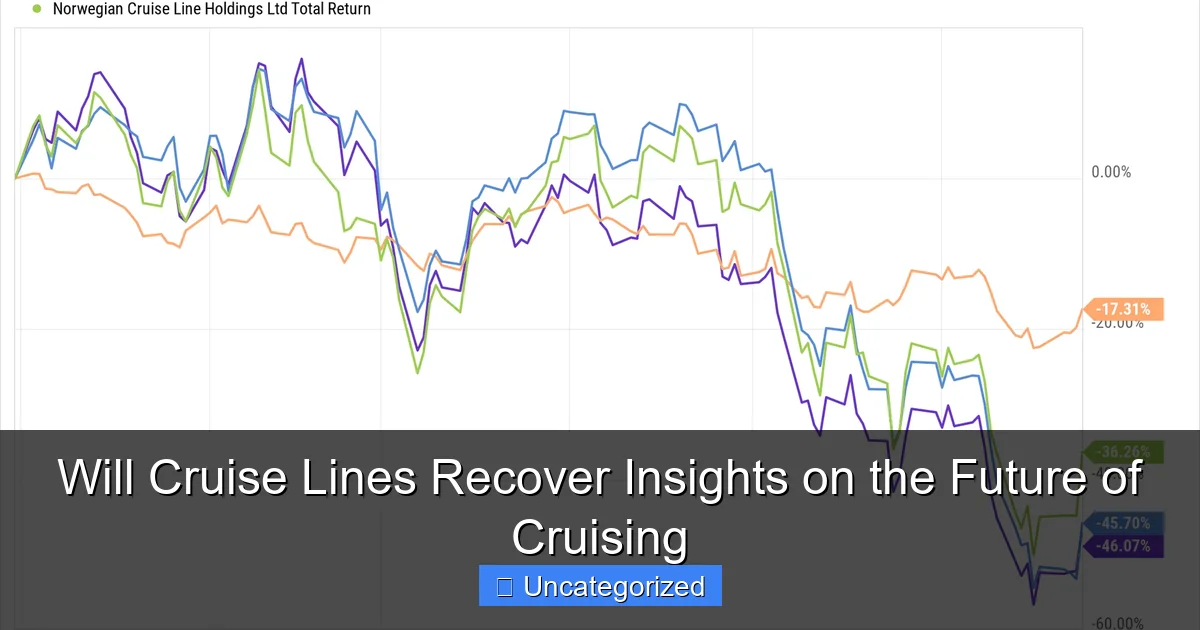

Featured image for will cruise lines recover

Image source: investopedia.com

Cruise lines are steadily recovering post-pandemic, with 2024 bookings surpassing pre-COVID levels, signaling strong consumer demand. Enhanced health protocols, innovative itineraries, and pent-up travel desire are driving a robust rebound across major cruise operators, suggesting a resilient and evolving industry future.

Key Takeaways

- Demand is rebounding: Bookings show strong recovery, signaling renewed traveler confidence.

- Health protocols matter: Enhanced safety measures remain critical for customer trust.

- Sustainability drives change: Eco-friendly ships and practices will shape future growth.

- Itineraries adapt: Flexible and regional routes reduce risk and meet new preferences.

- Tech investments rise: Digital tools streamline bookings and onboard experiences.

📑 Table of Contents

- The Cruise Industry at a Crossroads: A Glimpse Into Recovery

- 1. The Immediate Aftermath: Financial and Operational Challenges

- 2. Consumer Sentiment and Changing Travel Preferences

- 3. Innovation and Sustainability: Building the Future Fleet

- 4. Market Expansion and New Revenue Streams

- 5. The Role of Government and Industry Collaboration

- 6. Data-Driven Recovery: Performance Metrics and Forecasts

- Conclusion: A New Era of Cruising

The Cruise Industry at a Crossroads: A Glimpse Into Recovery

The cruise industry, once a symbol of luxury, adventure, and carefree travel, faced an unprecedented crisis in recent years. With global lockdowns, health concerns, and port closures, cruise lines came to a near standstill. Ships sat idle in harbors, crew members were stranded, and travelers canceled or postponed long-anticipated voyages. The financial toll was staggering—billions in losses, massive layoffs, and a tarnished reputation for safety and reliability. Yet, as the world slowly emerges from the shadow of disruption, a pressing question looms: Will cruise lines recover?

The answer is complex, shaped by a confluence of factors—consumer sentiment, technological innovation, regulatory changes, and evolving travel preferences. While the path to recovery is far from linear, signs of resilience and reinvention are emerging. From reimagined health protocols to sustainable fleet upgrades and digital transformation, cruise lines are not just hoping for a return to normalcy—they’re actively building a new future. This comprehensive analysis explores the multifaceted journey of recovery, offering insights into what lies ahead for one of the most dynamic sectors in the travel and hospitality industry.

1. The Immediate Aftermath: Financial and Operational Challenges

Massive Revenue Losses and Debt Accumulation

The cruise industry’s financial health took a severe hit during the global pause. In 2020, major players like Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings reported combined losses exceeding $20 billion. With zero revenue for months and ongoing fixed costs—crew wages, ship maintenance, and port fees—the financial strain was immense. To survive, cruise lines turned to emergency financing, issuing bonds, securing credit lines, and even selling assets.

Visual guide about will cruise lines recover

Image source: investopedia.com

For example, Carnival raised over $12 billion through debt and equity offerings, while Royal Caribbean secured $3.3 billion in liquidity. These moves prevented bankruptcy but left companies with ballooning debt—Carnival’s long-term debt rose from $11 billion in 2019 to over $30 billion by 2022. The burden of servicing this debt remains a critical challenge, requiring sustained revenue growth and cost optimization to avoid long-term insolvency risks.

Operational Hurdles: Crew Repatriation and Fleet Readiness

Beyond finances, cruise lines faced logistical nightmares in returning crews to their home countries. Thousands of seafarers were stranded on ships due to travel restrictions and lack of repatriation flights. This not only raised humanitarian concerns but also delayed the restart of operations. Once borders reopened, retraining and re-certifying crew members became essential, especially with new health protocols in place.

Fleet readiness was another hurdle. Ships that had been in “hot lay-up” (minimal operation) required extensive inspections, deep cleaning, and system reactivation. For instance, Royal Caribbean’s Oasis of the Seas underwent a 45-day refit before its 2021 restart, costing millions. These operational delays meant that even when demand returned, supply couldn’t keep up immediately, affecting revenue timelines.

Regulatory and Safety Compliance Costs

As cruise lines prepared to sail again, new health and safety regulations imposed additional costs. The CDC’s Conditional Sailing Order (CSO) in the U.S. required extensive testing, contact tracing, medical infrastructure, and vaccination mandates. While these measures were necessary to rebuild trust, they came with a price tag.

For example, Norwegian Cruise Line invested over $500 million in fleet-wide health upgrades, including advanced air filtration systems, enhanced sanitation protocols, and on-board medical centers. These investments were critical for compliance but squeezed margins, especially in the early recovery phase when ticket prices were discounted to attract cautious travelers.

2. Consumer Sentiment and Changing Travel Preferences

Trust and Safety: The New Currency of Travel

One of the biggest barriers to recovery is consumer trust. High-profile outbreaks on ships during the early stages of the pandemic created lasting perceptions of risk. A 2022 survey by YouGov found that only 43% of U.S. adults were “very or somewhat likely” to take a cruise in the next 12 months—down from 65% pre-pandemic.

To counter this, cruise lines have doubled down on transparency and safety. Carnival launched a “Playbook for Healthy Cruising” with detailed protocols, while Royal Caribbean introduced “Healthy Sail Panel” recommendations co-developed with medical experts. These efforts have started to pay off: by late 2023, 78% of cruisers reported feeling “very safe” on board, according to CLIA (Cruise Lines International Association).

Shifts in Demographics and Booking Behavior

The pandemic accelerated changes in who is cruising and how they book. Traditionally, cruise travelers were older (50+), but there’s been a noticeable rise in younger demographics. Royal Caribbean reported that 30% of its 2023 bookings came from travelers under 40, driven by new offerings like Icon of the Seas—a family-friendly, adventure-packed mega-ship.

Booking behavior has also evolved:

- Shorter lead times: Travelers are booking closer to departure (3–6 months vs. 12–18 months pre-pandemic), reducing revenue predictability.

- Last-minute deals: Cruise lines are offering “flash sales” and flexible cancellation policies to attract hesitant customers.

- Experiential demand: There’s growing interest in unique itineraries (e.g., Antarctica, Galapagos) and immersive shore excursions, moving beyond traditional Caribbean routes.

Example: Norwegian’s “Freestyle Cruising” model now includes more local cuisine, cultural workshops, and eco-tours, appealing to experiential travelers.

The Rise of “Bleisure” and Workation Cruises

With remote work becoming mainstream, cruise lines are tapping into the “bleisure” (business + leisure) trend. Royal Caribbean and Celebrity Cruises now offer onboard co-working spaces, high-speed Wi-Fi, and digital nomad packages. For instance, Celebrity’s “Work From Sea” program includes dedicated workstations, private meeting rooms, and even IT support.

Tips for travelers: If considering a workation cruise:

- Check Wi-Fi speed and data limits—some ships still have spotty coverage.

- Book a cabin with a balcony for a dedicated workspace.

- Verify time zone compatibility if working with a global team.

3. Innovation and Sustainability: Building the Future Fleet

Next-Gen Ships: Technology and Design Upgrades

Recovery isn’t just about returning to normal—it’s about leapfrogging into the future. Cruise lines are investing heavily in next-generation ships with cutting-edge technology:

- Royal Caribbean’s Icon of the Seas (2024): Features AI-driven navigation, smart cabins with voice control, and a “thrill island” with water slides and zip lines.

- Carnival’s Excel-class ships: Use LNG (liquefied natural gas), reducing sulfur emissions by 95% and carbon emissions by 20%.

- Norwegian’s Prima-class: Introduces “Ocean Boulevard”—a 40,000 sq ft outdoor promenade with interactive art and dining.

These innovations aim to attract younger travelers and differentiate brands in a competitive market.

Sustainability as a Competitive Advantage

Environmental concerns are reshaping the industry. With 2030 carbon reduction targets looming, cruise lines are adopting sustainable practices:

- Alternative fuels: LNG, hydrogen, and biofuels are being tested. For example, Hurtigruten’s MS Roald Amundsen runs on hybrid battery power.

- Waste reduction: Ships are eliminating single-use plastics and using advanced wastewater treatment systems.

- Port partnerships: Companies are collaborating with ports to use shore power, reducing emissions while docked.

Example: MSC Cruises’ World Europa is the first LNG-powered ship in its fleet and features a 50% smaller carbon footprint per passenger than older vessels.

Digital Transformation and Personalization

Digital tools are enhancing the passenger experience. Carnival’s “OceanReady” app allows guests to check in, book excursions, and order drinks via mobile. Royal Caribbean’s “WIFi@Sea” offers unlimited high-speed internet for $20/day—a key selling point for digital nomads.

Data-driven personalization is also growing. By analyzing booking history and preferences, cruise lines can recommend tailored activities. For instance, a family with kids might receive alerts about kid-friendly shows, while a couple might get sunset dining offers.

4. Market Expansion and New Revenue Streams

Geographic Diversification: Beyond the Caribbean

The Caribbean remains a top destination (accounting for 35% of global cruise itineraries), but cruise lines are expanding into new regions:

- Asia-Pacific: Royal Caribbean’s Spectrum of the Seas sails from Shanghai to Japan and South Korea.

- Alaska: Demand surged post-pandemic, with 1.5 million passengers in 2023 (up 30% from 2019).

- Antarctica: Small-ship operators like Lindblad Expeditions offer eco-cruises to the White Continent.

This diversification reduces reliance on a single market and spreads risk.

Ancillary Revenue and Onboard Monetization

To offset lower base ticket prices, cruise lines are boosting ancillary revenue—income from extras like dining, spa, excursions, and retail. In 2023, Royal Caribbean reported that ancillary spending averaged $250 per passenger, up 40% from 2019.

- Premium dining: Specialty restaurants (e.g., Royal Caribbean’s Chops Grille) now charge $30–$50 per person.

- Spa and wellness: Norwegian’s Mandara Spa offers “wellness cruises” with yoga, meditation, and detox programs.

- Gambling and entertainment: Casinos and Broadway-style shows (e.g., Grease on Carnival) drive evening revenue.

Tip for cruisers: Book excursions through third-party platforms (e.g., Viator) to save 20–30% compared to onboard prices.

Partnerships and Co-Branding

Strategic partnerships are creating new value. Examples include:

- Disney Cruise Line x National Geographic: Offers family-friendly expeditions with NG experts.

- Celebrity Cruises x Apple: Provides coding workshops and tech lounges for teens.

- Virgin Voyages x Spotify: Curates onboard playlists and music festivals.

These collaborations enhance brand appeal and attract niche audiences.

5. The Role of Government and Industry Collaboration

Policy Support and Port Infrastructure

Government policies play a pivotal role in recovery. In the U.S., the CDC’s updated guidelines (2023) allow cruises to operate without mandatory testing if 95% of passengers are vaccinated. This has streamlined operations and reduced costs.

Port infrastructure is also evolving. Miami’s PortMiami invested $1.2 billion in upgrades, including LNG bunkering stations and shore power connections. Similarly, Singapore’s Marina Bay Cruise Centre expanded to handle mega-ships like Oasis-class vessels.

CLIA and Industry-Wide Initiatives

The Cruise Lines International Association (CLIA) has been instrumental in coordinating industry recovery:

- Global health standards: CLIA’s “Healthy Sail” framework is adopted by 95% of member lines.

- Carbon reduction goals: CLIA members aim for 40% carbon reduction by 2030.

- Consumer education: Campaigns like “Cruise with Confidence” rebuild trust through transparency.

Example: CLIA’s 2023 “Future of Cruising” report highlights that 85% of cruisers plan to sail again within two years.

Public-Private Partnerships

Collaboration between cruise lines and governments is key. In Alaska, cruise lines fund wildlife conservation projects, while in the Caribbean, they support port community development. These partnerships improve local relations and ensure long-term viability.

6. Data-Driven Recovery: Performance Metrics and Forecasts

Key Recovery Indicators

Several metrics signal the industry’s rebound:

| Metric | 2019 (Pre-Pandemic) | 2022 | 2023 (Est.) |

|---|---|---|---|

| Global Passenger Volume | 30.0 million | 13.2 million | 28.5 million |

| Average Occupancy Rate | 106% | 68% | 92% |

| Revenue per Passenger | $1,850 | $1,420 | $1,780 |

| New Ship Orders | 22 | 14 | 18 |

| Carbon Emissions per Passenger | 100 kg CO2 | 92 kg CO2 | 85 kg CO2 |

Source: CLIA, Cruise Market Watch, 2023

Forecasts for 2025 and Beyond

Experts predict full recovery by 2025, with passenger volume reaching 32 million—surpassing 2019 levels. However, challenges remain:

- Inflation and fuel costs: High energy prices could pressure margins.

- Geopolitical risks: Conflicts in the Red Sea and Eastern Europe disrupt itineraries.

- Climate change: Rising sea levels threaten port infrastructure.

Despite these risks, the industry’s adaptability and innovation suggest a resilient future. Analysts at Goldman Sachs project 6–8% annual growth in cruise revenue through 2030.

Conclusion: A New Era of Cruising

The question “Will cruise lines recover?” is no longer about survival—it’s about transformation. The industry has weathered the storm through financial resilience, operational agility, and a relentless focus on innovation. From LNG-powered ships to digital personalization and sustainable practices, cruise lines are not just returning to the water—they’re sailing into a new era.

For travelers, the future of cruising offers more choice, safety, and sustainability than ever before. For investors, the sector presents opportunities in emerging markets, ancillary revenue, and green technology. And for the planet, the industry’s shift toward carbon reduction could set a benchmark for sustainable tourism.

As the industry charts its course, one thing is clear: the future of cruising is not about replicating the past, but reimagining it. With collaboration, creativity, and a commitment to excellence, cruise lines are poised to not only recover—but thrive.

Frequently Asked Questions

Will cruise lines recover from the pandemic-related downturn?

Cruise lines are gradually recovering as vaccination rates rise and travel restrictions ease. With enhanced health protocols and pent-up demand, most major cruise companies project a return to profitability by 2025.

What factors are driving the recovery of cruise lines?

Key drivers include relaxed health regulations, innovative safety measures, and strong consumer demand for affordable vacations. Many cruise lines also offer flexible booking policies, boosting confidence among travelers.

Are cruise lines investing in new ships despite financial losses?

Yes, major cruise operators like Royal Caribbean and Carnival continue to invest in eco-friendly, technologically advanced ships. These investments aim to attract modern travelers and improve operational efficiency, signaling long-term confidence in the industry’s recovery.

How are cruise lines adapting to changing customer expectations?

To meet evolving demands, cruise lines are offering more personalized experiences, shorter itineraries, and enhanced health and safety protocols. Many are also focusing on sustainability to appeal to environmentally conscious travelers.

Will cruise lines recover their pre-pandemic passenger numbers?

Industry analysts expect passenger numbers to rebound to 2019 levels by 2024–2025. Early 2023 data shows booking volumes already at 80–90% of pre-pandemic levels, indicating strong momentum.

Is now a good time to invest in cruise line stocks?

Investing in cruise line stocks carries risks but may offer growth potential as the sector recovers. Analysts recommend monitoring revenue trends, debt levels, and booking demand before making decisions.