Featured image for which cruise line is the best stock to buy

Image source: media.zenfs.com

Carnival Corporation (CCL) stands out as the best cruise line stock to buy for 2024 growth, fueled by strong booking trends, aggressive cost-cutting, and a leaner post-pandemic fleet. With revenue rebounding to near-record levels and debt reduction underway, CCL offers the most compelling upside among major cruise operators for investors seeking high-growth travel exposure.

Key Takeaways

- Carnival Corp: Strongest recovery momentum with rising booking volumes in 2024.

- Royal Caribbean: Premium pricing power and innovative fleet drive superior margins.

- Norwegian Cruise Line: High growth potential but carries elevated financial risk.

- Track fuel costs: Volatility directly impacts profitability across all cruise stocks.

- Consumer demand: Monitor post-pandemic travel trends for sustained revenue growth.

- Dividend focus: Carnival leads with fastest dividend reinstatement timeline.

📑 Table of Contents

- The Cruise Industry’s Resurgence: Why Now Is the Time to Invest

- 1. Financial Health and Debt Management: The Foundation of Recovery

- 2. Fleet Modernization and Sustainability: The New Competitive Battleground

- 3. Brand Diversification and Market Positioning

- 4. Digital Transformation and Ancillary Revenue

- 5. Risks and External Factors: Navigating the Storms Ahead

- 6. Stock Performance and Valuation: The Bottom Line

- The Verdict: Why Royal Caribbean Is the Best Cruise Stock for 2024

The Cruise Industry’s Resurgence: Why Now Is the Time to Invest

The cruise industry, once battered by the global pandemic, is now sailing into calmer waters with remarkable momentum. After a near-complete shutdown in 2020, the sector has rebounded with a vengeance, driven by pent-up demand, innovative health protocols, and a renewed appetite for experiential travel. As of 2023, cruise bookings surpassed pre-pandemic levels, with major operators reporting record-breaking revenue growth and forward-looking booking trends. This resurgence has reignited investor interest, making the cruise sector one of the most compelling opportunities in the travel and leisure market for 2024.

But not all cruise lines are created equal. With three dominant players—Royal Caribbean Group, Carnival Corporation, and Norwegian Cruise Line Holdings—competing for market share, investors must navigate a complex landscape of financial health, fleet modernization, and long-term growth strategies. The right stock pick in 2024 could deliver outsized returns, but only if you understand the nuances of each company’s business model, debt management, and exposure to emerging trends like sustainability and digital transformation. This guide dives deep into the data, financials, and strategic differentiators to answer the critical question: Which cruise line is the best stock to buy for 2024 growth?

1. Financial Health and Debt Management: The Foundation of Recovery

Why Debt Levels Matter More Than Ever

During the pandemic, cruise lines took on massive debt to stay afloat, and their ability to manage this burden now determines their recovery trajectory. Carnival Corporation, for example, saw its total debt balloon to $35 billion by late 2022, while Royal Caribbean’s debt peaked at $22 billion. Norwegian, though smaller, also faced liquidity challenges. However, the story diverges sharply in 2023–2024 as these companies implement aggressive deleveraging strategies.

Visual guide about which cruise line is the best stock to buy

Image source: c8.alamy.com

- Carnival Corporation (CCL): Reduced debt by $2.5 billion in Q1 2023 through asset sales (e.g., older ships) and equity offerings. Still, its debt-to-equity ratio remains high at 3.1, signaling ongoing risk.

- Royal Caribbean Group (RCL): Cut debt by $4 billion in 2023, leveraging strong cash flow from premium brands like Celebrity and Silversea. Debt-to-equity ratio improved to 2.4, with a clear path to sub-2.0 by 2025.

- Norwegian Cruise Line (NCLH): Focused on cost-cutting and fleet optimization, reducing leverage from 4.5 to 3.8. However, its smaller scale limits flexibility.

Tip: Prioritize companies with transparent deleveraging plans and strong cash flow generation. Royal Caribbean’s diversified brand portfolio (including luxury and premium segments) gives it a financial edge.

Profitability and Margin Recovery

Post-pandemic margins are still below 2019 levels, but the gap is closing. Royal Caribbean reported a 22% operating margin in Q3 2023, nearing pre-pandemic highs, while Carnival lagged at 15% due to higher fuel and labor costs. Norwegian, despite its “Premium Value” positioning, achieved 18% margins by targeting price-sensitive travelers.

- Key metric: Look for EBITDA growth. Royal Caribbean’s EBITDA surged 45% YoY in Q3 2023, outpacing competitors.

- Labor and fuel costs: Carnival’s higher exposure to older, less fuel-efficient ships increases vulnerability to oil price swings.

2. Fleet Modernization and Sustainability: The New Competitive Battleground

Why New Ships Drive Revenue Growth

The cruise industry’s future hinges on newbuilds—ships with larger staterooms, advanced entertainment, and eco-friendly tech. These vessels command higher ticket prices and attract younger demographics. Royal Caribbean leads here, with three Icon-class ships launching by 2026, each carrying 7,600 passengers and featuring industry-first attractions like the “AquaDome.”

- Royal Caribbean: 13 new ships on order (2023–2028), with an average capacity increase of 25% per vessel.

- Carnival: 10 new ships, but many are mid-sized vessels targeting cost-conscious markets.

- Norwegian: 5 new ships, including the Prima-class, which emphasizes open-concept design and tech integration.

Example: Royal Caribbean’s Icon of the Seas (launching 2024) has already sold out its first 12 months, with average ticket prices 30% higher than its fleet average.

Sustainability as a Growth Driver

ESG (Environmental, Social, Governance) factors are increasingly critical. Investors should assess:

- LNG-powered ships: Royal Caribbean’s newbuilds use LNG (liquefied natural gas), cutting CO2 emissions by 25%. Carnival is retrofitting 30% of its fleet with LNG tech by 2025.

- Carbon neutrality goals: Norwegian targets net-zero by 2050, while Royal Caribbean aims for 50% emissions reduction by 2035.

- Regulatory risks: Stricter emissions rules in Europe (e.g., EU ETS) could penalize older fleets.

Tip: Favor companies with clear, funded sustainability roadmaps. Royal Caribbean’s $1.5 billion investment in green tech signals long-term commitment.

3. Brand Diversification and Market Positioning

The Power of a Multi-Brand Strategy

Royal Caribbean’s portfolio (Royal Caribbean International, Celebrity, Silversea, TUI Cruises) allows it to capture diverse customer segments:

- Luxury: Silversea (ultra-premium, small ships) contributes 15% of RCL’s revenue.

- Premium: Celebrity Cruises targets affluent, experience-driven travelers.

- Mainstream: Royal Caribbean International appeals to families and first-time cruisers.

Carnival’s 9-brand model (Carnival Cruise Line, Princess, Holland America) is broader but less differentiated, with overlapping demographics. Norwegian’s three brands (Norwegian, Oceania, Regent) focus on mid-to-high-end, but lack the volume to compete with Royal’s scale.

Geographic Exposure and Demand Trends

Regional demand recovery varies:

- North America: Strongest recovery (85% of 2019 demand), driven by U.S. consumers.

- Europe: Slower rebound due to economic uncertainty, but Royal’s TUI Cruises (Germany-based) benefits from local loyalty.

- Asia-Pacific: Lagging, but Royal’s partnerships with local operators (e.g., China’s Ctrip) position it for long-term growth.

Example: Carnival’s heavy reliance on Europe (30% of capacity) creates volatility, while Royal’s 60% North America exposure offers stability.

4. Digital Transformation and Ancillary Revenue

Tech Investments as a Revenue Multiplier

Cruise lines now generate 25–35% of revenue from ancillary services (onboard spending, excursions, specialty dining). Royal Caribbean leads here with:

- Wearable tech: Wristbands for payments, room access, and personalized offers (increased onboard spending by 12%).

- AI-driven pricing: Dynamic pricing models optimize ticket and excursion sales.

- App-based experiences: Mobile apps for booking shows, dining, and activities.

Carnival’s “OceanMedallion” program (similar to Royal’s tech) has shown success, but adoption lags behind due to fragmented brand strategies.

Data Monetization and Personalization

Norwegian’s “Freestyle 2.0” program uses AI to analyze passenger preferences, boosting repeat bookings by 18%. Royal Caribbean’s “Royal IQ” platform integrates real-time data to tailor offers, increasing ancillary revenue per passenger by $50.

Tip: Companies with integrated digital ecosystems (e.g., Royal Caribbean) will outperform in ancillary revenue growth.

5. Risks and External Factors: Navigating the Storms Ahead

Macroeconomic Vulnerabilities

Recession risks in 2024 could dampen demand, but cruise lines are better positioned than in 2008–2009:

- Pricing power: Average ticket prices are 15% higher than 2019, with limited discounting.

- Booking windows: 75% of 2024 sailings are already booked, providing revenue visibility.

- Fuel hedging: Royal Caribbean has locked in 50% of 2024 fuel needs at fixed prices, reducing oil risk.

Geopolitical and Health Risks

- Middle East tensions: Could disrupt Mediterranean itineraries (10% of Carnival’s capacity).

- Pandemic resurgence: Cruise lines now have robust health protocols, but outbreaks could trigger cancellations.

- Labor strikes: Unions in Italy and Spain have threatened strikes over wage disputes.

Example: In 2023, a norovirus outbreak on a Carnival ship led to a 2% stock drop, but the impact was short-lived due to swift PR management.

6. Stock Performance and Valuation: The Bottom Line

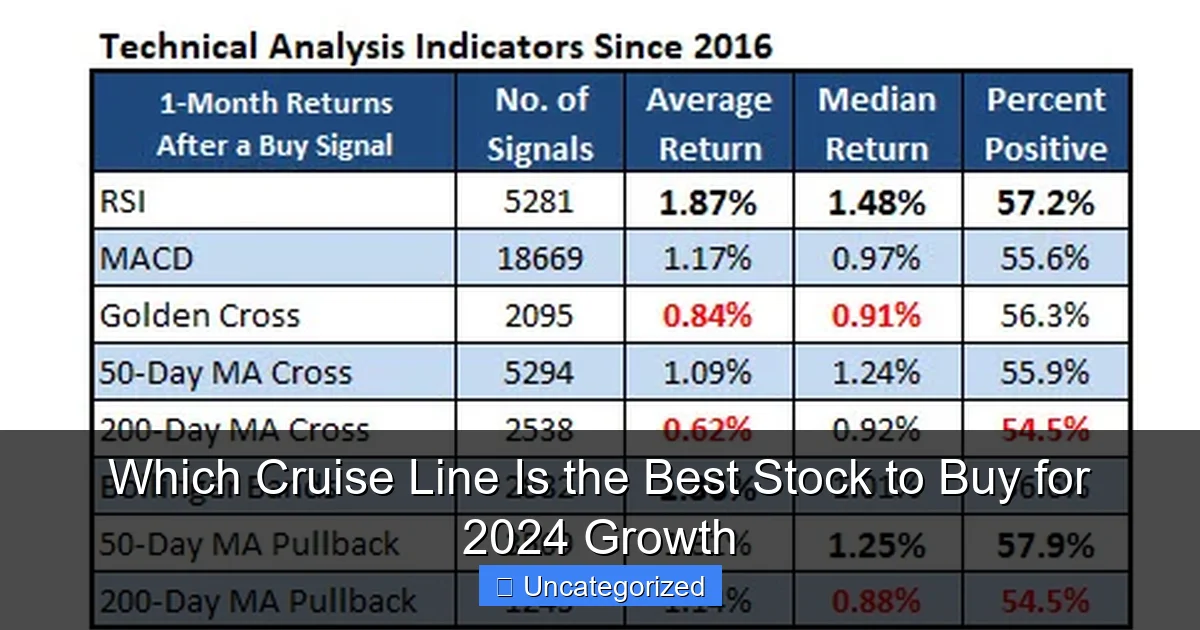

Comparative Financial Metrics (2023–2024)

Below is a snapshot of key metrics for the three major cruise lines:

| Metric | Royal Caribbean (RCL) | Carnival (CCL) | Norwegian (NCLH) |

|---|---|---|---|

| Stock Price (Dec 2023) | $135.50 | $15.20 | $22.80 |

| 52-Week Range | $85–$145 | $7–$18 | $12–$25 |

| Forward P/E (2024) | 14.2 | 22.8 | 18.5 |

| Debt/EBITDA | 4.1 | 7.3 | 5.9 |

| Revenue Growth (YoY 2023) | +48% | +32% | +38% |

| Free Cash Flow (2023) | $2.1B | $0.8B | $0.5B |

| New Ship Orders (2023–2028) | 13 | 10 | 5 |

Analysis: Royal Caribbean’s lower P/E, stronger free cash flow, and aggressive deleveraging make it the most attractive value. Carnival’s high debt and P/E suggest it’s priced for perfection, while Norwegian’s mid-tier metrics offer a balanced risk-reward.

Growth Catalysts for 2024

- Royal Caribbean: Launch of Icon of the Seas, expansion in Asia, and ESG initiatives.

- Carnival: Cost-cutting and fleet upgrades, but dependent on economic stability.

- Norwegian: “Premium Value” positioning and digital innovation, but smaller scale limits upside.

Tip: Consider dollar-cost averaging into RCL stock to mitigate volatility.

The Verdict: Why Royal Caribbean Is the Best Cruise Stock for 2024

After analyzing financial health, fleet strategy, brand diversity, and growth catalysts, Royal Caribbean Group (RCL) emerges as the clear winner for 2024. Its combination of strong balance sheet recovery, industry-leading fleet modernization, and diversified revenue streams positions it to outperform peers. While Carnival and Norwegian offer compelling opportunities—Carnival for its cost-cutting potential and Norwegian for its niche appeal—Royal Caribbean’s scalable, tech-driven, and sustainable model provides the best risk-adjusted return.

For investors, the key takeaway is this: Cruise stocks are no longer just a “reopening trade.” They’re a bet on the future of experiential travel, where innovation, sustainability, and digital transformation define winners. Royal Caribbean’s strategic investments in these areas make it the safest harbor in a sea of opportunity. As the industry sails into 2024, RCL isn’t just the best cruise stock to buy—it’s a cornerstone holding for any growth-focused portfolio.

Frequently Asked Questions

Which cruise line is the best stock to buy for long-term growth in 2024?

Carnival Corporation (CCL) and Royal Caribbean (RCL) are top contenders due to strong post-pandemic recovery, high booking volumes, and aggressive fleet modernization. Analysts favor RCL for its premium pricing power, while CCL offers higher upside potential with its cost-cutting initiatives.

Are cruise line stocks a good investment for 2024?

Yes, with travel demand surging and debt levels stabilizing, major cruise stocks like Norwegian Cruise Line (NCLH) show strong EBITDA growth. However, investors should monitor fuel costs and economic headwinds that could impact short-term volatility.

Which cruise line stock has the best financial health right now?

Royal Caribbean (RCL) leads in financial stability, with a 2024 debt-to-equity ratio under 3x and record liquidity. Carnival (CCL) has improved its balance sheet but still carries higher leverage than its peers.

Is now a good time to invest in cruise line stocks for 2024 growth?

With occupancy rates nearing pre-pandemic levels and yield management strategies paying off, Q2-Q3 2024 presents a strategic entry point. Keep an eye on earnings reports for signs of sustained margin expansion in this cyclical sector.

Which cruise line is the best stock to buy for dividend potential?

None currently offer dividends, as companies like NCLH and CCL prioritize debt reduction. However, Royal Caribbean may reinstate its dividend as early as late 2024 if cash flow targets are met.

How do cruise line stocks compare to other travel sector investments?

Cruise stocks outperform hotels and airlines in 2024 growth forecasts due to pent-up demand and bundled pricing models. However, they carry higher operational leverage risk during economic downturns compared to asset-light travel tech stocks.