Featured image for how much is disney cruise line vacation protection plan

Image source: images.ctfassets.net

The Disney Cruise Line Vacation Protection Plan is worth the investment for peace of mind, covering trip cancellations, medical emergencies, and missed connections. Priced at 8-10% of your cruise cost, it offers comprehensive benefits—including 100% reimbursement for cancellations and 24/7 emergency assistance—making it a smart choice for families and high-value itineraries. For stress-free travel, this plan delivers unmatched value when unexpected disruptions occur.

Key Takeaways

- Costs 10-12% of trip: Plan price scales with total cruise cost.

- Covers cancellations: Reimburses pre-paid expenses for covered reasons.

- Includes medical emergencies: Pays for onboard or emergency care.

- Protects delays: Compensates for missed sailings due to weather or strikes.

- No pre-existing condition waivers: Disclose health issues to ensure coverage.

- Compare alternatives: Third-party plans may offer broader benefits.

📑 Table of Contents

- Is the Disney Cruise Line Vacation Protection Plan Worth the Investment?

- Understanding the Disney Cruise Line Vacation Protection Plan

- How Much Does the Disney Cruise Line Vacation Protection Plan Cost?

- Comparing Disney’s Plan to Third-Party Travel Insurance

- Real-World Scenarios: When the Protection Plan Pays Off

- Tips to Maximize the Value of Your Protection Plan

- Final Verdict: Is the Disney Cruise Line Vacation Protection Plan Worth It?

Is the Disney Cruise Line Vacation Protection Plan Worth the Investment?

Planning a Disney cruise is an exciting endeavor, filled with dreams of magical experiences, world-class entertainment, and unforgettable family moments. From character meet-and-greets to immersive themed dining and breathtaking destinations, Disney Cruise Line (DCL) offers a vacation experience unlike any other. However, even the most meticulously planned trips can face unexpected disruptions—flights delayed due to weather, sudden illness, or family emergencies. That’s where the Disney Cruise Line Vacation Protection Plan enters the picture. Designed to safeguard your investment, this optional insurance plan promises peace of mind by covering a range of unforeseen circumstances that could otherwise derail your dream vacation.

But how much is the Disney Cruise Line Vacation Protection Plan worth? Is it a prudent financial decision or an unnecessary add-on? With cruise vacations often costing thousands of dollars per family, the stakes are high. The protection plan isn’t just about reimbursing you for a canceled trip—it’s about ensuring you don’t lose everything due to circumstances beyond your control. In this comprehensive guide, we’ll dive deep into the cost, coverage, benefits, and real-world value of the Disney Cruise Line Vacation Protection Plan. We’ll compare it to third-party alternatives, analyze when it makes the most sense to purchase, and provide practical tips to help you decide whether this plan is worth your hard-earned money.

Understanding the Disney Cruise Line Vacation Protection Plan

What Is the Disney Cruise Line Vacation Protection Plan?

The Disney Cruise Line Vacation Protection Plan is an optional travel insurance product offered directly by Disney Cruise Line. It’s designed to protect your financial investment in the event of trip cancellation, trip interruption, or medical emergencies during your cruise. Unlike general travel insurance, this plan is tailored specifically for Disney cruise itineraries, meaning it accounts for the unique aspects of DCL’s booking policies, port locations, and onboard services.

Visual guide about how much is disney cruise line vacation protection plan

Image source: cruise-tw.b-cdn.net

The plan is administered by a third-party insurer—currently, it’s provided through Allianz Global Assistance, a well-known name in the travel insurance industry. This partnership ensures that claims are processed professionally and in accordance with industry standards. The plan is available for purchase at the time of booking or within a specified window (usually 15–21 days) after your initial deposit, depending on the cruise date and booking terms.

What Does the Plan Cover?

The coverage includes several key components, each addressing different risks:

- Trip Cancellation: Reimbursement for non-refundable cruise fares, airfare booked through Disney, and pre-paid excursions if you must cancel before departure due to covered reasons (e.g., illness, injury, death in the family, jury duty, or natural disasters).

- Trip Interruption: Covers additional expenses (like airfare home) and unused cruise days if your trip is cut short due to a covered reason.

- Medical Expenses: Reimburses emergency medical and dental treatments during the cruise, up to the plan’s limits (typically $10,000–$25,000).

- Medical Evacuation: Covers the cost of emergency transport to the nearest adequate medical facility or back home, often a critical benefit in remote destinations.

- Travel Delay: Reimburses expenses (meals, lodging, transportation) if your trip is delayed due to weather, airline issues, or mechanical breakdowns.

- Baggage Delay & Loss: Covers essential purchases if your baggage is delayed more than 24 hours or lost permanently.

- 24/7 Assistance Services: Access to a global emergency assistance team for help with medical referrals, legal support, or travel coordination.

What’s Not Covered?

While the plan is robust, it’s not all-encompassing. Exclusions include:

- Pre-existing medical conditions (unless you purchase within 14 days of initial deposit and meet other criteria).

- Traveling against a physician’s advice.

- High-risk activities (e.g., extreme sports) not part of official Disney excursions.

- Voluntary cancellation due to fear of travel, unless tied to a government-issued travel warning.

- Losses due to war, terrorism, or pandemic-related cancellations (though some pandemic-related benefits may apply under specific conditions).

Understanding these exclusions is crucial—knowing what’s not covered helps you decide whether supplemental insurance or a third-party plan might be a better fit.

How Much Does the Disney Cruise Line Vacation Protection Plan Cost?

Cost Structure and Pricing Tiers

The price of the Disney Cruise Line Vacation Protection Plan is not a flat fee—it’s calculated as a percentage of your total cruise fare, including taxes, fees, and any add-ons like excursions or onboard credits. The exact percentage varies based on the length of the cruise, destination, and the number of travelers.

As of 2024, the cost typically ranges from 7% to 10.5% of your total cruise cost. Here’s a breakdown:

- Short cruises (3–5 nights): 7–8.5%

- Standard cruises (7 nights): 8–9.5%

- Longer cruises (10+ nights) or Alaska/Hawaii itineraries: 9–10.5%

For example, if your 7-night Disney cruise for a family of four costs $6,000, the protection plan would cost between $480 and $570 (8–9.5% of $6,000). For a 3-night cruise at $3,000, the cost would be $210–$255.

Additional Costs and Add-Ons

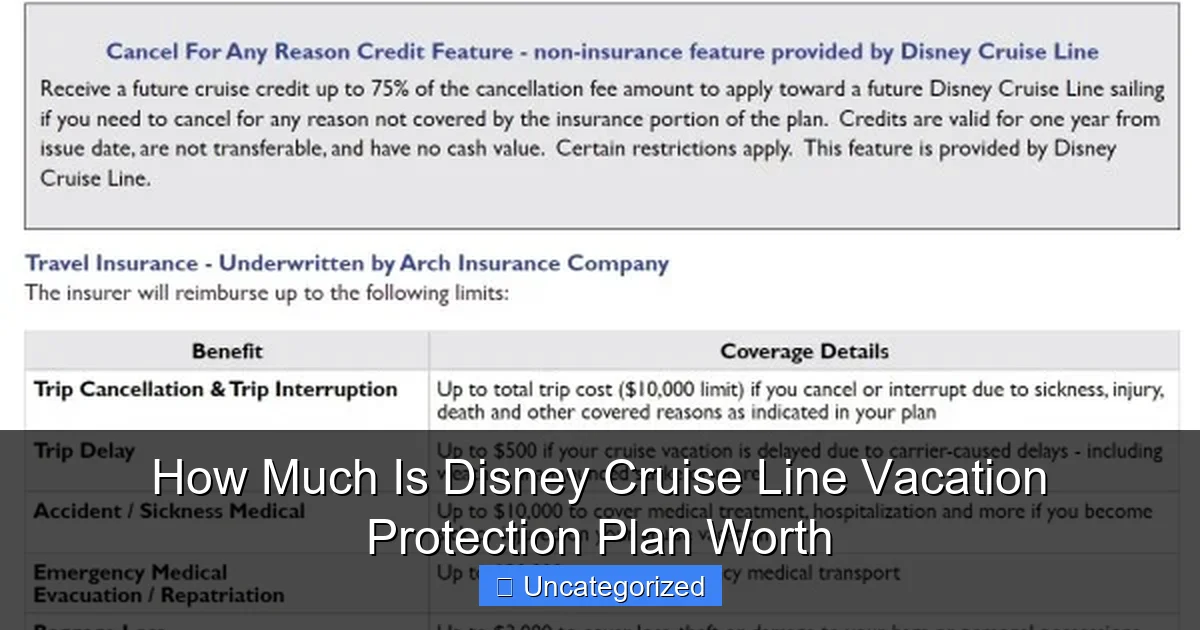

Disney also offers an optional “Cancel for Any Reason” (CFAR) upgrade, which allows you to cancel your trip for non-covered reasons and receive a partial refund (usually 75% of your non-refundable costs). This upgrade is available only if you purchase the base protection plan within 14 days of your initial deposit and is priced at an additional 4–5% of your cruise cost.

For the $6,000 cruise example, adding CFAR would cost an extra $240–$300, bringing the total protection cost to $720–$870. While this increases the premium, it offers unmatched flexibility—ideal for travelers with uncertain schedules or those booking far in advance.

Is It Worth the Price?

To determine value, consider the risk vs. reward equation. A 7–10% premium may seem steep, but when compared to the total cost of a family cruise, it’s a relatively small percentage of your overall investment. For instance, losing a $6,000 cruise due to a medical emergency could result in a 100% loss, whereas the protection plan caps your risk at $570.

Moreover, Disney’s plan includes no deductibles on most benefits and offers streamlined claims processing—key advantages over some third-party insurers that may require out-of-pocket expenses upfront.

Comparing Disney’s Plan to Third-Party Travel Insurance

Coverage Breadth and Flexibility

While Disney’s plan is convenient and cruise-specific, third-party insurers (like Allianz Travel Insurance, Travel Guard, or InsureMyTrip) often offer broader coverage options and more flexible terms. For example:

- Many third-party plans offer higher medical and evacuation limits (e.g., $50,000–$100,000).

- Some include coverage for pandemic-related cancellations or quarantine expenses.

- CFAR upgrades are often available with higher refund percentages (up to 90%).

- Pre-existing condition waivers are more accessible if purchased early.

However, third-party plans may require you to book airfare and excursions separately through their approved providers to qualify for full coverage. Disney’s plan, by contrast, automatically covers airfare booked through their Air2Sea program and pre-paid excursions, simplifying the process.

Claims Process and Customer Service

Disney’s protection plan benefits from integration with their booking system. Claims are submitted directly through Allianz, but Disney’s customer service team can assist with documentation and coordination—especially useful during cruise-related disruptions.

Third-party insurers may have more complex claims procedures, requiring you to submit receipts, medical records, and itinerary details manually. However, some offer mobile apps for faster claims submission and 24/7 multilingual support.

Cost Comparison

Below is a sample cost comparison for a 7-night Disney cruise ($6,000) and a 3-night cruise ($3,000):

| Insurance Provider | 7-Night Cruise Cost | 3-Night Cruise Cost | Medical Limit | CFAR Available? | CFAR Cost (7-night) |

|---|---|---|---|---|---|

| Disney Cruise Line Plan | $480–$570 (8–9.5%) | $210–$255 (7–8.5%) | $25,000 | Yes | $240–$300 |

| Allianz Travel Insurance (via InsureMyTrip) | $350–$500 (6–8%) | $180–$240 (6–8%) | $50,000 | Yes | $200–$270 |

| Travel Guard (AIG) | $400–$550 (7–9%) | $200–$260 (7–8.7%) | $100,000 | Yes | $220–$310 |

| Squaremouth (Custom Plan) | $300–$450 (5–7.5%) | $150–$220 (5–7.3%) | $25,000–$100,000 | Yes | $180–$250 |

As shown, third-party plans can be 10–30% cheaper than Disney’s, especially for shorter cruises. However, they may require more legwork to ensure coverage aligns with your specific itinerary and needs.

When to Choose Disney vs. Third-Party

Choose Disney’s plan if:

- You booked airfare through Air2Sea or pre-paid excursions.

- You value seamless integration with Disney’s customer service.

- You want a simple, no-hassle claims process.

Choose a third-party plan if:

- You need higher medical or evacuation coverage.

- You booked flights independently and want broader CFAR terms.

- You’re cost-conscious and comfortable managing claims independently.

Real-World Scenarios: When the Protection Plan Pays Off

Scenario 1: Sudden Illness Before Departure

Situation: A family of four is set to depart on a 7-night Disney cruise to the Caribbean. Two days before the cruise, one child is hospitalized with appendicitis, requiring surgery. The family must cancel the trip.

Without protection: They lose $6,000 in non-refundable cruise costs and $1,200 in Air2Sea flights. Total loss: $7,200.

With Disney’s plan: They submit medical records and receive a full refund for cruise and airfare. Cost of plan: $570. Net savings: $6,630.

Scenario 2: Flight Delay Causing Missed Embarkation

Situation: A couple flying from Chicago to Miami misses their cruise due to a 24-hour flight delay caused by a blizzard. Their luggage is also delayed.

Without protection: They lose $3,500 in cruise fare and spend $800 on hotel and meals. Total loss: $4,300.

With Disney’s plan: They claim travel delay benefits, receiving $800 for expenses and a prorated refund for missed cruise days. Luggage delay reimburses $200 for essentials. Cost of plan: $280. Net savings: $3,420.

Scenario 3: Medical Emergency During the Cruise

Situation: A passenger suffers a heart attack during a Disney cruise to Alaska. The ship’s medical staff stabilizes them, but they require emergency evacuation to a hospital in Juneau.

Without protection: The family pays $25,000 for evacuation and $5,000 for medical treatment. Total cost: $30,000.

With Disney’s plan: Medical evacuation and treatment are covered up to $25,000. They also receive $500 for travel delay. Cost of plan: $570. Net savings: $24,430.

Scenario 4: Using CFAR for Uncertainty

Situation: A family books a 10-night cruise to Europe 18 months in advance. Six months later, a job change creates scheduling conflicts. They cancel using CFAR.

Without CFAR: They lose $8,000 in cruise costs.

With CFAR: They receive 75% refund ($6,000) after paying $800 for the base plan and $400 for CFAR. Net loss: $1,200 instead of $8,000.

Tips to Maximize the Value of Your Protection Plan

Purchase Early and Understand the Window

The protection plan must be purchased within 14–21 days of your initial deposit to qualify for certain benefits, including the pre-existing condition waiver and CFAR. Set a calendar reminder to avoid missing this window.

Keep Detailed Records

Save all receipts, medical records, and communication related to cancellations or delays. For medical claims, ask the ship’s medical staff for a full report. For travel delays, obtain a written statement from the airline or cruise line.

Know Your Covered Reasons

Review the list of covered reasons for cancellation/interruption. Common covered events include:

- Illness or injury requiring hospitalization.

- Death or serious illness of a family member.

- Jury duty or court subpoena.

- Natural disasters affecting travel or destination.

- Work-related layoffs (if employed at booking).

Note: “Fear of travel” or “change of mind” are not covered unless you have CFAR.

Combine with Other Protections

Your credit card may offer travel protections (e.g., trip delay or baggage insurance). Use these in tandem with the Disney plan—just ensure there’s no overlap in claims.

Evaluate Based on Your Risk Profile

Ask yourself:

- Are you traveling during hurricane season or winter?

- Do any travelers have chronic health conditions?

- Is your job or schedule unstable?

- Are you booking far in advance?

If the answer to any of these is “yes,” the protection plan becomes more valuable.

Final Verdict: Is the Disney Cruise Line Vacation Protection Plan Worth It?

After analyzing the cost, coverage, and real-world scenarios, the answer depends on your personal circumstances—but for most families, the Disney Cruise Line Vacation Protection Plan is a worthwhile investment. At 7–10% of your cruise cost, it offers comprehensive protection against the most common and costly travel disruptions. The integration with Disney’s booking system, no-deductible structure, and 24/7 assistance make it a convenient and reliable choice, especially for first-time cruisers or those booking complex itineraries.

The plan truly shines in high-stakes situations: medical emergencies, natural disasters, or sudden family crises. In these cases, the cost of the plan pales in comparison to the potential loss. Even the optional CFAR upgrade, while expensive, can provide invaluable flexibility for travelers with uncertain schedules.

That said, cost-conscious travelers or those with robust existing travel insurance (e.g., through credit cards or employer benefits) may find better value in third-party plans. Always compare coverage limits, exclusions, and claims processes before deciding.

Ultimately, the value of the Disney Cruise Line Vacation Protection Plan isn’t just in financial reimbursement—it’s in peace of mind. When you’re thousands of miles from home, navigating a foreign port, or dealing with a medical emergency, knowing you’re protected can make all the difference. For families investing thousands in a once-in-a-lifetime vacation, that peace of mind is priceless.

In the end, the protection plan isn’t just about protecting your money—it’s about protecting your dreams. And in the world of Disney, where magic is promised, a little extra security ensures that the only surprises you encounter are the good kind.

Frequently Asked Questions

How much is the Disney Cruise Line Vacation Protection Plan?

The cost of the Disney Cruise Line Vacation Protection Plan varies depending on your cruise length, stateroom category, and total trip cost, but it typically ranges from 7% to 10% of your cruise fare. For an exact quote, use Disney’s online calculator or contact their customer service.

Is the Disney Cruise Line Vacation Protection Plan worth the price?

Yes, if you value peace of mind for unforeseen cancellations, medical emergencies, or travel delays. The plan covers trip interruption, baggage loss, and emergency medical expenses, making it a worthwhile investment for most travelers.

Does the Disney Cruise Line Vacation Protection Plan include COVID-19 coverage?

Yes, the plan includes coverage for trip cancellations or interruptions due to COVID-19, provided the illness is diagnosed by a physician and documented. Check the policy details for specific exclusions or limitations.

Can I cancel the Disney Cruise Line Vacation Protection Plan after purchasing?

You can cancel the plan within 14 days of purchase (or before final payment for your cruise, whichever comes first) for a full refund. After this window, refunds are only issued for covered reasons.

How much does the Disney Cruise Line Vacation Protection Plan cost for a family?

For a family of four on a 7-night cruise, the plan usually costs between $300 and $600, depending on stateroom type and add-ons like rental car coverage. Always get a personalized quote based on your booking details.

What’s excluded from the Disney Cruise Line Vacation Protection Plan?

Pre-existing medical conditions (unless waived), high-risk activities, or cancellations due to personal financial issues aren’t covered. Review the full policy terms to understand all exclusions before purchasing.