Featured image for could cruise lines go bust

Image source: myvirtualvacations.net

Cruise lines face unprecedented financial strain due to rising fuel costs, regulatory pressures, and fluctuating demand—factors that could push weaker operators into bankruptcy. While major brands like Carnival and Royal Caribbean have weathered past storms, smaller or debt-laden companies may not survive another major disruption, making industry consolidation and strategic bailouts increasingly likely.

Key Takeaways

- Cruise lines face financial risks due to high debt and operational costs.

- Diversify bookings early to safeguard against sudden industry downturns.

- Monitor company health via quarterly earnings and liquidity reports.

- Regulations impact survival—new environmental rules may strain profits.

- Travel insurance is essential to protect investments if lines collapse.

- Innovation drives recovery—lines adapting tech and experiences will thrive.

📑 Table of Contents

- Could Cruise Lines Go Bust? The Shocking Truth Revealed

- The Financial Vulnerabilities of Cruise Lines

- External Risks: Pandemics, Geopolitics, and Climate Change

- Market Shifts: Changing Consumer Behavior and Competition

- Operational Challenges: Crew Shortages and Supply Chain Issues

- Can Cruise Lines Survive? Strategies for Resilience

- Data: Cruise Line Financial Health (2023)

- Conclusion: The Future of Cruise Lines

Could Cruise Lines Go Bust? The Shocking Truth Revealed

The allure of cruising—endless ocean views, gourmet dining, Broadway-style shows, and exotic destinations—has long made it a dream vacation for millions. From families seeking fun-filled getaways to retirees chasing bucket-list adventures, the cruise industry has thrived for decades, with giants like Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line leading the charge. Yet, behind the glitz and glamour lies a fragile ecosystem of high operating costs, global economic dependencies, and unprecedented risks that have left many wondering: Could cruise lines go bust?

Recent history has shown that even the most seemingly invincible industries are not immune to collapse. The pandemic, geopolitical tensions, environmental regulations, and shifting consumer behaviors have all placed immense pressure on cruise operators. In 2020, the industry came to a near-standstill, with ships stranded at sea, thousands of crew members stranded without pay, and billions in losses. While many lines have rebounded, the underlying vulnerabilities remain. This article dives deep into the financial, operational, and market forces that could threaten the survival of cruise lines—and reveals the shocking truth about whether your favorite cruise brand could be on the brink of failure.

The Financial Vulnerabilities of Cruise Lines

High Fixed Costs and Low Margins

Cruise lines operate on razor-thin profit margins, typically between 5% and 10%. Despite generating billions in annual revenue, their high fixed costs make them extremely sensitive to disruptions. A single cruise ship can cost upwards of $1 billion to build, with annual operating expenses (fuel, crew, maintenance, port fees) running into hundreds of millions. For example, Royal Caribbean’s Symphony of the Seas, one of the largest cruise ships in the world, cost $1.35 billion to construct and requires over 2,200 crew members to operate.

Visual guide about could cruise lines go bust

Image source: images.rigzone.com

Unlike airlines or hotels, which can scale operations up or down based on demand, cruise ships are “all-in” investments. Once a vessel is built, it must sail—even if occupancy is low—to cover fixed costs. This creates a dangerous cycle: low demand leads to price wars, which erode margins, which in turn make it harder to service debt. In 2020, Carnival Corporation reported a net loss of $10.2 billion, while Royal Caribbean lost $5.8 billion. These losses were only mitigated by massive government loans and private capital raises.

Debt Overload and Liquidity Crunch

To survive the pandemic, cruise lines took on unprecedented levels of debt. According to financial filings, Carnival Corporation’s long-term debt ballooned from $10.8 billion in 2019 to over $35 billion by 2023. Similarly, Royal Caribbean’s debt rose from $11.5 billion to $24 billion. While low interest rates initially made borrowing manageable, rising rates and inflation have increased the cost of servicing this debt.

For instance, Carnival’s interest expenses surged from $477 million in 2019 to $1.2 billion in 2023. With global interest rates still elevated, this burden could worsen. If a cruise line fails to generate enough cash flow to meet its obligations, it risks defaulting on loans or triggering credit rating downgrades—both of which could lead to a liquidity crisis.

Example: The Collapse of Cruise & Maritime Voyages

In 2020, UK-based Cruise & Maritime Voyages (CMV) became one of the first major casualties of the pandemic. Despite being a smaller player, CMV’s collapse highlights how quickly a cruise line can unravel. The company filed for administration after:

- Passenger numbers dropped 90% in 2020.

- Port fees and fuel costs drained cash reserves.

- Investors pulled out, leaving a £100 million funding gap.

CMV’s ships were sold at fire-sale prices, and thousands of employees lost their jobs. This case underscores how even well-established brands can collapse without a financial safety net.

External Risks: Pandemics, Geopolitics, and Climate Change

The Pandemic Aftermath

The COVID-19 pandemic was a wake-up call for the cruise industry. Ships like the Ruby Princess and Diamond Princess became floating hotspots, leading to global shutdowns. The U.S. CDC’s “No Sail Order” in March 2020 halted all U.S.-based operations for 15 months. While the industry has since resumed sailing, passenger confidence remains fragile. A 2023 survey by Cruise Critic found that 22% of travelers still fear health risks on cruises.

Moreover, the cost of pandemic compliance—enhanced sanitation, medical facilities, and crew testing—adds $10–$20 per passenger, further squeezing margins. If a new variant or health crisis emerges, the industry could face another shutdown, with no guarantee of government bailouts this time.

Geopolitical Tensions and Route Disruptions

Cruise lines rely on stable geopolitical conditions to operate. Conflicts, trade wars, or terrorism can disrupt routes overnight. For example:

- In 2023, Red Sea tensions forced cruise lines to reroute ships away from Egypt and Israel, adding 1,000+ nautical miles to Mediterranean itineraries and increasing fuel costs by 20%.

- The Russia-Ukraine war led to the cancellation of Baltic Sea cruises, a key revenue source for European lines.

These disruptions force cruise lines to either cancel itineraries (refunding passengers) or absorb higher costs—both of which hurt profitability.

Climate Change and Environmental Regulations

The cruise industry is under increasing pressure to reduce its carbon footprint. Ships emit 200–300 grams of CO2 per passenger-kilometer—far higher than trains or planes. New regulations, such as the EU’s FuelEU Maritime initiative, will require ships to cut emissions by 2% by 2025 and 75% by 2050. Compliance costs could exceed $200,000 per ship annually.

Additionally, destinations like Venice and Amsterdam are banning large cruise ships to protect fragile ecosystems. If more ports follow suit, cruise lines may face route limitations, reducing revenue potential.

Market Shifts: Changing Consumer Behavior and Competition

Post-Pandemic Travel Preferences

The pandemic reshaped how people travel. Many now prioritize flexibility, sustainability, and unique experiences over mass-market cruising. A 2022 Booking.com report found that 55% of travelers prefer “off-the-beaten-path” destinations, while 48% seek eco-friendly options. Cruise lines, with their large ships and standardized itineraries, struggle to meet these demands.

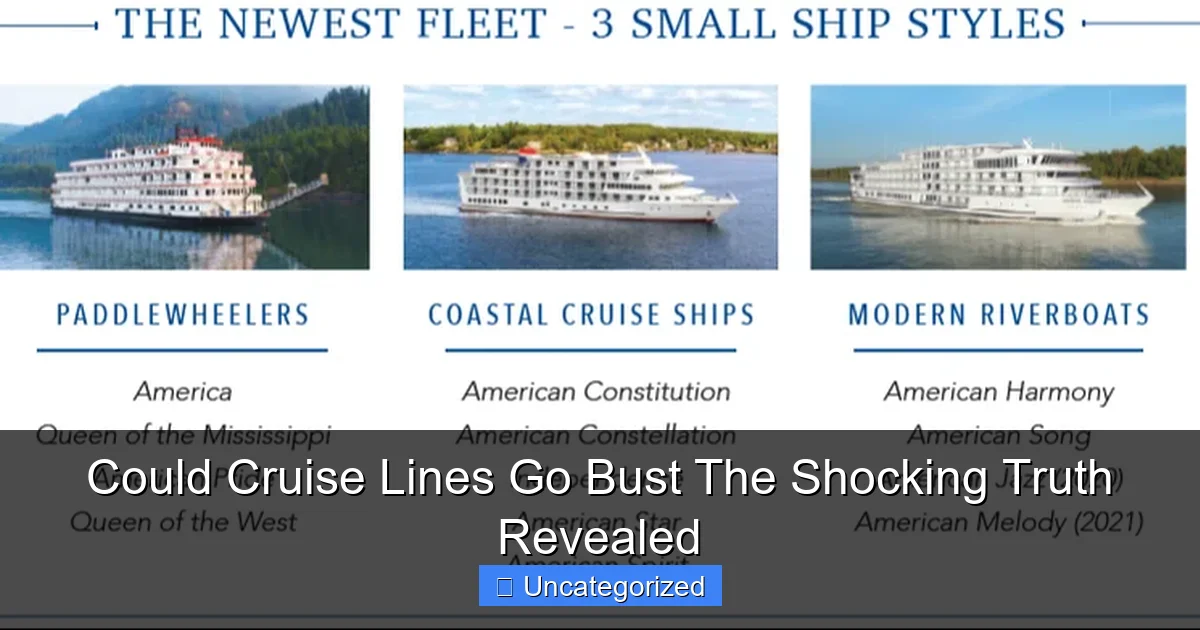

Moreover, younger travelers (Gen Z and Millennials) are less loyal to traditional cruise brands. They prefer boutique river cruises, expedition yachts, or land-based alternatives. This shift is forcing cruise lines to diversify, but smaller vessels and niche offerings require new investments—and new risks.

Rise of Competitors and Alternative Experiences

Cruise lines face competition from:

- River cruises: Smaller, more intimate, and often cheaper (e.g., Viking River Cruises).

- Expedition cruises: Focus on wildlife and adventure (e.g., Lindblad Expeditions).

- Land-based resorts: All-inclusive hotels in the Caribbean or Mediterranean offer similar amenities without the sea.

For example, Norwegian Cruise Line’s 2023 acquisition of luxury line Oceania Cruises and Regent Seven Seas reflects a pivot toward premium experiences. But this strategy requires heavy capital investment, which may not pay off if demand doesn’t rebound.

Price Sensitivity and Overcapacity

To attract passengers, cruise lines have resorted to deep discounts. A 7-day Caribbean cruise that once cost $1,200 now sells for $500–$700. While this boosts occupancy, it erodes profitability. Additionally, the industry is facing overcapacity. Between 2023 and 2027, 50+ new ships are scheduled to launch, adding 100,000+ berths. If demand doesn’t keep pace, prices will drop further, creating a race to the bottom.

Operational Challenges: Crew Shortages and Supply Chain Issues

Labor Shortages and Rising Wages

The cruise industry relies on a global workforce of over 500,000 crew members. The pandemic caused a mass exodus, with 30–40% of crew leaving the industry. Replacing them has been costly:

- Royal Caribbean increased crew wages by 15% in 2022 to attract workers.

- Training and certifications now take 6–12 months, delaying ship deployments.

With inflation driving up living costs, wage demands will likely rise, further straining budgets.

Supply Chain Disruptions

Cruise ships require a constant flow of supplies—food, fuel, spare parts, and amenities. The pandemic exposed vulnerabilities in this supply chain. For example:

- In 2021, a shortage of refrigerated containers delayed food deliveries to Caribbean ports.

- Steel and semiconductor shortages slowed shipbuilding, pushing back delivery dates.

These disruptions increase operational costs and risk itinerary cancellations.

Example: The “Floating Ghost Town” of 2020

During the pandemic, over 200 cruise ships were stranded at sea with no passengers. Crew members were trapped for months, with limited supplies and no income. Carnival Corporation spent $1.5 billion to repatriate 50,000 crew members—a cost it could ill afford. This crisis revealed how dependent cruise lines are on smooth operations and global cooperation.

Can Cruise Lines Survive? Strategies for Resilience

Diversification and Niche Markets

To survive, cruise lines must diversify. Strategies include:

- Luxury and expedition cruising: Higher margins and loyal customers (e.g., Silversea Cruises).

- Short cruises: Attract first-time cruisers with 3–4 day itineraries.

- Theme cruises: Music, wellness, or culinary-focused voyages.

For example, Virgin Voyages’ “adults-only” cruises target Millennials, while Disney Cruise Line’s family-friendly ships command premium prices.

Technology and Sustainability Investments

Investing in innovation can reduce costs and attract eco-conscious travelers:

- Liquefied natural gas (LNG) ships: Reduce emissions by 25% (e.g., Carnival’s Mardi Gras).

- AI and automation: Streamline operations and cut labor costs.

- Digital health passports: Improve pandemic resilience.

Royal Caribbean’s Icon of the Seas, launching in 2024, will be the first LNG-powered ship in its fleet, setting a new standard for sustainability.

Financial Safeguards and Partnerships

To avoid collapse, cruise lines must strengthen financial resilience:

- Debt refinancing: Secure long-term, low-interest loans.

- Insurance and hedging: Protect against fuel price volatility.

- Government partnerships: Collaborate on emergency response plans.

Norwegian Cruise Line’s 2020 $2.2 billion debt restructuring helped it survive the pandemic—a model other lines could follow.

Data: Cruise Line Financial Health (2023)

| Cruise Line | Debt (USD) | Revenue (USD) | Net Profit Margin | Passenger Capacity (2023) |

|---|---|---|---|---|

| Carnival Corporation | $35.2 billion | $18.6 billion | 5.1% | 130,000 |

| Royal Caribbean Group | $24.1 billion | $14.8 billion | 7.3% | 90,000 |

| Norwegian Cruise Line | $12.5 billion | $6.9 billion | 3.8% | 55,000 |

| MSC Cruises | $18.7 billion | $10.2 billion | 6.5% | 80,000 |

Source: Company financial reports, 2023. Note: Debt includes long-term and short-term obligations.

Conclusion: The Future of Cruise Lines

The question “Could cruise lines go bust?” is no longer theoretical. The industry faces existential threats—from financial fragility and external shocks to shifting consumer demands. Yet, the cruise giants are not doomed. By embracing innovation, diversifying offerings, and strengthening financial safeguards, they can adapt and survive.

For travelers, the message is clear: book with caution. Choose lines with strong balance sheets, flexible cancellation policies, and a track record of resilience. For the industry, the path forward requires bold decisions—whether that means retiring older ships, investing in sustainability, or rethinking business models.

The shocking truth? Cruise lines are at a crossroads. Those that innovate will thrive; those that resist change may not. As the tides of global travel shift, the survival of these floating cities will depend on their ability to navigate the storm—and emerge stronger on the other side.

Frequently Asked Questions

Could cruise lines go bust due to financial instability?

Yes, cruise lines could go bust if they face prolonged financial strain from factors like high debt, low bookings, or operational disruptions. The COVID-19 pandemic, for instance, exposed vulnerabilities in the industry’s cash flow and reliance on continuous revenue.

What are the warning signs that a cruise line might go bankrupt?

Key indicators include delayed refunds, canceled sailings, layoffs, or public announcements of debt restructuring. If a cruise line struggles to pay vendors or delays new ship orders, it may signal deeper financial issues. Monitoring these signs can help travelers assess risk.

How does the “could cruise lines go bust” scenario impact passengers?

If a cruise line collapses, passengers with booked trips may face cancellations or lose deposits unless protected by travel insurance or bonding programs. Some countries’ maritime laws prioritize passenger refunds, but recovery isn’t guaranteed. Always check the line’s financial health before booking.

Are luxury cruise lines less likely to go bust than mainstream ones?

Luxury lines often have niche markets and higher profit margins per passenger, which can buffer against downturns. However, their smaller scale and higher operating costs make them vulnerable to sudden market shifts, so no cruise line is entirely immune to collapse.

What role does government aid play in preventing cruise line bankruptcies?

During crises like pandemics, government bailouts or tax breaks can provide critical lifelines. However, most cruise lines are registered overseas, limiting direct state support. This reliance on private funding increases their exposure to market risks.

Can travel insurance protect you if a cruise line goes bust?

Some comprehensive policies cover insolvency, but many exclude it unless explicitly stated. Always check policy terms and consider “cancel for any reason” add-ons for extra protection. Booking with credit cards that offer trip cancellation benefits can also help.