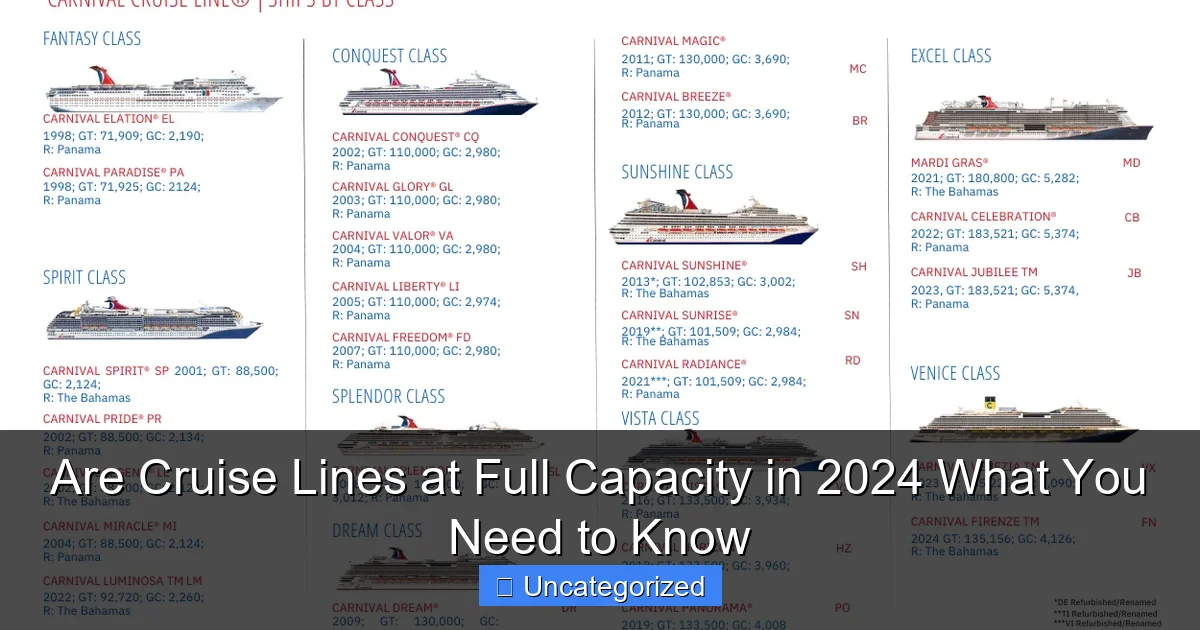

Featured image for are cruise lines at full capacity

Image source: cruiseindustrynews.com

Most major cruise lines are operating at or near full capacity in 2024, driven by pent-up travel demand and expanded fleets post-pandemic. Popular itineraries often sell out months in advance, making early booking essential for securing preferred cabins and pricing. With occupancy rates surpassing 90% industry-wide, the era of last-minute cruise deals has largely faded.

Key Takeaways

- Cruise lines are near full capacity in 2024, with most ships operating at 90%+ occupancy.

- Book early to secure spots—peak seasons and popular routes sell out months ahead.

- New ships boost capacity but demand still outpaces supply on major lines.

- Shoulder seasons offer flexibility with better availability and lower prices.

- Smaller lines fill fastest—luxury and expedition cruises often reach 100% capacity first.

- Last-minute deals are rare due to high demand; don’t rely on late discounts.

📑 Table of Contents

- Are Cruise Lines at Full Capacity in 2024? What You Need to Know

- Current State of Cruise Line Occupancy in 2024

- Factors Limiting Full Capacity Despite High Demand

- How Cruise Lines Are Responding to Capacity Challenges

- What Travelers Should Expect in 2024

- Data and Trends: A Closer Look at 2024 Capacity Metrics

- Conclusion: Navigating the New Era of Cruise Travel

Are Cruise Lines at Full Capacity in 2024? What You Need to Know

The cruise industry, a once-thriving sector that faced unprecedented challenges during the global pandemic, is now sailing back into calmer waters. After years of halted operations, reduced fleets, and cautious reopenings, 2024 marks a pivotal year for cruise lines as they strive to return to pre-pandemic glory. But a pressing question lingers on the minds of travelers, industry analysts, and investors alike: Are cruise lines at full capacity in 2024? The answer is more nuanced than a simple yes or no. While many ships are operating at or near maximum occupancy, others face lingering operational, staffing, and regulatory hurdles that prevent them from reaching full capacity. This resurgence is not just about filling cabins—it’s about rebuilding trust, adapting to new traveler expectations, and navigating a transformed global travel landscape.

As travelers return in droves, drawn by enticing deals, upgraded safety protocols, and the allure of exotic destinations, cruise lines are racing to meet demand. Yet, the journey to full capacity is not without obstacles. From labor shortages to supply chain disruptions and evolving health regulations, the industry is navigating a complex recovery. In this comprehensive guide, we’ll explore the current state of cruise line occupancy, the factors influencing capacity, and what travelers can expect in 2024. Whether you’re a first-time cruiser or a seasoned sea traveler, understanding the dynamics of cruise capacity will help you make informed decisions and maximize your onboard experience.

Current State of Cruise Line Occupancy in 2024

Post-Pandemic Recovery and Demand Surge

After a nearly two-year hiatus, the cruise industry began its phased restart in mid-2021, with cautious itineraries and limited passenger loads. Fast forward to 2024, and the narrative has shifted dramatically. According to the Cruise Lines International Association (CLIA), global cruise passenger numbers reached 31.5 million in 2023, surpassing pre-pandemic levels of 29.7 million in 2019. This surge in demand has pushed many major cruise lines—including Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings—to operate at 90% to 98% average occupancy across their fleets.

Visual guide about are cruise lines at full capacity

Image source: cruisemummy.co.uk

For example, Royal Caribbean’s Symphony of the Seas, one of the world’s largest cruise ships with a capacity of 5,518 guests, has been consistently sailing at over 95% occupancy since early 2023. Similarly, Carnival Cruise Line reported an average load factor of 96% in Q1 2024, with some Caribbean itineraries selling out months in advance. This high demand is driven by pent-up wanderlust, aggressive marketing campaigns, and the perception of cruises as a safe, all-inclusive vacation option.

Regional Differences in Capacity

While global averages are promising, capacity levels vary significantly by region. The Caribbean remains the most popular cruise destination, with ships operating at near-full capacity during peak seasons (December–April). In contrast, Alaska and European cruises face more volatility. Alaskan itineraries, for instance, are subject to seasonal constraints and port availability, often resulting in lower occupancy outside the summer months (May–September).

European cruises, particularly in the Mediterranean, are experiencing a resurgence, but capacity is still below 2019 levels in some areas. For instance, Norwegian Cruise Line’s Norwegian Epic, which sails from Barcelona, reported an average occupancy of 88% in 2023, up from 72% in 2022. However, geopolitical tensions in Eastern Europe and fluctuating air travel costs have dampened demand for Black Sea and Baltic routes.

Smaller and Niche Cruise Lines

While mainstream lines are thriving, smaller luxury and expedition cruise operators face a different reality. These niche players, such as Silversea, Seabourn, and Lindblad Expeditions, often operate with lower passenger counts (100–500 guests) and prioritize personalized service over volume. In 2024, these lines report average occupancies of 80–90%, with some luxury vessels selling out months ahead due to high demand for exclusive experiences.

For example, Lindblad Expeditions’ National Geographic Endurance, a polar expedition ship, has seen a 25% increase in bookings compared to 2022, with Arctic and Antarctic itineraries filling up within weeks of release. However, their smaller fleet size and specialized itineraries mean they’re less likely to hit 100% capacity regularly.

Factors Limiting Full Capacity Despite High Demand

Staffing Shortages and Crew Availability

One of the most significant barriers to achieving full capacity is the persistent staffing crisis in the cruise industry. The pandemic led to mass layoffs, with an estimated 250,000 cruise employees laid off globally in 2020. While hiring has ramped up, many former crew members have transitioned to shore-based jobs, leaving a gap in experienced personnel.

Royal Caribbean, for instance, has reported a 15% shortfall in crew staffing across its fleet in early 2024, particularly in key roles like chefs, entertainers, and hospitality staff. This shortage forces ships to operate with reduced crew-to-guest ratios, limiting the number of passengers they can safely accommodate. For example, a ship designed for 4,000 guests might cap occupancy at 3,600 to maintain service standards.

Tip: Travelers booking in 2024 may notice longer wait times for dining, excursions, and onboard services. To mitigate this, consider booking specialty dining packages or excursions in advance, and opt for off-peak sailing times when crew availability is higher.

Port Infrastructure and Regulatory Constraints

Even with high demand, cruise lines are constrained by port capacity and local regulations. Many popular destinations, such as Venice, Santorini, and Dubrovnik, have implemented passenger caps to combat overtourism. Venice, for instance, now limits large cruise ships to two per day, reducing total passenger arrivals by 40% compared to 2019.

Additionally, some ports lack the infrastructure to handle multiple mega-ships simultaneously. In Cozumel, Mexico, the port can accommodate three large vessels at once, but simultaneous arrivals often lead to congestion, delays, and reduced guest satisfaction. To avoid these issues, cruise lines are adjusting itineraries, sometimes skipping ports or shortening stays.

Supply Chain and Operational Challenges

The global supply chain disruptions that plagued industries post-pandemic continue to impact cruise operations. From food and beverage supplies to spare parts for ship maintenance, delays and cost increases are forcing cruise lines to make operational adjustments.

For example, Carnival Cruise Line reported a 12% increase in food costs in 2023 due to inflation and shipping delays. To manage this, some ships have reduced buffet hours or limited specialty dining options, indirectly affecting the guest experience and, in some cases, deterring repeat bookings. Additionally, delayed ship repairs—such as the 3-month dry-dock extension for Carnival Breeze in 2023—reduce fleet availability and limit capacity.

How Cruise Lines Are Responding to Capacity Challenges

Fleet Expansion and New Ship Launches

To meet rising demand and overcome operational constraints, cruise lines are aggressively expanding their fleets. In 2024 alone, over 15 new cruise ships are scheduled to launch, including Royal Caribbean’s Utopia of the Seas, Norwegian’s Norwegian Aqua, and Carnival’s Carnival Jubilee. These vessels are designed with higher capacity (up to 7,000 guests) and enhanced efficiency to maximize occupancy.

For example, Utopia of the Seas, set to debut in July 2024, features 2,805 staterooms and a modular design that allows for flexible space usage. Royal Caribbean plans to operate this ship at 98% capacity on its 3- and 4-night Bahamas itineraries, targeting younger travelers with a focus on entertainment and social experiences.

Dynamic Pricing and Revenue Management

Cruise lines are leveraging advanced revenue management systems to optimize pricing and occupancy. Dynamic pricing models adjust fares in real-time based on demand, booking pace, and competitor pricing. This allows lines to fill cabins without resorting to deep discounts that erode profitability.

For instance, Princess Cruises uses AI-powered tools to predict demand spikes and adjust pricing for specific cabin categories. In 2023, this strategy increased their average revenue per passenger by 8% while maintaining 92% occupancy. Travelers can benefit by booking early for the best rates or waiting for last-minute deals during off-peak periods.

Enhanced Health and Safety Protocols

To rebuild trust and attract health-conscious travelers, cruise lines have implemented robust safety measures, including enhanced air filtration, on-site medical facilities, and flexible cancellation policies. While these protocols don’t directly affect capacity, they reduce the risk of outbreaks that could force ships to sail below capacity.

Norwegian Cruise Line’s “Peace of Mind” policy, which allows free cancellations up to 48 hours before departure, has been a key factor in driving bookings. Similarly, Royal Caribbean’s onboard testing and vaccination requirements have minimized quarantine incidents, ensuring smoother operations.

Targeted Marketing and Loyalty Programs

Cruise lines are also using data-driven marketing and loyalty incentives to fill cabins. For example, Carnival’s “VIFP Club” (Very Important Fun Person) offers perks like priority boarding, onboard credits, and exclusive events to repeat guests. In 2024, 45% of Carnival’s bookings came from loyal customers, up from 38% in 2022.

Additionally, lines are targeting new demographics, such as solo travelers and multi-generational families, with specialized packages. Norwegian’s “Studio Cabins,” designed for solo cruisers, have seen a 30% increase in occupancy since their introduction.

What Travelers Should Expect in 2024

Booking Tips for High-Demand Itineraries

With many cruises selling out quickly, travelers need to plan strategically. Here are key tips:

- Book early: For popular routes like the Caribbean and Alaska, aim to book 9–12 months in advance.

- Consider shoulder seasons: Cruises in April, September, or October often have lower prices and fewer crowds.

- Monitor price trends: Use fare comparison tools like CruiseSheet or VacationStarter to track price drops.

- Be flexible with ports: Ships may substitute ports due to congestion or weather, so research backup destinations.

Onboard Experience and Service Levels

While most ships are operating near capacity, travelers should be prepared for potential service delays due to staffing shortages. However, cruise lines are investing in training and automation to maintain quality. For example, Royal Caribbean’s Wonder of the Seas uses self-service kiosks for check-in and digital menus to reduce wait times.

Guests can also expect enhanced entertainment, with new shows like Grease on Carnival Celebration and The Wizard of Oz on Norwegian Encore. Additionally, many ships are adding new dining concepts, such as Royal Caribbean’s The Mason Jar, a Southern-style restaurant.

Excursion and Port Experience

Port congestion remains a concern, especially in high-traffic destinations like Nassau and St. Thomas. To avoid long lines, book private excursions or arrive early. Some cruise lines, like Disney Cruise Line, offer exclusive access to private islands (e.g., Castaway Cay), which are less crowded.

For example, Disney’s Wish offers a “Private Island Escape” package that includes priority tendering and reserved beach areas. This premium experience, while more expensive, ensures a smoother visit.

Data and Trends: A Closer Look at 2024 Capacity Metrics

Occupancy Rates by Cruise Line (2023–2024)

The following table summarizes average occupancy rates for major cruise lines, highlighting recovery trends and regional variations:

| Cruise Line | Average Occupancy (2023) | Average Occupancy (Q1 2024) | Key Markets | Notable Challenges |

|---|---|---|---|---|

| Royal Caribbean | 94% | 96% | Caribbean, Alaska, Europe | Staffing shortages, port congestion |

| Carnival Cruise Line | 93% | 95% | Caribbean, Mexico, Bermuda | Food cost inflation, delayed repairs |

| Norwegian Cruise Line | 90% | 92% | Mediterranean, Bahamas, Alaska | Geopolitical tensions, air travel costs |

| Disney Cruise Line | 97% | 98% | Caribbean, Alaska, Europe | High demand, limited fleet size |

| Holland America Line | 88% | 89% | Alaska, Europe, Asia | Seasonal constraints, niche appeal |

| Silversea (Luxury) | 82% | 85% | Arctic, Antarctica, South Pacific | Smaller fleet, high operating costs |

Future Projections and Industry Outlook

Industry analysts predict that cruise lines will reach 100% average capacity by 2025, driven by fleet expansion, improved staffing, and sustained demand. CLIA forecasts a 7% annual growth rate through 2026, with Asia-Pacific markets (e.g., China, Japan) expected to contribute significantly.

However, challenges like climate regulations (e.g., the EU’s Emissions Trading System) and rising fuel costs may force lines to optimize itineraries and reduce speed, indirectly affecting capacity. For example, Carnival plans to retrofit 10 ships with LNG (liquefied natural gas) engines by 2025, which could temporarily reduce fleet availability.

Conclusion: Navigating the New Era of Cruise Travel

In 2024, the cruise industry stands at a fascinating crossroads. While most major lines are operating at 90–98% capacity—a testament to their resilience and adaptability—true “full capacity” remains a work in progress. Staffing shortages, port constraints, and supply chain issues continue to pose hurdles, but the sector’s proactive responses—fleet expansion, dynamic pricing, and enhanced safety—are paving the way for a robust recovery.

For travelers, this means a return to the vibrant, bustling cruise experiences of the past, albeit with some adjustments. Booking early, staying flexible, and understanding the factors behind capacity fluctuations will ensure a smoother journey. Meanwhile, cruise lines must balance growth with sustainability, ensuring that the pursuit of full occupancy doesn’t compromise safety, service, or the environment.

As we sail into the latter half of 2024, one thing is clear: the cruise industry is back, and it’s stronger than ever. Whether you’re chasing sunsets in the Caribbean, glaciers in Alaska, or cultural gems in Europe, now is an excellent time to set course. Just remember to pack your patience, your sense of adventure, and a willingness to embrace the new normal of modern cruise travel. The seas are waiting—and they’re more full of life than ever.

Frequently Asked Questions

Are cruise lines at full capacity in 2024?

Most major cruise lines are operating near or at full capacity in 2024, driven by high post-pandemic demand and expanded fleets. However, capacity can vary by ship, itinerary, and season.

Why are cruise ships so full this year?

Cruise lines have rebounded strongly after the pandemic, with many ships sailing at 90-100% occupancy. Pent-up travel demand, new ships, and aggressive marketing campaigns have contributed to the surge in bookings.

Is it harder to find last-minute cruise deals due to full capacity?

Yes, with many cruise lines at full capacity, last-minute deals are less common. Early booking is now recommended to secure cabins and preferred sailing dates, especially for peak seasons.

Do cruise lines ever exceed their listed passenger capacity?

Cruise lines rarely exceed their official capacity limits for safety and comfort. However, some ships may temporarily accommodate more passengers by using crew areas or adding extra berths during high-demand periods.

Which cruise lines are closest to full capacity in 2024?

Carnival, Royal Caribbean, and Norwegian Cruise Line report some of the highest occupancy rates, with many sailings at or near full capacity. Luxury lines like Regent and Seabourn also show strong demand.

How can I avoid overcrowded cruise ships?

To avoid full-capacity ships, consider off-peak sailings (e.g., shoulder seasons) or less popular itineraries. Smaller luxury or expedition cruise lines often have lower passenger counts and more space.