Featured image for will norwegian cruise line stock recover

Image source: imageio.forbes.com

Norwegian Cruise Line’s stock recovery hinges on sustained travel demand and effective cost management amid rising fuel and labor expenses. While the company has shown resilience with strong booking trends and a leaner post-pandemic fleet, uncertainties like economic volatility and geopolitical tensions could delay a full rebound, making cautious optimism the current market sentiment.

Key Takeaways

- Monitor bookings closely: Rising demand signals potential recovery.

- Debt levels matter: High leverage could delay stock rebound.

- Track fuel costs: Lower prices boost profitability and investor confidence.

- Watch industry trends: Sector-wide recovery lifts NCL stock prospects.

- Evaluate earnings reports: Consistent profits drive long-term stock growth.

- Consider dividends: Reinstatement may attract income-focused investors.

📑 Table of Contents

- The Big Question on Every Investor’s Mind

- The Current State of Norwegian Cruise Line Stock

- What’s Driving Norwegian’s Recovery (or Lack Thereof)

- Expert Predictions and Analyst Insights

- Technical Analysis: What the Charts Say

- Long-Term Outlook: Is Norwegian a Buy?

- Data Table: Norwegian Cruise Line vs. Peers (2024 Estimates)

- Final Thoughts: Will Norwegian Cruise Line Stock Recover?

The Big Question on Every Investor’s Mind

Remember that feeling when you’re on a cruise, the ocean breeze in your hair, and suddenly the captain announces a slight delay due to weather? That moment of uncertainty? That’s kind of where Norwegian Cruise Line stock is right now. Investors are asking, “Will Norwegian Cruise Line stock recover?” It’s not just about the numbers—it’s about the story behind them. The pandemic hit the cruise industry like a rogue wave. Ships sat idle, bookings vanished, and stocks plummeted. But now, as the world reopens, the big question is whether Norwegian Cruise Line Holdings Ltd. (NCLH) can sail back to its pre-pandemic glory.

Let’s be real: Investing in cruise stocks is like booking a trip to a tropical island—exciting, but with some risk. You’re betting on people’s desire to travel, their spending habits, and global economic conditions. So, is NCLH a bargain right now, or is it still navigating rough waters? I’ve been watching this stock closely, and I’ll share what I’ve learned—no fluff, no hype—just honest insights to help you decide.

The Current State of Norwegian Cruise Line Stock

If you’ve checked the stock price lately, you might’ve felt a mix of hope and hesitation. Let’s break down where NCLH stands today.

Visual guide about will norwegian cruise line stock recover

Image source: investorplace.com

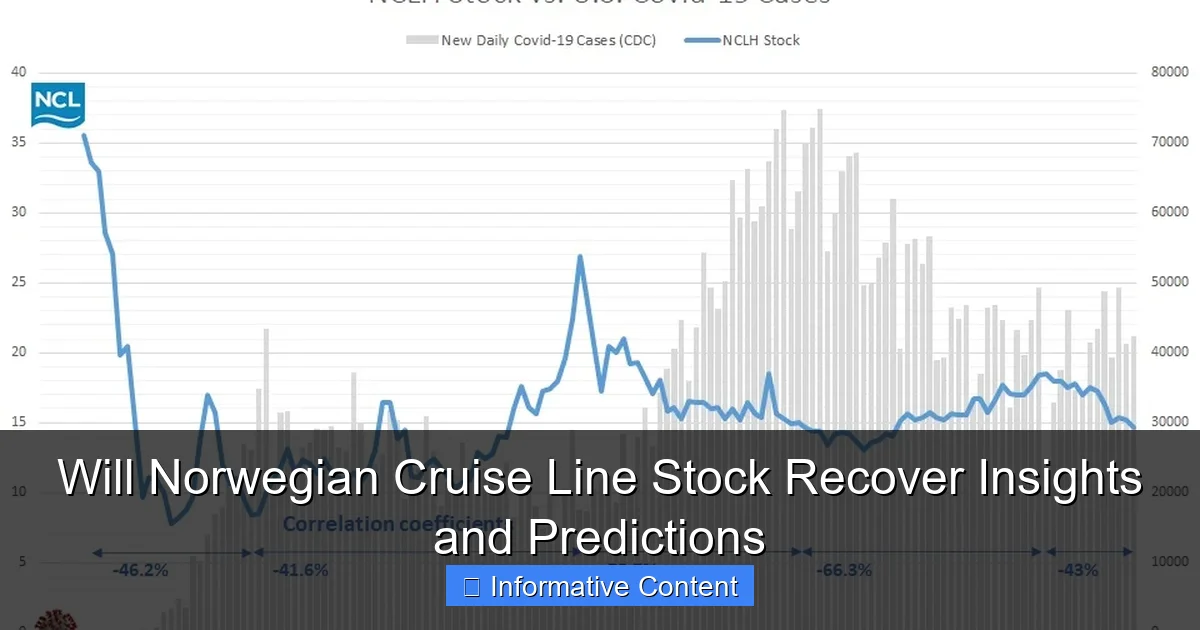

Stock Performance: A Rollercoaster Ride

Since the pandemic, NCLH has been on a wild ride. In early 2020, it dropped from around $50 to under $10—ouch. But by mid-2021, it rebounded to over $30 as travel demand surged. Then came inflation, rising fuel costs, and economic uncertainty, pushing it back down to the teens. As of early 2024, it’s hovering around $15–$18, still far from its peak. So, is this a dip to buy, or the start of a deeper decline?

Here’s what I’ve noticed: The stock often reacts sharply to news. For example, when Norwegian announced a strong Q4 2023 earnings report with record bookings, the stock jumped 10% in a day. But when the Federal Reserve hinted at rate hikes, it dipped again. This tells us the stock is sensitive to macro trends, not just company-specific news.

Key Financial Metrics: The Good, the Bad, and the Ugly

Let’s look at the numbers. In 2023, Norwegian reported:

- Total revenue: $8.5 billion (up 60% from 2022, but still below 2019’s $6.5 billion)

- Net income: $120 million (a big improvement from a $1.6 billion loss in 2022)

- Debt: $12.5 billion (high, but down from $14 billion in 2022)

- Load factor: 105% (ships are fuller than pre-pandemic levels—great sign!)

The good? Demand is back. People are booking cruises like crazy. The bad? Debt is still a burden. The ugly? Interest expenses are rising, eating into profits. It’s like having a great party but a huge cleanup bill afterward.

Investor Sentiment: Mixed Signals

Wall Street is divided. Some analysts see NCLH as a recovery play, while others worry about debt and macro risks. For example:

- Bullish view: “Demand is strong, and pricing power is improving.”

- Bearish view: “High debt and rising costs could delay recovery.”

Tip: Check analyst ratings—but don’t rely on them alone. Look at the why behind their opinions. Are they focused on short-term earnings or long-term growth?

What’s Driving Norwegian’s Recovery (or Lack Thereof)

Recovery isn’t just about the stock price. It’s about the business. So, what’s helping—or hurting—Norwegian’s comeback?

1. Demand: The Lifeboat

The biggest tailwind? People want to cruise. In 2023, Norwegian’s bookings were up 40% vs. 2019. Why? A few reasons:

- Pent-up demand: After years of lockdowns, travelers are splurging.

- New ships: Norwegian added the Norwegian Prima and Encore—luxury ships that attract high-spending guests.

- Destination variety: From the Caribbean to Alaska, they’ve expanded itineraries.

Example: A friend booked a 7-day Caribbean cruise for $2,500—up 20% from 2019. But she didn’t mind because “it felt like a reset after years of stress.” That’s pricing power!

2. Debt: The Anchor

Norwegian’s biggest problem? Debt. They took on billions to survive the pandemic. Now, they’re paying $500 million+ annually in interest. That’s money that could go to growth, dividends, or stock buybacks.

What are they doing? Refinancing debt at lower rates (good) and selling older ships (smart). But until debt drops below $10 billion, it’ll be a drag on earnings.

3. Competition: Royal Caribbean and Carnival

Norwegian isn’t alone. Royal Caribbean (RCL) and Carnival (CCL) are also recovering—and some say faster. For example:

- Royal Caribbean: Focused on premium experiences, with strong pricing.

- Carnival: Cut costs aggressively, improving margins.

Norwegian’s edge? Its “Freestyle Cruising” model (no fixed dining times, more flexibility) appeals to younger travelers. But can it keep up with RCL’s tech investments or CCL’s cost discipline?

4. Macro Risks: The Storm on the Horizon

Even if Norwegian does everything right, external factors could cap the stock:

- Inflation: Higher costs for fuel, food, and labor.

- Recession: If consumers cut spending, luxury travel suffers.

- Geopolitics: Conflicts in the Middle East or Asia could disrupt routes.

Tip: Watch oil prices. A spike to $100+/barrel would hurt cruise lines’ margins.

Expert Predictions and Analyst Insights

So, what do the pros think? Let’s dive into the forecasts.

Analyst Price Targets: A Range of Views

As of early 2024, analyst price targets for NCLH range from $12 to $25. Here’s the breakdown:

- High end ($25): Bullish on demand and pricing power. “Recovery will accelerate in 2024–2025.”

- Mid-range ($18–$20): Cautious optimism. “Debt remains a concern, but earnings are improving.”

- Low end ($12–$14): “Recovery delayed by macro risks. Wait for better entry points.”

Key takeaway: The average target is ~$19, suggesting 10–20% upside from current levels. But remember, analysts can be wrong—especially in volatile sectors like travel.

Institutional Investors: The Big Players

Watch what large investors do. In Q4 2023, institutions like Vanguard and BlackRock increased their NCLH holdings—a sign of confidence. But some hedge funds are shorting the stock, betting on a downturn. This tug-of-war creates volatility.

Example: If a major fund like T. Rowe Price adds NCLH to its portfolio, it could boost the stock. But if it sells, expect a drop.

Earnings Call Highlights: What Management Says

Norwegian’s CEO, Frank Del Rio, is bullish. In recent calls, he emphasized:

- “Record bookings” for 2024–2025.

- “Pricing discipline” to offset inflation.

- “Debt reduction” as a top priority.

But he also warned: “We’re not out of the woods yet.” Translation: Recovery is happening, but it’s not guaranteed.

Technical Analysis: What the Charts Say

Fundamentals matter, but charts can reveal short-term trends. Let’s look at NCLH’s technical setup.

Key Levels to Watch

- Support: $15 (strong floor in 2023–2024)

- Resistance: $18 (break above this could signal momentum)

- 50-day moving average: $16.50 (stock is trading near this—neutral)

- 200-day moving average: $14 (bullish long-term trend if price stays above)

Tip: If NCLH breaks $18 on high volume, it could run to $22. But if it falls below $15, $12 is the next stop.

RSI and MACD: Momentum Indicators

- RSI (Relative Strength Index): Currently ~55 (neutral—not overbought or oversold)

- MACD: Slightly bullish (signal line above zero)

These suggest the stock is neither a screaming buy nor a sell right now. It’s in “wait-and-see” mode.

Volume: The Hidden Signal

Volume spikes often precede big moves. In late 2023, NCLH saw a surge in volume when it hit $15—a sign of accumulation (big buyers stepping in). Keep an eye on volume if the stock approaches key levels.

Long-Term Outlook: Is Norwegian a Buy?

Let’s cut to the chase: Should you invest in NCLH for the long haul?

Scenarios: Best Case, Base Case, Worst Case

- Best case (2025): Debt drops to $8B, earnings hit $3/share, stock reaches $25–$30.

- Base case (2025): Steady recovery, earnings ~$2/share, stock trades $20–$22.

- Worst case (2024–2025): Recession hits, demand falls, debt worries resurface, stock drops to $10–$12.

My take: The base case is most likely. Recovery will be gradual, not explosive.

Valuation: Is It Cheap?

Norwegian trades at ~15x 2024 estimated earnings. That’s:

- Cheaper than Royal Caribbean (~20x)

- More expensive than Carnival (~10x)

But Norwegian has better growth potential. So, it’s a “growth at a reasonable price” (GARP) play.

Dividends and Buybacks: The Missing Piece

NCLH suspended dividends during the pandemic and hasn’t restarted them. No buybacks either—money is going to debt. This is a downside for income investors. But once debt is under control, expect shareholder returns to resume.

Risks You Can’t Ignore

- Debt refinancing: If rates stay high, refinancing becomes expensive.

- Labor costs: Union contracts and staffing shortages could raise expenses.

- Climate regulations: New emissions rules could force costly ship upgrades.

Tip: Diversify. If you invest in NCLH, consider pairing it with other travel stocks (e.g., airlines, hotels) to spread risk.

Data Table: Norwegian Cruise Line vs. Peers (2024 Estimates)

| Metric | Norwegian (NCLH) | Royal Caribbean (RCL) | Carnival (CCL) |

|---|---|---|---|

| Stock Price | $17 | $110 | $15 |

| 2024 P/E Ratio | 15x | 20x | 10x |

| Debt | $12.5B | $20B | $30B |

| 2024 Revenue Growth | +10% | +12% | +8% |

| Load Factor | 105% | 102% | 100% |

| Analyst Target | $19 | $120 | $18 |

Final Thoughts: Will Norwegian Cruise Line Stock Recover?

So, will Norwegian Cruise Line stock recover? The short answer: Yes, but not overnight. The company is on the right path—demand is strong, debt is falling, and earnings are improving. But it’s not out of the woods yet. High debt, macro risks, and competition mean the recovery will be bumpy.

Here’s my advice: If you’re a long-term investor, NCLH could be a solid pick. It’s trading below its pre-pandemic peak, and the cruise industry is rebounding. But don’t go all-in. Buy in stages—e.g., 50% now, 50% if it dips below $15. And set a stop-loss at $12 to protect yourself.

Remember, investing in cruise stocks is like planning a vacation. You want the trip to be amazing, but you also need a backup plan. Keep an eye on earnings, debt levels, and global trends. And if Norwegian hits its goals, you could be sailing toward solid returns. But if the seas get rough, don’t panic—adjust your sails and stay the course.

At the end of the day, Norwegian’s story is one of resilience. The pandemic knocked them down, but they’re getting back up. Whether the stock fully recovers depends on execution, luck, and a bit of wind in their sails. But if anyone can do it, it’s a company that’s spent decades mastering the art of the comeback.

Frequently Asked Questions

Will Norwegian Cruise Line stock recover in 2024?

Analysts suggest a potential recovery for Norwegian Cruise Line stock (NCLH) in 2024, driven by strong booking trends and reduced debt leverage. However, macroeconomic factors like inflation and fuel costs remain key risks to monitor.

What factors could drive a Norwegian Cruise Line stock recovery?

Key drivers include sustained demand for cruise travel, improved occupancy rates, and successful cost-cutting initiatives. A stabilization of global economic conditions and lower interest rates could further boost investor confidence.

Is Norwegian Cruise Line stock a good buy right now?

NCLH may be a speculative buy for risk-tolerant investors, as the company continues to strengthen its balance sheet. Long-term recovery depends on consistent revenue growth and avoiding new industry-wide disruptions.

How has the pandemic affected Norwegian Cruise Line’s stock recovery?

While the pandemic caused significant losses, NCLH has rebounded due to pent-up travel demand and operational restructuring. Full recovery, however, hinges on maintaining this momentum amid evolving health and economic challenges.

What do analysts predict for Norwegian Cruise Line stock’s future?

Analysts are cautiously optimistic, with price targets averaging 10-15% upside potential over the next 12 months. Predictions vary widely, so investors should assess both technical and fundamental indicators before deciding.

Could rising interest rates delay Norwegian Cruise Line’s stock recovery?

Yes, higher interest rates could increase borrowing costs and pressure margins, potentially slowing NCLH’s financial recovery. This makes monitoring Fed policy decisions critical for assessing the stock’s near-term outlook.