Featured image for why are cruise line stocks down today

Image source: g.foolcdn.com

Rising fuel costs and renewed economic uncertainty are hammering cruise line stocks today, as investors fear shrinking profit margins and weaker consumer demand. Ongoing labor strikes in key ports have further disrupted itineraries, spooking markets already wary of inflation and fluctuating travel trends.

Key Takeaways

- Market volatility: Rising interest rates spook investors, pressuring cruise line stocks.

- Fuel costs: Soaring fuel prices squeeze profit margins industry-wide.

- Debt concerns: High post-pandemic debt levels raise solvency fears.

- Demand slowdown: Weaker booking trends signal consumer spending pullback.

- Geopolitical risks: Trade disruptions and instability deter travel investments.

- Regulatory pressures: Stricter emissions rules increase compliance costs.

📑 Table of Contents

- The Stormy Seas of Cruise Line Stocks: What’s Sinking the Industry?

- 1. Macroeconomic Headwinds: Inflation, Interest Rates, and Consumer Spending

- 2. Rising Operational Costs: Fuel, Labor, and Supply Chain Challenges

- 3. Geopolitical and Environmental Risks

- 4. Competitive Pressures and Market Saturation

- 5. Company-Specific Challenges and Financial Health

- 6. The Road Ahead: Can Cruise Stocks Recover?

The Stormy Seas of Cruise Line Stocks: What’s Sinking the Industry?

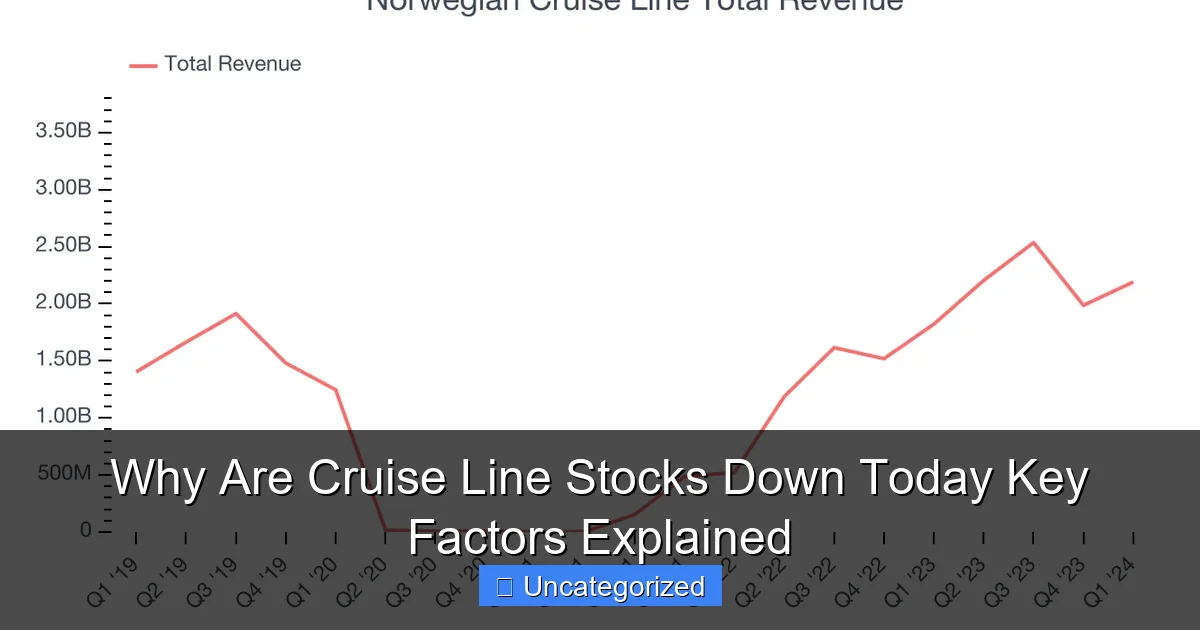

Investors in cruise line stocks have been riding a rollercoaster in recent months, with shares of major players like Carnival Corporation (CCL), Royal Caribbean Group (RCL), and Norwegian Cruise Line Holdings (NCLH) experiencing significant volatility. As of today, the sector is seeing another downward trend, leaving many wondering: Why are cruise line stocks down today? While the pandemic initially decimated the industry, the post-COVID recovery was supposed to signal smoother sailing. However, a complex mix of macroeconomic pressures, operational challenges, and shifting consumer behaviors continues to create turbulence in the sector. Understanding these dynamics is crucial for both current investors and those considering entering the market.

The cruise industry, once seen as a resilient vacation option, now faces a perfect storm of headwinds that are impacting investor sentiment. From rising fuel costs to geopolitical instability affecting travel routes, the factors contributing to today’s stock declines are multifaceted. This article dives deep into the key drivers behind the current downturn, analyzing everything from macroeconomic indicators to company-specific challenges. Whether you’re a seasoned investor tracking CCL, RCL, or NCLH, or simply curious about the broader travel sector’s health, we’ll unpack the data, trends, and expert insights needed to navigate these choppy waters. Let’s explore the five critical factors sinking cruise line stocks today.

1. Macroeconomic Headwinds: Inflation, Interest Rates, and Consumer Spending

Inflation’s Impact on Discretionary Spending

One of the most significant factors dragging down cruise line stocks today is the persistent inflationary environment gripping global economies. As inflation rates remain elevated, consumers are tightening their budgets, and discretionary spending—like vacations—is often the first to be cut. A cruise vacation, which typically includes costs for tickets, onboard spending, excursions, and airfare, becomes a luxury item when grocery bills and utility costs are rising. Data from the U.S. Bureau of Labor Statistics shows that consumer price index (CPI) increases have outpaced wage growth, reducing real disposable income.

Visual guide about why are cruise line stocks down today

Image source: barchart-news-media-prod.aws.barchart.com

Practical Example: In Q2 2023, Carnival Corporation reported a 12% year-over-year increase in booking volume but a 7% decline in average spend per passenger. This suggests that while demand remains, consumers are opting for shorter, less expensive cruises—a trend that pressures margins. Investors interpret this as a sign of demand elasticity, where higher prices lead to lower volume, ultimately hurting profitability.

Interest Rate Hikes and Financing Costs

The Federal Reserve’s aggressive interest rate hikes to combat inflation have had a dual impact on cruise lines. First, higher rates make it more expensive for companies to service their massive debt loads. Carnival, for instance, carries over $30 billion in long-term debt, much of it incurred during the pandemic. With rates now above 5%, interest expenses have ballooned, reducing net income and free cash flow.

Second, higher interest rates make risk-free assets like Treasury bonds more attractive to investors. This shifts capital away from volatile sectors like travel, further pressuring stock prices. For example, in July 2023, Royal Caribbean’s interest expense rose 23% YoY, while its stock price dropped 15% over the same period.

Consumer Confidence and Travel Sentiment

Surveys from the Conference Board and University of Michigan show that consumer confidence remains below pre-pandemic levels. While travel demand has rebounded, there’s a growing preference for “value-driven” experiences. This shift benefits budget airlines and all-inclusive resorts but puts premium-priced cruise vacations at a disadvantage. A 2023 Deloitte survey found that 41% of travelers now prioritize affordability over luxury—a trend directly impacting cruise line pricing power.

2. Rising Operational Costs: Fuel, Labor, and Supply Chain Challenges

Fuel Price Volatility

Cruise ships are among the most fuel-intensive modes of transportation, with a single vessel consuming up to 150 tons of fuel per day. The ongoing volatility in crude oil prices—driven by geopolitical tensions, OPEC+ production cuts, and global demand fluctuations—has created significant cost pressures. While oil prices have moderated from 2022 highs, they remain 20-30% above 2019 levels, squeezing cruise line margins.

Data Insight: Carnival’s Q2 2023 earnings call revealed that fuel costs accounted for 18% of total operating expenses, up from 12% in 2019. To offset this, companies are investing in LNG-powered ships (e.g., Royal Caribbean’s “Icon Class”) and retrofitting vessels with energy-saving technologies. However, these investments require upfront capital, further straining balance sheets.

Labor Shortages and Wage Inflation

The cruise industry is grappling with a global labor shortage, particularly for skilled roles like engineers, chefs, and hospitality staff. Post-pandemic, many workers left the sector for more stable industries, leading to aggressive recruitment campaigns. Norwegian Cruise Line, for example, reported a 30% increase in crew wages in 2023 compared to 2022.

This labor crunch is exacerbated by union negotiations and rising expectations for improved working conditions. In June 2023, the International Transport Workers’ Federation (ITF) secured a 15% wage hike for crew members across multiple lines, directly impacting operational costs. Investors view these increases as long-term margin pressures rather than temporary adjustments.

Supply Chain Disruptions

From food and beverage supplies to spare parts for engines, cruise lines rely on a complex global supply chain. The war in Ukraine has disrupted key suppliers of wheat, sunflower oil, and steel, while ongoing port congestion in Asia and Europe delays critical deliveries. Carnival reported a 10% increase in food costs in 2023 due to supply chain issues, while Royal Caribbean faced a 3-week delay in dry-dock maintenance for one vessel, costing $12 million in lost revenue.

3. Geopolitical and Environmental Risks

Conflict in Key Cruise Regions

Geopolitical instability in popular cruise destinations is deterring bookings and increasing insurance costs. The war in Ukraine has led to the cancellation of Black Sea cruises, while tensions in the Red Sea (due to Houthi attacks on commercial vessels) have forced rerouting of Middle East itineraries. These disruptions not only reduce revenue but also require costly fuel surcharges for longer voyages.

Case Study: In January 2024, Norwegian Cruise Line canceled 12 Mediterranean voyages due to Red Sea risks, resulting in a $25 million revenue loss. Investors penalized the stock with a 5% single-day drop, reflecting concerns about operational resilience.

Climate Change and Regulatory Pressures

Environmental regulations are tightening globally. The International Maritime Organization (IMO) now requires ships to reduce CO2 emissions by 40% by 2030. Compliance requires expensive retrofits, such as scrubbers or LNG conversions. Carnival’s 2023 sustainability report revealed a $2.1 billion investment in green technologies over the next decade—a cost that investors fear will erode profitability.

Additionally, extreme weather events (e.g., hurricanes, wildfires) are disrupting itineraries. In 2023, 15% of Caribbean cruises were rerouted due to hurricanes, costing the industry an estimated $300 million in lost revenue and compensation.

Insurance and Liability Costs

As climate risks and geopolitical threats grow, insurance premiums for cruise lines have skyrocketed. Royal Caribbean reported a 40% increase in hull and machinery insurance costs in 2023. These rising liabilities make investors wary of long-term stability.

4. Competitive Pressures and Market Saturation

Overcapacity in Key Markets

The cruise industry is adding new ships at an unprecedented rate. Carnival alone has 12 vessels scheduled for delivery between 2023-2025, while Royal Caribbean will add 7 “Icon Class” mega-ships. This rapid expansion risks market saturation, especially in popular regions like the Caribbean and Mediterranean.

When supply outpaces demand, cruise lines resort to discounting—a tactic that hurts margins. In Q3 2023, Norwegian Cruise Line offered 30% off Caribbean voyages, leading to a 5% decline in net revenue per passenger. Investors view such promotions as unsustainable.

Competition from Alternative Vacation Options

Cruise lines now compete with a wider array of travel options, including all-inclusive resorts, luxury safaris, and experiential tourism. A 2023 McKinsey report found that 35% of travelers who previously chose cruises now prefer land-based vacations. This shift is particularly pronounced among younger demographics (ages 25-40), who prioritize sustainability and authenticity.

Tip for Investors: Monitor booking lead times and occupancy rates for new ships. Delayed bookings or low occupancy (below 80%) signal demand weakness, which often precedes stock declines.

Brand Reputation and Public Perception

Negative publicity from incidents like norovirus outbreaks, onboard crimes, or environmental violations damages brand equity. In 2023, a viral video of overcrowding on a Carnival ship led to a 10% drop in bookings for that vessel. Social media amplifies such incidents, making reputation management critical.

5. Company-Specific Challenges and Financial Health

Debt Burdens and Liquidity Concerns

All three major cruise lines carry substantial debt. As of Q1 2024:

| Company | Total Debt (Billions) | Debt/EBITDA Ratio | Interest Expense (2023) |

|---|---|---|---|

| Carnival Corp | $31.2 | 5.8x | $1.4 billion |

| Royal Caribbean | $24.7 | 4.3x | $980 million |

| Norwegian Cruise Line | $13.5 | 6.1x | $520 million |

High debt/EBITDA ratios (above 4x) signal financial stress. Investors are concerned that rising interest rates will make refinancing more expensive, potentially triggering credit downgrades.

Dividend Cuts and Share Dilution

To conserve cash, cruise lines have suspended dividends and issued new shares. Carnival halted dividends in 2020 and has yet to resume them, while Norwegian Cruise Line diluted shares by 15% in 2022 to raise capital. These moves erode shareholder value and signal weak near-term prospects.

Management Strategy and Execution Risks

Investors scrutinize management’s ability to navigate challenges. For example, Royal Caribbean’s aggressive new-build program has been praised for innovation but criticized for over-leveraging. Conversely, Carnival’s focus on cost-cutting has improved margins but raised concerns about service quality. Missteps in strategy (e.g., overexpansion, underinvestment) can lead to sharp stock declines.

6. The Road Ahead: Can Cruise Stocks Recover?

Potential Catalysts for Recovery

Despite current challenges, there are signs of long-term resilience:

- Demographic Tailwinds: The aging population in developed markets (e.g., U.S., Europe) favors cruise vacations, as they require less planning and offer all-inclusive amenities.

- New Markets: Growth in Asia (especially China) could offset weakness in traditional regions. Royal Caribbean’s “Spectrum of the Seas” now operates year-round in Shanghai.

- Cost Optimization: Digital transformation (e.g., AI-powered pricing, dynamic itineraries) may improve efficiency.

Investor Considerations

For those holding or considering cruise stocks, key metrics to watch include:

- Booking trends (lead time, occupancy, pricing)

- Debt refinancing timelines (next major maturity dates)

- Fuel hedging strategies (companies using futures contracts to lock in prices)

- ESG performance (carbon intensity, waste reduction)

Tip: Diversify exposure by investing in cruise-adjacent sectors (e.g., port operators, onboard retailers) to mitigate company-specific risks.

Expert Outlook

Analysts at Morgan Stanley predict a “U-shaped recovery” for cruise stocks, with profitability returning to pre-pandemic levels by 2025. However, they caution that volatility will persist until inflation cools and debt burdens ease. The key takeaway: While today’s downturn is painful, the industry’s long-term fundamentals remain intact for patient investors.

In conclusion, the decline in cruise line stocks today reflects a confluence of macroeconomic pressures, operational challenges, and sector-specific risks. From inflation-driven cost pressures to geopolitical disruptions and debt burdens, the factors are deeply interconnected. However, the cruise industry’s ability to adapt—through technological innovation, market diversification, and financial restructuring—suggests that today’s storm may not be the end of the journey. For investors, the path forward requires careful navigation, but those who stay the course may find calmer waters ahead.

Frequently Asked Questions

Why are cruise line stocks down today?

Cruise line stocks are often impacted by broader market trends, including rising interest rates, inflation concerns, or geopolitical tensions affecting travel demand. Today’s dip could also stem from weaker-than-expected earnings reports or forward guidance from major cruise operators.

What factors are driving the decline in cruise line stocks today?

Key factors include rising fuel costs, labor shortages, and fears of an economic slowdown reducing discretionary spending. Additionally, recent outbreaks of illness on ships or negative media coverage may be weighing on investor sentiment.

How does the current economy affect cruise line stock performance?

Economic uncertainty, including inflation and potential recessions, leads consumers to delay or cancel big-ticket vacations like cruises. This directly impacts revenue forecasts, causing investors to sell off cruise line stocks amid demand concerns.

Are rising interest rates to blame for cruise line stocks down today?

Yes, higher interest rates increase borrowing costs for cruise lines, which are often highly leveraged, and reduce consumer spending power. This dual pressure can trigger investor caution, contributing to today’s stock declines.

Did a specific event cause cruise line stocks to drop today?

Check for recent news like a major port closure, new travel advisories, or a company-specific issue (e.g., a ship accident or regulatory fine). Such events can spark sudden sell-offs in cruise line stocks due to operational or reputational risks.

Will cruise line stocks recover after today’s drop?

Recovery depends on resolving near-term headwinds like fuel prices and consumer demand. Historically, cruise stocks rebound during periods of economic growth and stable travel sentiment, but timing remains uncertain.