Featured image for who owns all the cruise lines

Image source: oceanblissjourneys.com

The cruise industry is dominated by three major parent companies—Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings—which collectively own over 70% of the world’s cruise lines. These global giants control well-known brands like Carnival, Princess, Royal Caribbean International, and Norwegian Cruise Line, shaping everything from itineraries to onboard experiences. Understanding this ownership structure reveals how consolidation drives innovation, pricing, and market trends across the seas.

Key Takeaways

- Carnival Corporation owns 9 major cruise brands, dominating the global market.

- Royal Caribbean Group controls 5 key lines, including Celebrity and Silversea.

- NCLH operates Norwegian, Oceania, and Regent Seven Seas Cruises.

- Smaller players like MSC and Disney are rapidly expanding their fleets.

- Vertical integration helps parent companies cut costs and boost profits.

- Loyalty programs and partnerships drive repeat bookings across owned brands.

- Market consolidation continues as giants acquire niche and luxury lines.

📑 Table of Contents

- Introduction: The Hidden Powers Behind the Cruise Industry

- The Big Three: The Dominant Cruise Corporations

- Independent and Niche Players: Beyond the Big Three

- Ownership Models: Public, Private, and Joint Ventures

- Global Expansion and Market-Specific Strategies

- Environmental and Regulatory Influences on Ownership

- Conclusion: The Future of Cruise Ownership

- Key Cruise Ownership Data at a Glance

Introduction: The Hidden Powers Behind the Cruise Industry

When you board a luxurious cruise ship—whether it’s the Carnival Breeze with its vibrant water slides, the Royal Caribbean Symphony of the Seas with its robotic bartenders, or the ultra-luxurious Regent Seven Seas Explorer—you might not think about who actually owns these floating cities. Yet behind every cruise line, every itinerary, and every onboard experience lies a complex web of corporate ownership, mergers, and global strategy. The cruise industry, valued at over $150 billion globally and serving more than 30 million passengers annually, is dominated by a surprisingly small number of parent companies. These conglomerates don’t just own one or two brands—they control multiple cruise lines across different market segments, from budget-friendly to ultra-premium.

Understanding who owns all the cruise lines reveals a fascinating story of consolidation, branding strategy, and global competition. While passengers may choose a cruise based on destination, price, or onboard amenities, the real power lies with a handful of corporate giants who shape the entire industry. This blog post dives deep into the ownership structures of the world’s major cruise brands, uncovers the strategic reasons behind these ownership models, and explains how these parent companies influence everything from ship design to environmental policies. Whether you’re a travel enthusiast, a business analyst, or simply curious about the forces shaping your next vacation, this comprehensive guide reveals the truth behind the curtain of the cruise world.

The Big Three: The Dominant Cruise Corporations

The cruise industry is largely controlled by three major parent companies: Carnival Corporation & plc, Royal Caribbean Group, and Norwegian Cruise Line Holdings Ltd. Together, these three corporations account for over 75% of the global cruise market share, operating more than 100 ships across dozens of brands. Their dominance is not accidental—it’s the result of decades of strategic acquisitions, brand differentiation, and global expansion.

Visual guide about who owns all the cruise lines

Image source: touristsecrets.com

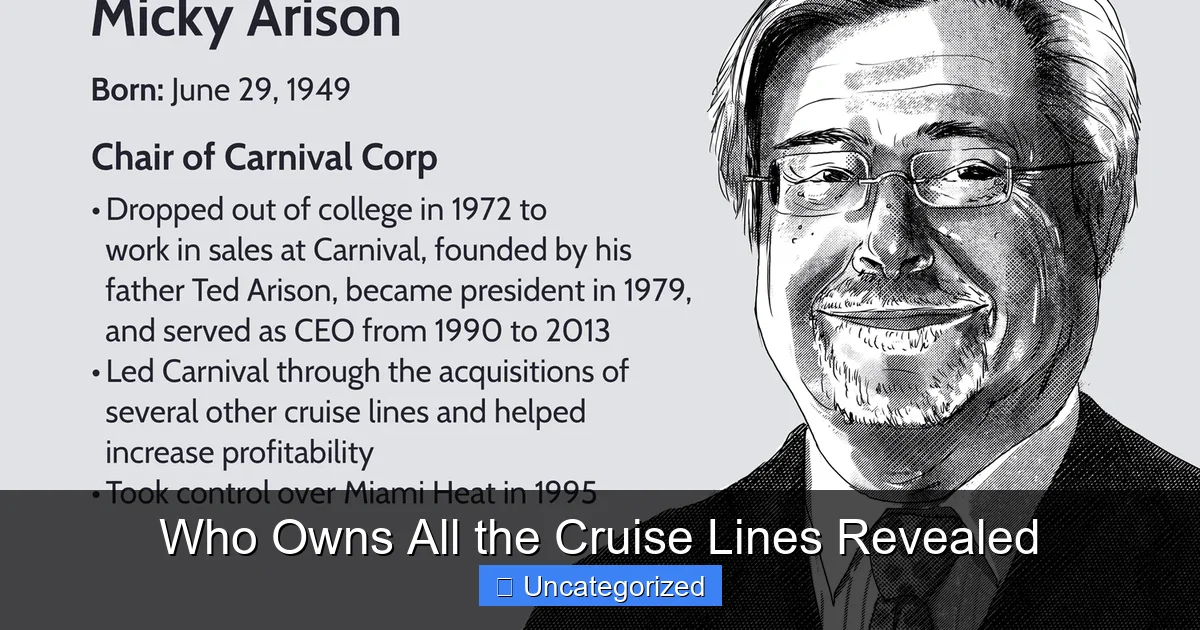

Carnival Corporation & plc: The World’s Largest Cruise Operator

Headquartered in Miami, Florida, and listed on both the New York and London Stock Exchanges, Carnival Corporation & plc is the largest cruise company in the world. With a fleet of over 90 ships and a market capitalization exceeding $20 billion, it operates 10 distinct cruise brands, each targeting a different customer segment. This “house of brands” strategy allows Carnival to capture a wide range of travelers without diluting any single brand’s identity.

- Carnival Cruise Line – The flagship brand, known for fun, family-friendly cruises with a “Fun Ship” theme. Popular with first-time cruisers and families.

- Princess Cruises – Mid-range, elegant ships with a focus on destination-rich itineraries. Famous for the Love Boat TV series.

- Holland America Line – Premium brand with a heritage dating back to 1873. Appeals to older travelers and those seeking a more refined experience.

- Seabourn – Ultra-luxury, all-suite ships with high staff-to-guest ratios and inclusive pricing.

- Cunard – British heritage brand, famous for transatlantic voyages on the Queen Mary 2.

- AIDA Cruises – German-focused brand with vibrant, youth-oriented ships.

- P&O Cruises (UK) – British brand with a traditional yet modern feel.

- P&O Australia – Tailored for the Australian market with relaxed, informal cruising.

- Costa Cruises – Italian brand with a Mediterranean flair, popular in Europe and Asia.

- Carnival China – A joint venture targeting the rapidly growing Chinese cruise market.

Tip: If you’re booking a cruise and want to know the parent company, check the brand’s website footer—most list Carnival Corporation as the parent. This can help you understand corporate policies on sustainability, refunds, and loyalty programs.

Royal Caribbean Group: Innovation and Scale

Royal Caribbean Group, also based in Miami, is the second-largest cruise operator, with a fleet of over 60 ships across four major brands. Known for pushing the boundaries of cruise ship design, Royal Caribbean has pioneered innovations like virtual balconies, robot bartenders, and the Ultimate Abyss—a 10-story dry slide.

- Royal Caribbean International – The flagship brand, offering large, amenity-rich ships like Wonder of the Seas, the world’s largest cruise ship.

- Silversea Cruises – Acquired in 2018, this ultra-luxury, all-inclusive brand caters to high-net-worth travelers.

- TUI Cruises – A joint venture with TUI Group, targeting the German-speaking market with a premium experience.

- Hapag-Lloyd Cruises – Acquired in 2019, this German luxury and expedition brand focuses on cultural and polar expeditions.

Royal Caribbean’s strategy emphasizes scale, technology, and destination immersion. For example, its Perfect Day at CocoCay private island in the Bahamas is a masterclass in creating exclusive, high-capacity experiences. The company also invests heavily in liquefied natural gas (LNG) propulsion and shore power to reduce emissions—a key selling point for environmentally conscious travelers.

Norwegian Cruise Line Holdings: The Challenger

Norwegian Cruise Line Holdings (NCLH) rounds out the “Big Three” with a fleet of over 30 ships and a market cap of around $8 billion. Based in Miami, NCLH operates three brands, each with a distinct positioning:

- Norwegian Cruise Line (NCL) – Known for “Freestyle Cruising,” which eliminates assigned dining times and formal dress codes. Appeals to younger, independent travelers.

- Oceania Cruises – Premium brand focused on culinary excellence, with gourmet dining and destination-intensive itineraries.

- Regent Seven Seas Cruises – Ultra-luxury, all-inclusive brand with some of the highest space-to-guest ratios in the industry.

NCLH differentiates itself through inclusivity and flexibility. For example, Regent Seven Seas includes airfare, shore excursions, and premium drinks in its base price—something rare in the ultra-luxury segment. NCLH also recently launched the Prima-class ships, featuring infinity pools, outdoor dining, and interactive art installations, aiming to redefine modern luxury.

Independent and Niche Players: Beyond the Big Three

While the Big Three dominate, a number of independent and niche cruise lines thrive by serving specialized markets or maintaining unique ownership models. These companies often focus on expedition cruising, river voyages, or cultural immersion, offering experiences that mass-market brands can’t replicate.

Expedition and Luxury Specialists

Companies like Lindblad Expeditions (in partnership with National Geographic) and Quark Expeditions focus on polar regions, wildlife, and scientific exploration. These brands often operate smaller ships (under 200 passengers) to access remote areas and provide expert-led excursions. Lindblad, for example, partners with National Geographic to offer onboard naturalists, photographers, and scientists—adding educational value to every voyage.

Scenic Luxury Cruises & Tours and its sister brand Emerald Cruises offer river and ocean cruises with a strong focus on all-inclusive luxury and private balcony suites. Scenic is privately owned by Australian entrepreneur Glen Moroney, giving it more flexibility in ship design and service offerings. Their Scenic Eclipse is a “yacht expedition” vessel with a helicopter and submarine—showcasing the potential of niche innovation.

River Cruise Leaders

The river cruise segment is dominated by a few key players, many of which are independent or family-owned:

- Viking Cruises – Founded by Torstein Hagen, Viking is the largest river cruise operator in Europe, with over 80 river ships. It also operates ocean and expedition vessels. Viking is privately held, allowing it to reinvest profits into new ships and global expansion.

- AmaWaterways – Family-owned and known for active excursions and wellness-focused itineraries. AmaWaterways emphasizes local cuisine and small-group tours, appealing to culturally curious travelers.

- Uniworld Boutique River Cruise Collection – Acquired by The Travel Corporation (TTC), a privately held group that also owns Insight Vacations and Trafalgar. Uniworld focuses on designer interiors and boutique experiences, with each ship themed after a different European destination.

Tip: When choosing a river cruise, consider the ownership model. Family-owned brands like AmaWaterways often provide more personalized service, while larger groups like TTC offer loyalty benefits across multiple brands.

Other Notable Independents

Several other cruise lines operate outside the Big Three but still have significant global reach:

- MSC Cruises – Owned by the Mediterranean Shipping Company (MSC), a global shipping giant. MSC has rapidly expanded, with a fleet of over 20 ships and plans to build more. It targets the European and South American markets with affordable, family-friendly cruises.

- Disney Cruise Line – Fully owned by The Walt Disney Company. Known for themed experiences, character interactions, and family-friendly amenities. Disney operates four ships with a fifth launching in 2024.

- Virgin Voyages – A joint venture between Richard Branson’s Virgin Group and private equity firm Bain Capital. Virgin Voyages targets adults-only, with a focus on modern design, inclusive pricing, and nightlife.

Ownership Models: Public, Private, and Joint Ventures

The way cruise lines are owned has a major impact on their operations, growth strategies, and customer experience. Understanding these models helps explain why some brands innovate rapidly while others focus on stability and heritage.

Publicly Traded Corporations

Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings are all publicly traded on major stock exchanges. This means they answer to shareholders, report quarterly earnings, and must balance growth with profitability. While this can drive innovation and expansion (e.g., new ships, new destinations), it can also lead to cost-cutting measures during downturns, such as the 2020-2021 pandemic, when many ships were laid up and staff furloughed.

Public ownership also enables access to capital markets. For example, Royal Caribbean raised $2.3 billion in debt and equity during the pandemic to stay afloat—something privately held companies might struggle to do.

Privately Held and Family-Owned Brands

Brands like Viking Cruises, AmaWaterways, and Scenic are privately held, often by founders or families. This structure offers several advantages:

- Long-term planning without quarterly pressure

- Greater control over brand identity and service standards

- Ability to reinvest profits into new ships or sustainability initiatives

For example, Viking’s founder Torstein Hagen has consistently prioritized ship quality and educational programming over short-term profits, resulting in high customer satisfaction and strong repeat bookings.

Joint Ventures and Strategic Partnerships

Joint ventures allow cruise companies to enter new markets or share risks. Examples include:

- TUI Cruises – Joint venture between Royal Caribbean Group and TUI Group (a German travel company)

- Carnival China – Joint venture between Carnival and China State Shipbuilding Corporation

- Lindblad Expeditions-National Geographic – Partnership that combines expedition expertise with media reach

These models enable brands to localize offerings, leverage existing infrastructure, and access new customer bases without full ownership risk.

Global Expansion and Market-Specific Strategies

Cruise ownership is not just about controlling brands—it’s about strategic positioning in key markets. The Big Three and independents alike tailor their fleets, itineraries, and marketing to regional preferences.

Asia-Pacific: A Growth Frontier

The Asia-Pacific region, particularly China, is a major growth area. Carnival’s Carnival China joint venture, Royal Caribbean’s Quantum-class ships deployed in Shanghai, and Norwegian’s Norwegian Joy (built specifically for Chinese tastes) show how companies adapt to local culture.

- Chinese travelers often prefer short itineraries, gambling, and group tours.

- Ships like Norwegian Joy include Karaoke lounges, Mahjong tables, and Chinese dining options.

Europe: Heritage and Luxury

European markets favor heritage brands like Cunard and Hapag-Lloyd, as well as river cruising. Companies like Viking and AmaWaterways dominate the Rhine, Danube, and Seine rivers with culturally immersive experiences.

North America: Mass Market and Niche Appeal

In the U.S. and Canada, the Big Three dominate the Caribbean, Alaska, and Mediterranean markets. However, niche brands like Disney and Virgin Voyages attract specific demographics—families and millennials, respectively—through unique branding and experience design.

Environmental and Regulatory Influences on Ownership

Ownership structures also shape how cruise lines respond to environmental regulations, climate change, and public scrutiny. The International Maritime Organization (IMO) and regional bodies like the European Union are pushing for cleaner fuels, reduced emissions, and sustainable practices.

Green Initiatives by Parent Companies

Royal Caribbean Group has invested over $2 billion in LNG-powered ships and shore power connections. Carnival Corporation has committed to net-zero emissions by 2050 and is testing biofuels and fuel cells. Norwegian Cruise Line Holdings is installing exhaust gas cleaning systems (scrubbers) on its fleet.

Tip: When choosing a cruise, check the parent company’s sustainability report. Publicly traded companies often publish detailed ESG (Environmental, Social, Governance) disclosures.

Regulatory Challenges and Consolidation

Stricter environmental laws and port regulations may favor larger, better-capitalized companies. Smaller, independent lines may struggle with compliance costs, potentially leading to more acquisitions or partnerships in the future. For example, the EU’s Emissions Trading System (ETS) will start charging cruise lines for carbon emissions in 2024, adding pressure on all operators.

Conclusion: The Future of Cruise Ownership

The question of who owns all the cruise lines is more than a curiosity—it reveals the strategic forces shaping the future of travel. The Big Three—Carnival, Royal Caribbean, and Norwegian—will likely continue to dominate through scale, innovation, and global reach. Meanwhile, independent and niche players will thrive by offering unique, high-touch experiences that mass-market brands can’t replicate.

Ownership models will evolve as environmental regulations tighten, new markets emerge, and consumer preferences shift. We may see more joint ventures in Asia, green tech investments across all fleets, and even new entrants from tech or hospitality giants. But one thing is certain: the cruise industry will remain a dynamic, competitive landscape where ownership is not just about control—it’s about vision, sustainability, and the ability to deliver unforgettable experiences on the high seas.

Whether you’re booking your next vacation or analyzing industry trends, understanding the ownership behind the brands empowers you to make smarter, more informed decisions. The next time you step onto a cruise ship, remember: behind the smiling staff and glittering pools is a corporate strategy decades in the making—and now you know who’s really in charge.

Key Cruise Ownership Data at a Glance

| Parent Company | Brands | Fleet Size (2024) | Headquarters | Ownership Type | Notable Innovations |

|---|---|---|---|---|---|

| Carnival Corporation & plc | 10 (Carnival, Princess, Seabourn, etc.) | 90+ ships | Miami, FL / Southampton, UK | Public (NYSE/LSE) | LNG-powered ships, MedallionNet Wi-Fi |

| Royal Caribbean Group | 4 (Royal Caribbean, Silversea, TUI, Hapag-Lloyd) | 60+ ships | Miami, FL | Public (NYSE) | Virtual balconies, Ultimate Abyss, CocoCay |

| Norwegian Cruise Line Holdings | 3 (Norwegian, Oceania, Regent) | 30+ ships | Miami, FL | Public (NYSE) | Freestyle Cruising, Prima-class infinity pools |

| Viking Cruises | 1 (Viking) | 80+ river, 10+ ocean ships | Los Angeles, CA | Private | Expedition ships, onboard experts |

| MSC Cruises | 1 (MSC) | 20+ ships | Geneva, Switzerland | Private (MSC Group) | LNG-powered ships, MSC World Europa |

| Disney Cruise Line | 1 (Disney) | 5 ships (by 2024) | Orlando, FL | Public (Disney) | Themed experiences, character dining |

Frequently Asked Questions

Who owns all the cruise lines in the world?

The global cruise industry is primarily dominated by three major parent companies: Carnival Corporation & plc, Royal Caribbean Group, and Norwegian Cruise Line Holdings. Together, they own over 80% of the world’s major cruise lines through subsidiaries and brands.

Which company owns the most cruise lines?

Carnival Corporation & plc owns the most cruise lines, including popular brands like Carnival Cruise Line, Princess Cruises, Holland America Line, and Costa Cruises. This makes it the largest cruise operator by fleet size and number of brands under its umbrella.

Does Royal Caribbean own other cruise lines?

Yes, Royal Caribbean Group owns several cruise lines, including Royal Caribbean International, Celebrity Cruises, and Silversea Cruises. They also hold a majority stake in TUI Cruises and Hapag-Lloyd Cruises through joint ventures.

Who owns all the cruise lines under the luxury segment?

Many luxury cruise lines are owned by larger parent companies, such as Silversea (Royal Caribbean Group) and Regent Seven Seas (Norwegian Cruise Line Holdings). Independent luxury brands like Viking Cruises remain privately owned but still partner with major industry players for growth.

Are any cruise lines owned by governments or private investors?

While most major cruise lines are publicly traded, some smaller or regional brands may be privately held or government-supported, such as China State Shipbuilding Corporation’s involvement in domestic cruise ventures. However, the vast majority of “who owns all the cruise lines” leads back to the three big publicly traded corporations.

How can I find out who owns a specific cruise line?

To discover who owns a specific cruise line, check the company’s investor relations website or annual reports, which list parent companies and subsidiaries. Industry databases and news sources covering “who owns all the cruise lines” also provide up-to-date ownership structures.