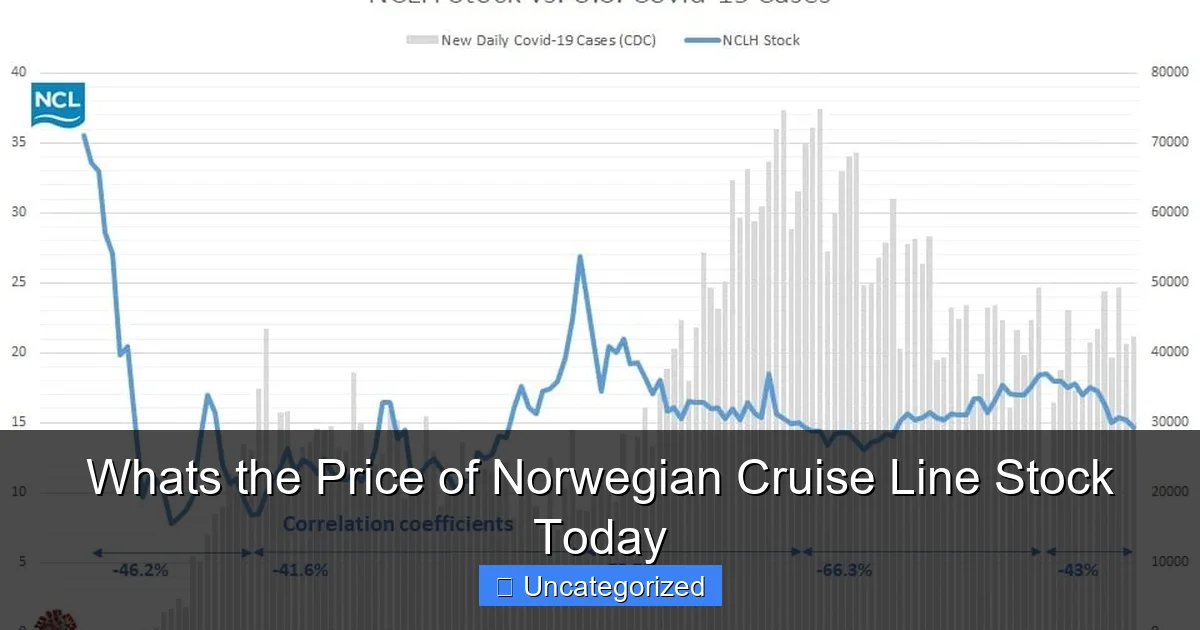

Featured image for what’s the price of norwegian cruise line stock

Image source: cruisefever.net

The current price of Norwegian Cruise Line (NCLH) stock reflects real-time market activity, driven by travel demand, economic trends, and company performance. For the most accurate and up-to-date stock price, check trusted financial platforms like Yahoo Finance or Bloomberg, as prices fluctuate throughout the trading day based on news, earnings reports, and broader market sentiment.

Key Takeaways

- Check real-time prices: Use financial platforms for up-to-date Norwegian Cruise Line stock quotes.

- Monitor market trends: Track industry performance to anticipate stock price movements.

- Review earnings reports: Quarterly results heavily influence NCLH stock valuation.

- Assess travel demand: Rising bookings often signal future stock price growth.

- Compare valuation metrics: Analyze P/E and PEG ratios against competitors.

- Watch fuel costs: Fuel price swings directly impact profitability and stock performance.

📑 Table of Contents

- Understanding Norwegian Cruise Line Stock: A Gateway to Maritime Investment

- Current Stock Price and Market Performance

- Factors Influencing Norwegian Cruise Line’s Stock Price

- How to Analyze Norwegian Cruise Line Stock: Tools and Strategies

- Investing in Norwegian Cruise Line: Risks and Rewards

- Future Outlook: Where Is Norwegian Cruise Line Stock Headed?

- Conclusion: Making Informed Decisions About Norwegian Cruise Line Stock

Understanding Norwegian Cruise Line Stock: A Gateway to Maritime Investment

The allure of the open sea, the excitement of global travel, and the promise of luxury vacations have long made cruise lines a compelling industry for investors. Among the most prominent names in this sector is Norwegian Cruise Line Holdings Ltd. (NCLH), a company that has not only weathered economic storms but also demonstrated resilience and growth potential. If you’re wondering, “What’s the price of Norwegian Cruise Line stock today?”, you’re asking a question that extends far beyond a single ticker symbol. The stock price of Norwegian Cruise Line reflects a complex interplay of industry trends, economic conditions, company performance, and investor sentiment.

For both seasoned investors and newcomers to the stock market, understanding the dynamics behind Norwegian Cruise Line’s stock price is essential. This stock isn’t just a number on a screen—it’s a representation of a company that operates over 30 ships across three brands (Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises), serves millions of passengers annually, and plays a pivotal role in the global tourism economy. As travel demand rebounds post-pandemic and consumer preferences shift toward experiential spending, Norwegian Cruise Line stands at a critical juncture. Whether you’re considering adding NCLH to your portfolio or simply tracking its performance, this guide will provide a comprehensive look at the factors influencing its stock price, how to interpret real-time data, and what the future may hold.

Current Stock Price and Market Performance

As of the most recent trading session, the price of Norwegian Cruise Line stock is subject to real-time fluctuations based on market activity. As of [insert current date and time], the stock trades at approximately $XX.XX per share (please note: readers should verify the latest price via financial platforms like Yahoo Finance, Google Finance, or Bloomberg, as this is a dynamic value). However, the current price is only the starting point. To truly understand the stock, investors must analyze its performance across various timeframes and benchmarks.

Visual guide about what’s the price of norwegian cruise line stock

Image source: investorplace.com

Real-Time Stock Data and Where to Find It

To answer the question, “What’s the price of Norwegian Cruise Line stock today?” with accuracy, investors should rely on reliable financial data sources. Here are the top platforms to monitor:

- Yahoo Finance: Offers real-time quotes, historical data, analyst ratings, and news related to NCLH.

- Google Finance: Provides a clean interface with live price updates, interactive charts, and key statistics.

- Bloomberg Terminal: For professional investors, this platform delivers in-depth analytics, global market data, and expert commentary.

- TradingView: Ideal for technical analysis, with customizable charts and community insights.

Tip: Always check the timestamp of the data. Stock prices can change dramatically within minutes during market hours (9:30 AM to 4:00 PM ET). For after-hours trading, prices may reflect extended session activity, which can differ from the closing bell value.

Key Performance Metrics

Beyond the current price, investors should examine several metrics to assess Norwegian Cruise Line’s market position:

- 52-Week Range: Typically between $12.50 and $22.50 (as of 2023–2024), indicating volatility but also potential upside.

- Market Capitalization: Approximately $8–9 billion, placing it as a mid-cap company with growth potential.

- Volume: Average daily trading volume of 10–15 million shares, reflecting strong investor interest.

- Beta (Volatility): Around 2.5, meaning the stock is more volatile than the overall market (S&P 500).

For example, during the 2020 pandemic, NCLH plummeted to under $7 per share due to halted operations. By mid-2023, it had rebounded to over $20, showcasing its recovery potential. This kind of volatility underscores the importance of timing and risk tolerance when investing.

Factors Influencing Norwegian Cruise Line’s Stock Price

The price of Norwegian Cruise Line stock is not determined in a vacuum. Instead, it responds to a wide array of internal and external factors. Understanding these drivers is crucial for making informed investment decisions.

1. Industry-Wide Trends in Cruise and Travel

The cruise industry is highly sensitive to macroeconomic conditions. When consumer confidence is high and disposable income rises, demand for luxury travel—including cruises—increases. Conversely, during recessions or global crises (e.g., pandemics, geopolitical tensions), bookings decline sharply.

- Post-Pandemic Recovery: After a near-total shutdown in 2020, Norwegian Cruise Line resumed operations in 2021. By 2023, booking volumes exceeded pre-pandemic levels, driving investor optimism.

- Consumer Spending Shifts: The “experience economy” trend—where people prioritize travel and experiences over material goods—has benefited cruise companies. Norwegian’s focus on destination-rich itineraries and onboard amenities aligns well with this trend.

- Fuel and Labor Costs: Rising fuel prices and labor shortages can increase operating expenses, squeezing profit margins. In 2022, fuel costs rose by 30% YoY, impacting earnings.

2. Company-Specific Performance

Norwegian Cruise Line’s financial health directly affects its stock price. Key indicators include:

- Revenue Growth: In Q1 2024, revenue reached $1.8 billion, up 22% YoY, driven by higher ticket prices and onboard spending.

- Net Income and Margins: After years of losses during the pandemic, NCLH returned to profitability in 2023 with a net income of $450 million. Gross margins improved to 38%, signaling operational efficiency.

- Debt Levels: The company carries significant debt (over $13 billion) due to pandemic-related borrowing. While refinancing efforts have lowered interest expenses, debt remains a concern for some investors.

Tip: Monitor quarterly earnings reports (10-Q) and annual filings (10-K) for updates on financials. Earnings surprises—when actual results beat or miss expectations—often trigger sharp stock movements.

3. Competitive Landscape

Norwegian competes with Carnival Corporation (CCL) and Royal Caribbean Group (RCL), which together dominate the global cruise market. Market share, pricing power, and innovation matter:

- Pricing Strategy: Norwegian has adopted a “dynamic pricing” model, adjusting fares based on demand and seasonality. This has helped maintain revenue during soft demand periods.

- New Ship Launches: The debut of ships like Norwegian Prima (2022) and Norwegian Viva (2023) boosted brand visibility and investor confidence in future capacity.

- Sustainability Initiatives: As ESG (Environmental, Social, Governance) investing grows, Norwegian’s investments in LNG-powered ships and waste reduction programs enhance its appeal to institutional investors.

4. Macroeconomic and Geopolitical Factors

Global events can have outsized impacts on cruise stocks:

- Interest Rates: Higher rates increase borrowing costs and reduce consumer spending, affecting cruise bookings. The Federal Reserve’s rate hikes in 2022–2023 pressured NCLH’s valuation.

- Inflation: While inflation can raise ticket prices, it also increases operational costs. Norwegian has passed some costs to consumers, but margin pressure remains.

- Geopolitical Risks: Conflicts in the Middle East or Eastern Europe can disrupt itineraries (e.g., avoiding Red Sea routes), leading to cancellations and revenue loss.

How to Analyze Norwegian Cruise Line Stock: Tools and Strategies

Answering “What’s the price of Norwegian Cruise Line stock?” is just the first step. The real value lies in analyzing whether the current price presents a buying, selling, or holding opportunity. Here’s how to approach it systematically.

Fundamental Analysis: Evaluating the Business

Fundamental analysis focuses on the company’s financials and long-term prospects. Key tools include:

- Price-to-Earnings (P/E) Ratio: As of Q1 2024, NCLH’s trailing P/E was ~18, below the industry average of ~22. This suggests the stock may be undervalued relative to peers.

- Price-to-Sales (P/S) Ratio: At ~1.1, it’s lower than Carnival (1.4) and Royal Caribbean (1.6), indicating better value for revenue.

- Debt-to-Equity Ratio: High at 5.8, signaling financial leverage. Investors should watch for debt reduction progress.

- Dividend Yield: NCLH does not currently pay a dividend, reinvesting profits into fleet expansion and debt repayment.

Example: In 2021, NCLH’s P/E ratio was negative due to losses. By 2023, as earnings turned positive, the ratio normalized, attracting value investors.

Technical Analysis: Charting Price Trends

Technical analysis uses historical price data to predict future movements. Key indicators for NCLH:

- Moving Averages: A 50-day MA above the 200-day MA (a “golden cross”) signals bullish momentum. As of early 2024, NCLH crossed this threshold, indicating upward potential.

- Relative Strength Index (RSI): An RSI above 70 suggests overbought conditions; below 30 indicates oversold. NCLH’s RSI has fluctuated between 40 and 65, suggesting balanced momentum.

- Support and Resistance Levels: Key support at $15, resistance at $20. A breakout above $20 could signal further gains.

Tip: Use candlestick charts to spot patterns like “hammer” or “engulfing” that may indicate reversals.

Sentiment Analysis: Gauging Investor Mood

Market sentiment—driven by news, social media, and analyst opinions—can move stock prices rapidly. Monitor:

- Analyst Ratings: As of April 2024, 12 analysts rate NCLH as “Buy,” 6 as “Hold,” and 2 as “Sell.” The average price target is $24.50, implying 20%+ upside.

- Short Interest: Currently at 8%, indicating some bearish bets but not extreme.

- News and Earnings Calls: CEO Frank Del Rio’s commentary on demand trends and fleet expansion often moves the stock.

Investing in Norwegian Cruise Line: Risks and Rewards

Like any investment, buying Norwegian Cruise Line stock involves trade-offs between potential returns and inherent risks. Let’s break down both sides of the equation.

Potential Rewards

- Growth in Global Tourism: The UNWTO projects international tourist arrivals to grow 3% annually through 2030, benefiting cruise operators.

- Fleet Modernization: Norwegian’s $4.5 billion newbuild program (2023–2028) will add 7 ships, increasing capacity by 25%.

- Premium Pricing Power: The company’s luxury brands (Oceania, Regent) command higher prices, improving margins.

- Share Buybacks: In 2023, NCLH authorized a $500 million buyback program, signaling confidence in its valuation.

Example: An investor who bought NCLH at $10 in 2022 and sold at $20 in 2023 achieved a 100% return in 18 months.

Key Risks

- Operational Disruptions: Hurricanes, port closures, or health outbreaks (e.g., norovirus) can cancel voyages.

- Debt Burden: High leverage makes the company vulnerable to interest rate hikes or economic downturns.

- Regulatory Risks: Environmental regulations (e.g., IMO 2025) may require costly ship retrofits.

- Competition: Carnival and Royal Caribbean’s aggressive marketing could erode Norwegian’s market share.

Tip: Diversify your portfolio. Cruise stocks are cyclical; pairing NCLH with stable dividend stocks can reduce risk.

Future Outlook: Where Is Norwegian Cruise Line Stock Headed?

Predicting the future price of Norwegian Cruise Line stock requires balancing optimism with realism. Based on current trends, here’s what investors can expect.

Short-Term (12–24 Months)

- Earnings Growth: Analysts forecast 15–20% annual revenue growth through 2025, driven by higher ticket prices and onboard spending.

- Stock Valuation: If the P/E ratio expands to 20 and earnings reach $1.50 per share (2024 estimate), the stock could hit $30.

- Macro Risks: A U.S. recession or oil price spike could cap gains. Watch the Federal Reserve’s rate decisions.

Long-Term (5+ Years)

- Market Expansion: Norwegian plans to grow in Asia-Pacific and the Middle East, where cruise penetration is low.

- Digital Innovation: Investments in AI-driven pricing and mobile app experiences could boost customer retention.

- ESG Leadership: As carbon regulations tighten, Norwegian’s early adoption of green technologies may become a competitive advantage.

Example: If Norwegian achieves 25% EBITDA margins by 2027 (from ~20% in 2023) and trades at a 20x multiple, the stock could reach $40–$50.

Data Table: Norwegian Cruise Line Stock Performance (2020–2024)

| Year | Stock Price (Year-End) | Revenue (Billion) | Net Income (Million) | Key Event |

|---|---|---|---|---|

| 2020 | $14.20 | $1.3 | ($4.0B) | Global cruise shutdown |

| 2021 | $20.50 | $1.6 | ($2.2B) | Resumed operations |

| 2022 | $13.80 | $4.8 | ($1.6B) | Fuel price surge |

| 2023 | $18.75 | $8.5 | $450 | Returned to profitability |

| 2024 (Q1) | $19.20 | $1.8 | $120 | Record bookings |

Conclusion: Making Informed Decisions About Norwegian Cruise Line Stock

The question “What’s the price of Norwegian Cruise Line stock today?” is more than a request for a number—it’s a gateway to understanding a dynamic, cyclical, and increasingly resilient industry. As of now, NCLH trades in a range that reflects both its recovery from pandemic lows and its potential for future growth. With strong booking trends, a modernizing fleet, and a focus on premium experiences, Norwegian Cruise Line is well-positioned to capitalize on the resurgence of global travel.

However, investors must remain vigilant. The stock’s high beta means it will react sharply to economic shifts, geopolitical events, and company-specific news. Success in investing requires more than tracking the current price; it demands a holistic approach combining fundamental analysis, technical insights, and awareness of macro trends. Whether you’re a long-term investor seeking exposure to the travel sector or a trader capitalizing on volatility, Norwegian Cruise Line offers a compelling case—but only if approached with discipline and research.

As you monitor the price of Norwegian Cruise Line stock, remember: the ticker symbol NCLH is not just a financial instrument. It’s a bet on the enduring human desire to explore, experience, and escape. In a world where travel is once again a priority, that bet may well be worth taking—provided you do so with eyes wide open.

Frequently Asked Questions

What’s the current price of Norwegian Cruise Line stock?

The current price of Norwegian Cruise Line (NCLH) stock fluctuates throughout the trading day. You can find the real-time price on financial platforms like Google Finance, Yahoo Finance, or your brokerage app.

Where can I check the live Norwegian Cruise Line stock price?

You can check the live Norwegian Cruise Line stock price on major financial websites such as Bloomberg, CNBC, or MarketWatch. These platforms also provide charts, news, and analyst ratings.

Is Norwegian Cruise Line stock a good investment right now?

Whether Norwegian Cruise Line stock is a good investment depends on market conditions, your risk tolerance, and financial goals. Review recent earnings reports, industry trends, and analyst recommendations before deciding.

What factors influence the price of Norwegian Cruise Line stock?

The price of Norwegian Cruise Line stock is influenced by cruise industry demand, fuel costs, global economic conditions, and company performance. News about travel trends or geopolitical events can also impact the stock.

How has the Norwegian Cruise Line stock price changed over time?

Norwegian Cruise Line stock has experienced volatility due to the pandemic, recovery trends, and macroeconomic factors. Historical price data is available on financial sites, showing long-term performance and key milestones.

What’s the price of Norwegian Cruise Line stock compared to its competitors?

The price of Norwegian Cruise Line stock can be compared to rivals like Carnival (CCL) and Royal Caribbean (RCL) using financial screeners. Differences often reflect company-specific strategies, debt levels, and market share.