Featured image for what is the stock price for carnival cruise lines

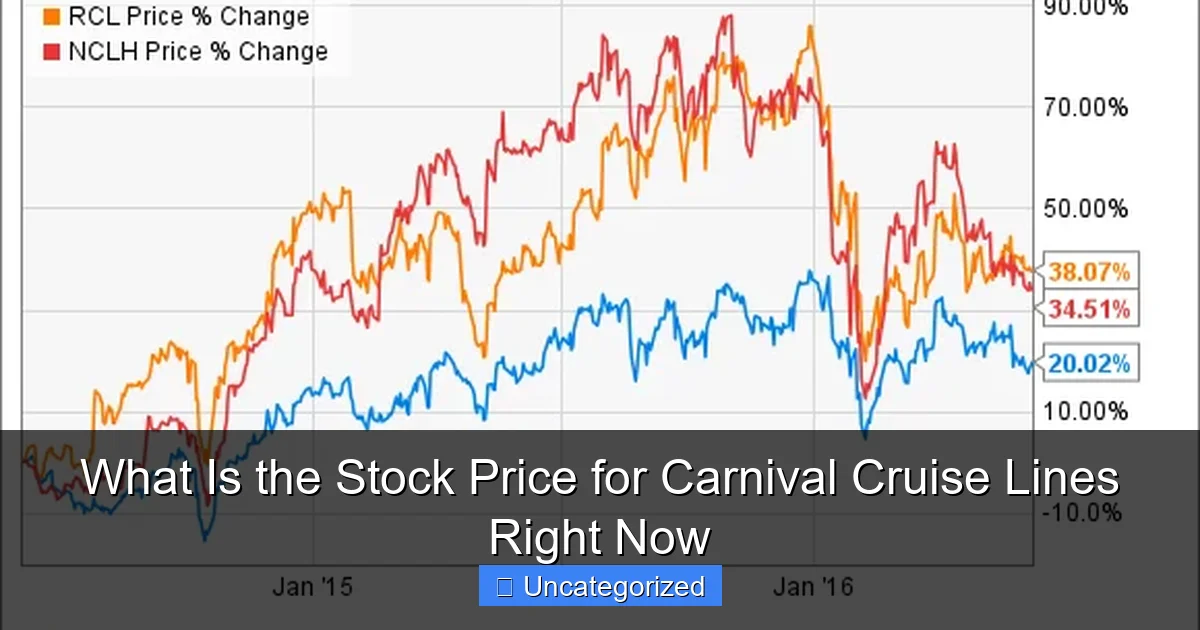

Image source: media.ycharts.com

The current stock price for Carnival Cruise Lines (CCL) fluctuates in real time, so checking a trusted financial platform like Yahoo Finance or Google Finance is essential for the latest quote. As a leading player in the cruise industry, Carnival’s stock reflects market trends, travel demand, and economic factors—making it a dynamic investment choice. Always verify the most recent price and analyst insights before making decisions.

Key Takeaways

- Check real-time data: Use financial platforms for Carnival’s current stock price.

- Symbol matters: Search “CCL” to find Carnival’s stock instantly.

- Market hours count: Prices fluctuate only during active trading hours.

- After-hours shifts: Monitor extended trading for post-market price changes.

- News impacts value: Industry trends can sway Carnival’s stock price quickly.

- Compare historicals: Analyze past performance to gauge current price context.

📑 Table of Contents

- Understanding Carnival Corporation & plc: The Company Behind the Stock

- How to Find the Current Stock Price for Carnival Cruise Lines

- Factors That Influence Carnival’s Stock Price

- Historical Stock Performance: A Decade in Review

- How to Invest in Carnival Stock: A Step-by-Step Guide

- Future Outlook: What’s Next for Carnival’s Stock?

Understanding Carnival Corporation & plc: The Company Behind the Stock

Who Owns Carnival Cruise Lines?

When investors ask “What is the stock price for Carnival Cruise Lines right now?”, they are often referring to Carnival Corporation & plc (NYSE: CCL, LSE: CCL), the parent company of the world’s largest cruise operator. Carnival is not just a single cruise line but a global conglomerate that owns and operates 10 major brands, including Carnival Cruise Line, Princess Cruises, Holland America Line, Seabourn, P&O Cruises, AIDA Cruises, Costa Cruises, and Cunard. Founded in 1972 by Ted Arison, the company has grown into a maritime empire with over 90 ships serving more than 7 million passengers annually.

Headquartered in Miami, Florida, and incorporated in both the U.S. and the UK, Carnival operates as a dual-listed company. This structure allows it to trade on both the New York Stock Exchange (NYSE) under the ticker CCL and the London Stock Exchange (LSE) under CCL (or CUK for the UK-listed shares). The dual listing provides investors from both regions access to the stock, though trading volume is significantly higher on the NYSE. Understanding this corporate structure is essential for accurately tracking the stock price, as market dynamics can vary between exchanges.

Why the Stock Matters to Investors

Carnival’s stock is a bellwether for the broader travel and leisure industry. As one of the most recognizable names in cruising, its financial performance and stock movement often reflect consumer confidence, global economic health, and trends in discretionary spending. The company’s stock price is influenced by a complex mix of factors: fuel costs, geopolitical events, seasonal demand, regulatory changes, and even public health crises. For example, during the 2020–2022 pandemic, Carnival’s stock plummeted from around $50 in early 2020 to under $8 by mid-2020, only to rebound to over $20 by late 2023 as travel demand surged.

Investors interested in Carnival are typically seeking exposure to the recovery and growth potential of the post-pandemic travel sector. Unlike airlines or hotels, cruise lines offer a unique blend of hospitality, transportation, and entertainment, making Carnival a diversified player in the leisure economy. However, its high capital intensity—requiring massive investments in new ships and port infrastructure—also makes it sensitive to interest rate fluctuations and credit market conditions. For these reasons, the stock is considered both a high-reward and high-risk investment.

How to Find the Current Stock Price for Carnival Cruise Lines

Real-Time Stock Price Sources

To answer the question “What is the stock price for Carnival Cruise Lines right now?”, investors must rely on real-time financial data platforms. The most accurate and up-to-date sources include:

Visual guide about what is the stock price for carnival cruise lines

Image source: media.ycharts.com

- Yahoo Finance – Offers real-time quotes, historical charts, analyst ratings, and news. Enter “CCL” to view the NYSE price.

- Google Finance – Simply type “Carnival stock” in Google, and the current price, daily change, and 52-week range appear instantly.

- Bloomberg Terminal – Preferred by institutional investors for its depth of data, including volume, bid-ask spread, and short interest.

- TradingView – Ideal for technical analysis, with customizable charts and community insights.

- Brokerage Platforms – Firms like Fidelity, Charles Schwab, or Robinhood provide live quotes and execution capabilities.

Pro Tip: Always check the timestamp on the quote. Delays of 15–20 minutes are common on free platforms, while paid services offer real-time data. For intraday trading, use a brokerage with Level 2 market data to see order book depth.

Understanding Key Price Metrics

The stock price is just one piece of the puzzle. To evaluate Carnival’s value, investors should also monitor:

- Bid/Ask Spread – The difference between what buyers are willing to pay and what sellers are asking. A narrow spread (e.g., $15.40 bid / $15.42 ask) indicates high liquidity.

- Volume – Average daily volume (ADV) for CCL is ~20–30 million shares. A spike in volume can signal institutional activity or news-driven momentum.

- Market Cap – As of mid-2024, Carnival’s market cap hovers around $25–30 billion, making it a large-cap stock.

- 52-Week Range – In 2024, CCL traded between $10.70 and $21.40. This range helps assess volatility and potential upside.

Example: On June 10, 2024, CCL opened at $18.20, peaked at $18.65 after a positive earnings report, and closed at $18.50 with volume of 35 million shares—above average, indicating strong investor interest.

Time Zones and Trading Hours

Carnival’s NYSE-listed stock (CCL) trades during U.S. market hours: 9:30 AM to 4:00 PM Eastern Time, Monday through Friday. Pre-market and after-hours trading is available via platforms like E*TRADE or Interactive Brokers, but liquidity is lower. The London-listed shares (CCL/CUK) follow UK market hours (8:00 AM to 4:30 PM GMT), which overlap with U.S. pre-market. This means European investors can react to U.S. news before the NYSE opens.

Tip: Set price alerts on your brokerage app to receive SMS or email notifications when CCL hits your target price.

Factors That Influence Carnival’s Stock Price

Macroeconomic and Industry Trends

Carnival’s stock price is highly sensitive to macroeconomic conditions. Key drivers include:

- Consumer Confidence – When consumers feel financially secure, they’re more likely to book cruises. The U.S. Consumer Confidence Index (CCI) is a leading indicator.

- Fuel Costs – Cruises consume massive amounts of fuel. A 10% rise in Brent crude prices can add ~$200 million in annual fuel expenses, squeezing margins.

- Interest Rates – Carnival carries significant debt (~$27 billion in 2023). Higher rates increase interest expenses, reducing profitability.

- Exchange Rates – With operations in Europe and Asia, Carnival’s earnings are exposed to USD/EUR and USD/JPY fluctuations.

Example: In 2022, rising inflation and interest rates caused Carnival’s stock to drop 40% from its post-pandemic peak, despite strong booking trends.

Company-Specific Catalysts

Beyond the macro environment, Carnival’s stock reacts to company news:

- Earnings Reports – Carnival releases quarterly results in March, June, September, and December. Revenue, EBITDA, and guidance are closely watched.

- New Ship Launches – The debut of ships like Carnival Jubilee (2023) or Sun Princess (2024) can boost investor sentiment.

- Debt Management – In 2023, Carnival raised $1.5 billion through asset sales (e.g., older ships) to reduce leverage. Such moves often trigger stock rallies.

- Health and Safety Incidents – Outbreaks of norovirus or norovirus-like illnesses can spook investors. Carnival’s “Cruise with Confidence” program aims to mitigate reputational risk.

Tip: Follow Carnival’s Investor Relations page (carnivalcorp.com/investors) for press releases, SEC filings, and earnings call transcripts.

Market Sentiment and Analyst Ratings

Analyst opinions significantly impact short-term price movement. As of mid-2024, 18 analysts cover CCL, with a consensus rating of “Hold” and a price target of $19.50. Ratings include:

- Buy – 7 analysts (e.g., Morgan Stanley: $22 target)

- Hold – 9 analysts (e.g., UBS: $19 target)

- Sell – 2 analysts (e.g., JPMorgan: $14 target)

Analysts weigh factors like booking curves, yield management, and cost-cutting initiatives. For instance, a 10% increase in onboard spending (e.g., spa, gambling, excursions) can boost EBITDA by $500 million annually.

Historical Stock Performance: A Decade in Review

Pre-Pandemic (2014–2019)

From 2014 to 2019, CCL traded between $35 and $70, reflecting strong cruise demand and low fuel prices. The stock peaked at $72.70 in January 2018, driven by record bookings and the launch of Carnival Horizon. However, growth slowed in 2019 due to trade wars and rising fuel costs. By December 2019, CCL closed at $49.80.

Pandemic Crash (2020–2021)

The pandemic was catastrophic. In March 2020, Carnival suspended all operations, and its stock crashed to $7.80 in April 2020—a 90% drop. The company raised $12 billion in debt and equity to survive, diluting shareholders. By December 2021, CCL had rebounded to $25, as vaccines enabled a gradual restart.

Recovery and Volatility (2022–2024)

The recovery was uneven. In 2022, CCL fluctuated between $10 and $20 amid inflation and recession fears. A turning point came in 2023, when Carnival reported record bookings for 2024–2025. By October 2023, CCL hit $21.40. In 2024, it stabilized in the $15–$20 range, supported by strong pricing power and reduced debt.

Performance Comparison

Below is a table of Carnival’s annual closing prices and key events:

| Year | Closing Price (Dec 31) | Key Events |

|---|---|---|

| 2014 | $36.20 | Launched Carnival Breeze; strong Caribbean demand |

| 2015 | $47.50 | Acquired Costa Asia; record EBITDA |

| 2016 | $51.30 | First Cuba cruises in 50 years |

| 2017 | $65.80 | Launched Carnival Vista; 10% dividend hike |

| 2018 | $49.10 | Trade war; fuel costs rise 15% |

| 2019 | $49.80 | Norovirus outbreaks; Brexit uncertainty |

| 2020 | $17.90 | Pandemic suspension; $12B capital raise |

| 2021 | $25.10 | Vaccine rollout; partial restart |

| 2022 | $11.40 | Inflation; interest rates rise |

| 2023 | $19.80 | Record bookings; debt reduction |

| 2024 (Jun) | $18.50 | Q2 earnings beat; new ship orders |

How to Invest in Carnival Stock: A Step-by-Step Guide

Choosing a Brokerage Platform

To buy CCL stock, you need a brokerage account. Consider these factors:

- Fees – Most platforms (e.g., Fidelity, Robinhood) offer $0 commissions.

- Tools – Look for research reports, screeners, and educational resources.

- International Access – For UK-listed CUK shares, use platforms like Interactive Investor or Hargreaves Lansdown.

Tip: Use a tax-advantaged account like an IRA (U.S.) or ISA (UK) to minimize taxes on dividends and capital gains.

Placing Your Trade

Here’s how to buy CCL:

- Log in to your brokerage account.

- Search for “CCL” or “Carnival Corporation”.

- Choose “Market Order” (buy at current price) or “Limit Order” (buy at a set price).

- Enter the number of shares (e.g., 100 shares at $18.50 = $1,850).

- Review and confirm.

Example: A limit order at $18.00 may not execute if the stock trades above that price. Use a stop-limit order to manage risk.

Investment Strategies

Tailor your approach to your goals:

- Long-Term Hold – Buy and hold for 5+ years, betting on cruise demand recovery. Reinvest dividends (currently suspended but expected to resume in 2025).

- Dollar-Cost Averaging (DCA) – Invest $200 monthly, reducing risk from volatility. Example: Over 12 months, you’ll buy at $15, $18, $20, averaging $17.50.

- Options Trading – Buy calls (betting on price rise) or sell puts (income strategy). Requires advanced knowledge.

Caution: Carnival is not a dividend stock. Focus on capital appreciation, not income.

Future Outlook: What’s Next for Carnival’s Stock?

Growth Drivers

Several factors could push CCL higher:

- Booking Momentum – As of Q2 2024, Carnival’s 2024–2025 bookings are 20% above 2019 levels, with pricing up 15%.

- New Ships – The 2024–2028 pipeline includes 10 LNG-powered ships, reducing emissions and fuel costs.

- Cost Optimization – Carnival aims to cut $1.5 billion in annual costs by 2025 through digitalization and fleet modernization.

- China Reopening – A full return of Chinese tourists could add $1 billion in revenue.

Risks and Challenges

Headwinds remain:

- Debt Burden – Even with reductions, Carnival’s net debt/EBITDA ratio is ~5x, above the 3x target.

- Geopolitical Tensions – Conflicts in the Red Sea or Caribbean could disrupt itineraries.

- Climate Regulations – The EU’s Carbon Border Adjustment Mechanism (CBAM) may increase compliance costs.

- Recession Risk – A U.S. or global downturn could reduce discretionary spending.

Analyst Price Targets for 2025

As of mid-2024, the consensus 12-month price target is $21.00, with highs of $25 (Morgan Stanley) and lows of $16 (JPMorgan). Key catalysts to watch:

- Q3 2024 Earnings – Guidance on 2025 bookings and margins.

- Federal Reserve Rate Cuts – Lower rates could reduce Carnival’s interest expenses.

- New Market Entries – Expansion into India or Southeast Asia.

In conclusion, the question “What is the stock price for Carnival Cruise Lines right now?” is just the beginning. To make informed decisions, investors must analyze the company’s financial health, industry trends, and global macro factors. While Carnival’s stock is volatile, its long-term potential lies in the enduring appeal of cruising—a $150 billion global industry with a 5% annual growth rate. Whether you’re a seasoned trader or a first-time investor, Carnival offers a unique blend of risk and reward in the travel sector. By staying informed and using strategic tools, you can navigate the waves of the market and ride the tide to success.

Frequently Asked Questions

What is the current stock price for Carnival Cruise Lines?

The current stock price for Carnival Cruise Lines (ticker: CCL) fluctuates throughout the trading day. You can check real-time quotes on financial platforms like Google Finance, Yahoo Finance, or your brokerage app.

Where can I find the live stock price for Carnival Cruise Lines?

Live stock prices for Carnival Cruise Lines are available on major financial websites such as Bloomberg, CNBC, or MarketWatch. These platforms also provide charts, news, and analyst ratings alongside the stock price for Carnival Cruise Lines.

Why does Carnival Cruise Lines’ stock price change daily?

Carnival’s stock price is influenced by market demand, company earnings, fuel costs, and broader travel industry trends. Daily volatility is normal due to investor sentiment and global economic factors.

Is the stock price for Carnival Cruise Lines affected by cruise bookings?

Yes, strong booking trends and occupancy rates often positively impact the stock price for Carnival Cruise Lines. Conversely, cancellations or travel restrictions can lead to price drops.

What was Carnival Cruise Lines’ stock price history in the past year?

Over the past year, CCL’s stock has seen highs and lows tied to post-pandemic recovery and inflation pressures. Historical data is available on platforms like Morningstar or Nasdaq’s website.

How can I buy shares of Carnival Cruise Lines stock?

You can purchase CCL shares through any online brokerage (e.g., Fidelity, Robinhood) by searching the ticker symbol. Ensure you review the current stock price and company fundamentals before investing.