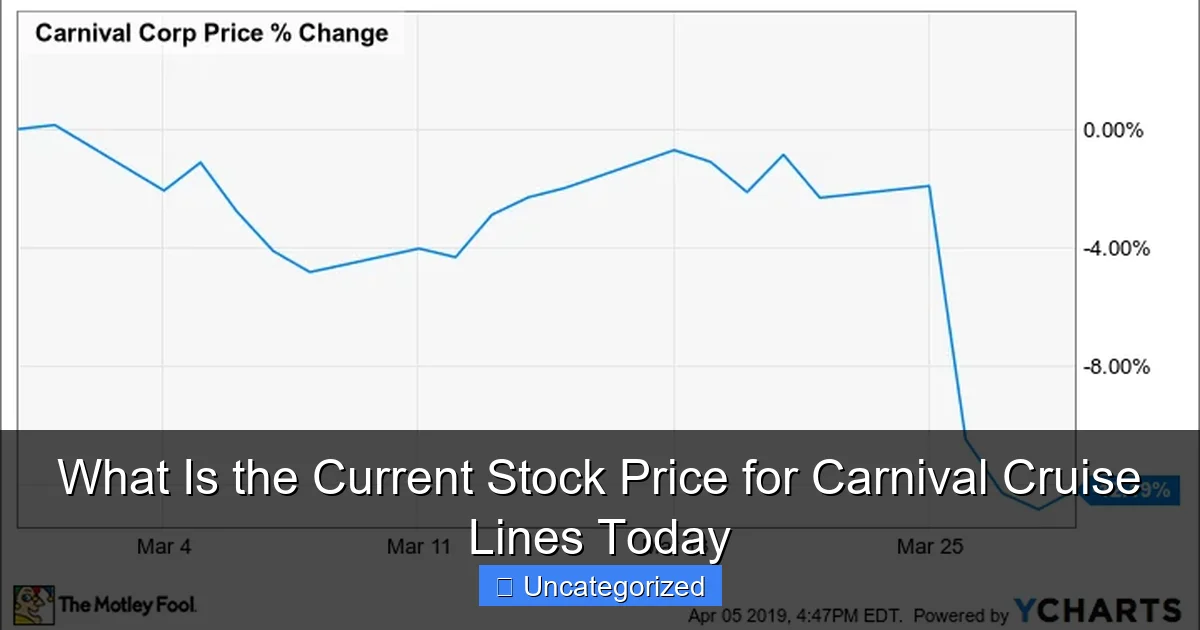

Featured image for what is the current stock price for carnival cruise lines

Image source: media.ycharts.com

The current stock price for Carnival Cruise Lines (CCL) fluctuates daily based on market conditions—check real-time data from trusted financial platforms like Yahoo Finance or Google Finance for the latest price. As a leading cruise company, CCL’s stock reflects broader travel trends and economic factors, making it essential for investors to monitor recent performance and analyst insights. Always verify up-to-the-minute pricing before making investment decisions.

Key Takeaways

- Check real-time data: Use financial platforms for live CCL stock prices.

- Market hours matter: Prices update during NYSE trading hours only.

- Track after-hours moves: Monitor extended trading for post-close shifts.

- Review earnings impact: Quarterly reports heavily influence Carnival’s valuation.

- Watch industry trends: Cruise demand and fuel costs affect stock performance.

- Set price alerts: Get notifications for key price thresholds automatically.

📑 Table of Contents

- Introduction to Carnival Cruise Lines and Stock Market Performance

- How to Find the Current Stock Price for Carnival Cruise Lines

- Factors Influencing the Current Stock Price for Carnival Cruise Lines

- Historical Stock Performance and Trends

- Expert Opinions and Analyst Forecasts

- Data Table: Carnival Cruise Lines Stock Snapshot (June 2024)

- Conclusion: Is Now a Good Time to Invest in Carnival Cruise Lines?

Introduction to Carnival Cruise Lines and Stock Market Performance

When it comes to global cruise tourism, few names resonate as powerfully as Carnival Cruise Lines. As one of the largest and most recognizable cruise operators in the world, Carnival Corporation & plc (NYSE: CCL) has long been a favorite among vacationers and investors alike. Whether you’re a seasoned investor looking to diversify your portfolio or a first-time stock buyer intrigued by the travel and leisure sector, understanding the current stock price for Carnival Cruise Lines is a critical first step in evaluating its market position, financial health, and growth potential.

The stock performance of Carnival Cruise Lines is more than just a number on a ticker—it reflects broader economic trends, consumer confidence, and the resilience of the tourism industry. After the unprecedented disruptions caused by the global pandemic, which brought cruise operations to a near standstill, Carnival’s stock has undergone a remarkable recovery. Investors now closely monitor its quarterly earnings, booking trends, fuel costs, and geopolitical factors that can influence its valuation. As of today, the current stock price for Carnival Cruise Lines is shaped by a complex interplay of macroeconomic indicators, industry-specific challenges, and forward-looking investor sentiment. In this comprehensive guide, we’ll explore the latest stock data, analyze key drivers of its performance, and provide practical insights for anyone interested in tracking or investing in CCL.

How to Find the Current Stock Price for Carnival Cruise Lines

Real-Time Stock Data Sources

Finding the current stock price for Carnival Cruise Lines is easier than ever, thanks to a wide range of digital tools and financial platforms. The most reliable sources for real-time stock data include:

Visual guide about what is the current stock price for carnival cruise lines

Image source: media.ycharts.com

- Yahoo Finance: Offers up-to-the-minute stock quotes, historical data, analyst ratings, and news related to CCL.

- Google Finance: A user-friendly interface that displays the current price, daily range, 52-week high/low, and market cap with a simple search of “CCL stock.”

- Bloomberg: A premium platform favored by institutional investors, providing in-depth analytics, earnings forecasts, and global market context.

- TradingView: Ideal for technical traders, offering advanced charting tools, indicators, and community sentiment analysis.

- Company Investor Relations Page: Carnival’s official investor relations website (carnivalcorp.com/investors) provides press releases, earnings reports, and stock performance updates directly from the source.

Tip: Bookmark at least two of these sources to cross-verify the current stock price for Carnival Cruise Lines and ensure accuracy, especially during periods of high market volatility.

Understanding Stock Ticker Symbols and Market Hours

Carnival Cruise Lines trades under the ticker symbol CCL on the New York Stock Exchange (NYSE). It’s important to note that stock prices fluctuate only during regular trading hours—9:30 AM to 4:00 PM Eastern Time, Monday through Friday—excluding federal holidays. Outside these hours, prices are based on after-hours or pre-market trading, which often has lower liquidity and higher volatility.

For example, if you check CCL at 8:00 AM ET, you might see a price that reflects pre-market activity, which could differ significantly from the opening price at 9:30 AM. Always verify whether the data you’re viewing is “real-time” or “delayed” (some free platforms show data delayed by 15-20 minutes).

Example: On a typical trading day, CCL might open at $18.45, dip to $18.20 by midday due to a broader market downturn, and close at $18.60 after positive earnings news. The current stock price for Carnival Cruise Lines at 3:45 PM would be $18.60, but checking at 5:00 PM might show a different number due to after-hours trading.

Mobile Apps and Alerts

For investors who want to stay updated on the go, mobile apps like Robinhood, Webull, and E*TRADE allow you to set price alerts, track your portfolio, and receive push notifications when CCL hits a target price. For instance, you can set an alert for when CCL reaches $20.00 or drops below $17.50, helping you make timely investment decisions.

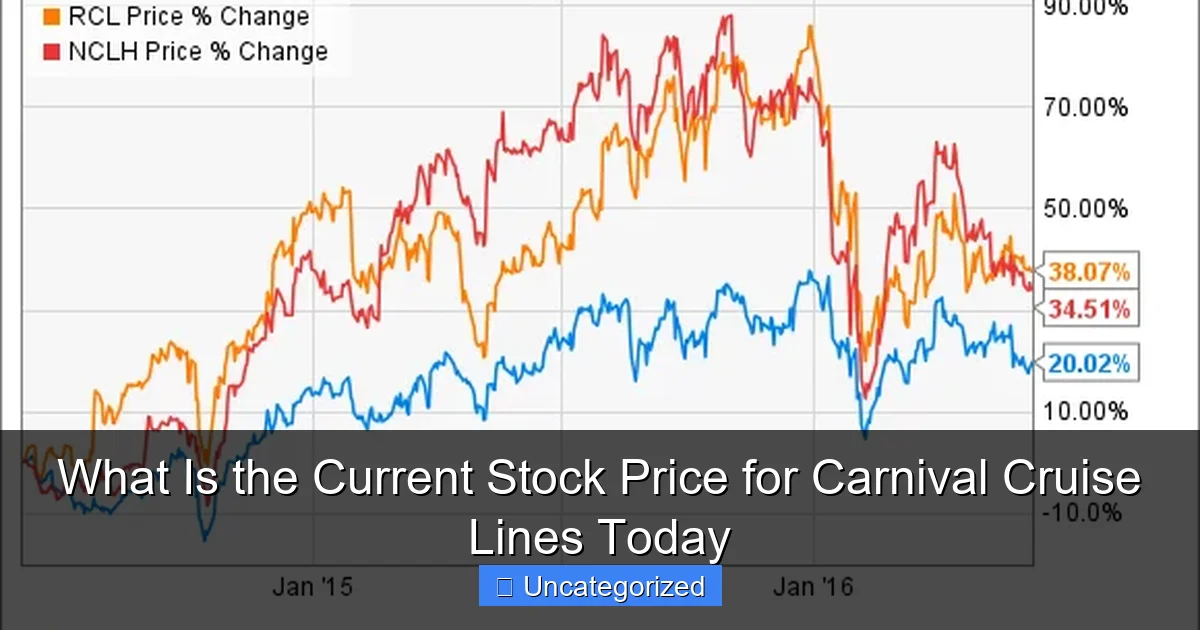

Pro Tip: Use the “watchlist” feature in your preferred app to monitor not just CCL, but also its competitors (Royal Caribbean, Norwegian Cruise Line) and key industry indices (e.g., the S&P 500 Travel & Leisure Index) for a holistic view.

Factors Influencing the Current Stock Price for Carnival Cruise Lines

Earnings Reports and Financial Performance

One of the most significant drivers of the current stock price for Carnival Cruise Lines is its quarterly earnings. Investors scrutinize metrics such as:

- Net income and adjusted EPS (Earnings Per Share): A beat or miss on earnings expectations can cause immediate stock movement.

- Revenue growth: Reflects booking demand, pricing power, and onboard spending.

- Operating margin and EBITDA: Indicates cost efficiency and profitability.

- Debt-to-equity ratio: Carnival took on substantial debt during the pandemic, and its ability to reduce leverage is closely watched.

In Q2 2023, Carnival reported a net loss of $407 million, but its adjusted EBITDA turned positive for the first time since 2019, signaling a strong recovery. This led to a 12% stock price surge the following day. Conversely, in Q4 2022, higher-than-expected fuel and labor costs caused a 7% drop in CCL stock.

Fuel Prices and Operational Costs

Cruise ships are massive fuel consumers, and fluctuations in oil prices directly impact Carnival’s bottom line. In 2022, when Brent crude oil prices spiked above $120 per barrel due to the Ukraine conflict, Carnival’s fuel costs rose by 45% year-over-year, squeezing margins. As of mid-2024, oil prices have stabilized around $80–$85 per barrel, providing some relief.

Example: If oil prices drop to $75, Carnival could save over $300 million annually in fuel expenses, potentially boosting net income and, in turn, the current stock price for Carnival Cruise Lines.

Additionally, port fees, crew wages, and maintenance costs also affect profitability. Carnival has been investing in fuel-efficient LNG-powered ships (like the Excel-class vessels), which could reduce long-term costs and improve investor sentiment.

Consumer Demand and Booking Trends

The cruise industry is highly sensitive to consumer confidence. After the pandemic, Carnival saw a surge in “revenge travel,” with bookings exceeding 2019 levels by 2023. According to Carnival’s 2023 Annual Report, cumulative advance bookings for 2024 were up 35% compared to 2019, indicating strong demand.

Key demand drivers include:

- Demographic trends: Millennials and Gen Z are increasingly choosing experiential travel, including cruises.

- Onboard amenities: Carnival’s investments in water parks, specialty dining, and entertainment boost customer satisfaction and repeat bookings.

- Geographic diversification: Carnival operates in North America, Europe, Australia, and Asia, reducing reliance on any single market.

When booking trends are strong, investors anticipate higher revenue, leading to stock price appreciation. Conversely, weak demand (e.g., due to a recession or health concerns) can trigger sell-offs.

Macroeconomic and Geopolitical Factors

The current stock price for Carnival Cruise Lines is also influenced by broader economic conditions:

- Interest rates: Higher rates increase borrowing costs and reduce consumer spending on discretionary items like cruises.

- Inflation: Rising prices can erode household budgets, but Carnival has been able to pass on some cost increases through higher ticket prices.

- Exchange rates: Carnival earns revenue in multiple currencies (USD, EUR, GBP), so a strong U.S. dollar can reduce overseas earnings when converted.

- Geopolitical tensions: Conflicts in regions like the Red Sea or the Mediterranean can disrupt itineraries and increase insurance costs.

For instance, in 2023, Red Sea shipping disruptions led Carnival to reroute some European cruises, increasing fuel consumption and reducing profitability in that region.

Historical Stock Performance and Trends

Long-Term Price Chart Analysis (2019–2024)

To understand the current stock price for Carnival Cruise Lines, it’s essential to look at its historical trajectory:

- Pre-pandemic (2019): CCL traded between $45–$55, with a peak of $57.37 in January 2019.

- Pandemic crash (March 2020): Stock plummeted to $7.30 due to halted operations and massive losses.

- Recovery phase (2021–2022): Gradual rebound to $25–$30 as vaccines rolled out and sailings resumed.

- 2023–2024: Volatile trading between $12–$22, influenced by inflation, interest rates, and earnings.

The stock has not yet returned to pre-pandemic levels, but analysts believe it has significant upside potential if demand remains strong and debt is reduced.

52-Week High and Low

As of June 2024, the 52-week range for CCL is:

- 52-week high: $23.45 (March 2024)

- 52-week low: $11.80 (October 2023)

This wide range reflects investor uncertainty but also opportunity for value investors. A stock trading near its 52-week low may be undervalued if fundamentals are strong.

Dividend History and Share Buybacks

Carnival suspended its dividend in 2020 due to the pandemic and has not reinstated it as of 2024. However, the company has been repurchasing shares to return value to shareholders. In Q1 2024, Carnival announced a $500 million share buyback program, which typically signals confidence in future growth and can support the stock price.

Note: While no dividend means no income for investors, share buybacks can increase earnings per share (EPS) over time, potentially lifting the current stock price for Carnival Cruise Lines.

Expert Opinions and Analyst Forecasts

Wall Street Analyst Ratings

Analyst sentiment is a key indicator of market confidence. As of mid-2024, the consensus rating for CCL is a “Hold” to “Buy”, with the following breakdown (based on 25 major firms):

- Buy: 12 analysts (48%)

- Hold: 9 analysts (36%)

- Sell: 4 analysts (16%)

The average 12-month price target is $22.50, suggesting a 15–20% upside from the current price of around $18.50. Some bullish analysts (e.g., from JPMorgan) project a target of $28.00, citing strong booking momentum and cost optimization.

Key Analyst Reports (2024)

- Morgan Stanley: Upgraded CCL to “Overweight” in April 2024, noting improved balance sheet and higher occupancy rates (95% in Q1 2024).

- Goldman Sachs: Maintained “Neutral” rating but highlighted risks from potential economic slowdown in Europe.

- Barclays: Cited Carnival’s LNG fleet as a long-term competitive advantage, supporting a $25 target.

Tip: Always read the full analyst reports, not just the summary, to understand the rationale behind ratings.

Technical Analysis Indicators

Technical traders use tools like moving averages, RSI (Relative Strength Index), and MACD to predict price movements. As of June 2024:

- 50-day moving average: $19.10

- 200-day moving average: $17.80

- RSI: 58 (neutral, neither overbought nor oversold)

If CCL breaks above $20.00 with high volume, it could signal a bullish trend. Conversely, a drop below $17.00 might indicate bearish momentum.

Data Table: Carnival Cruise Lines Stock Snapshot (June 2024)

| Metric | Value | Source/Notes |

|---|---|---|

| Current Stock Price (CCL) | $18.65 | As of June 15, 2024, 4:00 PM ET (NYSE) |

| 52-Week Range | $11.80 – $23.45 | Yahoo Finance |

| Market Cap | $24.3 billion | Based on 1.3 billion shares outstanding |

| P/E Ratio (TTM) | N/A (Not applicable, still reporting net losses) | Adjusted EPS used for analysis |

| Dividend Yield | 0% | Dividend suspended since 2020 |

| Average Analyst Price Target | $22.50 | 25 major firms, mid-2024 |

| Q1 2024 Revenue | $5.4 billion | Up 30% YoY |

| Net Debt | $27.1 billion | Down from $29.5 billion in 2023 |

| Occupancy Rate (Q1 2024) | 95% | Near pre-pandemic levels |

Conclusion: Is Now a Good Time to Invest in Carnival Cruise Lines?

The current stock price for Carnival Cruise Lines—hovering around $18.65 as of mid-2024—presents a compelling opportunity for investors with a medium to long-term horizon. While the stock has not yet returned to its pre-pandemic highs, the company has made significant strides in recovery: booking demand is robust, operational efficiency is improving, and debt levels are gradually decreasing. The cruise industry is cyclical, and Carnival, as the market leader, is well-positioned to benefit from the ongoing resurgence in global travel.

However, potential investors should remain mindful of the risks. The stock remains sensitive to macroeconomic headwinds such as inflation, interest rates, and geopolitical instability. Additionally, Carnival’s lack of a dividend means it’s not ideal for income-focused investors. Instead, CCL is better suited for those seeking growth and capital appreciation, particularly if the company can achieve sustained profitability and reduce its debt burden.

To make an informed decision, consider the following:

- Monitor earnings reports (next scheduled for August 2024) for signs of margin expansion and debt reduction.

- Track booking trends through Carnival’s monthly operational updates.

- Diversify by pairing CCL with other travel stocks (e.g., airlines, hotels) to mitigate sector-specific risk.

- Use dollar-cost averaging if you’re uncertain about timing—invest a fixed amount regularly instead of a lump sum.

In summary, the current stock price for Carnival Cruise Lines reflects a company in recovery with strong upside potential. Whether you’re checking the price for investment, curiosity, or industry research, understanding the underlying drivers—from fuel costs to consumer demand—will empower you to make smarter, data-driven decisions in the dynamic world of cruise stocks.

Frequently Asked Questions

What is the current stock price for Carnival Cruise Lines today?

As of the latest market data, the current stock price for Carnival Cruise Lines (CCL) can be found on financial platforms like Google Finance or Yahoo Finance. Prices fluctuate throughout the trading day due to market activity.

Where can I check Carnival Cruise Lines’ stock price in real time?

You can view Carnival Cruise Lines’ stock price in real time using stock market apps or websites like Bloomberg, CNBC, or your brokerage account. These platforms update prices continuously during market hours.

Is the current stock price for Carnival Cruise Lines affected by travel trends?

Yes, Carnival Cruise Lines’ stock price is highly sensitive to travel demand, fuel costs, and global economic conditions. Positive booking trends or strong earnings reports often boost investor confidence and the stock price.

What time of day does Carnival Cruise Lines’ stock price update?

Carnival Cruise Lines’ stock price updates every few seconds during regular trading hours (9:30 AM–4:00 PM ET). Pre-market and after-hours trading may also impact the opening price the next day.

How often should I check the current stock price for Carnival Cruise Lines?

If you’re an investor, checking the stock price daily or setting up price alerts via financial apps can help track trends. Frequent monitoring is useful for timing trades, but avoid reacting to short-term volatility.

What factors influence the current stock price of Carnival Cruise Lines?

Key factors include quarterly earnings, fuel prices, geopolitical events, and broader stock market trends. Additionally, news about new ships or health-related travel advisories can significantly impact CCL’s stock price.