Featured image for what industry is cruise lines in

Image source: flatworldknowledge.lardbucket.org

Cruise lines operate in the global travel and hospitality industry, specifically within the niche of leisure maritime tourism. They combine transportation, entertainment, and luxury accommodations to create all-inclusive vacation experiences, setting them apart from traditional transportation or hotel sectors.

Key Takeaways

- Cruise lines operate in the travel and tourism industry, focusing on leisure and vacation experiences.

- They are part of the maritime sector, adhering to strict international shipping and safety regulations.

- Highly competitive market driven by customer experience, innovation, and global itineraries.

- Revenue streams include ticket sales, onboard spending, and excursions, requiring diversified business models.

- Sustainability is critical due to environmental scrutiny and shifting consumer preferences.

- Technology integration enhances booking, onboard services, and personalized guest experiences.

📑 Table of Contents

- Introduction: The Voyage Beyond the Horizon

- The Core Classification: Cruise Lines as a Hybrid Industry

- Economic Impact and Revenue Streams: Beyond Ticket Sales

- Regulatory and Operational Frameworks: Navigating a Complex Web

- Technological Innovation and Sustainability: The Future of Cruising

- Market Trends and Competitive Landscape: Who Dominates the Waves?

- Conclusion: The Multidimensional World of Cruise Lines

Introduction: The Voyage Beyond the Horizon

The cruise industry has long captured the imagination of travelers, conjuring images of luxurious liners slicing through turquoise waters, vibrant ports of call, and all-inclusive vacations where the sea is both the destination and the journey. But behind the glittering decks and gourmet buffets lies a complex, multifaceted sector that transcends simple categorization. What industry is cruise lines in? This seemingly straightforward question reveals a web of economic, regulatory, and operational layers that place cruise lines at the intersection of multiple industries. From hospitality and transportation to tourism and even real estate, the cruise industry is a hybrid powerhouse that defies traditional boundaries.

As of 2024, the global cruise market is valued at over $155 billion, with projections to reach $230 billion by 2030, according to Statista and Allied Market Research. More than 30 million passengers set sail annually pre-pandemic, with recovery trends showing strong rebound in 2023–2024. Yet, despite its scale, the cruise sector often flies under the radar in discussions about major industries. This post dives deep into the what, how, and why of the cruise industry’s classification, exploring its economic footprint, regulatory frameworks, supply chain dynamics, and future trajectory. Whether you’re a travel enthusiast, investor, or industry professional, understanding where cruise lines fit in the global economy is key to grasping their unique challenges and opportunities.

The Core Classification: Cruise Lines as a Hybrid Industry

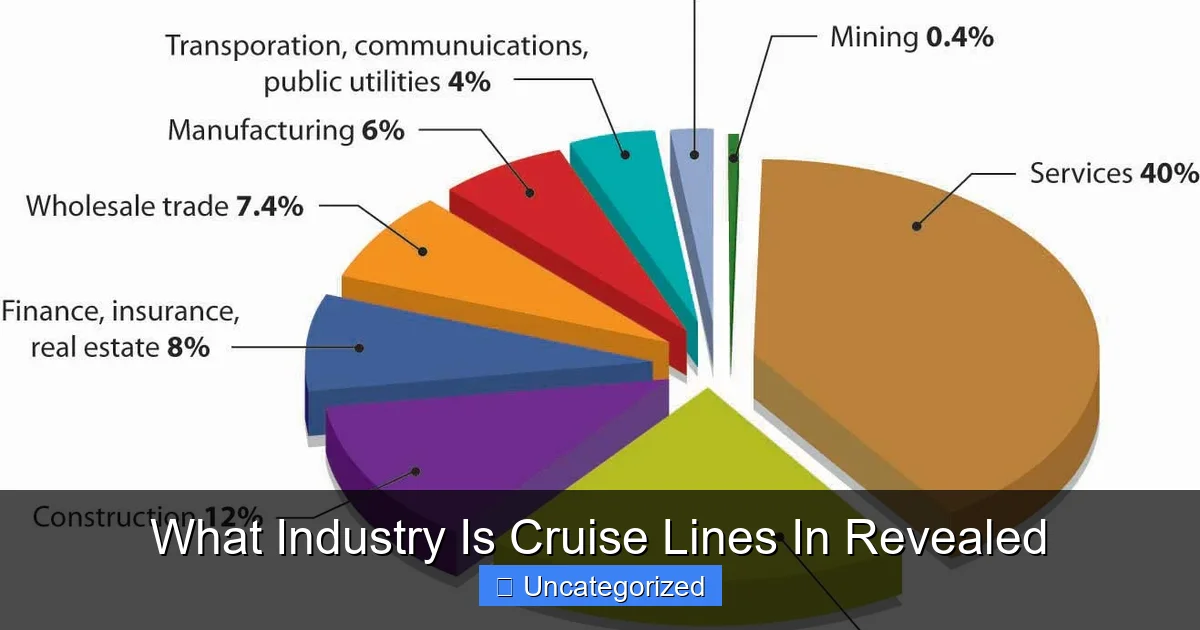

Primary Industry Sectors Involved

At first glance, one might assume cruise lines belong solely to the travel and tourism industry. While this is partially true, the reality is far more nuanced. Cruise lines operate at the convergence of several distinct sectors, each contributing to their business model and operational framework. The primary industries involved include:

Visual guide about what industry is cruise lines in

Image source: c.pxhere.com

- Hospitality and Leisure: Onboard services—dining, entertainment, spa, accommodations—mirror those of luxury hotels and resorts. The cruise ship functions as a floating hotel, with crew-to-guest ratios rivaling five-star properties.

- Transportation and Maritime: The movement of passengers across oceans and waterways places cruise lines squarely within the transportation sector. This includes navigation, fuel logistics, port operations, and compliance with international maritime laws.

- Tourism and Destination Services: Shore excursions, guided tours, and port partnerships make cruise lines integral to the tourism ecosystem of coastal and island destinations.

- Retail and Onboard Commerce: Duty-free shops, specialty boutiques, and branded retail spaces generate significant revenue, akin to airport retail or resort shopping.

- Entertainment and Media: Broadway-style shows, live music, comedy clubs, and even onboard casinos place cruise lines within the entertainment industry.

Why “Hybrid” Matters

Labeling cruise lines as a “hybrid” industry is not just academic—it has real-world implications. For example, when a cruise ship docks in Miami, it doesn’t just bring tourists; it triggers a cascade of economic activity across multiple sectors. The Port of Miami, the world’s busiest cruise port, sees over 7 million passengers annually, generating $5 billion in direct and indirect economic impact. This includes fuel suppliers, port authorities, customs officials, taxi drivers, hoteliers, and local tour operators—each representing a different industry node in the cruise ecosystem.

Moreover, hybrid classification affects regulatory compliance. Cruise lines must adhere to standards from the International Maritime Organization (IMO), the U.S. Coast Guard, the Centers for Disease Control and Prevention (CDC), and various national and local tourism boards. This multi-jurisdictional oversight underscores the complexity of operating across industries. For instance, the CDC’s Vessel Sanitation Program (VSP) regulates onboard health standards, while the IMO’s MARPOL treaty governs environmental emissions and waste disposal.

Economic Impact and Revenue Streams: Beyond Ticket Sales

Primary Revenue Sources

While ticket sales are the most visible revenue stream, they represent only a portion of the cruise industry’s financial picture. In fact, onboard spending accounts for 20–30% of total revenue for major cruise lines. This includes:

- Onboard Sales: Alcohol, specialty dining, spa treatments, and retail purchases. For example, Royal Caribbean’s “Cruise Planner” app allows guests to pre-book experiences, boosting revenue through upselling.

- Shore Excursions: Partnering with local operators, cruise lines take a commission on tours, often marking up prices by 30–50%.

- Gambling (Casinos): Onboard casinos, operating only in international waters, are a major profit center. Carnival Corporation’s casinos generate over $1 billion annually.

- Insurance and Add-Ons: Travel insurance, internet packages, and photo services contribute to ancillary revenue.

- Corporate and Group Bookings: Incentive travel, conferences, and weddings at sea offer high-margin opportunities.

Economic Multiplier Effect

The cruise industry’s economic impact extends far beyond the ship. According to the Florida-Caribbean Cruise Association (FCCA), every 1,000 cruise passengers generate $2.1 million in direct spending in a port city. This includes:

- Local Employment: Port workers, tour guides, taxi drivers, and artisans benefit from cruise traffic. In Cozumel, Mexico, over 70% of tourism jobs are linked to cruise tourism.

- Supply Chain Demand: Cruise ships require massive provisions—food, water, fuel, medical supplies—often sourced locally. Norwegian Cruise Line, for instance, spends $2 billion annually on food and beverage procurement.

- Infrastructure Investment: Ports like Barcelona and Sydney have invested millions in modernizing terminals to handle larger ships, creating construction and engineering jobs.

Case Study: The Impact of a Single Ship

Consider the Harmony of the Seas, one of the world’s largest cruise ships. With a capacity of 6,687 passengers and 2,100 crew, a single 7-day Caribbean cruise generates:

- $3.5 million in ticket sales

- $1.2 million in onboard spending

- $800,000 in shore excursion commissions

- $500,000 in port fees and taxes

This translates to over $6 million in direct economic activity per voyage, not including indirect benefits to local economies. For cruise lines, this diversified revenue model ensures resilience—even if ticket sales dip, onboard and shore spending can compensate.

Regulatory and Operational Frameworks: Navigating a Complex Web

International Maritime Regulations

Cruise lines operate under a labyrinth of international, national, and local regulations. The cornerstone is the International Maritime Organization (IMO), a UN agency that sets standards for safety, security, and environmental protection. Key regulations include:

- International Convention for the Safety of Life at Sea (SOLAS): Mandates lifeboats, fire safety, and emergency procedures.

- MARPOL (Marine Pollution): Limits emissions, sewage discharge, and garbage disposal. New ships must now comply with the IMO 2020 sulfur cap (0.5% sulfur in fuel).

- International Ship and Port Facility Security (ISPS) Code: Requires anti-terrorism measures and passenger screening.

Health and Safety Oversight

Post-pandemic, health regulations have become even more critical. The CDC’s Vessel Sanitation Program conducts unannounced inspections, grading ships on a 100-point scale. A score below 85 results in public reporting and potential fines. Additionally:

- Medical Facilities: Ships must have onboard clinics with doctors and nurses. Carnival’s fleet, for example, employs over 300 medical staff.

- Quarantine Protocols: Outbreaks of norovirus or COVID-19 trigger strict isolation and disinfection procedures.

- Passenger Screening: Pre-embarkation health checks and vaccination requirements (e.g., for yellow fever in certain ports) are now standard.

Labor and Crew Regulations

With thousands of crew members from diverse countries, cruise lines must comply with labor laws under the Maritime Labour Convention (MLC 2006). This includes:

- Wage Standards: Crew must be paid at least the ILO’s minimum wage.

- Working Hours: Maximum 14-hour shifts with 10-hour rest periods.

- Living Conditions: Adequate cabins, food, and medical care are mandatory.

For example, Royal Caribbean employs over 75,000 crew members across 60 nationalities. Managing this workforce requires robust HR systems, language training, and cultural sensitivity programs.

Technological Innovation and Sustainability: The Future of Cruising

Green Technology and Emissions Reduction

Sustainability is no longer optional for cruise lines. With increasing pressure from regulators and consumers, the industry is investing heavily in eco-friendly technologies:

- Liquefied Natural Gas (LNG): Ships like Carnival’s AIDAnova run on LNG, reducing sulfur oxide emissions by 90% and carbon dioxide by 20%.

- Scrubbers and Exhaust Gas Cleaning Systems: These “scrub” sulfur from diesel exhaust, allowing ships to use cheaper, high-sulfur fuel while complying with IMO 2020.

- Shore Power: Ships plug into local grids while docked, cutting idling emissions. The Port of Seattle offers shore power for 90% of cruise calls.

- Waste-to-Energy Systems: Norwegian Cruise Line uses plasma gasification to convert waste into energy, reducing landfill dependence.

Digital Transformation and Guest Experience

Technology is revolutionizing the guest experience. Key innovations include:

- Smart Ships: Royal Caribbean’s “WOWband” wristbands replace room keys and payment cards, enabling contactless access and purchases.

- AI-Powered Personalization: Cruise lines use data analytics to tailor dining, entertainment, and excursion recommendations. MSC Cruises’ “MSC for Me” app offers real-time navigation and activity suggestions.

- Virtual Reality (VR) and Augmented Reality (AR): Pre-cruise VR tours help guests visualize cabins and itineraries, while AR apps enhance port exploration (e.g., “Carnival Hub”).

- Robotics and Automation: Self-service kiosks, robotic bartenders (e.g., Carnival’s “Bionic Bar”), and automated laundry systems reduce labor costs and improve efficiency.

Case Study: The Rise of Expedition Cruising

Expedition cruises—small ships exploring remote regions like Antarctica and the Galapagos—are growing at 12% annually. These vessels prioritize sustainability, using:

- Hybrid Electric Propulsion: Lindblad Expeditions’ National Geographic Endurance combines diesel with battery power.

- Zero-Discharge Policies: All waste is incinerated or offloaded, with strict no-plastic rules.

- Carbon Offsetting: Companies like Hurtigruten offer carbon-neutral voyages through reforestation projects.

Market Trends and Competitive Landscape: Who Dominates the Waves?

Key Players and Market Share

The cruise industry is dominated by three major corporations, which control over 70% of the global market:

| Company | Brands | Fleet Size (2024) | Market Share |

|---|---|---|---|

| Carnival Corporation | Carnival, Princess, Holland America, Costa, AIDA | 90+ ships | 43% |

| Royal Caribbean Group | Royal Caribbean, Celebrity, Silversea, Azamara | 60+ ships | 25% |

| Norwegian Cruise Line Holdings | Norwegian, Oceania, Regent | 30+ ships | 15% |

| Others (MSC, Disney, etc.) | MSC, Disney, Virgin Voyages | 40+ ships | 17% |

This concentration allows for economies of scale but also raises concerns about oligopoly dynamics. Smaller players, however, are gaining traction with niche offerings—e.g., Virgin Voyages targets millennials with adults-only, tech-forward ships.

Emerging Trends Shaping the Industry

- Experiential Travel: Demand for immersive, culturally rich itineraries is rising. Cunard’s “World Cruise” (100+ days) sells out within hours.

- Short Cruises and “Cruisetour” Packages: Combining cruises with land tours (e.g., Alaska cruise + Denali National Park) appeals to time-constrained travelers.

- Private Islands: Carnival’s “Half Moon Cay” and Royal Caribbean’s “Perfect Day at CocoCay” offer exclusive, controlled destinations.

- Digital Nomad Cruises: Companies like Remote Year offer month-long “workcations” with high-speed internet and coworking spaces.

Challenges and Opportunities

The industry faces headwinds, including:

- Geopolitical Risks: Conflicts in the Red Sea and Black Sea disrupt itineraries.

- Environmental Scrutiny: Cruise ships are often labeled “floating polluters,” prompting calls for stricter regulations.

- Labor Shortages: Post-pandemic, recruiting and retaining crew remains a challenge.

Yet, opportunities abound: rising demand in Asia (China, India), growth in river and expedition cruising, and untapped potential in sustainable luxury.

Conclusion: The Multidimensional World of Cruise Lines

The cruise industry is a masterclass in hybridity—a dynamic blend of hospitality, transportation, tourism, and entertainment that operates on a global scale. Far from being a niche sector, cruise lines are economic powerhouses that drive employment, innovation, and cultural exchange across continents. By understanding the what industry is cruise lines in, we gain insight into a sector that thrives on complexity, resilience, and adaptability.

From the regulatory rigor of the IMO to the economic ripple effects in port cities, from green tech breakthroughs to AI-powered guest experiences, the cruise industry is evolving at a rapid pace. As travelers seek deeper, more sustainable, and personalized experiences, cruise lines are rising to the challenge—transforming ships into floating cities that redefine the boundaries of leisure and commerce. Whether you’re booking your first cruise or analyzing market trends, one thing is clear: the cruise industry is not just in one sector—it’s in all of them, and its voyage is far from over.

Frequently Asked Questions

What industry is cruise lines in?

Cruise lines operate within the travel and tourism industry, specifically under the maritime leisure and hospitality sector. They offer vacation experiences combining transportation, accommodation, dining, and entertainment on cruise ships.

Is the cruise line industry part of the transportation or hospitality industry?

Cruise lines straddle both the transportation industry (as they transport passengers across oceans) and the hospitality industry (providing lodging, dining, and onboard experiences). Their hybrid model makes them a unique niche within tourism.

What industry classification does a cruise line belong to?

Cruise lines fall under the North American Industry Classification System (NAICS) code 483112 for “Deep Sea Passenger Transportation.” This reflects their role in moving passengers via waterways while offering recreational services.

How does the cruise industry fit into the broader tourism sector?

The cruise industry is a key segment of the global tourism sector, often grouped with resorts, airlines, and hotels. It contributes significantly to port economies and international travel markets through itineraries and onboard spending.

Are cruise lines considered part of the luxury goods industry?

While not a traditional luxury goods sector, premium cruise lines (like Regent or Seabourn) operate in the luxury travel market, offering high-end amenities, exclusive destinations, and personalized services. Their positioning aligns with luxury hospitality trends.

What industry challenges do cruise lines face?

Cruise lines navigate challenges common to the maritime travel industry, including environmental regulations, fuel costs, and seasonal demand fluctuations. They also address health concerns (like norovirus outbreaks) and geopolitical risks affecting itineraries.