Featured image for what are the cruise line stocks

Image source: i.pinimg.com

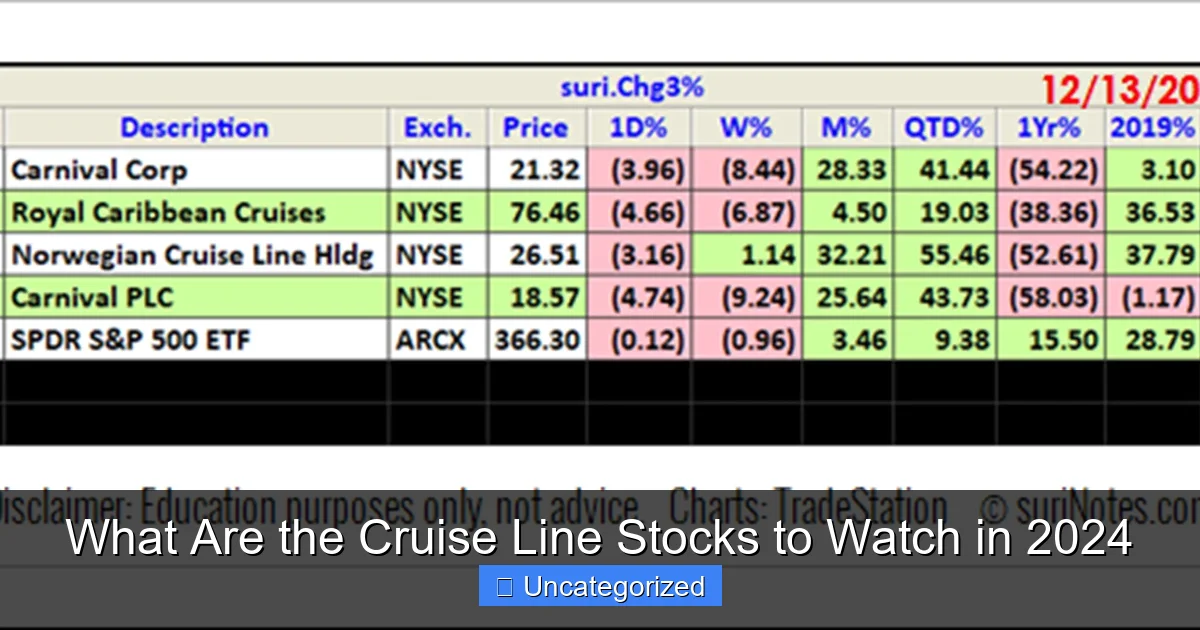

The top cruise line stocks to watch in 2024 are Carnival Corporation (CCL), Royal Caribbean Group (RCL), and Norwegian Cruise Line Holdings (NCLH), as the industry rebounds with record bookings and pricing power. These market leaders are capitalizing on strong consumer demand, expanded fleets, and improved balance sheets, making them key investment opportunities in the travel and leisure sector. Watch for earnings growth, debt reduction progress, and new-ship innovations as key drivers of stock performance this year.

Key Takeaways

- Top performers: Focus on Carnival (CCL), Royal Caribbean (RCL), and Norwegian (NCLH) for 2024 growth.

- Recovery trends: Bookings are rebounding; prioritize stocks with strong revenue forecasts and occupancy rates.

- Debt concerns: Monitor leverage ratios—lower debt stocks may offer more stability in volatile markets.

- New ships: Invest in lines expanding fleets—new vessels drive higher margins and customer demand.

- Dividend potential: Some stocks may resume payouts; track cash flow and balance sheet improvements.

- Geopolitical risks: Avoid overexposure to regions with regional instability impacting cruise itineraries.

📑 Table of Contents

- Introduction to Cruise Line Stocks in 2024

- Understanding the Cruise Line Industry Landscape

- Top Cruise Line Stocks to Watch in 2024

- Key Metrics and Financial Health of Cruise Line Stocks

- Risks and Challenges in Cruise Line Investing

- Investment Strategies for Cruise Line Stocks in 2024

- Conclusion: Navigating the Waves of Cruise Line Investing

Introduction to Cruise Line Stocks in 2024

The cruise industry, once battered by the global pandemic, has staged a remarkable comeback, emerging as one of the most dynamic sectors in the travel and leisure market. As international travel restrictions eased and consumer confidence rebounded, cruise lines experienced a surge in bookings, with many reporting record-breaking demand for 2024 itineraries. This resurgence has reignited investor interest in cruise line stocks, a category that includes some of the most recognizable names in the vacation industry. With pent-up demand, rising ticket prices, and aggressive fleet expansion plans, the sector is poised for significant growth—making it a compelling area for investors seeking exposure to the broader travel and consumer discretionary space.

For those considering adding cruise line stocks to their portfolios, 2024 presents a unique convergence of tailwinds: strong booking momentum, improved balance sheets, and a shift toward premium and experiential cruising. However, investing in this sector is not without risks. The industry remains sensitive to macroeconomic shifts, geopolitical tensions, and environmental regulations. As such, understanding which cruise line stocks are best positioned for long-term success requires a deep dive into financial performance, operational strategies, and market positioning. This guide explores the top cruise line stocks to watch in 2024, analyzing key players, growth drivers, risks, and investment opportunities to help you make informed decisions in a rapidly evolving market.

Understanding the Cruise Line Industry Landscape

The Major Players in the Cruise Sector

The global cruise industry is dominated by a handful of publicly traded companies, each with distinct brand portfolios, target demographics, and operational footprints. The three largest players—Carnival Corporation & plc (CCL), Royal Caribbean Group (RCL), and Norwegian Cruise Line Holdings Ltd. (NCLH)—collectively control over 70% of the market share. These companies operate multiple brands, allowing them to serve diverse customer segments, from budget-conscious families to luxury travelers.

Visual guide about what are the cruise line stocks

Image source: msgraphics.blob.core.windows.net

- Carnival Corporation & plc: The largest cruise operator by fleet size, Carnival owns nine brands, including Carnival Cruise Line, Princess Cruises, Holland America Line, and Costa Cruises. Its broad reach enables it to capture volume-driven demand, particularly in the mid-tier and family vacation markets.

- Royal Caribbean Group: Known for innovation and large-scale ships like the Symphony of the Seas, Royal Caribbean operates Royal Caribbean International, Celebrity Cruises, and Silversea Cruises. The company has heavily invested in destination development, including private islands and exclusive experiences.

- Norwegian Cruise Line Holdings: With brands like Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises, NCLH focuses on premium and luxury experiences. It has differentiated itself through its “Freestyle Cruising” concept, offering flexible dining and onboard activities.

Beyond these giants, smaller operators such as MSC Cruises (privately held but rapidly expanding) and Lindblad Expeditions (LIND) are gaining traction, particularly in the expedition and eco-tourism segments. For investors, focusing on the publicly traded leaders provides the most liquidity and transparency, while niche players offer high-growth potential with higher volatility.

Industry Trends Shaping 2024

Several macro and micro trends are reshaping the cruise industry in 2024, directly impacting the performance of cruise line stocks:

- Demand Recovery and Premiumization: Post-pandemic, travelers are prioritizing experiences over material goods. Cruise lines are responding by offering more premium packages, longer itineraries, and immersive excursions. This shift toward “value-added” cruising supports higher revenue per passenger.

- Fleet Modernization and Sustainability: New LNG-powered ships and investments in carbon reduction technologies are reducing emissions and improving fuel efficiency. For example, Royal Caribbean’s Icon of the Seas, launching in 2024, is the first LNG-powered ship in North America.

- Digital Transformation: Enhanced mobile apps, AI-driven personalization, and contactless services are improving the guest experience and operational efficiency.

- Geographic Diversification: While the Caribbean remains a top destination, cruise lines are expanding into Asia, the Mediterranean, and Antarctica, reducing reliance on any single region.

Investors should monitor how well each company adapts to these trends. For instance, companies with aggressive fleet renewal plans and strong ESG (Environmental, Social, and Governance) commitments are likely to attract institutional investors and command higher valuations.

Top Cruise Line Stocks to Watch in 2024

Carnival Corporation & plc (CCL): The Volume Leader with a Turnaround Story

Carnival Corporation is the most widely recognized name in cruising, with a fleet of over 90 ships and a presence in every major market. After a brutal pandemic-induced downturn, CCL has rebounded strongly, reporting record quarterly revenues in late 2023. The stock has risen over 150% from its 2022 lows, but it remains below pre-pandemic levels, suggesting potential upside.

Key Strengths:

- Brand Diversity: With brands like Princess and Holland America, CCL can target both mass-market and premium segments.

- Cost-Cutting Success: The company reduced its fleet by 20% during the pandemic, streamlining operations and lowering fixed costs.

- Strong Bookings: As of Q1 2024, CCL reported 20% higher booking volumes compared to 2019, with pricing up 12%.

Risks:

- High Debt Load: Carnival still carries over $30 billion in debt, though it has been paying it down through asset sales and equity offerings.

- Operational Inefficiencies: Managing a vast portfolio can lead to inconsistent guest experiences across brands.

Investor Tip: Watch for progress on debt reduction and margin expansion. If CCL can achieve a 15% operating margin (up from ~10% in 2023), the stock could see significant re-rating.

Royal Caribbean Group (RCL): Innovation and Experiential Cruising

Royal Caribbean is widely regarded as the most innovative cruise operator, with a track record of launching industry-defining ships and private destinations. The upcoming Icon of the Seas—a 20-deck, 5,600-passenger vessel—has already sold out for its inaugural season, signaling strong demand for premium experiences.

Key Strengths:

- Premium Pricing Power: RCL’s focus on high-end amenities (e.g., robotic bars, surf simulators) allows it to command higher ticket prices.

- Destination Ownership: Its private islands (e.g., CocoCay, Labadee) provide exclusive revenue streams and reduce port dependency.

- Financial Health: RCL has the strongest balance sheet among the Big Three, with lower leverage and higher cash reserves.

Risks:

- High Capex: Building mega-ships like Icon requires massive upfront investment, which can strain cash flow.

- Geopolitical Exposure: RCL has significant operations in Europe and Asia, making it vulnerable to regional disruptions.

Investor Tip: Monitor RCL’s yield (revenue per passenger per day) and occupancy rates. A sustained yield above $250 and occupancy over 110% (due to onboard spending) would signal strong pricing power.

Norwegian Cruise Line Holdings (NCLH): The Luxury Play

Norwegian stands out for its focus on luxury and flexibility. Its “Freestyle Cruising” model appeals to millennials and Gen Z travelers who value choice and personalization. The company’s Oceania and Regent brands are among the highest-rated in the luxury segment.

Key Strengths:

- High-End Appeal: Oceania and Regent command premium pricing, with average ticket prices 30% above industry norms.

- Strong Recovery Momentum: NCLH reported a 25% year-over-year revenue increase in Q4 2023, outpacing peers.

- Cost Management: The company has reduced operating expenses by 18% since 2019 through automation and fleet optimization.

Risks:

- Brand Integration Challenges: Integrating Oceania and Regent post-acquisition has been complex, leading to occasional service inconsistencies.

- Debt Concerns: NCLH’s debt-to-EBITDA ratio remains elevated at ~6x, though improving.

Investor Tip: Track NCLH’s luxury segment performance. If Regent and Oceania maintain occupancy above 90% and yield growth of 5-7% annually, the stock could outperform.

Lindblad Expeditions (LIND): The Niche Growth Story

While not a mass-market player, Lindblad Expeditions offers a compelling alternative for investors seeking exposure to high-margin, sustainable tourism. Specializing in small-ship expeditions to Antarctica, Galápagos, and the Arctic, Lindblad has carved out a unique niche with loyal, high-income clientele.

Key Strengths:

- High Margins: Lindblad’s average ticket price exceeds $10,000, with EBITDA margins of 25%+.

- Partnership with National Geographic: This alliance enhances brand credibility and attracts premium travelers.

- Low Capital Intensity: Operating smaller ships reduces fuel and port costs.

Risks:

- Limited Scale: With only 14 ships, Lindblad is vulnerable to demand shocks.

- Regulatory Risks: Expedition cruising faces increasing environmental scrutiny in sensitive regions.

Investor Tip: Lindblad is a “story stock” with high growth potential. Watch for fleet expansion plans and partnerships with luxury travel agencies.

Key Metrics and Financial Health of Cruise Line Stocks

Analyzing Financial Performance

Evaluating cruise line stocks requires a focus on industry-specific metrics beyond standard P/E ratios. Key indicators include:

- Net Yield: Revenue per passenger per day, adjusted for discounts. Higher yields indicate pricing power.

- Occupancy Rate: Percentage of available berths sold. Rates above 100% (due to onboard spending) are ideal.

- Adjusted EBITDA: Measures operational profitability, excluding one-time items.

- Debt-to-EBITDA Ratio: Indicates financial leverage. Ratios below 5x are generally safe.

- Free Cash Flow (FCF): Critical for debt repayment and dividends.

Below is a comparative table of the Big Three cruise lines as of Q1 2024:

| Metric | Carnival (CCL) | Royal Caribbean (RCL) | Norwegian (NCLH) |

|---|---|---|---|

| Net Yield (2023) | $185 | $240 | $220 |

| Occupancy Rate | 105% | 112% | 108% |

| Adjusted EBITDA (2023, $B) | 3.2 | 4.8 | 2.9 |

| Debt-to-EBITDA | 6.5x | 4.2x | 6.0x |

| Free Cash Flow (2023, $B) | 1.1 | 2.3 | 0.8 |

| 2024 Revenue Growth Guidance | 15% | 20% | 18% |

Balance Sheet and Liquidity

Post-pandemic, liquidity is a top concern. Carnival has raised $12 billion in new capital since 2020, while Royal Caribbean maintains a $2 billion cash buffer. Norwegian, though smaller, has secured $1.5 billion in undrawn credit lines. Investors should prioritize companies with strong liquidity and manageable debt maturities. For example, RCL’s debt matures in 2026-2028, reducing near-term refinancing risk.

Risks and Challenges in Cruise Line Investing

Macroeconomic and Geopolitical Risks

Cruise lines are highly sensitive to economic cycles. A recession could reduce discretionary spending, while inflation may increase fuel and labor costs. Additionally, geopolitical tensions—such as conflicts in the Middle East or Eastern Europe—can disrupt itineraries. For instance, Royal Caribbean canceled several Mediterranean cruises in 2023 due to regional instability.

Investor Tip: Diversify across regions. Companies with strong North American and Asian footprints (e.g., Carnival) may weather European volatility better.

Environmental and Regulatory Pressures

The cruise industry faces increasing scrutiny over emissions and waste. New IMO (International Maritime Organization) regulations mandate a 40% reduction in carbon intensity by 2030. Companies investing in LNG, hydrogen, or carbon capture (e.g., Royal Caribbean’s Icon) are better positioned. However, compliance costs could pressure margins.

Investor Tip: Review each company’s ESG reports. Look for concrete decarbonization targets and partnerships with green tech firms.

Operational and Reputational Risks

Outbreaks (e.g., norovirus, COVID-19) can severely impact bookings and stock prices. In 2022, Carnival’s stock dropped 15% after a norovirus outbreak on the Regal Princess. Robust health protocols and transparent communication are critical.

Investment Strategies for Cruise Line Stocks in 2024

Short-Term vs. Long-Term Approaches

For short-term traders, focus on momentum plays. Royal Caribbean’s Icon of the Seas launch in 2024 could drive a 10-15% stock pop. Watch for earnings surprises and booking updates.

For long-term investors, consider dividend potential. Carnival suspended dividends in 2020 but plans to reinstate them by 2025. Royal Caribbean may follow suit. Look for companies with improving FCF and balance sheets.

Diversification and Portfolio Allocation

Given the sector’s volatility, limit cruise line exposure to 5-10% of a diversified portfolio. Pair high-growth picks (e.g., Lindblad) with stable performers (e.g., RCL). Use ETFs like Defiance Hotel, Airline, and Cruise ETF (CRUZ) for broad exposure.

Final Tip: Monitor insider trading activity. Significant insider buying (e.g., Carnival’s CEO purchased $2M in shares in Q4 2023) often signals confidence in the recovery.

Conclusion: Navigating the Waves of Cruise Line Investing

The cruise industry’s 2024 outlook is undeniably bright, but not without turbulence. As the sector rides a wave of pent-up demand, innovation, and premiumization, investors have a rare opportunity to capitalize on a multi-year recovery cycle. The cruise line stocks highlighted in this guide—Carnival, Royal Caribbean, Norwegian, and Lindblad—each offer unique value propositions, from volume-driven growth to luxury differentiation and niche sustainability.

Success in this space requires a balanced approach: leveraging financial metrics like net yield and EBITDA, staying alert to macro risks, and aligning investments with long-term trends like digital transformation and environmental stewardship. Whether you’re a growth-focused trader or a dividend-seeking investor, the cruise industry’s resurgence in 2024 is too significant to ignore. By focusing on companies with strong balance sheets, strategic vision, and operational excellence, you can navigate the choppy waters of travel investing and ride the next wave of profits—all while keeping an eye on the horizon for emerging opportunities and challenges. The seas may be unpredictable, but with the right strategy, your portfolio can sail smoothly into the future.

Frequently Asked Questions

What are the cruise line stocks to watch in 2024?

Top cruise line stocks to watch in 2024 include Carnival Corporation (CCL), Royal Caribbean Group (RCL), and Norwegian Cruise Line Holdings (NCLH), which dominate the industry. These companies are rebounding post-pandemic, with strong booking trends and fleet expansions driving investor interest.

How do cruise line stocks perform in a high-interest-rate environment?

Cruise line stocks often face pressure during high-interest-rate periods due to their heavy debt loads and sensitivity to consumer spending. However, strong travel demand and revenue growth in 2024 could offset these challenges, making them a mixed but potentially rewarding bet.

Are cruise line stocks a good long-term investment?

Yes, if you believe in the sustained recovery of global travel and tourism. Carnival, Royal Caribbean, and Norwegian are investing in new ships, sustainability, and premium experiences, positioning them for long-term growth as demand for experiential travel rises.

What factors should I consider before investing in cruise line stocks?

Key factors include fuel costs, debt levels, booking trends, and geopolitical stability, as these directly impact profitability. Monitoring quarterly earnings and industry capacity growth will help gauge whether cruise line stocks align with your risk tolerance.

Which cruise line stock has the highest growth potential in 2024?

Royal Caribbean (RCL) stands out due to its aggressive fleet upgrades, strong pricing power, and expansion into private destinations. Analysts also highlight Norwegian (NCLH) for its cost-cutting efforts and younger demographic appeal.

Do cruise line stocks pay dividends?

Most major cruise lines, including CCL and RCL, suspended dividends during the pandemic and have yet to reinstate them as they prioritize debt reduction. However, future payouts could return as financial health improves, making them a watchlist item for income investors.