Featured image for is carnival cruise line american owned

Image source: i.pinimg.com

Carnival Cruise Line is not American-owned—it’s a multinational corporation headquartered in Miami but incorporated in Panama and listed on the New York Stock Exchange. Founded by Ted Arison, an Israeli-American entrepreneur, the company operates under a complex global structure, reflecting its international fleet and operations. This blend of American branding and foreign registration fuels common misconceptions about its ownership.

Key Takeaways

- Carnival Cruise Line is American-owned: Headquartered in Miami, Florida, with deep U.S. roots.

- Operated by Carnival Corporation: A global cruise giant with 9 major brands under its umbrella.

- Publicly traded on NYSE: Ticker symbol “CCL” confirms its U.S. corporate structure.

- U.S. regulations apply: Complies with American maritime laws and labor standards.

- Global workforce, American leadership: Ships employ international crew but are managed by U.S. executives.

- Supports U.S. economy: Pays American taxes and partners with U.S.-based suppliers.

📑 Table of Contents

- Is Carnival Cruise Line American Owned? The Truth Revealed

- The Birth of Carnival: A Story Rooted in America

- Ownership Structure: Decoding the Corporate Layers

- Operations: How American Is Carnival’s Day-to-Day Business?

- Comparative Analysis: Carnival vs. Other Major Cruise Lines

- Legal and Economic Implications of Carnival’s Ownership

- Conclusion: The Verdict on Carnival’s Ownership

Is Carnival Cruise Line American Owned? The Truth Revealed

When you think of Carnival Cruise Line, vibrant pool decks, lively entertainment, and all-you-can-eat buffets might come to mind. But behind the fun and frivolity lies a complex corporate structure that raises a crucial question: Is Carnival Cruise Line American owned? For travelers who prioritize supporting American businesses or are curious about the global nature of the cruise industry, this is more than just trivia—it’s a matter of transparency and trust.

The answer isn’t as straightforward as you might expect. While Carnival Cruise Line proudly flies the American flag, operates primarily in U.S. waters, and serves millions of American passengers each year, its ownership structure spans international borders. This blog post will peel back the layers of Carnival’s corporate identity, exploring its history, parent company, regulatory status, and operational footprint. Whether you’re a seasoned cruiser or planning your first voyage, understanding who truly owns Carnival can help you make informed choices and deepen your appreciation for the cruise giant that’s redefined vacationing at sea.

The Birth of Carnival: A Story Rooted in America

Founding Vision and Early Years

Carnival Cruise Line was founded in 1972 by Ted Arison, an Israeli-American entrepreneur with a bold vision: to make cruising accessible and fun for the average American family. The company’s first ship, the MS Mardi Gras, set sail from Miami to the Caribbean, marking the beginning of what would become the “Fun Ships” era. From the outset, Carnival targeted the U.S. market, with Miami serving as its operational and cultural hub. The brand’s early marketing campaigns, filled with slogans like “The Fun Ship is Here!” resonated strongly with American audiences, cementing its identity as a homegrown success story.

Visual guide about is carnival cruise line american owned

Image source: i.pinimg.com

Growth and the Shift Toward Globalization

By the 1980s, Carnival was expanding rapidly. It acquired competitors like Holland America Line and introduced larger, more innovative ships. However, this growth came with a strategic pivot. In 1993, Carnival Corporation—the parent company—was incorporated in Panama, a move that sparked debate about its American identity. Why incorporate abroad? The decision was driven by tax efficiency, maritime regulations, and the flexibility of international corporate structures. Despite this, Carnival maintained its U.S. headquarters in Miami and continued to operate under U.S. Coast Guard and federal regulations. This duality—American operations with international legal status—is a recurring theme in the cruise industry.

Key Milestones in Carnival’s American Journey

- 1972: Carnival Cruise Line founded in Miami, Florida.

- 1987: Launched the Fantasy-class ships, revolutionizing mid-range cruising.

- 1993: Carnival Corporation incorporated in Panama but headquartered in Miami.

- 2003: Merged with P&O Princess Cruises, creating Carnival Corporation & plc, a dual-listed company.

- 2020: Survived the COVID-19 pandemic with U.S. government support, highlighting its economic ties to America.

Ownership Structure: Decoding the Corporate Layers

Carnival Corporation vs. Carnival Cruise Line

To answer “Is Carnival Cruise Line American owned?” we must distinguish between Carnival Cruise Line (the brand) and Carnival Corporation & plc (the parent company). Carnival Cruise Line is one of 10 cruise brands under the Carnival Corporation umbrella, which also includes Princess Cruises, Holland America, and Costa Cruises. The parent company is a dual-listed entity, meaning it’s publicly traded on both the New York Stock Exchange (NYSE: CCL) and the London Stock Exchange (LSE: CCL). This structure reflects its global investor base and operational reach.

Shareholders and Nationality

As a publicly traded company, Carnival Corporation is owned by thousands of shareholders worldwide. However, U.S.-based institutional investors hold a significant stake:

- Top U.S. Shareholders (2023): Vanguard Group (12.3%), BlackRock (8.7%), and State Street Corporation (5.2%).

- Founder’s Legacy: The Arison family retains a 10% ownership stake through trusts, with Micky Arison (Ted’s son) serving as Chairman until 2023.

While these figures suggest strong American ownership, the company’s dual incorporation (Panama and the UK) and global operations mean no single nationality dominates its equity structure.

Tax and Regulatory Implications

Carnival Corporation’s incorporation in Panama and the UK allows it to benefit from:

- Favorable tax treaties (reducing corporate tax burdens).

- Flexibility in registering ships under flags of convenience (e.g., Panama, Bermuda).

- Access to international capital markets.

Despite this, Carnival pays U.S. federal taxes on income generated from U.S. operations and complies with U.S. labor and safety standards for its American-based employees. For example, Carnival’s Miami headquarters employs over 3,000 U.S. workers, and its ships undergo regular U.S. Coast Guard inspections.

Operations: How American Is Carnival’s Day-to-Day Business?

U.S.-Based Infrastructure

Carnival’s operational footprint in America is massive:

- Headquarters: Miami, Florida (since 1972).

- Port Operations: 10 U.S. homeports, including Miami, Port Canaveral, and Galveston.

- Employment: 15,000+ U.S. employees (shore-based and crew).

- Supply Chain: Partnerships with U.S. companies for food, fuel, and ship maintenance.

This infrastructure creates a symbiotic relationship with the American economy. For instance, Carnival’s 2023 economic impact report estimated $12 billion in annual spending in the U.S., supporting 250,000 jobs.

Fleet Registration and Crew Nationalities

Here’s where Carnival’s global nature shines:

- Ship Registration: Most Carnival ships are registered in Panama or Bermuda (flags of convenience), which offer lower fees and regulatory flexibility.

- Crew Composition: Only 10-15% of crew members are U.S. citizens; the majority come from the Philippines, India, and Europe.

- U.S. Coast Guard Oversight: Ships calling at U.S. ports must comply with American safety and environmental laws, even if registered abroad.

Tip: If you’re curious about a ship’s registration, check its hull—flags are displayed near the stern. Carnival’s Freedom and Horizon fly the Panamanian flag, while the Panorama is registered in Bermuda.

Marketing and Brand Identity

Carnival’s branding is unapologetically American. From its “Choose Fun” campaign to partnerships with U.S. celebrities (e.g., Shaquille O’Neal as Carnival’s “Chief Fun Officer”), the company leans into its Miami roots. Even its onboard experiences—like Fourth of July fireworks and Thanksgiving dinners—cater to American cultural preferences. This strategic branding helps maintain the perception of Carnival as an American company, even as its corporate structure evolves.

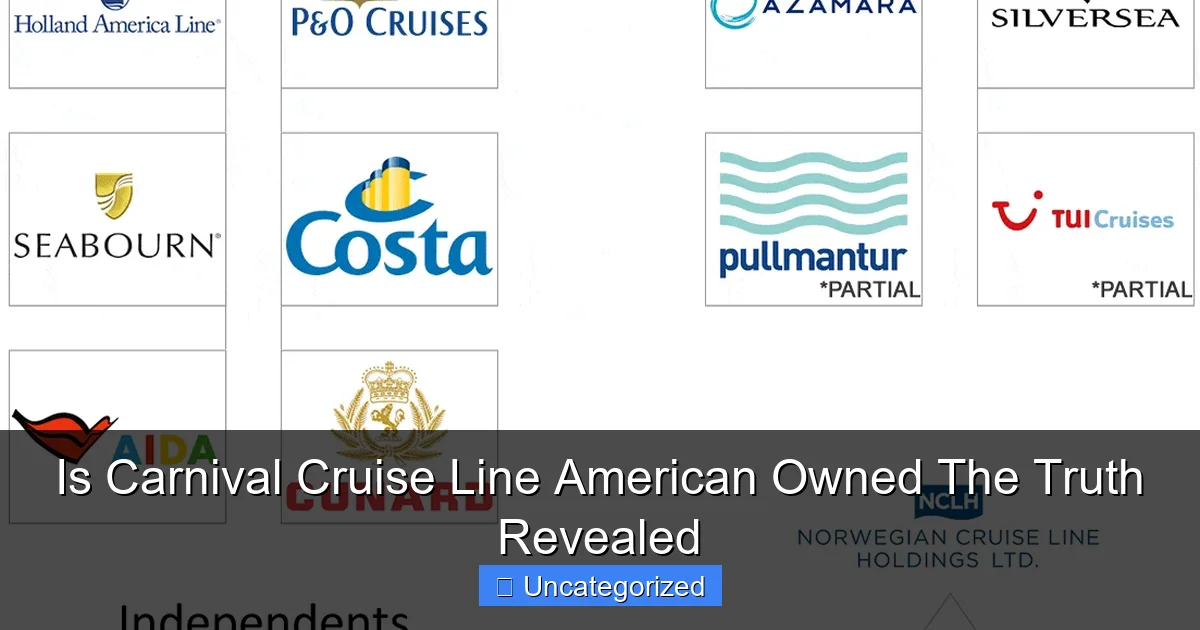

Comparative Analysis: Carnival vs. Other Major Cruise Lines

Ownership Models in the Cruise Industry

To contextualize Carnival’s ownership, let’s compare it to competitors:

| Company | Parent Company | Incorporation | U.S. Operations | Flag of Ships |

|---|---|---|---|---|

| Carnival Cruise Line | Carnival Corporation & plc | Panama/UK | Miami HQ, U.S. ports | Panama/Bermuda |

| Royal Caribbean | Royal Caribbean Group | Liberia | Miami HQ, U.S. ports | Bahamas/Liberia |

| Norwegian Cruise Line | Norwegian Cruise Line Holdings | Bermuda | Miami HQ, U.S. ports | Bahamas/Bermuda |

| Disney Cruise Line | The Walt Disney Company | U.S. (Delaware) | Miami HQ, U.S. ports | Bahamas |

Key takeaway: All major cruise lines are incorporated abroad for tax and regulatory reasons, but maintain strong U.S. operational ties. Disney Cruise Line is the closest to “fully American” due to its Delaware incorporation and U.S.-based crew (30% American), but even it registers ships in the Bahamas.

Why the Global Structure?

The cruise industry’s reliance on international incorporation stems from:

- Tax Optimization: Countries like Panama and Liberia offer lower corporate taxes.

- Maritime Flexibility: Flags of convenience reduce labor costs (e.g., hiring crew from lower-wage countries).

- Investor Access: Dual listings attract global capital.

This model isn’t unique to Carnival—it’s an industry standard. However, Carnival’s scale (10 brands, 90+ ships) makes its global structure more visible.

Legal and Economic Implications of Carnival’s Ownership

U.S. Regulations and Compliance

Despite its foreign incorporation, Carnival must adhere to U.S. laws:

- Jones Act: Requires ships carrying passengers between U.S. ports to be U.S.-built, owned, and crewed. Carnival bypasses this by using foreign-registered ships for international itineraries.

- Tax Obligations: Pays U.S. federal taxes on income from U.S. operations (e.g., port fees, onboard sales).

- Labor Laws: Complies with the Fair Labor Standards Act for U.S.-based employees.

Practical Tip: If you’re a U.S. taxpayer, your Carnival cruise purchases are subject to state sales tax, and tips to U.S. crew members are reported to the IRS.

Economic Impact on America

Carnival’s operations directly benefit the U.S. economy:

- Port Revenue: Pays millions in docking fees annually (e.g., $25 million to Port Canaveral in 2022).

- Tourism Boost: U.S. port cities see increased hotel and restaurant spending from cruisers.

- Job Creation: Supports 12,000+ U.S. jobs in shipbuilding, hospitality, and logistics.

During the pandemic, Carnival received $2.2 billion in U.S. government aid, underscoring its economic significance.

Controversies and Criticisms

Carnival’s ownership structure has faced scrutiny:

- Tax Avoidance: Critics argue foreign incorporation reduces U.S. tax revenue.

- Labor Practices: Low wages for foreign crew (e.g., $1,000/month for Filipino waiters).

- Environmental Impact: Foreign-registered ships face fewer U.S. emissions regulations.

Carnival counters these claims with sustainability initiatives (e.g., LNG-powered ships) and crew welfare programs (e.g., free healthcare, education).

Conclusion: The Verdict on Carnival’s Ownership

So, is Carnival Cruise Line American owned? The answer is a nuanced yes and no. While Carnival Cruise Line operates as an American brand—with U.S. headquarters, marketing, and passenger base—its parent company, Carnival Corporation & plc, is incorporated internationally and owned by a global investor pool. This duality is a strategic choice, not a loophole, and reflects the realities of the modern cruise industry.

For travelers, this means Carnival remains a quintessentially American vacation experience, even as its corporate structure embraces globalization. The company’s economic impact, regulatory compliance, and cultural identity are deeply tied to the U.S., ensuring that your Carnival cruise supports American jobs, ports, and businesses. At the same time, its international ownership allows it to innovate, compete, and deliver affordable vacations on a global scale.

Ultimately, Carnival’s story is a testament to the interconnected world we live in. Whether you’re sailing from Miami to Cozumel or exploring Alaska’s glaciers, you’re experiencing the best of both worlds: American fun with a global backbone. So the next time you board a Carnival ship, remember—you’re not just choosing a cruise line, you’re choosing a brand that bridges continents, cultures, and corporate identities.

Frequently Asked Questions

Is Carnival Cruise Line American owned?

Carnival Cruise Line is an American company headquartered in Miami, Florida, but it is a subsidiary of Carnival Corporation & plc, a dual-listed British-American entity. While it operates under U.S. branding and serves primarily American passengers, its ownership structure is multinational.

Who actually owns Carnival Cruise Line?

Carnival Cruise Line is owned by Carnival Corporation & plc, a global cruise giant incorporated in Panama and listed on both the New York and London stock exchanges. This dual structure means it has significant American and British ownership stakes.

Is Carnival Cruise Line based in the United States?

Yes, Carnival Cruise Line’s operational headquarters are in Miami, Florida, and it’s deeply rooted in the U.S. market. However, its parent company, Carnival Corporation, is a multinational corporation with global operations.

Why does Carnival Cruise Line appear American if it’s not fully U.S.-owned?

The line caters heavily to American travelers, with U.S. dollar pricing, English-language services, and U.S.-based ships. Despite its multinational ownership, its branding and customer experience are tailored to an American audience.

Are Carnival Cruise Line ships registered in the U.S.?

Most Carnival ships are registered in Panama or other foreign countries due to maritime laws, but they are operated by a U.S.-managed team. This is common in the cruise industry to streamline international operations.

Does Carnival Cruise Line pay U.S. taxes?

As a subsidiary of Carnival Corporation & plc, it adheres to international tax regulations. While it generates revenue in the U.S., its tax obligations are shared across jurisdictions due to its global corporate structure.