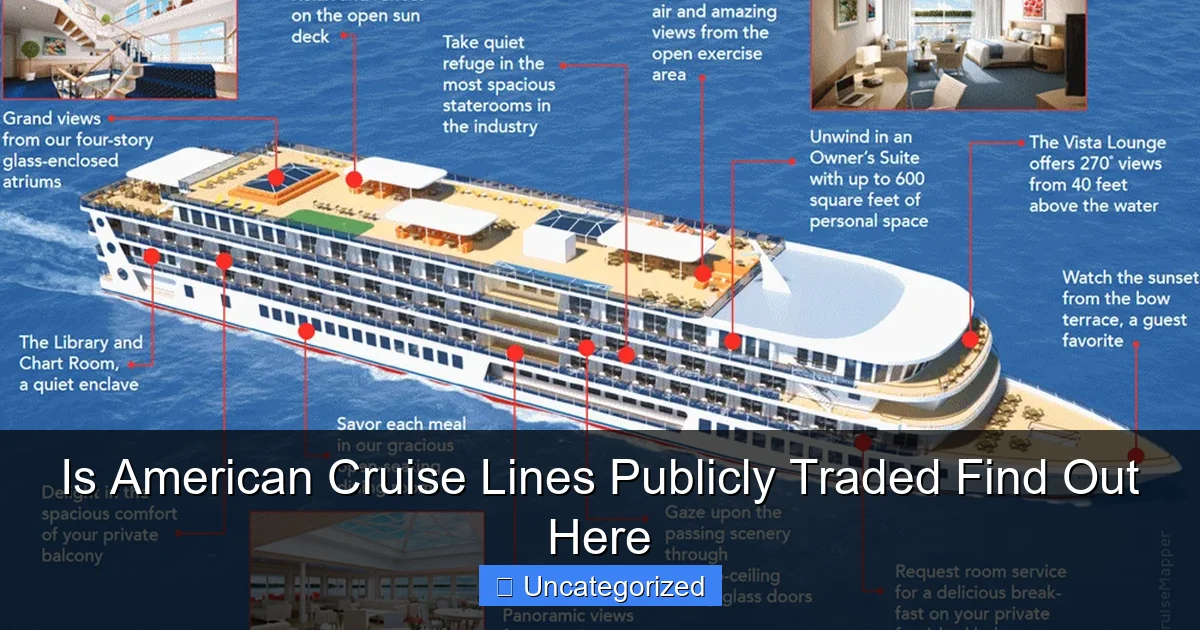

Featured image for is american cruise lines publicly traded

Image source: cruisemapper.com

American Cruise Lines is not publicly traded, meaning its stock is not available on public exchanges like the NYSE or NASDAQ. The company remains privately owned, allowing it to focus on long-term growth without shareholder pressure—ideal for investors seeking stable, independent operators in the cruise sector.

Key Takeaways

- Not publicly traded: American Cruise Lines is a private company with no stock exchange listing.

- No ticker symbol: You cannot invest directly through public markets or buy shares.

- Alternative options: Consider cruise industry ETFs or publicly traded competitors like Carnival or Royal Caribbean.

- Private ownership: The company remains family-owned, avoiding public reporting requirements.

- Monitor filings: Check SEC updates for any future IPO or acquisition news.

📑 Table of Contents

- Is American Cruise Lines Publicly Traded? Find Out Here

- Understanding American Cruise Lines: Company Overview

- Corporate Structure and Ownership: Why It’s Private

- Publicly Traded Cruise Lines: A Comparison

- Why American Cruise Lines Remains Private: Strategic Reasons

- Could American Cruise Lines Go Public in the Future?

- Conclusion: The Private Advantage in the Cruise Industry

Is American Cruise Lines Publicly Traded? Find Out Here

When it comes to the cruise industry, few names evoke the charm of coastal exploration and riverine adventures quite like American Cruise Lines (ACL). With a fleet of modern small ships and classic paddlewheelers, ACL has carved out a niche catering to domestic travelers seeking immersive U.S.-based voyages. From the scenic Pacific Northwest to the historic waterways of New England and the mighty Mississippi River, their itineraries are designed to showcase America’s natural and cultural treasures. But as the cruise sector continues to evolve—especially in the wake of global disruptions like the pandemic—investors, industry watchers, and even loyal passengers often ask: Is American Cruise Lines publicly traded?

This question isn’t just about stock tickers and balance sheets—it reflects a deeper curiosity about the company’s structure, growth strategy, and long-term vision. For potential investors, understanding whether ACL is publicly traded can inform decisions about portfolio diversification, market exposure, and risk assessment. For customers, it can shed light on the company’s financial stability, transparency, and commitment to service. In this comprehensive guide, we’ll dive deep into the corporate structure of American Cruise Lines, explore its ownership, analyze why it remains private, compare it with publicly traded peers, and examine what the future might hold. Whether you’re an investor eyeing opportunities in the travel sector or a traveler curious about the company behind your next river cruise, this article has the answers you need.

Understanding American Cruise Lines: Company Overview

History and Founding

American Cruise Lines was founded in 1991 by Charles A. Robertson, a visionary in the U.S. domestic cruise industry. Unlike major international players such as Carnival or Royal Caribbean, ACL focused exclusively on American waterways from the outset. The company began with a single ship, the American Eagle, and has since grown into a dominant force in the small-ship cruise segment. Over the decades, ACL has launched numerous vessels, including modern coastal cruisers like the American Star and riverboats such as the American Harmony, each tailored to specific regional itineraries.

Visual guide about is american cruise lines publicly traded

Image source: cruisetradenews.com

The company’s growth has been organic and deliberate. Rather than pursuing rapid expansion through mergers or acquisitions, ACL has invested heavily in newbuilds, often constructing ships in U.S. shipyards to comply with the Jones Act—a federal law requiring vessels transporting passengers between U.S. ports to be built, owned, and operated by American entities. This commitment to domestic operations has not only strengthened ACL’s brand identity but also insulated it from some of the regulatory and logistical challenges faced by foreign-flagged cruise lines.

Fleet and Itineraries

Today, ACL operates a fleet of over 15 vessels, including:

- Coastal cruisers: Small ships designed for oceanic routes along the East Coast, Pacific Coast, and Alaska, with capacity for 100–190 passengers.

- Riverboats: Paddlewheelers and modern river vessels sailing the Mississippi, Ohio, Columbia, and other major rivers, accommodating 150–200 guests.

- Newbuilds: The company has introduced several new vessels in recent years, such as the American Liberty and American Legend, featuring eco-friendly propulsion and enhanced passenger amenities.

ACL’s itineraries are carefully curated to emphasize cultural immersion, local cuisine, and off-the-beaten-path destinations. For example, their “Great Rivers of Florida” cruise explores the Suwannee and St. Johns Rivers, while the “Alaska Inside Passage” voyage offers up-close views of glaciers and wildlife. These unique offerings have helped ACL maintain high customer satisfaction and strong repeat booking rates, even during industry downturns.

Business Model and Market Position

American Cruise Lines operates under a premium, all-inclusive model. Unlike mass-market cruise lines that rely on onboard spending (casinos, bars, shopping), ACL includes most amenities—meals, excursions, and select alcoholic beverages—in the base fare. This approach appeals to travelers seeking a more relaxed, value-driven experience.

With a focus on the domestic U.S. market, ACL has positioned itself as a patriotic alternative to foreign-owned cruise lines. Its marketing emphasizes American crew members, locally sourced food, and U.S.-built ships—a strategy that resonates with older demographics and patriotic travelers. The company also benefits from growing interest in “regenerative tourism” and sustainable travel, as its smaller ships have a lower environmental footprint than mega-cruisers.

Corporate Structure and Ownership: Why It’s Private

Private Ownership Model

The most direct answer to the question “Is American Cruise Lines publicly traded?” is no. American Cruise Lines is a privately held company, meaning its shares are not listed on any public stock exchange, and ownership is restricted to a small group of individuals and entities. The company is primarily owned by the Robertson family, with Charles A. Robertson serving as CEO and Chairman. Additional shares may be held by senior executives and long-term investors, but there is no public disclosure of the full ownership breakdown.

This private status is not uncommon in niche travel sectors. Many boutique cruise operators, luxury tour companies, and regional airlines remain private to maintain operational flexibility and avoid the scrutiny and short-term pressures of public markets. For ACL, staying private has allowed the company to:

- Make long-term investment decisions without quarterly earnings pressure.

- Focus on customer experience and brand integrity rather than stock performance.

- Control information flow and maintain competitive advantage.

Financial Privacy and Strategic Advantages

As a private company, ACL is not required to file financial statements with the U.S. Securities and Exchange Commission (SEC). This means revenue, profit margins, and debt levels are not publicly available. However, industry analysts and trade publications (e.g., Cruise Industry News, Travel Weekly) have estimated ACL’s annual revenue at $200–300 million, with steady growth over the past decade.

The absence of public reporting allows ACL to:

- Reinvest profits directly into fleet expansion and service improvements. For example, the company’s recent investment in LNG-compatible engines and hybrid propulsion systems was made without the need for shareholder approval.

- Maintain pricing power. Unlike public companies that may cut prices to boost occupancy, ACL can uphold premium pricing based on service quality.

- Respond quickly to market changes. During the pandemic, ACL suspended operations, refunded customers, and redesigned health protocols without the need for board approvals or investor briefings.

No IPO History or Public Filings

There is no record of American Cruise Lines filing for an initial public offering (IPO) or registering securities with the SEC. A search of the SEC’s EDGAR database returns no filings under “American Cruise Lines,” “ACL,” or related entities. This contrasts sharply with publicly traded peers like Carnival Corporation (CCL) and Norwegian Cruise Line Holdings (NCLH), which file 10-Ks, 10-Qs, and proxy statements regularly.

Moreover, ACL has never issued bonds or sought public financing. Its capital structure appears to rely on retained earnings, private loans, and family investment—further reinforcing its private status.

Publicly Traded Cruise Lines: A Comparison

Major Public Cruise Companies

To understand what ACL’s private status means in context, it’s helpful to compare it with publicly traded cruise giants. The three largest public cruise companies are:

| Company | Ticker | Market Cap (2023) | Fleet Size | Primary Market |

|---|---|---|---|---|

| Carnival Corporation & plc | CCL | $25.1 billion | 87 ships | Global (mass-market) |

| Royal Caribbean Group | RCL | $28.7 billion | 64 ships | Global (premium/luxury) |

| Norwegian Cruise Line Holdings | NCLH | $8.3 billion | 29 ships | Global (freestyle cruising) |

These companies operate on a vastly different scale. Carnival alone carries over 13 million passengers annually, compared to ACL’s estimated 200,000. Their business models emphasize volume, onboard revenue, and global itineraries, while ACL focuses on niche, domestic, and experiential travel.

Key Differences in Operations and Strategy

The differences between public and private cruise lines extend beyond size:

- Capital Access: Public companies can raise capital through stock offerings, debt issuance, and investor relations. ACL relies on private funding, which limits its ability to scale rapidly but reduces financial risk.

- Investor Pressure: Public cruise lines face intense scrutiny from shareholders, analysts, and the media. For example, Carnival’s stock dropped over 70% during the pandemic due to investor panic. ACL, by contrast, could weather the crisis with internal decision-making.

- Transparency: Public companies must disclose financials, executive compensation, and risks. ACL’s lack of disclosure can be a double-edged sword—while it protects privacy, it also limits trust among potential partners and investors.

- Brand Focus: ACL’s private status allows it to prioritize customer experience over profit metrics. Public companies often balance both, sometimes at the expense of service quality.

Performance During Industry Crises

The 2020–2021 pandemic was a stress test for the cruise industry. Publicly traded companies saw their stock prices plummet, suspended dividends, and laid off thousands. Carnival reported a $10 billion loss in 2020. In contrast, ACL:

- Refunded all passengers within 30 days of cancellations.

- Retained all staff through government relief programs.

- Reopened operations in July 2021 with enhanced health protocols.

This agility highlights the benefits of private ownership: no need to appease Wall Street, faster decision-making, and a focus on long-term brand health.

Why American Cruise Lines Remains Private: Strategic Reasons

Control and Autonomy

The Robertson family has maintained control over ACL for over 30 years. By remaining private, they avoid the dilution of ownership that comes with public offerings. This control enables:

- Consistent leadership and vision.

- Family values embedded in company culture (e.g., emphasis on American-made, local hiring).

- Freedom to reject external pressures (e.g., activist investors, short-term profit demands).

Market Niche and Differentiation

ACL occupies a unique position in the cruise market: it’s the only major U.S.-based cruise line focused exclusively on domestic itineraries. Going public could dilute this niche appeal. For example:

- Investors might push for expansion into international markets, undermining the “American-only” brand.

- Shareholders could demand higher returns, leading to price increases that alienate loyal customers.

- Public scrutiny might force changes in operations (e.g., cost-cutting on excursions or crew training).

Regulatory and Financial Considerations

The Jones Act and other U.S. maritime regulations add complexity to ACL’s operations. Public companies must disclose compliance risks, which could attract regulatory scrutiny or lawsuits. By staying private, ACL can:

- Manage compliance internally without public disclosure.

- Avoid the cost of SEC reporting (estimated $1–2 million annually for mid-sized public companies).

- Maintain flexibility in hiring and contracting (e.g., using U.S.-only crew without public labor disclosures).

Future Growth Without Public Pressure

ACL’s growth strategy is gradual and capital-intensive. The company has announced plans to add 5–7 new ships by 2030, including vessels designed for the Great Lakes and Gulf Coast. These projects require significant investment but don’t need to be justified to quarterly earnings calls. Private ownership allows ACL to:

- Fund newbuilds through retained earnings and private loans.

- Take calculated risks (e.g., new itineraries, tech upgrades) without fear of stock price drops.

- Prioritize sustainability and innovation over short-term returns.

Could American Cruise Lines Go Public in the Future?

Potential Triggers for an IPO

While ACL remains private today, several factors could prompt a future public offering:

- Need for Capital: If ACL plans a major expansion (e.g., 20+ new ships), public markets could provide access to billions in capital.

- Succession Planning: As Charles Robertson ages, the family may consider an IPO to monetize their investment and ensure a smooth transition.

- Market Conditions: A strong cruise sector recovery or investor appetite for travel stocks could make an IPO attractive.

- Acquisition Interest: A larger cruise line or private equity firm might acquire ACL, potentially taking it public later.

Risks and Challenges of Going Public

An IPO would bring significant challenges:

- Loss of Control: Shareholders could demand changes in strategy, pricing, or operations.

- Increased Costs: Compliance, auditing, and investor relations could add $5–10 million in annual expenses.

- Market Volatility: Cruise stocks are notoriously volatile. A downturn could hurt the company’s reputation.

- Brand Dilution: Public ownership might force ACL to compromise its niche identity.

Industry Precedents

Few niche cruise companies have gone public. Most remain private or are acquired by larger firms. For example:

- Lindblad Expeditions (LIND): A rare publicly traded small-ship operator, but it focuses on global expeditions, not U.S. rivers.

- Scenic Group: A private luxury cruise line that has resisted IPO offers.

These examples suggest that niche operators often prefer privacy, even at the cost of slower growth.

Conclusion: The Private Advantage in the Cruise Industry

So, is American Cruise Lines publicly traded? The answer is a clear no—and there are compelling reasons for this choice. As a privately held company, ACL enjoys unparalleled autonomy, strategic flexibility, and a focus on long-term customer satisfaction. Its ownership by the Robertson family ensures that the company’s core values—American-built ships, domestic itineraries, and personalized service—remain intact, even as the cruise industry evolves.

For investors, ACL’s private status means you won’t find its stock on the NYSE or NASDAQ. But that doesn’t mean the company is irrelevant to the market. In fact, its resilience during the pandemic, steady growth, and commitment to innovation make it a quiet leader in the domestic travel sector. If you’re looking to invest in the cruise industry, consider ACL as a benchmark for what’s possible outside the glare of Wall Street.

For travelers, the private model is a win. Without shareholder pressure, ACL can invest in better ships, more immersive excursions, and superior service. Whether you’re sailing the Mississippi or exploring the Pacific Northwest, you’re experiencing a company that prioritizes your journey over quarterly profits.

Looking ahead, ACL’s private status is likely to remain unchanged—unless a major strategic shift occurs. But even then, the company’s focus on quality, sustainability, and American heritage will likely endure. In a world of mass-market tourism, American Cruise Lines stands as a testament to the power of staying private, staying true, and sailing your own course.

Frequently Asked Questions

Is American Cruise Lines publicly traded on any stock exchange?

No, American Cruise Lines is not publicly traded. It is a privately owned company, meaning its shares are not available for purchase on public stock exchanges like the NYSE or NASDAQ.

Can I invest in American Cruise Lines stock?

Unfortunately, you cannot invest in American Cruise Lines stock because the company is privately held. Investment opportunities are limited to private equity or internal stakeholders.

Why isn’t American Cruise Lines publicly traded like other cruise companies?

American Cruise Lines remains privately owned to maintain greater control over operations and strategic decisions, avoiding the regulatory and financial reporting requirements of public companies. This structure allows the brand to focus on niche markets like U.S. river and coastal cruising.

Are there any plans for American Cruise Lines to go public?

As of now, American Cruise Lines has not announced any plans to go public. The company continues to operate under private ownership, with no indication of an IPO in the near future.

How does being privately held affect American Cruise Lines’ services?

Being privately held allows American Cruise Lines to prioritize customer experience and long-term growth over short-term shareholder returns. This often translates to more personalized service and flexibility in itinerary planning.

What are the alternatives if I want to invest in a publicly traded cruise line?

If you’re looking for publicly traded cruise options, consider companies like Carnival Corporation (CCL), Royal Caribbean Group (RCL), or Norwegian Cruise Line Holdings (NCLH). These stocks are actively traded and offer exposure to the broader cruise industry.