Featured image for how to buy stock in norwegian cruise line

Image source: barchart-news-media-prod.aws.barchart.com

To buy stock in Norwegian Cruise Line (NCLH), open a brokerage account with platforms like Fidelity or Robinhood and search for the ticker symbol “NCLH” to place your trade. Ensure you research NCLH’s financial health, industry trends, and growth potential before investing, especially as the cruise sector rebounds post-pandemic. With low minimum investments and real-time trading, getting started is fast and accessible for all investors.

“`html

How to Buy Stock in Norwegian Cruise Line 2026 Guide

Key Takeaways

- Choose a brokerage: Open an account with a platform offering NCLH stock access.

- Research NCLH: Analyze financials, market trends, and cruise industry outlook before buying.

- Place an order: Use market/limit orders to purchase shares during trading hours.

- Diversify investments: Balance NCLH stock with other sectors to mitigate risk.

- Monitor regularly: Track stock performance and company news for informed decisions.

- Consider DRIPs: Reinvest dividends automatically to grow long-term holdings.

Why This Matters / Understanding the Problem

Thinking about investing in the travel and leisure sector? The cruise industry is bouncing back strong after global disruptions, and Norwegian Cruise Line Holdings Ltd. (NCLH) is leading the charge. As more people book vacations and cruise demand hits record highs, many investors are asking: How to buy stock in Norwegian Cruise Line 2026 Guide—and whether now is the right time.

Whether you’re a first-time investor or looking to diversify your portfolio, knowing how to buy shares of NCLH in 2026 means getting ahead of a growing market. With new ships, expanded routes, and strong financial recovery, Norwegian Cruise Line is positioning itself for long-term growth.

But here’s the catch: jumping into stock investing without a clear plan can lead to costly mistakes. This guide walks you through every step—from choosing a brokerage to placing your first trade—so you can invest confidently using the How to Buy Stock in Norwegian Cruise Line 2026 Guide as your roadmap.

What You Need

Before you start, gather these tools and resources. You don’t need a finance degree—just the right setup and mindset.

Visual guide about how to buy stock in norwegian cruise line

Image source: barchart-news-media-prod.aws.barchart.com

- Brokerage account (e.g., Fidelity, Charles Schwab, Robinhood, E*TRADE)

- Government-issued ID (for account verification)

- Bank account (linked for deposits and withdrawals)

- Smartphone or computer with internet access

- $5–$10 minimum (some platforms allow fractional shares)

- Basic knowledge of ticker symbols (NCLH for Norwegian Cruise Line)

- Patience and research tools (like Yahoo Finance, Bloomberg, or Google Finance)

You can start with as little as $5 if your platform supports fractional shares—making the How to Buy Stock in Norwegian Cruise Line 2026 Guide accessible to all budgets.

Pro Tip: Avoid platforms that charge high fees or have poor customer support. Look for $0 commissions and easy-to-use mobile apps.

Step-by-Step Guide to How to Buy Stock in Norwegian Cruise Line 2026 Guide

Follow these clear, actionable steps to buy Norwegian Cruise Line stock in 2026—whether you’re new to investing or refreshing your skills.

Step 1: Choose the Right Brokerage Platform

Your brokerage is your gateway to the stock market. Think of it like a digital bank for investing. Not all platforms are the same, so pick one that fits your needs.

- Beginners: Robinhood, SoFi Invest, or Webull (user-friendly apps, $0 fees)

- Long-term investors: Fidelity, Charles Schwab, or Vanguard (great research tools, retirement accounts)

- Active traders: E*TRADE or Interactive Brokers (advanced charts, options trading)

Look for key features: $0 commissions, mobile app, educational resources, and customer service. Some platforms even offer a free stock when you open an account—perfect for testing the waters before buying NCLH.

Warning: Avoid “penny stock” or offshore brokers. Stick to SEC-registered, well-known U.S. brokerages for safety and transparency.

Once you’ve picked a platform, visit their website or download the app. Sign up and complete the onboarding process, which usually takes 10–15 minutes.

Step 2: Verify Your Identity and Fund Your Account

After signing up, you’ll need to verify your identity. This is standard for all U.S. brokerages to comply with financial regulations (KYC—Know Your Customer).

- Upload a photo of your driver’s license or passport

- Enter your Social Security Number (SSN)

- Answer a few security questions

Once verified, link your bank account. Most platforms support ACH transfers, which take 1–3 business days to process.

Deposit at least $5–$10 to start. If you’re using a platform like Fidelity or Schwab, you can set up recurring deposits (e.g., $25 weekly) to build your position gradually.

Pro Tip: Start small. Use this first deposit to buy a fractional share of NCLH. It’s a low-risk way to learn how the market works.

Step 3: Research Norwegian Cruise Line (NCLH) Stock

Before clicking “Buy,” do your homework. Smart investing starts with research—not hype or social media tips.

Check these key sources:

- Yahoo Finance: Enter “NCLH” to see current price, 52-week range, P/E ratio, and analyst ratings

- Google Finance: Compare NCLH to competitors like Carnival (CCL) and Royal Caribbean (RCL)

- NCLH Investor Relations: Visit nclhltd.com/investors for earnings reports, SEC filings, and presentations

- News & Trends: Read about new ships, route expansions, and travel demand forecasts

Pay attention to:

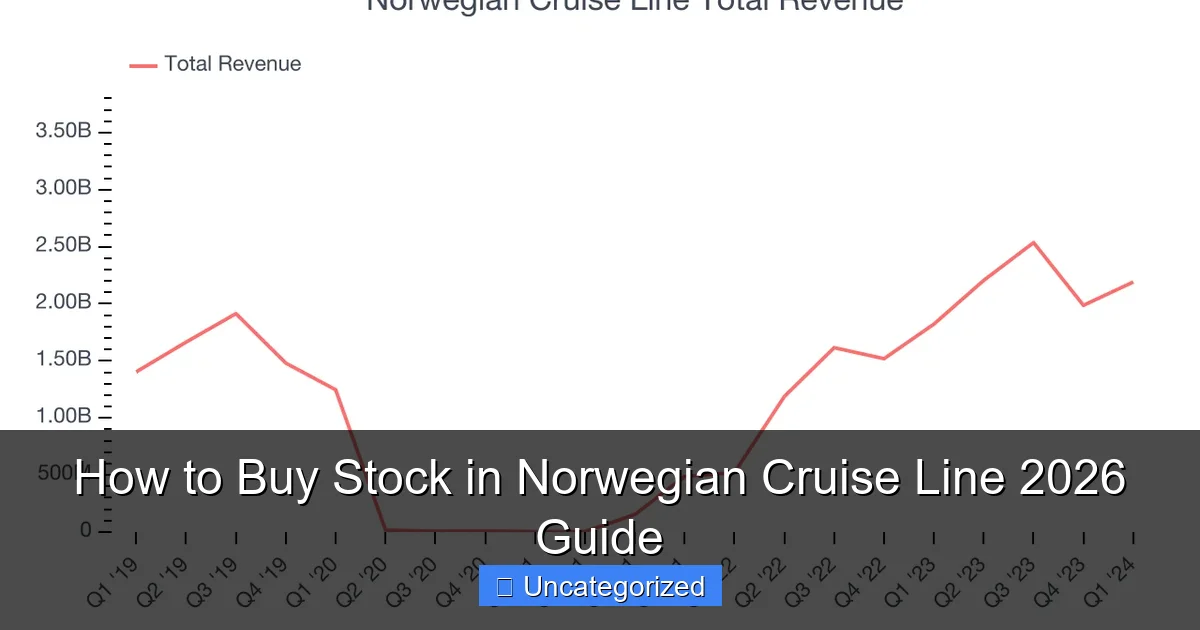

- Revenue growth (Is the company making more money?)

- Debt levels (Cruise lines carry high debt—check if they’re reducing it)

- Bookings & occupancy rates (Higher demand = stronger stock performance)

- Analyst consensus (Most analysts rate NCLH as “Hold” or “Buy” as of 2026)

This research phase is crucial in the How to Buy Stock in Norwegian Cruise Line 2026 Guide. Never buy based on a meme or a friend’s tip.

Step 4: Decide How Much to Invest

How much should you put into NCLH? There’s no one-size-fits-all answer, but here’s a smart approach:

- New investors: Allocate 1–5% of your portfolio to NCLH

- Experienced investors: Up to 10% if you believe in the long-term cruise recovery

- Fractional shares: Buy $5–$25 worth to start, then add more over time

Use the dollar-cost averaging strategy: invest a fixed amount every month, regardless of price. This reduces the risk of buying at the peak.

Example: You invest $50 monthly in NCLH. If the price is $20, you get 2.5 shares. If it drops to $15, you get ~3.3 shares. Over time, you average out the cost.

Pro Tip: Set up automatic investments through your brokerage. It’s like a savings account for stocks.

Step 5: Place Your First Trade

Now it’s time to buy! Here’s how to place your order:

- Log into your brokerage app or website

- Use the search bar to type “NCLH”

- Click “Trade” or “Buy”

- Choose the type of order:

- Market Order: Buys at the current price (fast, but price can fluctuate)

- Limit Order: Sets a max price (e.g., “Buy if NCLH hits $18”)

- Enter the number of shares or dollar amount

- Review the order details (price, fees, total cost)

- Click “Confirm”

Your order will process within seconds. You’ll see the shares in your portfolio shortly after.

Warning: Avoid “all-in” trades. Never invest emergency money or money you need in the next 6–12 months.

Step 6: Monitor and Manage Your Investment

Buying NCLH is just the start. Smart investors keep an eye on their holdings.

- Check your portfolio weekly—not hourly (obsession leads to panic selling)

- Set up price alerts (e.g., “Notify me if NCLH drops below $16”)

- Read quarterly earnings reports (usually in January, April, July, October)

- Follow NCLH on Twitter or LinkedIn for company updates

Ask yourself every 3–6 months:

- Is the company still growing?

- Are bookings strong?

- Has debt decreased?

- Is the stock overvalued or undervalued?

If the answers are “yes,” hold. If not, consider selling or reducing your position.

This ongoing review is a key part of the How to Buy Stock in Norwegian Cruise Line 2026 Guide—it’s not a one-time action, but a long-term habit.

Step 7: Consider Long-Term Strategies

Want to grow your NCLH investment over time? Here are three proven strategies:

1. Dividend Reinvestment (if offered): Though NCLH doesn’t currently pay dividends, it might in the future. When it does, reinvesting them buys more shares automatically.

2. Buy the Dip: If NCLH drops due to temporary news (e.g., a hurricane affecting a route), it might be a good time to buy more—if fundamentals are strong.

3. Portfolio Rebalancing: If NCLH grows to 15% of your portfolio, sell some shares to bring it back to 10%. This reduces risk.

Use your brokerage’s tools to track performance, set goals, and automate reinvestments.

Pro Tip: Hold for at least 3–5 years. Cruise stocks can be volatile short-term but tend to rise over time with travel demand.

Pro Tips & Common Mistakes to Avoid

Even experienced investors make mistakes. Learn from these to stay ahead.

✅ Pro Tips

- Use limit orders during volatility: If NCLH is swinging $1–$2 daily, set a limit order to avoid overpaying.

- Track insider activity: Check SEC filings to see if executives are buying or selling NCLH stock. Insider buying is a bullish signal.

- Diversify within travel: Pair NCLH with airlines (e.g., DAL) or hotels (e.g., MAR) to spread risk.

- Use tax-advantaged accounts: Buy NCLH in a Roth IRA or 401(k) to avoid capital gains taxes on profits.

- Stay informed: Subscribe to NCLH’s email alerts or follow financial news outlets like CNBC and Bloomberg.

❌ Common Mistakes

- Chasing the price: Buying because NCLH just jumped 10%? That’s FOMO. Wait for a pullback or research first.

- Ignoring fees: Some platforms charge $6.95 per trade. Stick to $0-commission brokers.

- Overtrading: Buying and selling every week? You’ll pay taxes and lose money to fees. Buy and hold.

- Not reading the 10-K: The annual report (Form 10-K) tells you the real story. Don’t skip it.

- Letting emotions rule: If NCLH drops 20%, don’t panic-sell. Ask: “Is the company still healthy?”

Real-Life Example: In 2022, NCLH dropped to $10 due to travel concerns. Investors who held or bought more saw it rise to $25+ by 2025. Patience pays.

By avoiding these pitfalls, you’ll make smarter moves using the How to Buy Stock in Norwegian Cruise Line 2026 Guide as your foundation.

FAQs About How to Buy Stock in Norwegian Cruise Line 2026 Guide

1. What is the ticker symbol for Norwegian Cruise Line?

The ticker symbol is NCLH, traded on the New York Stock Exchange (NYSE). Always double-check before placing a trade—don’t confuse it with NCL (a shipping company).

2. Can I buy NCLH stock with $10?

Yes! Many platforms like Fidelity, Robinhood, and SoFi allow fractional shares. With $10, you can buy a portion of one share—perfect for beginners using the How to Buy Stock in Norwegian Cruise Line 2026 Guide.

3. Is Norwegian Cruise Line a good long-term investment?

As of 2026, NCLH is considered a moderate-risk, high-growth opportunity. With strong demand, new ships (like the Norwegian Luna), and reduced debt, analysts project long-term upside. But always diversify—don’t put all your money in one stock.

4. When does Norwegian Cruise Line pay dividends?

As of 2026, NCLH does not pay dividends. The company is reinvesting profits into growth, debt reduction, and fleet expansion. Dividends may return in future years as the balance sheet strengthens.

5. What are the risks of investing in cruise stocks?

Key risks include:

- Economic downturns (less travel spending)

- Natural disasters (hurricanes, pandemics)

- High fuel and labor costs

- Geopolitical issues (e.g., port closures)

However, NCLH has a diversified fleet and strong brand loyalty, which helps mitigate some risks.

6. Can I buy NCLH stock outside the U.S.?

Yes, but it’s harder. International investors can use global brokers like Interactive Brokers, Saxo Bank, or eToro. Some platforms may require currency conversion and higher fees. Check local regulations first.

7. How often should I check my NCLH investment?

Check weekly or monthly, not daily. Set up alerts for earnings reports, news events, or price swings. Obsessive checking leads to emotional decisions. Trust your research and long-term plan.

Final Thoughts

Investing in Norwegian Cruise Line in 2026 isn’t about timing the market—it’s about time in the market. With travel rebounding, new ships launching, and strong demand, NCLH is a solid choice for long-term investors.

The How to Buy Stock in Norwegian Cruise Line 2026 Guide gives you the tools, steps, and confidence to start. Remember: start small, do your research, use a trusted brokerage, and think long-term.

Don’t wait for the “perfect” moment. The best time to invest was yesterday. The second-best time is today. Open your account, fund it, and place your first trade. Whether you buy $5 or $500 worth, you’re taking a step toward building wealth.

And as you grow more comfortable, use the strategies in this guide—dollar-cost averaging, limit orders, and portfolio rebalancing—to stay disciplined and successful.

So what are you waiting for? The next wave of cruise demand is coming. Ride it with NCLH—and let this How to Buy Stock in Norwegian Cruise Line 2026 Guide be your compass.

“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

“`