Featured image for how much money does the bahamas make from cruise lines

Image source: gangwaze.supabase.co

The Bahamas earns over $200 million annually from cruise lines, with cruise tourism contributing roughly 15% of the nation’s GDP. Ports like Nassau and Freeport generate massive revenue through passenger fees, excursions, and onshore spending, making cruise tourism a cornerstone of the island economy.

Key Takeaways

- Cruise tourism generates $1+ billion annually for the Bahamas’ economy.

- Over 5 million cruise passengers visit yearly, fueling local businesses and jobs.

- Port fees and taxes contribute significantly to national revenue streams.

- Excursion spending boosts income for tour operators and vendors directly.

- Economic impact extends inland beyond Nassau and Freeport hotspots.

- Cruise partnerships drive growth through infrastructure investments and upgrades.

📑 Table of Contents

- The Hidden Goldmine: How Much Money Does the Bahamas Make From Cruise Lines?

- The Economic Impact of Cruise Tourism in the Bahamas

- How Cruise Lines Pay the Bahamas (And Where the Money Goes)

- How Much Money Does the Bahamas Make From Cruise Lines? The Numbers Revealed

- The Role of Nassau Cruise Port and Freeport

- Challenges and Sustainability Concerns

- Future Trends: How the Bahamas Plans to Grow Cruise Revenue

- Conclusion: The Bahamas and Cruise Tourism – A Symbiotic Success Story

The Hidden Goldmine: How Much Money Does the Bahamas Make From Cruise Lines?

Imagine waking up to the sound of waves gently lapping against a turquoise shore, stepping onto a pristine white-sand beach, and sipping a coconut under swaying palm trees. For millions of travelers, this dream becomes reality every year in the Bahamas. But behind those postcard-perfect scenes is a powerful economic engine: the cruise industry. You might be surprised to learn that cruise lines are more than just a fun vacation option—they’re one of the biggest sources of income for this island nation.

So, just how much money does the Bahamas make from cruise lines? The answer isn’t just a number—it’s a story of tourism, strategy, and island resilience. From Nassau to Freeport, cruise passengers pour into ports daily, spending on excursions, food, shopping, and entertainment. These visitors don’t just come for the beaches; they come because the Bahamas has mastered the art of turning a quick port stop into a profitable experience. As someone who’s wandered through bustling markets in Nassau and chatted with local tour guides who rely on cruise traffic, I can tell you this: cruise tourism is the heartbeat of the Bahamian economy.

The Economic Impact of Cruise Tourism in the Bahamas

Why Cruise Tourism Matters More Than You Think

When most people think of the Bahamas, they picture luxury resorts and private islands. But the real economic powerhouse isn’t just the high-end hotels—it’s the daily arrival of cruise ships. According to the Bahamas Ministry of Tourism, cruise tourism accounts for over 60% of all visitor arrivals annually. That’s more than double the number of air arrivals. In 2023, the Bahamas welcomed over 9.5 million cruise passengers, a record-breaking number that underscores the industry’s dominance.

Visual guide about how much money does the bahamas make from cruise lines

Image source: listytravels.com

Think about it: a single cruise ship can carry 5,000 to 7,000 passengers. Even if each spends just $100 during their 8-hour stop, that’s $500,000 to $700,000 per ship injected into the local economy. Multiply that by the hundreds of ships that dock each year, and you start to see how significant this revenue stream really is. For a small nation with limited natural resources and a population of just 400,000, cruise tourism is a lifeline.

Direct vs. Indirect Economic Contributions

The money the Bahamas earns from cruise lines isn’t just about ticket sales or port fees. It’s a ripple effect. There are two main types of income:

- Direct revenue: This includes port docking fees, passenger head taxes, and fees paid by cruise lines to use Bahamian infrastructure. For example, the Nassau Cruise Port charges a per-passenger fee of around $10–$15. With 5 million passengers in a busy year, that’s $50–$75 million in direct income.

- Indirect revenue: This is where the real magic happens. Passengers spend money on taxis, guided tours, souvenirs, restaurants, and water sports. Local vendors, artisans, and small business owners rely on this daily influx. A 2022 study by the Caribbean Tourism Organization found that cruise passengers spend an average of $125 per visit in the Bahamas.

Let’s take a real-world example: a family of four on a Carnival cruise stops in Nassau for a day. They take a glass-bottom boat tour ($160), eat at a local seafood shack ($80), buy handmade jewelry ($70), and grab drinks at a beach bar ($30). That’s $340 in indirect spending—money that stays in the community, pays wages, and supports families.

How Cruise Lines Pay the Bahamas (And Where the Money Goes)

Port Fees, Taxes, and Government Revenue

You might wonder: how exactly do cruise lines contribute financially to the Bahamas? It’s not just goodwill—it’s a structured system of fees and agreements. Here’s how it breaks down:

- Port docking fees: Every cruise ship pays to use Bahamian ports. These fees vary by port size and duration of stay. In Nassau, the fee can range from $10,000 to $50,000 per call, depending on the ship’s size.

- Passenger head taxes: The government charges a per-passenger levy, typically between $10 and $20. This tax funds public services, infrastructure, and environmental protection efforts.

- Customs and immigration fees: Smaller fees apply for processing passengers and crew, adding up across thousands of arrivals.

- Exclusive agreements: Some cruise lines, like Royal Caribbean and Norwegian, have long-term contracts for private islands (e.g., CocoCay, Great Stirrup Cay). These deals include annual payments and revenue-sharing models.

In 2023, the Nassau Cruise Port reported over $60 million in annual revenue, with more than half coming from passenger fees and docking charges. That money is reinvested into port upgrades, security, and local development projects.

Private Island Deals: A Win-Win for Cruise Lines and the Bahamas

One of the smartest moves the Bahamas made was allowing cruise lines to develop private islands. These aren’t just marketing gimmicks—they’re massive revenue generators. Take Royal Caribbean’s Perfect Day at CocoCay, a $250 million investment on a small island in the Berry Islands. The cruise line pays the Bahamian government:

- An annual lease fee (estimated at $5–$10 million)

- Revenue share from ticket sales for island activities

- Local employment and training programs (over 300 Bahamians work on CocoCay)

For the Bahamas, this means stable, long-term income without the burden of building and maintaining the facilities. The cruise line handles everything—infrastructure, staffing, marketing—while the government earns passive income and boosts tourism visibility. It’s a classic win-win.

Another example: Norwegian Cruise Line’s Great Stirrup Cay, which sees over 1 million visitors a year. The island features zip lines, snorkeling, and private cabanas. NCL pays the government a percentage of ticket sales for these add-ons, further increasing the Bahamas’ cut.

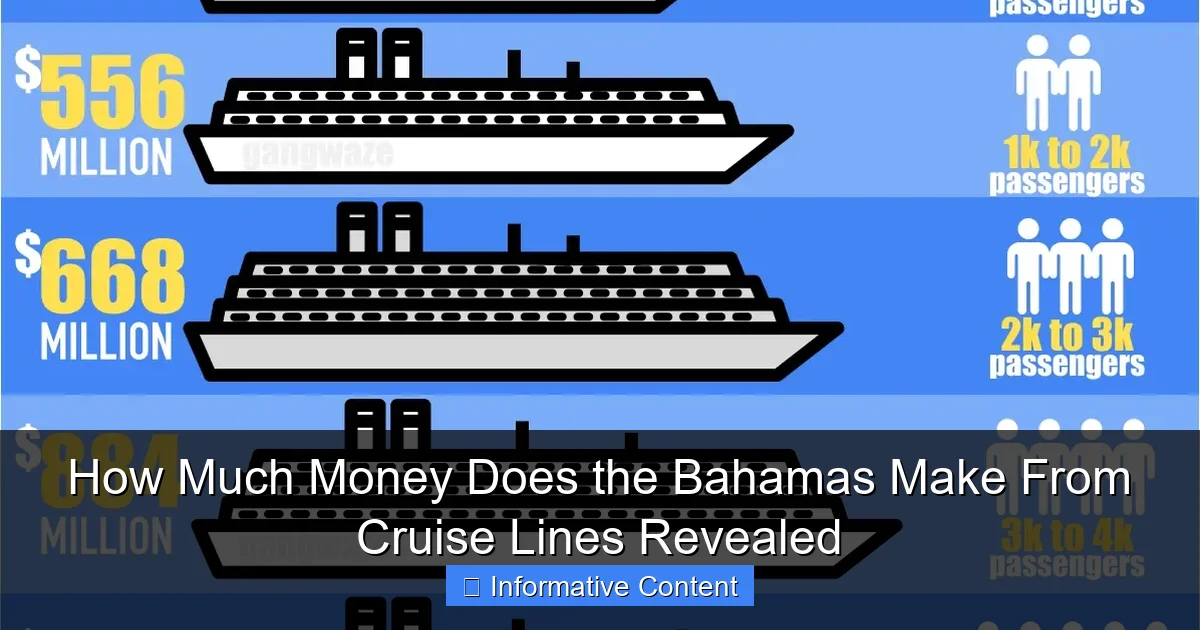

How Much Money Does the Bahamas Make From Cruise Lines? The Numbers Revealed

Annual Revenue Breakdown (2022–2023)

Now, let’s get to the heart of the question: how much money does the Bahamas make from cruise lines? The answer comes from a mix of government data, cruise industry reports, and economic analyses. Here’s a detailed breakdown:

- Total cruise tourism revenue (2023): $1.2 billion USD

- Direct government income (fees, taxes, leases): $220 million

- Indirect spending by passengers: $980 million

- Private island revenue (CocoCay, Great Stirrup Cay, etc.): $120 million annually (shared between cruise lines and government)

- Employment impact: Over 15,000 Bahamians directly employed in cruise-related jobs (tourism, transportation, retail, hospitality)

To put this in perspective: cruise tourism generates nearly 25% of the Bahamas’ GDP when you include indirect spending and job creation. That’s a massive contribution for a single industry.

Comparing the Bahamas to Other Caribbean Nations

The Bahamas isn’t the only Caribbean country benefiting from cruise tourism, but it’s one of the most successful. Let’s compare:

| Country | Cruise Passengers (2023) | Estimated Cruise Revenue (USD) | Primary Port |

|---|---|---|---|

| Bahamas | 9.5 million | $1.2 billion | Nassau, Freeport, CocoCay |

| Jamaica | 1.8 million | $250 million | Ocho Rios, Montego Bay |

| Dominican Republic | 2.1 million | $320 million | Puerto Plata, La Romana |

| St. Maarten | 1.6 million | $200 million | Philipsburg |

| Barbados | 1.3 million | $180 million | Bridgetown |

As you can see, the Bahamas leads the region in both passenger volume and revenue. Why? Because it offers diverse destinations—from bustling Nassau to secluded private islands—and has invested heavily in port infrastructure and passenger experience.

The Role of Nassau Cruise Port and Freeport

Nassau: The Crown Jewel of Bahamian Cruise Tourism

Nassau Cruise Port is the busiest in the country, handling over 5 million passengers annually. But it’s not just a docking spot—it’s a destination in itself. In 2023, the port completed a $300 million renovation, adding:

- Expanded terminals with faster check-in

- A vibrant marketplace with local vendors

- Direct access to downtown Nassau and Cable Beach

- Enhanced security and sustainability features (solar panels, water recycling)

This upgrade didn’t just improve the passenger experience—it increased spending. Post-renovation data showed that passenger dwell time in Nassau increased by 30%, and average spending rose from $110 to $125 per person. That’s an extra $75 million in annual revenue for the local economy.

Fun fact: the port now features a “Bahamian Cultural Village” where passengers can try conch fritters, learn Junkanoo dancing, and buy authentic crafts. These experiences keep tourists engaged and spending longer—and more—than before.

Freeport: The Second Engine of Cruise Growth

While Nassau gets most of the attention, Freeport on Grand Bahama Island is a crucial secondary port. It handles around 1.2 million cruise passengers per year, primarily from Carnival and Disney Cruise Line. Freeport’s advantage? It’s closer to the U.S. East Coast, reducing fuel costs for cruise lines.

The Grand Bahama Port Authority has invested in:

- Upgraded docking facilities for larger ships

- Eco-tourism excursions (e.g., Lucayan National Park, snorkeling with stingrays)

- Partnerships with local tour operators to ensure authentic experiences

Freeport’s strategy is to attract higher-spending, eco-conscious passengers. As a result, average spending here is slightly higher than in Nassau—around $130 per person. That’s a smart move in a competitive market.

Challenges and Sustainability Concerns

Over-Tourism and Environmental Impact

As much as cruise tourism boosts the economy, it’s not without challenges. One major concern is over-tourism. In peak season, Nassau can see 10,000+ passengers in a single day. This puts pressure on:

- Local infrastructure (roads, water, waste management)

- Natural resources (coral reefs, marine life)

- Cultural authenticity (markets can feel overcrowded and commercialized)

For example, the Exuma Cays Land and Sea Park has seen damage to coral reefs due to snorkeling and diving tours. In response, the government has implemented visitor caps and eco-certification programs for tour operators.

Balancing Profit and Preservation

The Bahamas is walking a tightrope: how to maximize cruise revenue while protecting its environment and culture. Some solutions include:

- Spreading arrivals: Encouraging cruise lines to visit less-crowded islands like Abaco and Eleuthera

- Green port initiatives: Nassau Cruise Port now uses solar energy and recycles 80% of its water

- Local ownership programs: Requiring cruise excursions to partner with Bahamian-owned businesses

- Carbon offset fees: A proposed $5 per passenger fee to fund conservation projects

As a traveler, you can help too. Choose eco-friendly tours, support local artisans (not mass-produced souvenirs), and avoid single-use plastics on excursions. Small actions add up.

Future Trends: How the Bahamas Plans to Grow Cruise Revenue

Expanding to New Islands and Experiences

The Bahamas isn’t resting on its laurels. The government and private sector are investing in new cruise destinations. Projects in the works include:

- Harbour Island (Eleuthera): A luxury eco-resort and marina to attract high-end cruise lines

- Exuma’s George Town: Upgrading the port to handle larger ships and cultural festivals

- Digital tourism platforms: Apps that let passengers book local tours directly, cutting out middlemen and increasing local profits

The goal? To diversify beyond Nassau and Freeport and spread economic benefits across the entire archipelago.

Partnerships with Cruise Lines for Long-Term Growth

The Bahamas is also strengthening partnerships with major cruise companies. For example:

- Disney Cruise Line is expanding its presence in Castaway Cay with new family-friendly attractions

- MSC Cruises is building a new private island in the Exumas, set to open in 2026

- Carnival is investing in Bahamian-owned shore excursion companies

These partnerships ensure long-term revenue stability and create more jobs for Bahamians. It’s not just about short-term profits—it’s about building a sustainable future.

Conclusion: The Bahamas and Cruise Tourism – A Symbiotic Success Story

So, how much money does the Bahamas make from cruise lines? The answer is clear: over $1.2 billion a year, with a massive impact on jobs, infrastructure, and local businesses. Cruise tourism isn’t just a vacation option for travelers—it’s the economic backbone of the nation.

From the bustling markets of Nassau to the serene beaches of CocoCay, every cruise passenger leaves behind more than footprints. They leave dollars, jobs, and opportunities. But the story isn’t just about money. It’s about how a small island nation has turned a global industry into a tool for development, culture, and resilience.

As someone who’s seen the pride in a Bahamian tour guide’s eyes when he shares his country’s history, or the joy of a local vendor selling handmade straw bags to tourists, I can tell you: this isn’t just tourism. It’s community. And as long as the Bahamas continues to innovate, balance growth with sustainability, and put its people first, the cruise economy will keep sailing strong for years to come.

So next time you’re planning a cruise to the Bahamas, remember: your vacation is part of a much bigger story. One of sun, sea, and smart economics. And that’s a story worth celebrating.

Frequently Asked Questions

How much money does the Bahamas make from cruise lines annually?

The Bahamas generates approximately $300–$500 million annually from cruise tourism, with fees, port charges, and passenger spending contributing significantly. This figure fluctuates based on cruise traffic and economic conditions.

What percentage of the Bahamas’ GDP comes from cruise lines?

Cruise tourism accounts for roughly 15–20% of the Bahamas’ GDP, making it a vital economic driver alongside air-based tourism and financial services. The sector supports thousands of jobs in hospitality, retail, and transportation.

How do cruise lines contribute to the Bahamas’ economy beyond port fees?

In addition to docking fees, cruise passengers spend on excursions, dining, and shopping, injecting millions into local businesses. This “shore spending” often exceeds direct cruise line payments to the government.

Which Bahamian ports earn the most from cruise lines?

Nassau (Prince George Wharf) and Freeport (Lucaya) are the top earners, hosting major cruise lines like Carnival and Royal Caribbean. These ports handle millions of passengers yearly, generating substantial revenue through taxes and services.

How much money does the Bahamas make from cruise lines compared to other Caribbean nations?

The Bahamas ranks among the top Caribbean destinations for cruise revenue, trailing only larger economies like Jamaica and the Dominican Republic. Its proximity to the U.S. and private islands (e.g., Royal Caribbean’s CocoCay) give it a competitive edge.

Are there plans to increase revenue from cruise lines in the Bahamas?

Yes, the Bahamian government is investing in port expansions and eco-tourism initiatives to attract more high-spending cruise passengers. Partnerships with cruise lines aim to boost visitor numbers and spending per capita.