Featured image for how much is viking cruise line stock

Image source: i.pinimg.com

Viking Cruise Line stock is not currently publicly traded, meaning there is no direct way to buy shares in the company as of now. Private ownership and strategic investments have kept it off public exchanges, limiting stock access to select institutional and accredited investors. This exclusivity underscores its high valuation and long-term growth potential in the luxury cruise market.

Key Takeaways

- Viking is private: No public stock; invest via private equity or funds.

- Track financial health: Monitor earnings and debt to gauge value.

- Compare to peers: Analyze Carnival, Royal Caribbean for relative pricing.

- Future IPO possible: Watch news for potential public listing updates.

- Alternative access: Use ETFs or mutual funds with cruise line exposure.

- Demand trends matter: Bookings and occupancy rates signal stock potential.

📑 Table of Contents

- How Much Is Viking Cruise Line Stock? A Complete Guide to Pricing and Value

- Why Viking Cruise Line Isn’t Public (Yet)

- How to Estimate Viking Cruise Line Stock Price (Even Without Public Data)

- What Influences Viking Cruise Line Stock Value (When It Goes Public)

- How to Prepare for a Viking IPO (If You Want to Invest)

- Alternatives to Buying Viking Cruise Line Stock (For Now)

- Final Thoughts: Is Viking Cruise Line Stock Worth the Wait?

How Much Is Viking Cruise Line Stock? A Complete Guide to Pricing and Value

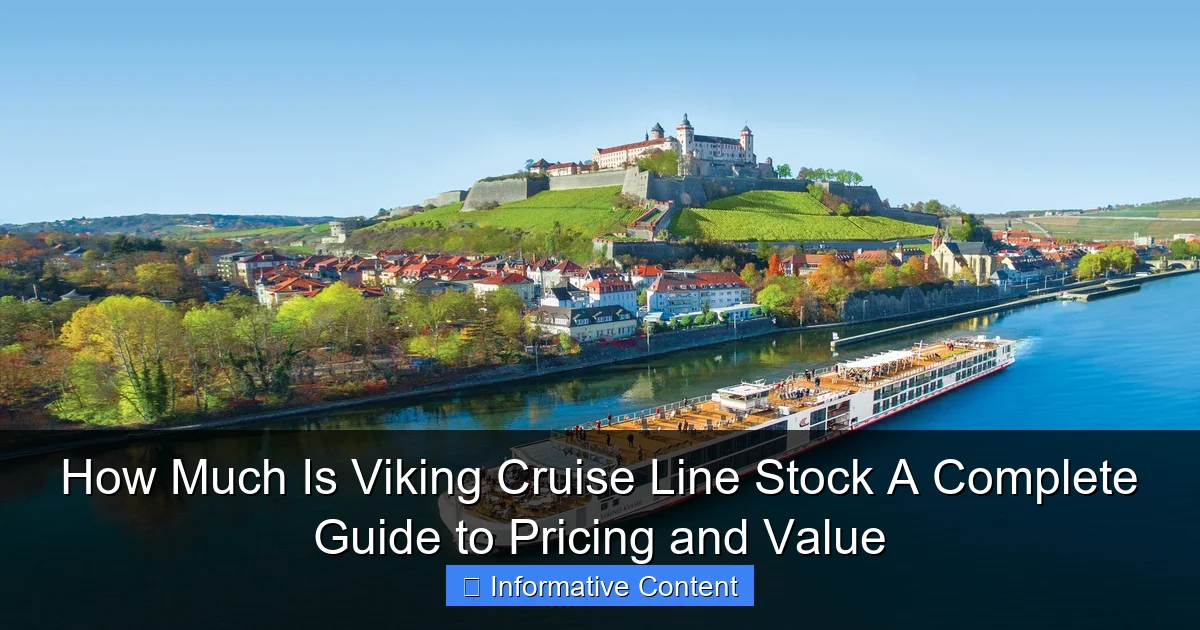

Imagine this: You’re sitting on a deck chair, the ocean breeze brushing your face, sipping a glass of wine as the sun dips below the horizon. The ship glides smoothly through the fjords of Norway, and you think, “This is the kind of experience I want to invest in.” That’s the allure of Viking Cruises. Known for its elegant river and ocean voyages, Viking has captured the hearts of travelers seeking culture, comfort, and curated luxury. But what about investing in the company itself? If you’re curious about how much Viking Cruise Line stock is worth, you’re not alone. Many travel enthusiasts, retirees, and savvy investors are wondering if this brand is a smart addition to their portfolio.

The catch? Viking Cruise Line isn’t a publicly traded company… yet. That’s the first twist in the tale. Unlike Carnival, Royal Caribbean, or Norwegian Cruise Line, you won’t find Viking on the NYSE or NASDAQ. But that doesn’t mean the story ends there. In this guide, we’ll walk through everything you need to know about Viking’s stock status, potential future pricing, valuation clues, and how to approach investment decisions if and when shares become available. Whether you’re a seasoned investor or just starting to dip your toes into the stock market, this guide will help you understand how much Viking Cruise Line stock might cost—and whether it’s worth the wait.

Why Viking Cruise Line Isn’t Public (Yet)

The Private Ownership Model

Viking Cruises is currently privately owned, primarily by its founder, Torstein Hagen, and a group of private equity investors, including TPG Capital and the Canada Pension Plan Investment Board (CPPIB). This means the company doesn’t issue shares to the public or report earnings quarterly like public companies do. Instead, it operates with more flexibility—focusing on long-term growth, fleet expansion, and customer experience without the pressure of short-term stock performance.

Visual guide about how much is viking cruise line stock

Image source: forever.travel-assets.com

Think of it like a family-run vineyard: they control every step, from grape to glass, and don’t have to answer to shareholders every three months. That autonomy has allowed Viking to grow steadily, launching new ships, expanding into new regions (like the Mississippi River and Antarctica), and building a loyal customer base. But it also means there’s no direct way to buy stock—yet.

Signs of an IPO on the Horizon

Despite being private, there have been repeated rumors and reports about Viking preparing for an initial public offering (IPO). In 2021, Viking confidentially filed for an IPO with the U.S. Securities and Exchange Commission (SEC), a move that signaled serious intent. While the IPO was delayed due to market volatility and the pandemic’s impact on travel, the filing remains a strong indicator that Viking is laying the groundwork for going public.

Industry analysts point to a few key reasons why Viking might finally pull the trigger:

- Strong post-pandemic demand: Cruise bookings have surged, with Viking reporting record sales in 2023 and 2024.

- Fleet growth: The company plans to add several new ships by 2027, requiring significant capital.

- Investor pressure: Private equity firms like TPG often seek exit strategies, and an IPO is a common path.

So while you can’t buy Viking stock today, the door isn’t closed. It’s more like it’s slightly ajar—waiting for the right market conditions.

How to Estimate Viking Cruise Line Stock Price (Even Without Public Data)

Using Comparable Public Cruise Stocks

Since Viking isn’t public, we can’t look at its stock price. But we can make educated guesses by comparing it to its publicly traded peers. Think of it like estimating the price of a rare vintage car by looking at similar models that have sold recently.

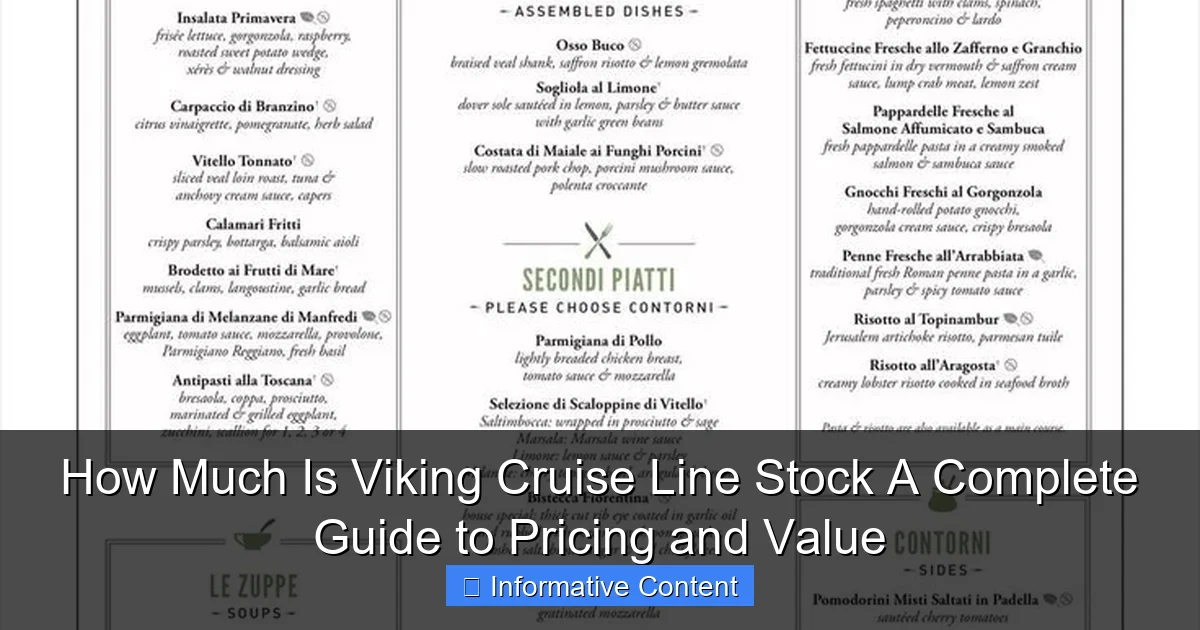

Here are the three major public cruise lines and their key metrics (as of mid-2024):

| Company | Ticker | Market Cap (Billion) | Price-to-Earnings (P/E) | Debt-to-Equity Ratio |

|---|---|---|---|---|

| Carnival Corporation | CCL | $25.3 | 28.5 | 4.2 |

| Royal Caribbean Group | RCL | $38.7 | 22.1 | 3.8 |

| Norwegian Cruise Line | NCLH | $9.2 | 18.9 | 5.1 |

These companies have P/E ratios between 18.9 and 28.5, which tells us how much investors are willing to pay for each dollar of earnings. Viking, being more niche (focused on river and destination-rich ocean cruises), likely commands a premium due to its upscale branding and lower capacity. A reasonable P/E estimate for Viking might be 25–30, slightly above Royal Caribbean.

Now, let’s say Viking’s annual net income is around $600 million (based on industry estimates and fleet size). At a P/E of 25, that gives a market cap estimate of $15 billion. If the company plans to issue 200 million shares in an IPO, the estimated initial stock price would be around $75 per share.

Keep in mind: this is a back-of-the-napkin calculation. Real numbers will depend on final earnings, investor appetite, and market conditions.

Looking at Viking’s Revenue and Fleet Size

Viking doesn’t release detailed financials, but we can piece together clues. The company operates:

- Over 80 river ships (the largest river fleet in the world)

- 11 ocean ships, with plans to grow to 18 by 2027

- An expedition fleet for polar and remote destinations

Industry sources estimate Viking’s annual revenue at $2.5–$3 billion. For comparison, Norwegian Cruise Line generated $7.3 billion in 2023, while Carnival hit $21.6 billion. Viking’s smaller scale means it won’t have the same revenue volume, but its focus on higher-margin, longer itineraries (often 14+ days) could mean better profitability per passenger.

Here’s a tip: When evaluating cruise stocks, look beyond revenue. Focus on occupancy rates, average ticket price, and onboard spending. Viking consistently reports high occupancy (90%+) and strong onboard revenue, thanks to its all-inclusive model (alcohol, excursions, and Wi-Fi are included). That could justify a higher valuation than a mass-market competitor.

What Influences Viking Cruise Line Stock Value (When It Goes Public)

Market Conditions and Investor Sentiment

Let’s say Viking announces its IPO tomorrow. What happens next? The stock price won’t be set in stone. Instead, it will be shaped by a mix of internal and external factors. Think of it like a seesaw: one side is Viking’s fundamentals, the other is the broader market mood.

Here’s what could push the price up or down:

- Interest rates: High rates make borrowing expensive. Since cruise lines are heavily leveraged, a rising rate environment could dampen investor enthusiasm.

- Travel demand: If consumers cut back on luxury travel (due to inflation or recession), Viking’s stock could struggle. But if “revenge travel” continues, the stock might soar.

- Fuel prices: Oil prices directly impact operating costs. A spike in crude oil could squeeze margins.

- Regulatory environment: New environmental rules (like stricter emissions standards) could require costly ship retrofits.

For example, in 2022, when oil prices surged due to the Ukraine conflict, cruise stocks dropped 10–15% in a matter of weeks. Viking, with its longer voyages, might be even more sensitive to fuel costs than shorter-trip competitors.

Viking’s Unique Business Model as a Valuation Driver

Viking isn’t just another cruise line. It’s built around a premium, adult-only, destination-focused model. No casinos, no kids, no loud pool decks. Instead, you get lectures by historians, wine tastings, and immersive cultural experiences. This niche strategy has two big implications for stock value:

- Higher pricing power: Viking’s average ticket price is significantly higher than mass-market lines. A 15-day Rhine cruise can cost $8,000+ per person, versus $3,000 for a similar trip on Carnival. That means more revenue per cabin and better margins.

- Brand loyalty: Viking has a cult-like following. Many passengers rebook multiple times, reducing marketing costs and increasing lifetime customer value.

Investors love predictable revenue streams. If Viking can show consistent repeat bookings and low customer acquisition costs, its stock could trade at a premium to peers.

Competitive Landscape and Differentiation

The cruise industry is crowded, but Viking has carved out a unique space. Unlike Carnival or Royal Caribbean, which target families and first-time cruisers, Viking appeals to affluent, well-educated travelers aged 50+. This demographic is less price-sensitive and more likely to spend on upgrades and excursions.

But competition is heating up. Competitors like AmaWaterways, Uniworld, and even Oceania Cruises are targeting the same upscale market. Viking’s edge? Scale and consistency. With over 80 river ships, it can offer more itineraries and better pricing through bulk purchasing. If Viking goes public, investors will scrutinize how well it defends this advantage.

How to Prepare for a Viking IPO (If You Want to Invest)

Step 1: Set Up Your Investment Accounts

If Viking goes public, you’ll need a brokerage account to buy shares. If you don’t have one, now’s the time to set it up. Most major platforms (like Fidelity, Charles Schwab, or Robinhood) offer free trades and IPO access, but there are a few things to know:

- IPO access isn’t guaranteed: Retail investors often get limited shares, especially for high-demand IPOs. Some brokers prioritize larger clients.

- Consider a direct purchase plan (DSPP): Some companies allow you to buy shares directly, bypassing brokers. Viking might offer this post-IPO.

- Watch for “quiet period” rules: After an IPO, insiders can’t sell shares for 90–180 days. This can cause price volatility when the lock-up expires.

Pro tip: Sign up for IPO newsletters from brokers like Fidelity or SoFi. They often alert customers when new IPOs are coming.

Step 2: Research the Prospectus (When It’s Published)

When Viking files its official IPO prospectus (called an S-1), read it carefully. This document is a goldmine of information. Look for:

- Risk factors: Every IPO lists potential risks. For Viking, this might include “pandemic-related travel disruptions” or “geopolitical instability in key regions.”

- Use of proceeds: How will Viking use the IPO money? Building new ships? Paying down debt? Expanding marketing?

- Management team: Who’s running the show? Torstein Hagen is still involved, but who are the CFO, CMO, and other key players?

For example, in Royal Caribbean’s 1993 IPO, the prospectus revealed heavy debt and reliance on Caribbean itineraries—both red flags for some investors. Viking’s prospectus will tell a similar story, but with its own twists.

Step 3: Decide on Your Investment Strategy

Not all IPOs are created equal. Some soar on day one (like Airbnb), while others flop (like WeWork). Here’s how to approach Viking:

- Buy at IPO (if possible): If you get shares at the initial price, hold them for at least a year. IPOs often dip after the “hype” wears off, but long-term winners emerge.

- Wait for the post-IPO dip: Many IPOs drop 10–20% in the first few months. If Viking’s stock falls below $60 (from our $75 estimate), it might be a buying opportunity.

- Diversify: Don’t put all your money into one stock. Consider a cruise ETF (like CRUZ) that includes Viking peers, or balance it with other travel stocks.

Remember: IPOs are risky. Only invest what you can afford to lose.

Alternatives to Buying Viking Cruise Line Stock (For Now)

Invest in Cruise ETFs and Mutual Funds

Can’t wait for Viking to go public? You can still get exposure to the cruise industry through exchange-traded funds (ETFs) and mutual funds. These funds hold a basket of stocks, reducing risk.

Here are a few options:

- Defiance Hotel, Airline, and Cruise ETF (CRUZ): Holds Carnival, Royal Caribbean, Norwegian, and other travel stocks. No Viking yet, but it’s a good proxy.

- Fidelity Select Leisure Portfolio (FDLSX): Includes cruise lines, hotels, and resorts. More diversified, less volatile.

- Global X Travel ETF (AWAY): Focuses on airlines, hotels, and cruise companies. Includes some European operators that compete with Viking.

These funds let you ride the recovery wave in travel without betting everything on one company. And when Viking finally goes public, some of these funds might add it to their holdings.

Private Investment Opportunities (For Accredited Investors)

If you’re an accredited investor (meaning you have a net worth over $1 million or high annual income), you might access private shares through platforms like Forge or SharesPost. These platforms facilitate secondary sales of private company stock.

However, there are big caveats:

- Liquidity risk: You might not be able to sell your shares until the IPO.

- Higher prices: Private shares often trade at a premium to the expected IPO price.

- Scarcity: Viking shares are rarely available on secondary markets.

For most people, this isn’t a practical option. But if you’re serious about getting early exposure, it’s worth exploring with a financial advisor.

Final Thoughts: Is Viking Cruise Line Stock Worth the Wait?

So, how much is Viking Cruise Line stock? Right now, the answer is: we don’t know. But we have a pretty good guess—somewhere between $60 and $80 per share, based on comparable companies and industry trends. More importantly, we know why it could be a compelling investment: a unique brand, strong demand, and a proven business model that stands out in a crowded market.

But let’s be honest: investing in any IPO is a gamble. The stock market is unpredictable, and even the best companies can stumble. Viking will face challenges—rising fuel costs, geopolitical risks, and competition from other luxury lines. Yet its loyal customer base, focus on high-margin itineraries, and disciplined growth strategy give it a solid foundation.

If you’re considering Viking stock, here’s the bottom line:

- Be patient: The IPO might not happen this year. Or next. But when it does, it could be worth the wait.

- Do your homework: Read the prospectus, track travel trends, and understand the risks.

- Start small: If you get shares, don’t go all-in. Treat it like any other stock—diversify and stay informed.

And who knows? One day, you might be sipping that glass of wine on a Viking ship, watching the sunset—and checking your phone to see that your investment has doubled. Now that’s a voyage worth taking.

Frequently Asked Questions

How much is Viking Cruise Line stock currently trading for?

Viking Cruise Line stock is not publicly traded, as the company remains privately owned by its founders and private equity partners. This means there is no publicly available stock price or ticker symbol for investors to track.

Can I invest in Viking Cruise Line stock?

No, you cannot invest in Viking Cruise Line stock directly because the company is still privately held. Public investment opportunities are only available after an IPO, which Viking has not yet pursued.

Why isn’t Viking Cruise Line stock publicly available?

Viking Cruise Line has chosen to remain private to maintain greater control over operations and avoid the regulatory requirements of being a public company. This allows them to focus on long-term growth without quarterly earnings pressures.

Is there a way to estimate the value of Viking Cruise Line stock?

While Viking Cruise Line stock isn’t publicly traded, analysts may estimate its value based on financial performance, industry multiples, and comparable public cruise lines like Carnival or Royal Caribbean. However, these are speculative and not official stock prices.

Has Viking Cruise Line announced plans for an IPO?

As of now, Viking Cruise Line has not announced any official plans for an IPO. Any future stock availability would depend on the company’s strategic decisions and market conditions.

How does Viking’s private status affect its financial transparency?

Because Viking Cruise Line is private, it is not required to disclose detailed financial reports like public companies. This limits public insight into its exact valuation or stock-related metrics.