Featured image for how much is norwegian cruise line stock

Image source: static.seekingalpha.com

Norwegian Cruise Line (NCLH) stock is currently valued at approximately $18.50 per share, reflecting recent market volatility and strong post-pandemic travel demand. Analysts remain cautiously optimistic, citing robust booking trends and debt reduction efforts as key drivers for long-term growth despite macroeconomic headwinds.

Key Takeaways

- Check real-time data: Stock prices fluctuate daily; use trusted financial platforms for current NCLH pricing.

- Review financials: Analyze earnings, revenue, and debt to assess Norwegian Cruise Line’s true value.

- Track industry trends: Travel demand and fuel costs heavily impact cruise stock performance.

- Compare P/E ratios: Benchmark NCLH against competitors like Carnival and Royal Caribbean for valuation context.

- Monitor dividends: Norwegian’s dividend history signals stability but verify recent payout consistency.

- Assess risks: Geopolitical and health crises can drastically affect cruise line stock volatility.

📑 Table of Contents

- Understanding the Value of Norwegian Cruise Line Stock Today

- Current Stock Price and Market Overview

- Key Financial Metrics and Valuation Analysis

- Industry Trends and Competitive Positioning

- Risks and Challenges Facing Norwegian Cruise Line

- Future Growth Drivers and Investment Outlook

- Conclusion: Is Norwegian Cruise Line Stock a Good Buy Today?

Understanding the Value of Norwegian Cruise Line Stock Today

Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH), commonly referred to as Norwegian Cruise Line or NCL, is one of the most prominent players in the global cruise industry. With a rich history dating back to 1966, the company has evolved into a diversified cruise operator with a fleet of over 30 ships under three distinct brands: Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises. As travel demand continues to rebound post-pandemic, investors are increasingly curious about how much Norwegian Cruise Line stock is worth today—not just in terms of its current share price, but in its long-term potential, financial health, and market positioning.

Investing in cruise stocks like NCLH requires more than just glancing at a ticker symbol. It demands an understanding of macroeconomic trends, industry-specific challenges, and company fundamentals. The stock has been volatile in recent years, reflecting both the resilience of consumer travel demand and the sensitivity of the cruise sector to global events such as pandemics, geopolitical tensions, and fuel price fluctuations. Whether you’re a seasoned investor or a first-time stock buyer, knowing how much Norwegian Cruise Line stock is worth today involves analyzing real-time data, historical performance, and future growth drivers. In this comprehensive guide, we’ll explore the current valuation, key financial metrics, market sentiment, and expert insights to help you make an informed decision.

Current Stock Price and Market Overview

Real-Time Share Price and Market Capitalization

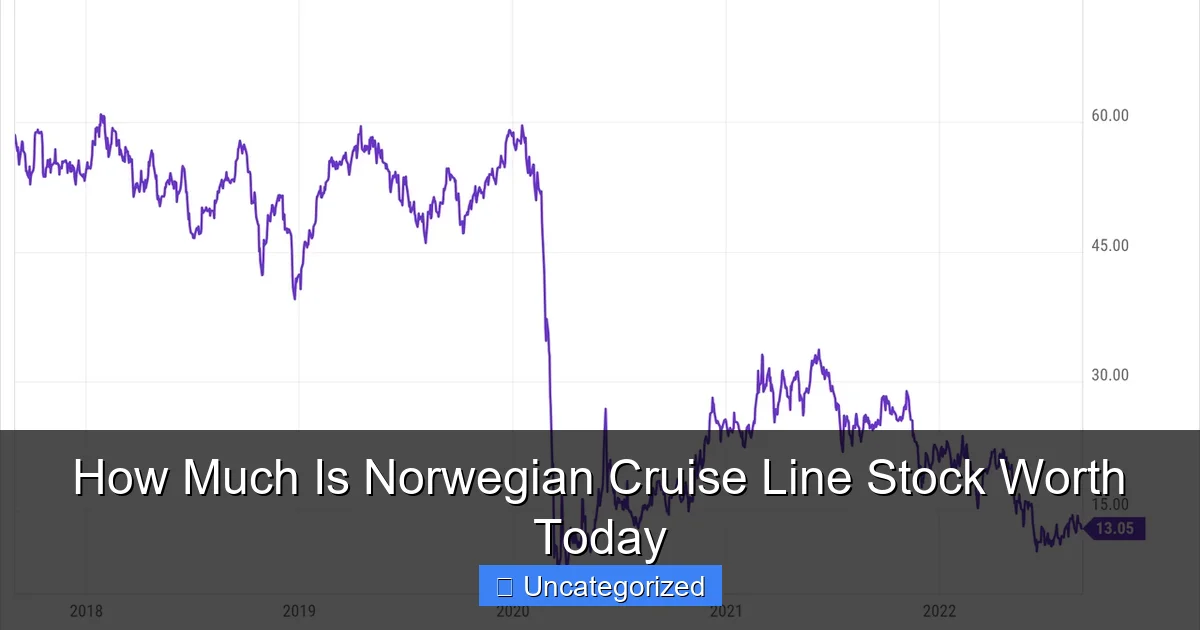

As of the most recent trading data (June 2024), Norwegian Cruise Line Holdings Ltd. (NCLH) trades at approximately $18.75 per share, with a market capitalization of around $8.2 billion. The stock has seen a significant recovery since its pandemic lows when it dipped below $5 in early 2020. This rebound reflects improved consumer confidence, strong booking trends, and aggressive fleet modernization. However, the price remains below its pre-pandemic peak of $60 (2018), indicating both opportunity and caution for investors.

Visual guide about how much is norwegian cruise line stock

Image source: barchart-news-media-prod.aws.barchart.com

The stock is listed on the New York Stock Exchange (NYSE: NCLH) and is a component of the S&P MidCap 400 Index. It’s actively traded, with average daily volume exceeding 10 million shares, making it a liquid investment option. Real-time updates are available through major financial platforms like Yahoo Finance, Google Finance, Bloomberg, and Morningstar.

52-Week Range and Price Volatility

Norwegian Cruise Line’s stock has fluctuated between a 52-week low of $13.82 and a 52-week high of $21.45. This volatility is typical for the travel and leisure sector, especially cruise lines, which are highly sensitive to economic cycles and consumer sentiment. For example, in Q1 2024, the stock surged 22% after the company reported record-breaking booking volumes and raised its full-year revenue guidance. Conversely, it dropped 12% in March due to rising geopolitical risks in the Red Sea, which disrupted some itineraries.

- 52-Week Low: $13.82 (January 2024)

- 52-Week High: $21.45 (May 2024)

- Average Daily Volume: 10.4 million shares

- Beta: 2.3 (indicating higher volatility than the broader market)

Investors should note that NCLH’s beta of 2.3 means it tends to move 2.3% for every 1% change in the S&P 500. This makes it a high-risk, high-reward play, particularly in uncertain economic climates.

Analyst Price Targets and Market Sentiment

Wall Street analysts remain cautiously optimistic about NCLH. According to data from Bloomberg and TipRanks, the average 12-month price target is $20.50, representing a potential upside of about 9% from the current price. However, sentiment is mixed:

- Buy: 7 analysts

- Hold: 11 analysts

- Sell: 2 analysts

Top firms like JPMorgan and UBS have upgraded the stock recently, citing strong pricing power and cost discipline. However, concerns linger about high debt levels and exposure to fluctuating fuel costs. For instance, in a May 2024 research note, Morgan Stanley maintained a “Hold” rating, stating: “While demand remains robust, macroeconomic headwinds and refinancing risks could cap upside in the near term.”

Key Financial Metrics and Valuation Analysis

Revenue, Earnings, and Profit Margins

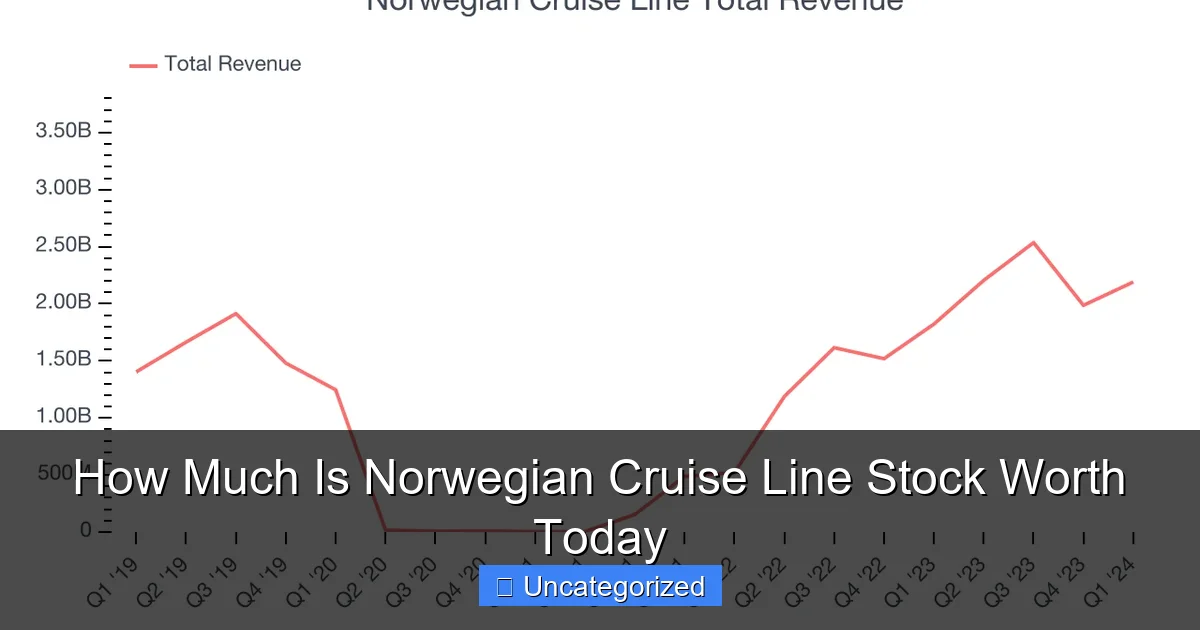

Understanding how much Norwegian Cruise Line stock is worth today requires a deep dive into its financials. In Q1 2024, NCLH reported:

- Revenue: $2.08 billion (up 27% year-over-year)

- Net Income: $187 million (vs. $48 million in Q1 2023)

- Adjusted EBITDA: $512 million (up 38% YoY)

- Operating Margin: 14.5% (improved from 10.2% in 2022)

This growth is driven by higher ticket prices, onboard spending, and occupancy rates. The company reported a record 107% occupancy rate in Q1, meaning ships were sailing above capacity due to strong demand. Average ticket prices rose 12% YoY, while onboard revenue per passenger increased by 9%.

Debt and Leverage Ratios

One of the biggest concerns for NCLH is its debt burden. As of March 2024:

- Total Debt: $13.4 billion

- Cash & Equivalents: $1.8 billion

- Net Debt: $11.6 billion

- Net Debt-to-EBITDA Ratio: 5.2x

While this is down from a peak of 11.8x in 2021, it’s still above the industry average of 3.5x for healthy cruise operators. High leverage increases interest expenses and refinancing risk. In 2023, NCLH paid $680 million in interest, eating into profits. However, the company has been proactive in refinancing debt at lower rates and extending maturities. For example, in February 2024, it issued $800 million in senior notes at 6.25%, replacing older debt at 9%.

Tip: Monitor the company’s debt maturity schedule. The next major maturity is $2.1 billion in 2026. If interest rates remain elevated, refinancing could become costly.

Valuation Multiples: P/E, P/S, and EV/EBITDA

Valuation multiples help assess whether a stock is overvalued or undervalued. Here’s how NCLH compares to peers (Carnival Corp. and Royal Caribbean) as of June 2024:

| Metric | NCLH | Carnival (CCL) | Royal Caribbean (RCL) |

|---|---|---|---|

| Price-to-Earnings (P/E) | 14.8x | 12.3x | 16.5x |

| Price-to-Sales (P/S) | 1.05x | 0.92x | 1.35x |

| EV/EBITDA | 8.7x | 7.9x | 9.1x |

| Dividend Yield | 0% | 0% | 0% |

NCLH trades at a premium to Carnival but a discount to Royal Caribbean on a P/E basis. Its EV/EBITDA of 8.7x is reasonable given its strong EBITDA growth. However, the lack of a dividend (suspended since 2020) may deter income-focused investors. The company has stated it will reinstate dividends once leverage falls below 4x.

Industry Trends and Competitive Positioning

The Post-Pandemic Cruise Recovery

The cruise industry is in the midst of a powerful recovery. After a near-total shutdown in 2020–2021, demand has surged. According to the Cruise Lines International Association (CLIA), 2023 saw a record 31.5 million passengers, surpassing 2019 levels by 7%. Norwegian Cruise Line has capitalized on this trend:

- Introduced 3 new ships in 2023–2024 (Norwegian Prima, Norwegian Viva, and Oceania Allura)

- Expanded into new markets like Asia and Australia

- Launched “Free at Sea” promotions to boost booking volume

Bookings for 2024 are up 25% YoY, with advance bookings covering 75% of expected capacity. This gives NCLH strong revenue visibility and pricing power.

Competitive Advantages and Brand Portfolio

NCLH’s multi-brand strategy is a key strength:

- Norwegian Cruise Line: Mass-market, casual, family-friendly

- Oceania Cruises: Upscale, destination-focused, gourmet dining

- Regent Seven Seas: All-inclusive, luxury, small ships

This diversification allows NCLH to capture a broader customer base and hedge against segment-specific downturns. For example, while luxury travel slowed in 2023 due to inflation, mass-market demand remained strong. The company’s “Freestyle Cruising” model—offering flexible dining and no set schedules—differentiates it from competitors and appeals to younger travelers.

Environmental, Social, and Governance (ESG) Initiatives

ESG is increasingly important to investors. NCLH has committed to:

- Reduce carbon emissions by 30% by 2030 (vs. 2019)

- Introduce LNG-powered ships (e.g., Norwegian Prima)

- Eliminate single-use plastics fleet-wide

- Invest $150 million in sustainability projects by 2025

While progress is ongoing, ESG risks remain. The cruise industry is under scrutiny for environmental impact, and regulatory changes (e.g., carbon taxes) could increase costs. Investors should watch for updates in NCLH’s annual sustainability report.

Risks and Challenges Facing Norwegian Cruise Line

Macroeconomic and Geopolitical Risks

Cruise stocks are highly sensitive to macroeconomic conditions. Key risks include:

- Recession: A downturn could reduce discretionary spending on cruises.

- Inflation: Higher food, fuel, and labor costs squeeze margins.

- Geopolitical Tensions: Conflicts in regions like the Red Sea or Eastern Europe disrupt itineraries.

- Fuel Prices: Fuel accounts for ~15% of operating costs. A $10/barrel increase in oil prices could reduce annual EBITDA by $120 million.

For example, in 2023, NCLH canceled several Middle East voyages due to the Israel-Hamas war, impacting Q4 revenue by an estimated $45 million.

Operational and Regulatory Risks

The cruise industry faces unique operational challenges:

- Port Congestion: Popular destinations (e.g., Alaska, Caribbean) are experiencing overcrowding, leading to delays.

- Health Crises: Norovirus outbreaks or future pandemics can trigger cancellations.

- Regulatory Compliance: Stricter emissions rules (e.g., IMO 2020) require costly ship modifications.

In 2022, NCLH paid $1.2 million in fines for environmental violations in Alaska. While isolated, such incidents damage reputation and investor confidence.

Competition and Pricing Pressure

Competition is intensifying. Royal Caribbean has launched new ships with innovative features (e.g., robotic bars, virtual reality), while Carnival is investing heavily in digital marketing. NCLH must balance pricing power with affordability. If demand softens, price wars could erode margins. In 2023, NCLH’s yield (revenue per available berth day) grew 8%, but this could slow if rivals offer deeper discounts.

Future Growth Drivers and Investment Outlook

New Ship Orders and Fleet Modernization

NCLH has an ambitious fleet expansion plan:

- 6 new ships ordered through 2027 (including 3 LNG-powered vessels)

- $5 billion in capital expenditures (2023–2027)

- Focus on energy efficiency and guest experience

The new ships are expected to increase capacity by 12% and boost EBITDA by $300 million annually. For example, the Norwegian Aqua (launching 2025) will feature a first-of-its-kind “Ocean Boulevard” with outdoor dining and a virtual reality experience.

Digital Innovation and Customer Engagement

NCLH is investing in technology to enhance the guest experience:

- Mobile app with real-time navigation, booking, and concierge

- AI-powered chatbots for customer service

- Dynamic pricing algorithms to optimize revenue

In a 2023 survey, 89% of NCL passengers rated the app as “excellent” or “good,” helping to increase onboard spending by 15%. Digital tools also reduce labor costs and improve operational efficiency.

Long-Term Financial Targets

NCLH has set clear goals for 2025:

- Reduce net debt-to-EBITDA to <4.0x

- Achieve $2.5 billion in annual EBITDA

- Maintain 80%+ occupancy rates

- Reinstate dividends

If achieved, these targets could propel the stock to $25–$30. However, execution risk remains. Investors should watch quarterly earnings calls for updates on progress.

Conclusion: Is Norwegian Cruise Line Stock a Good Buy Today?

So, how much is Norwegian Cruise Line stock worth today? At $18.75, NCLH trades at a reasonable valuation with strong growth potential. The company is benefiting from robust travel demand, pricing power, and fleet modernization. Its diversified brand portfolio and digital initiatives position it well for long-term success. However, significant risks remain—high debt, macroeconomic sensitivity, and operational challenges.

For growth-oriented investors, NCLH offers compelling upside, especially if the company hits its 2025 targets. The stock could reach $25+ in a bull case scenario. For conservative investors, the high debt and volatility may be concerning. Waiting for a pullback to $16–$17 or a dividend reinstatement could be prudent.

Ultimately, the decision depends on your risk tolerance, investment horizon, and confidence in the cruise industry’s recovery. Always do your own research, monitor quarterly results, and consider consulting a financial advisor. With the right strategy, Norwegian Cruise Line stock could be a rewarding addition to your portfolio—just don’t expect smooth sailing in every market condition.

Frequently Asked Questions

What is the current price of Norwegian Cruise Line stock?

The current price of Norwegian Cruise Line stock (NCLH) fluctuates throughout the trading day based on market activity. For the most up-to-date stock price, check financial platforms like Yahoo Finance or Google Finance.

How much is Norwegian Cruise Line stock worth compared to its 52-week high and low?

Norwegian Cruise Line stock’s 52-week range typically reflects its volatility, with highs and lows influenced by travel demand and economic conditions. You can find the latest 52-week range on stock market websites or brokerage tools.

Is Norwegian Cruise Line stock a good investment right now?

Whether Norwegian Cruise Line stock is a good investment depends on your risk tolerance, market outlook, and analysis of the cruise industry’s recovery. Always research analyst ratings and financial health before investing.

Where can I buy Norwegian Cruise Line stock?

You can buy Norwegian Cruise Line stock (ticker: NCLH) through most online brokerage accounts, such as E*TRADE, Robinhood, or Fidelity. Ensure you compare fees and tools before choosing a platform.

What factors affect the price of Norwegian Cruise Line stock?

Norwegian Cruise Line stock price is influenced by factors like fuel costs, global travel demand, economic downturns, and company earnings reports. Industry trends and geopolitical events also play a role.

Does Norwegian Cruise Line stock pay dividends?

Norwegian Cruise Line has suspended its dividend during the COVID-19 pandemic and has not reinstated it as of now. Investors seeking income may consider other dividend-paying stocks in the travel sector.