Featured image for how much does the average cruise liner make

Image source: lihpao.com

The average cruise liner generates $250,000 to $500,000 in daily revenue, driven by ticket sales, onboard spending, and premium packages. With profit margins hovering around 15-20%, these floating resorts turn massive passenger volumes into multi-million-dollar annual profits for major operators.

Key Takeaways

- Revenue varies widely: Average cruise liners earn $500M–$2B annually, depending on size and routes.

- Passenger spend matters: Onboard purchases can boost revenue by 30% beyond base ticket sales.

- Profit margins are slim: Net profits typically range from 5% to 15% of total revenue.

- Seasonality impacts earnings: Peak seasons generate 40–60% of annual income—plan accordingly.

- Fuel costs eat profits: Rising fuel prices can slash margins by up to 10% without surcharges.

- Loyalty programs pay off: Repeat customers spend 25% more, driving long-term revenue growth.

📑 Table of Contents

- How Much Does the Average Cruise Liner Make? Let’s Break It Down

- Revenue Streams: Where the Money Comes From

- Operating Costs: The Hidden Side of the Ledger

- Profit Margins: How Much Is Left After the Bills?

- Factors That Influence Earnings: Beyond the Basics

- Real-World Examples: What the Numbers Look Like

- Data Table: Cruise Liner Financial Snapshot (Average Estimates)

- Final Thoughts: The Bottom Line on Cruise Liner Earnings

How Much Does the Average Cruise Liner Make? Let’s Break It Down

Ever stood on the deck of a massive cruise ship, watching the sunset over the ocean, and thought, “This must cost a fortune to run—how much does this thing actually make?” You’re not alone. Whether you’re a curious traveler, an aspiring entrepreneur in the hospitality industry, or just someone fascinated by big business, the financial side of cruise liners is surprisingly complex—and incredibly fascinating.

From luxury suites to all-you-can-eat buffets, cruise ships are floating cities with economies all their own. But behind the glitz and glamour lies a well-oiled machine driven by revenue, costs, and smart business strategies. In this post, we’re going to pull back the curtain and answer the burning question: How much does the average cruise liner make? We’ll explore revenue streams, operating costs, profit margins, and real-world examples—all while keeping it real, relatable, and easy to understand. So grab your imaginary boarding pass and let’s dive in.

Revenue Streams: Where the Money Comes From

You might think a cruise ship makes most of its money from ticket sales—and you’re partially right. But the truth is, the revenue pie is sliced into many pieces. Cruise liners are masters at monetizing every square foot, every onboard experience, and even the time passengers spend waiting in line.

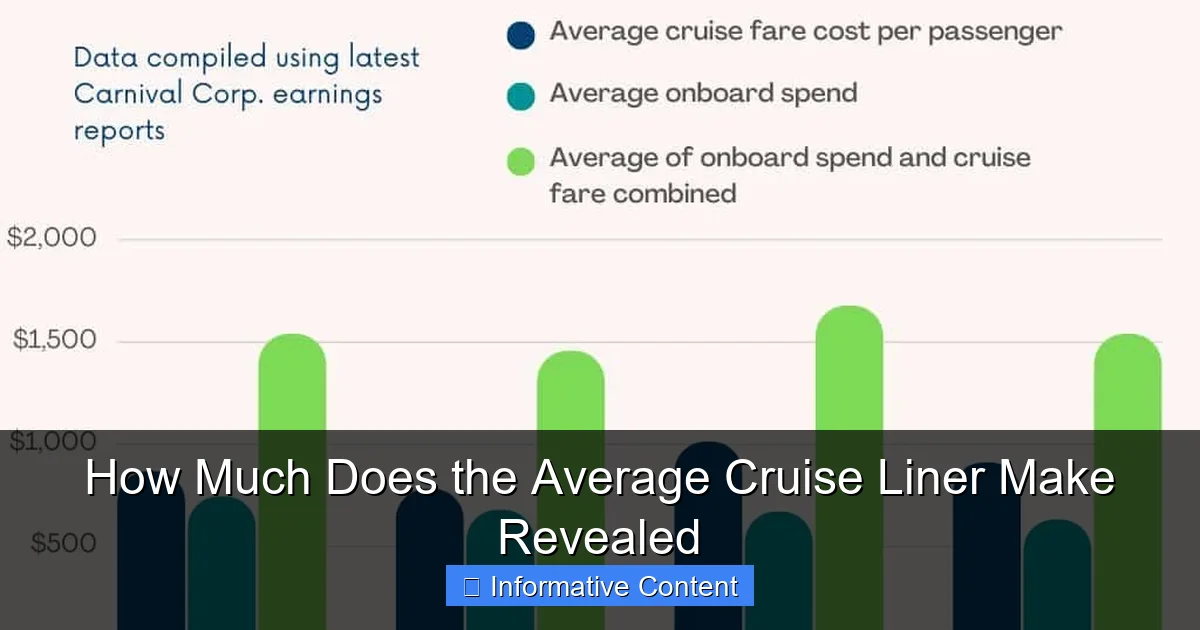

Visual guide about how much does the average cruise liner make

Image source: cruisefever.net

1. Passenger Ticket Sales (Fare Revenue)

This is the bread and butter. The average cruise liner earns a significant chunk—around 60–70%—from passenger fares. These aren’t just base prices; they include upgrades, cabin categories (inside, oceanview, balcony, suite), and early-bird or last-minute deals.

For example, a 7-day Caribbean cruise on a mid-sized ship with 2,500 passengers might charge an average of $1,200 per person. That’s $3 million in ticket revenue alone. But that’s not the full story.

- Balcony cabins can cost 50–100% more than inside cabins.

- Luxury suites on premium lines like Regent or Seabourn can go for $20,000+ per person for a week.

- Dynamic pricing means prices rise as cabins fill, boosting revenue.

2. Onboard Spending (Ancillary Revenue)

This is where cruise lines really shine. Once passengers are onboard, they’re a captive audience. And cruise companies know how to turn that into gold.

Onboard spending includes:

- Beverages (alcohol, specialty coffee, bottled water)

- Specialty dining (steakhouses, sushi bars, chef’s tables)

- Spa and salon services

- Casino gambling (a massive moneymaker)

- Retail shops (luxury watches, jewelry, souvenirs)

- Excursions (shore tours booked through the cruise line)

The average passenger spends $35–$50 per day on extras. Multiply that by 2,500 passengers over 7 days, and you’re looking at $612,500 to $875,000 in ancillary revenue. On a luxury ship, that number can double or triple.

3. Shore Excursions and Partnerships

While cruise lines offer their own excursions, they also partner with local tour operators. For every $100 excursion, the cruise line might take a 20–30% commission. It’s a win-win: passengers get curated experiences, and the ship gets a cut without running the tours.

Tip: If you’re budget-conscious, book excursions independently—but the cruise line makes more when you book through them. It’s one of their most profitable side hustles.

4. Other Revenue: Wi-Fi, Photography, and More

Don’t underestimate the small stuff. Wi-Fi packages can cost $15–$30 per day. Professional photos taken during the cruise? $20–$50 per print. Even the onboard art auctions generate income through commissions.

These “micro-revenues” add up fast. A single ship might earn $100,000+ per voyage just from these niche services.

Operating Costs: The Hidden Side of the Ledger

Now that we’ve covered how cruise ships make money, let’s talk about what it costs to keep them afloat—literally and financially. Running a cruise liner is like operating a small city on water, and the expenses are massive.

1. Fuel and Energy

This is the single biggest operating cost, often accounting for 20–30% of total expenses. Modern cruise ships are powered by heavy fuel oil (HFO) or marine gas oil (MGO), and fuel consumption is staggering.

An average cruise liner burns about 1,000 tons of fuel per day at sea. At $600 per ton, that’s $600,000 per day just to keep the engines running. Over a 7-day voyage, that’s $4.2 million in fuel alone.

Newer ships are investing in LNG (liquefied natural gas) and hybrid systems to reduce fuel costs and emissions—but the transition is expensive.

2. Crew Wages and Benefits

A typical cruise ship has 1,000–1,500 crew members. From captains and engineers to chefs, entertainers, and housekeeping staff, salaries vary widely.

- Entry-level positions: $1,000–$2,000/month

- Mid-level (supervisors, chefs): $3,000–$6,000/month

- Senior roles (captain, chief engineer): $10,000–$25,000/month

With 1,200 crew, average monthly payroll could be $2.5–$3.5 million. Add in housing, food, insurance, and benefits, and labor costs can eat up 25–30% of operating expenses.

3. Maintenance and Dry Docking

Like any vehicle, cruise ships need regular upkeep. Routine maintenance (cleaning, painting, engine checks) happens weekly or monthly. But every 2–3 years, ships undergo dry docking—a full inspection and repair in a shipyard.

Dry docking can cost $50–$100 million and last 3–6 weeks. During this time, the ship isn’t earning revenue, so timing is critical. Some lines stagger dry docks across their fleet to maintain income.

4. Food, Supplies, and Logistics

Feeding 3,000+ people daily is no small feat. A cruise ship might stock 20,000+ bottles of wine, 50,000+ meals, and tons of produce, meat, and dry goods for a single voyage.

Food costs can range from $300,000 to $1 million per voyage, depending on the ship size and cuisine quality. Luxury lines spend more per passenger, but they also charge more.

5. Port Fees and Taxes

Every time a ship docks, it pays port fees—for docking, waste disposal, water, and local taxes. These can range from $20,000 to $100,000 per port visit, depending on the location and passenger count.

In popular destinations like Cozumel or Nassau, fees are higher due to demand. Some ports even charge a “passenger head tax” of $5–$20 per person.

Profit Margins: How Much Is Left After the Bills?

Now comes the million-dollar question: How much profit does an average cruise liner actually make? The answer depends on the size, age, and brand of the ship, but we can break it down with real-world data.

Net Profit Per Voyage

Let’s take a hypothetical 7-day cruise on a mid-sized ship (2,500 passengers, 1,200 crew). Here’s a rough breakdown:

- Total Revenue: ~$5 million

- $3 million from tickets

- $800,000 from onboard spending

- $500,000 from excursions and commissions

- $200,000 from Wi-Fi, photos, etc.

- $500,000 from other sources (casino, retail)

- Total Operating Costs: ~$3.8 million

- $1.2 million fuel (7 days)

- $900,000 crew wages (7 days)

- $600,000 food and supplies

- $400,000 port fees (5 ports)

- $300,000 maintenance (daily upkeep)

- $400,000 other (insurance, marketing, etc.)

- Estimated Net Profit: ~$1.2 million per voyage

That’s a profit margin of about 24%—which is impressive for the hospitality industry. But remember, this is per voyage. A ship might do 50–70 voyages per year, depending on the season and route.

Annual Profit Per Ship

Multiply $1.2 million by 60 voyages, and you get $72 million in annual profit per ship. Of course, this varies:

- Budget lines (e.g., Carnival) might make $40–$50 million/year due to lower ticket prices but higher passenger volume.

- Luxury lines (e.g., Regent, Silversea) make less in absolute numbers (maybe $20–$30 million/year) but with higher margins per passenger.

- Premium lines (e.g., Royal Caribbean, Norwegian) often strike the best balance, earning $60–$80 million/year.

Industry-Wide Profitability

According to Carnival Corporation’s 2023 annual report, their average operating margin was 18.5%. Royal Caribbean reported a net margin of 22.3% in 2023. These numbers show that the industry is recovering strongly post-pandemic and is more profitable than many assume.

Factors That Influence Earnings: Beyond the Basics

Not all cruise ships are created equal. Several factors can make or break a ship’s financial performance—some under the company’s control, others not.

1. Ship Size and Age

Bigger isn’t always better. Larger ships (4,000+ passengers) have economies of scale—lower cost per passenger—but they also have higher fixed costs (fuel, crew, port fees). Older ships may have lower purchase costs but higher maintenance bills.

For example, Royal Caribbean’s Symphony of the Seas (228,000 tons, 5,500 passengers) earns more per voyage than a smaller ship, but it also costs more to build, fuel, and maintain. The sweet spot is often 2,000–3,500 passengers.

2. Itinerary and Seasonality

Location matters. A 7-day Alaska cruise in summer can command 50% higher prices than the same route in shoulder season. Similarly, Mediterranean cruises in July vs. November can have a 30–40% price difference.

Tip: Cruise lines use dynamic pricing algorithms to adjust fares based on demand, weather, and competition. They’re like airlines—but on water.

3. Brand and Target Market

Who are you selling to? A family-focused line like Disney Cruise Line can charge premium prices for themed experiences. A party-centric line like Norwegian’s “Freestyle Cruising” targets younger crowds with flexible dining and late-night entertainment.

Brand perception directly affects pricing power. A luxury line can charge $5,000/person for a week; a budget line might charge $800. But the luxury line has fewer passengers and higher costs per guest.

4. Economic and External Shocks

No one saw the pandemic coming, but it wiped out 2020–2021 revenues. Similarly, fuel price spikes (like in 2022) can slash profits. Geopolitical issues (e.g., Red Sea tensions) force rerouting, increasing fuel costs and reducing itinerary appeal.

The best cruise lines hedge against these risks with fuel contracts, insurance, and diversified itineraries.

5. Customer Retention and Loyalty Programs

It’s cheaper to keep a customer than to find a new one. Cruise lines invest heavily in loyalty programs (e.g., Carnival’s VIFP, Royal Caribbean’s Crown & Anchor). Repeat guests spend more onboard and book earlier, helping with revenue forecasting.

Data shows that loyal cruisers spend 20–30% more per voyage than first-timers. That’s a big deal when margins are tight.

Real-World Examples: What the Numbers Look Like

Let’s bring this to life with actual ships and companies. These examples show how different strategies play out in the real world.

Example 1: Carnival Cruise Line (Budget/Value)

- Ship: Carnival Breeze (130,000 tons, 3,690 passengers)

- Avg. Fare: $850 per person

- Onboard Spend: $40/person/day

- Voyage Length: 7 days

- Annual Voyages: 60

- Estimated Annual Profit: $45–$50 million

Carnival focuses on volume. Lower prices, higher passenger counts, and strong onboard revenue (especially drinks and excursions) keep margins healthy.

Example 2: Royal Caribbean (Premium/Innovative)

- Ship: Symphony of the Seas (228,000 tons, 5,518 passengers)

- Avg. Fare: $1,500 per person

- Onboard Spend: $45/person/day

- Special Features: Water slides, ice rink, robotic bar

- Annual Voyages: 55 (due to longer itineraries)

- Estimated Annual Profit: $75–$85 million

Royal Caribbean invests in “wow factor” experiences that justify higher prices and boost onboard spending. Their ships are floating resorts.

Example 3: Regent Seven Seas (Luxury/All-Inclusive)

- Ship: Seven Seas Explorer (56,000 tons, 750 passengers)

- Avg. Fare: $5,000 per person (all-inclusive: drinks, excursions, gratuities)

- Onboard Spend: $25/person/day (lower due to inclusions)

- Annual Voyages: 45 (longer, exotic itineraries)

- Estimated Annual Profit: $25–$30 million

Regent’s model is high price, low volume. Lower onboard spending, but higher margins per passenger. It’s a niche but profitable strategy.

Data Table: Cruise Liner Financial Snapshot (Average Estimates)

| Category | Budget Line (e.g., Carnival) | Premium Line (e.g., Royal Caribbean) | Luxury Line (e.g., Regent) |

|---|---|---|---|

| Avg. Ticket Price | $800–$1,000 | $1,200–$1,800 | $4,000–$6,000 |

| Passenger Count | 3,500–4,500 | 4,000–6,000 | 500–800 |

| Onboard Spend/Day | $35–$45 | $40–$55 | $20–$30 |

| Fuel Cost/Voyage | $1.0–$1.3M | $1.2–$1.8M | $0.6–$0.9M |

| Net Profit/Voyage | $800K–$1.0M | $1.1M–$1.5M | $400K–$600K |

| Annual Profit/Ship | $40–$50M | $60–$80M | $20–$30M |

| Profit Margin | 20–22% | 22–25% | 15–20% |

Final Thoughts: The Bottom Line on Cruise Liner Earnings

So, how much does the average cruise liner make? The short answer: a lot—but not without effort, strategy, and a few sleepless nights for the accountants. We’re talking tens of millions of dollars in annual profit per ship, driven by smart pricing, relentless cost control, and a knack for turning every onboard moment into a revenue opportunity.

But it’s not just about numbers. The cruise industry is a balancing act. Too much focus on profit, and you lose the magic that makes people return. Too little, and the ship might not survive the next economic downturn. The best lines—like Royal Caribbean, Carnival, and Regent—understand this. They invest in experiences, loyalty, and sustainability, knowing that long-term success comes from happy passengers, not just fat profit margins.

If you’re a traveler, this insight might change how you view your next cruise. Every drink, every excursion, every photo—it’s part of a bigger financial ecosystem. If you’re an entrepreneur, the cruise model offers lessons in scalability, customer experience, and ancillary revenue that apply to almost any industry.

And if you’re just curious? Well, now you know. The average cruise liner isn’t just floating on water—it’s floating on millions of dollars in revenue, clever cost management, and a whole lot of ambition. So the next time you’re sipping a cocktail on deck, raise a glass to the business behind the beauty. Because behind every sunset cruise is a very busy balance sheet.

Frequently Asked Questions

How much does the average cruise liner make annually?

The average cruise liner generates between $50 million to $200 million in annual revenue, depending on ship size, itinerary, and passenger capacity. Luxury and larger vessels tend to earn at the higher end of this range.

What factors influence how much a cruise liner earns?

Key factors include ticket pricing, onboard spending (e.g., dining, excursions), fuel costs, and seasonal demand. The average cruise liner’s profitability also hinges on occupancy rates and operational efficiency.

How much profit does the average cruise liner make after expenses?

After expenses like fuel, crew salaries, and maintenance, the average cruise liner’s net profit typically ranges from 10% to 20% of its revenue. This translates to $5 million to $40 million annually, depending on the ship’s scale.

Do cruise liners make more money than cargo ships?

Generally, yes—passenger revenue and onboard spending make the average cruise liner more profitable than cargo ships, which rely solely on freight fees. However, cargo ships often have lower operational costs and stable demand.

How much does the average cruise liner make per passenger?

The average cruise liner earns roughly $200 to $500 per passenger, per day, from tickets and onboard purchases. Longer voyages and premium cabins can push this figure even higher.

Has the average cruise liner’s earnings changed post-pandemic?

Yes, post-pandemic demand surges have boosted the average cruise liner’s earnings, with many companies reporting record bookings in 2023–2024. However, rising fuel and labor costs continue to impact net profits.