Featured image for how much does a cruise line make per cruise

Image source: shinecruise.com

Cruise lines generate millions per voyage, with net profits ranging from $500,000 to over $2 million per cruise, depending on ship size, itinerary, and occupancy. Fuel, labor, and port fees cut deep into revenue, yet premium pricing and onboard spending keep margins strong. The real windfall? Repeat passengers and high-margin extras like drink packages and excursions.

Key Takeaways

- Cruise lines earn $200–$500 per passenger on average, depending on cabin class and itinerary.

- Onboard spending boosts profits by up to 30% through dining, excursions, and retail.

- Premium and luxury lines yield higher margins due to exclusive services and pricing strategies.

- Fuel and labor are top cost drivers, impacting net earnings per cruise significantly.

- Full ships maximize revenue potential; even 10% vacancy slashes profitability sharply.

- Dynamic pricing optimizes income by adjusting fares based on demand and booking timing.

📑 Table of Contents

- The Hidden Economics of Cruising: How Much Does a Cruise Line Make Per Cruise?

- Revenue Streams: Where Cruise Lines Make Their Money

- Operational Costs: The Expenses Behind the Scenes

- Profit Margins: How Much Is Left After Expenses?

- The Role of Scale and Fleet Strategy

- External Factors: Market Conditions and Risks

- Conclusion: The Bottom Line on Cruise Profitability

The Hidden Economics of Cruising: How Much Does a Cruise Line Make Per Cruise?

Imagine boarding a floating city—a massive vessel with thousands of passengers, dozens of restaurants, entertainment venues, and even swimming pools—all sailing across the ocean. For travelers, a cruise is a dream vacation, a chance to explore new destinations without the hassle of constant packing and unpacking. But behind this seamless experience lies a complex financial ecosystem. Cruise lines are not just in the business of leisure; they are multinational corporations with intricate revenue streams, operational costs, and profit margins. Have you ever wondered how much a cruise line makes per cruise? The answer is far more nuanced than simply charging passengers for their cabins. From ticket sales to onboard spending, fuel costs to crew wages, the financials of a single cruise voyage involve a delicate balance of income and expenses.

Understanding the profitability of cruise lines is essential for investors, industry analysts, and even curious travelers. The cruise industry, valued at over $150 billion globally in 2023, has rebounded impressively after the pandemic-induced slump. With major players like Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings dominating the market, each cruise ship can generate millions of dollars in revenue. However, turning a profit is no small feat. High operational costs, fluctuating fuel prices, and the need for constant innovation mean that cruise lines must optimize every aspect of their business. In this comprehensive guide, we’ll dive deep into the financial mechanics of a cruise line’s earnings per voyage, exploring revenue sources, cost structures, and the factors that determine profitability. Whether you’re a business enthusiast or a future cruiser, this breakdown will reveal the true economics behind your next vacation at sea.

Revenue Streams: Where Cruise Lines Make Their Money

To answer how much a cruise line makes per cruise, we must first understand where the money comes from. Cruise revenue is not limited to ticket sales; it’s a multifaceted model that leverages both pre-cruise and onboard spending. The average cruise ship can carry between 2,000 and 6,000 passengers, and with fares ranging from $1,000 to $10,000+ per person, the base revenue is substantial. However, the real profit often comes from what happens after passengers board.

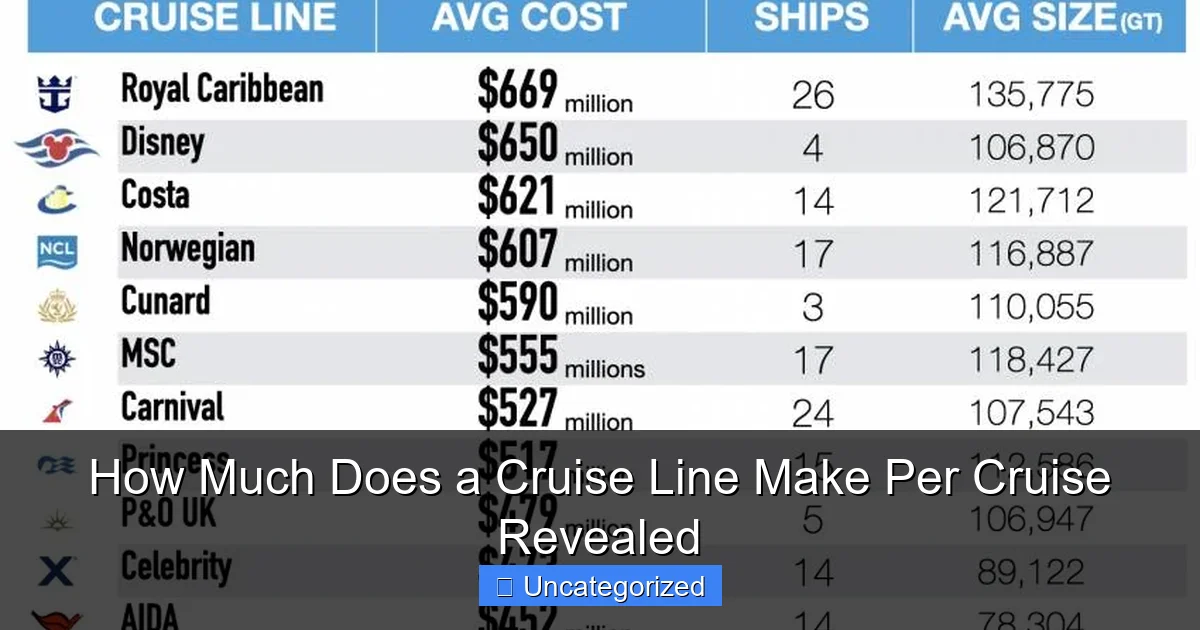

Visual guide about how much does a cruise line make per cruise

Image source: images.ctfassets.net

1. Ticket Sales (Fare Revenue)

The primary source of income is the cruise fare, which includes the cabin, meals, basic entertainment, and access to most public areas. Cruise lines use dynamic pricing models, adjusting fares based on demand, seasonality, and booking time. For example, a 7-day Caribbean cruise on Royal Caribbean’s Symphony of the Seas might sell for an average of $1,800 per passenger. With 5,500 passengers, the fare revenue alone could reach $9.9 million. However, not all of this is pure profit—discounts, promotions, and early-bird deals can reduce the effective price per passenger.

To maximize revenue, cruise lines segment their market. Suite guests pay more for exclusive perks, while budget-conscious travelers opt for interior cabins. Some lines, like Norwegian, offer “Free at Sea” promotions (free drink packages, shore excursions, or Wi-Fi), which attract bookings but reduce per-passenger revenue. The key is balancing volume and price to fill the ship while maintaining profitability.

2. Onboard Spending (Ancillary Revenue)

Ancillary revenue—spending beyond the base fare—is where cruise lines shine. Passengers are encouraged to spend on:

- Alcohol and specialty dining: Premium bars, wine tastings, and specialty restaurants (e.g., steakhouse, sushi bar) can add $100–$300 per passenger.

- Spa and fitness: Massages, facials, and personal training sessions are high-margin services.

- Casino and gaming: Onboard casinos generate significant revenue, especially on longer voyages.

- Retail and duty-free shopping: Branded shops sell luxury goods, jewelry, and souvenirs at premium prices.

- Wi-Fi and internet packages: Essential for modern travelers, with daily rates from $15 to $30.

Industry data shows that ancillary spending can add $300–$600 per passenger, turning a $1,800 fare into a $2,100–$2,400 total revenue stream. For a 5,500-passenger ship, this means an additional $1.65 million to $3.3 million per cruise.

3. Shore Excursions and Tours

Cruise lines partner with local tour operators to offer curated excursions. While they take a commission (typically 30–50%), these tours are a high-margin product. A $150 snorkeling trip might cost the cruise line only $75, with the rest going to the operator and the cruise line’s profit. With thousands of passengers booking tours, this can generate hundreds of thousands of dollars per cruise.

Operational Costs: The Expenses Behind the Scenes

While revenue is impressive, the costs of running a cruise ship are equally staggering. To understand how much a cruise line makes per cruise, we must subtract expenses from revenue. Cruise ships are among the most expensive assets to operate, with fixed and variable costs that impact profitability.

1. Fuel (Bunker) Costs

Fuel is the single largest operational expense, accounting for 15–25% of total costs. A large cruise ship can consume 250–300 tons of fuel per day, costing $150,000–$200,000 daily. For a 7-day cruise, fuel alone can cost $1.05 million to $1.4 million. Prices fluctuate with global oil markets, and some lines hedge fuel costs to mitigate risk. Newer ships with LNG (liquefied natural gas) or hybrid engines are more fuel-efficient, reducing this burden.

2. Crew Wages and Benefits

With 1,000–1,500 crew members per ship, labor costs are significant. Salaries vary by role and nationality (many crew come from developing countries), but average wages range from $1,500 to $5,000 per month. Including benefits, training, and repatriation, the total crew cost for a 7-day cruise can reach $2 million to $3 million.

3. Port Fees and Taxes

Each port charges docking, pilotage, and passenger fees. For a 7-day Caribbean cruise with 5 stops, these fees can total $500,000 to $1 million. Some destinations, like the Bahamas and Bermuda, charge higher fees to capitalize on tourism revenue.

4. Maintenance and Repairs

Ships require regular maintenance, including dry-docking every 3–5 years. Routine upkeep (cleaning, painting, mechanical checks) costs $200,000–$500,000 per cruise. Major repairs or engine overhauls can push this higher. Newer ships have lower maintenance costs due to advanced technology.

5. Food, Beverages, and Supplies

Feeding 7,000 people (passengers + crew) for a week requires massive logistics. The cost of food and beverages is $50–$100 per passenger per day, totaling $2.5 million to $5 million per cruise. Specialty dining ingredients (lobster, caviar) and premium alcohol increase this cost.

Profit Margins: How Much Is Left After Expenses?

Now that we’ve covered revenue and costs, let’s calculate the net profit per cruise. Using a hypothetical 7-day Caribbean voyage with 5,500 passengers, here’s a simplified breakdown:

| Revenue/Cost Category | Amount (USD) | Notes |

|---|---|---|

| Fare Revenue | $9,900,000 | $1,800 avg. fare × 5,500 passengers |

| Ancillary Revenue | $2,750,000 | $500 avg. per passenger × 5,500 |

| Shore Excursions | $550,000 | Commission on $1.1M in tours |

| Total Revenue | $13,200,000 | |

| Fuel Costs | ($1,225,000) | $175,000/day × 7 days |

| Crew Wages | ($2,500,000) | 1,200 crew × avg. $2,083 |

| Port Fees | ($750,000) | 5 ports × $150,000 avg. |

| Food & Beverages | ($3,850,000) | $70/person/day × 5,500 × 7 |

| Maintenance | ($350,000) | Routine upkeep |

| Marketing & Admin | ($1,000,000) | Advertising, sales, corporate overhead |

| Total Costs | ($9,675,000) | |

| Net Profit | $3,525,000 | 26.7% margin |

This example shows a healthy profit margin of 26.7%, but real-world margins vary. Luxury lines (e.g., Regent, Silversea) have higher fares and lower capacity, leading to margins of 30–40%. Budget lines (e.g., Carnival, Costa) rely on volume, with margins closer to 15–20%. During peak seasons (summer, holidays), margins can exceed 35%, while off-season cruises may barely break even.

Factors Affecting Profitability

Several variables impact net profit:

- Occupancy rate: A 90% occupancy rate reduces revenue by $1.3 million compared to 100%.

- Fuel price volatility: A 10% increase in fuel costs can erase $120,000 in profit.

- Onboard spending: A 10% increase in ancillary revenue adds $275,000.

- Currency exchange rates: International bookings are affected by USD fluctuations.

The Role of Scale and Fleet Strategy

How much a cruise line makes per cruise is also influenced by its fleet size and strategy. Larger corporations like Carnival and Royal Caribbean operate 100+ ships, allowing them to spread fixed costs (marketing, corporate salaries, IT systems) across more voyages. This economies of scale reduces per-cruise expenses and boosts profitability.

1. Fleet Modernization

Newer ships are more efficient, with:

- Lower fuel consumption: LNG-powered ships cut fuel costs by 20–30%.

- Higher capacity: Icon-class ships (e.g., Royal Caribbean’s Icon of the Seas) carry 7,000+ passengers.

- Advanced revenue systems: AI-driven pricing and onboard spending analytics.

For example, Royal Caribbean’s Icon of the Seas (launching 2024) will cost $2 billion to build but could generate $200 million in annual revenue, with a 30%+ margin.

2. Brand Segmentation

Major corporations operate multiple brands targeting different markets:

- Carnival Cruise Line: Budget-friendly, family-oriented.

- Princess Cruises: Mid-range, destination-focused.

- Holland America Line: Premium, traditional cruising.

This diversification spreads risk and captures more market segments. A luxury cruise on Seabourn might generate $10,000 per passenger, while a Carnival cruise targets $1,200—but both contribute to the parent company’s bottom line.

3. Revenue Management Systems

Modern cruise lines use sophisticated algorithms to optimize pricing and inventory. These systems analyze:

- Booking trends

- Competitor pricing

- Weather and geopolitical risks

For instance, if a hurricane threatens a route, the system may reroute the ship or offer last-minute discounts to fill cabins, minimizing revenue loss.

External Factors: Market Conditions and Risks

Even the best-managed cruise line is vulnerable to external forces. Understanding these risks is key to answering how much a cruise line makes per cruise in the real world.

1. Economic Cycles

During recessions, discretionary spending (like cruising) declines. In 2020, the pandemic caused a $15 billion loss for the industry. Recovery took 2–3 years, with lines offering deep discounts to attract bookings. However, post-pandemic demand surged, leading to record bookings and higher fares in 2023.

2. Geopolitical Risks

War, terrorism, or political instability can disrupt itineraries. For example, the Russia-Ukraine conflict forced cruise lines to cancel Black Sea voyages, losing millions in revenue. Lines now use real-time monitoring to adjust routes and protect profits.

3. Environmental Regulations

New IMO (International Maritime Organization) rules require ships to reduce carbon emissions. Compliance costs (e.g., scrubbers, LNG retrofits) can add $500,000–$2 million per ship. However, eco-friendly ships attract environmentally conscious travelers, boosting brand value.

4. Competition and Innovation

The rise of river cruises, private yacht charters, and adventure tourism has intensified competition. To stay ahead, cruise lines invest in:

- New ship designs (e.g., Royal Caribbean’s “Perfect Day at CocoCay” private island)

- Technology (virtual reality, app-based services)

- Unique experiences (space cruises, submersibles)

These innovations increase revenue potential but also raise development costs.

Conclusion: The Bottom Line on Cruise Profitability

So, how much does a cruise line make per cruise? The answer depends on the ship, itinerary, market conditions, and management strategy. On average, a 7-day cruise on a mid-sized ship can generate $10–$15 million in revenue, with net profits of $2–$4 million—a margin of 20–30%. Luxury lines may see higher per-passenger profits, while budget lines rely on volume. However, this is not a static figure. Fuel prices, occupancy rates, and onboard spending can swing profits by millions.

For cruise lines, profitability is a balancing act. They must fill ships, maximize ancillary revenue, control costs, and adapt to external risks. For travelers, understanding this economics can inform smarter booking choices—such as sailing during shoulder seasons (lower fares, higher onboard spending) or choosing ships with strong revenue-generating amenities (e.g., casinos, spas).

The cruise industry’s resilience and adaptability ensure its continued growth. As ships get larger, smarter, and more luxurious, the potential for profit grows—but so do the challenges. Whether you’re an investor, analyst, or vacationer, one thing is clear: behind every smooth sailing experience is a complex, high-stakes business model. The next time you step onto a cruise ship, remember—you’re not just on a vacation, you’re part of a multi-million-dollar financial ecosystem.

Frequently Asked Questions

How much does a cruise line make per cruise on average?

Cruise lines typically generate between $500,000 to over $2 million per cruise, depending on ship size, itinerary, and passenger capacity. Revenue comes from ticket sales, onboard spending, and add-on services like excursions and premium dining.

What factors influence how much a cruise line earns per voyage?

Key factors include ticket pricing, ship occupancy rates, onboard spending per passenger, and fuel/operational costs. Longer, luxury-focused itineraries often yield higher profits due to premium pricing and exclusive offerings.

How does onboard spending affect a cruise line’s per-cruise profits?

Onboard spending (e.g., drinks, spas, casinos) can contribute 20–35% of a cruise line’s total revenue per cruise. For a 3,000-passenger ship, this could mean an extra $1–3 million in profit, depending on passenger demographics and spending habits.

Do bigger cruise ships make more money per cruise?

Yes, larger ships generally earn more per cruise due to higher passenger capacity (up to 7,000 guests) and diverse revenue streams like specialty restaurants and entertainment venues. However, operating costs also scale with size, impacting net profits.

How much does a cruise line make per passenger?

Cruise lines earn roughly $150–$500 per passenger from tickets, plus $50–$200 from onboard spending. Luxury lines may see higher averages, while budget-focused voyages rely more on volume.

Are cruise lines profitable per cruise, or do they lose money?

Most major cruise lines operate at a profit per cruise, with net margins of 10–20% for well-managed voyages. Losses are rare and usually tied to external factors like fuel price spikes or low demand.