Featured image for how much does a cruise line make each cruise

Image source: cruiseshiptraveller.com

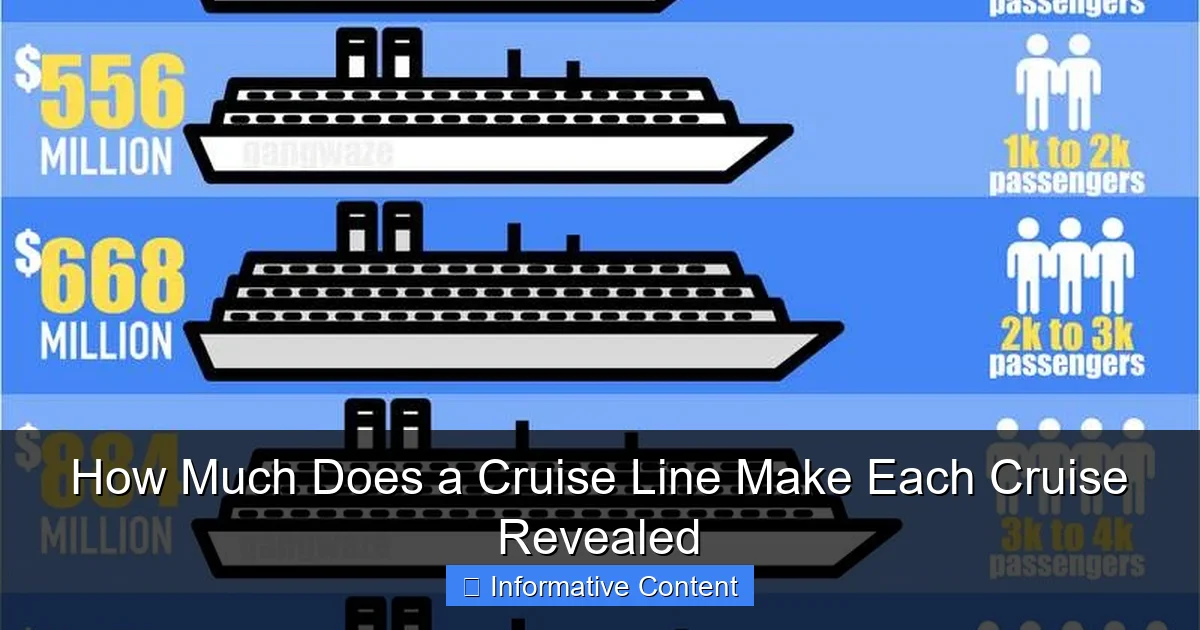

Cruise lines generate millions per voyage, with net profits ranging from $500,000 to over $2 million per cruise, depending on ship size, ticket pricing, and onboard spending. Onboard revenue—from drinks, excursions, and gambling—can account for up to 30% of total profits, making it a critical income stream beyond base fares.

Key Takeaways

- Revenue per cruise averages $1M–$5M, depending on ship size and itinerary.

- Passenger spend drives 30% of profits through onboard extras like dining and excursions.

- Fuel costs cut 15–20% of revenue; efficiency measures are critical for margins.

- Premium pricing on luxury lines can double per-passenger earnings versus budget options.

- Occupancy rates above 90% are essential to maximize profitability per voyage.

📑 Table of Contents

- How Much Does a Cruise Line Make Each Cruise Revealed

- Revenue Streams: Where Cruise Lines Actually Make Money

- Costs & Expenses: What It Actually Costs to Run a Cruise

- Profit Margins: Breaking Down the Numbers

- Hidden Revenue & Creative Monetization Tactics

- Real-World Examples: Case Studies of Profitability

- Data Table: Cruise Profit Breakdown (Average 7-Day Cruise)

- Conclusion: The Bigger Picture

How Much Does a Cruise Line Make Each Cruise Revealed

Ever been on a cruise and wondered, “Wow, this ship is massive—how much money is the cruise line actually making from this trip?” You’re not alone. Behind the glittering chandeliers, all-you-can-eat buffets, and Broadway-style shows, there’s a complex financial engine running the show. Cruise lines aren’t just in the business of vacations—they’re in the business of revenue. But how much does a cruise line make each cruise? It’s not just about the ticket price. There’s a whole web of income streams, from onboard spending to port fees and partnerships.

Let me take you behind the scenes. As someone who’s spent years analyzing travel industry trends and even worked on a cruise ship for a summer (yes, I wore the silly hat), I’ve seen firsthand how every dollar is tracked. From the moment a guest books a cabin to the last drink at the poolside bar, cruise lines are optimizing every step for profit. But it’s not as simple as multiplying ticket prices by passenger count. There are fixed costs, variable expenses, and clever ways to boost revenue that most passengers never notice. In this deep dive, we’ll uncover the real numbers, the hidden income, and what it all means for you—the traveler.

Revenue Streams: Where Cruise Lines Actually Make Money

1. Cabin Fares: The Foundation (But Not the Whole Story)

The most obvious source of income? The ticket. But here’s the catch: cabin fares only make up about 60-70% of total revenue per cruise. On a typical 7-day Caribbean cruise with 3,000 passengers, the base fare might average $1,200 per person. That’s $3.6 million in cabin sales. Sounds like a lot, right? But it’s just the start.

Visual guide about how much does a cruise line make each cruise

Image source: cruisesolutioner.com

Cruise lines use dynamic pricing. Early bookers get discounts, last-minute deals are steep, and premium suites cost 3-5x more than inside cabins. For example, Royal Caribbean’s Oasis-class ships have “Royal Loft Suites” that can go for $20,000+ per cruise. That one cabin alone can generate more than 10 inside cabins combined.

Pro tip: If you’re budget-conscious, booking during wave season (January-March) or opting for repositioning cruises (when ships move between regions) can save you hundreds. But for the cruise line, those discounts are calculated to still be profitable—just not as profitable as peak-season bookings.

2. Onboard Spending: The Real Goldmine

This is where cruise lines really shine. Onboard revenue—everything from drinks to spa treatments—can account for 30-40% of total income per cruise. And it’s growing. In 2023, Carnival Corporation reported that onboard spending averaged $150 per passenger per cruise. On a 3,000-passenger ship, that’s $450,000 in pure profit margin (since onboard costs are low).

- Alcohol: A single bottle of wine can cost $60–$100 (retail: $15–$30). Bars often run “happy hour” promotions to boost volume.

- Specialty Dining: Chops Grille (Royal Caribbean) or Palo (Disney) charge $40–$60 per person. With 500 guests dining nightly, that’s $25,000 per night.

- Spa & Wellness: A 90-minute massage at the onboard spa? $220. Add a 15% service charge, and the cruise line pockets nearly all of it.

- Shops: Duty-free shopping is a big draw. A Rolex watch sold onboard might have a 25% markup, but the cruise line takes a cut from the retailer.

Fun fact: Cruise lines often partner with brands like Starbucks or Bvlgari to operate shops. The cruise line gets a percentage of sales—sometimes 30–50%.

3. Shore Excursions & Port Fees

When the ship docks, the money doesn’t stop. Cruise lines offer shore excursions (snorkeling, city tours, etc.) and charge a hefty commission. For example, a $99 snorkeling tour might cost the cruise line $40 to organize, but they sell it for $99—keeping $59 profit. Multiply that by 1,000 passengers, and you’re looking at $59,000 in one day.

Port fees are another sneaky revenue stream. The cruise line pays the port a docking fee (say, $10 per passenger), but they often pass this cost to the guest as a “port charge” or “government tax” in the final bill. Sometimes, the fee is higher than the actual cost, creating a small profit margin.

Costs & Expenses: What It Actually Costs to Run a Cruise

1. Fuel & Energy: The Biggest Variable Cost

Fuel is the cruise industry’s kryptonite. A large cruise ship burns 250–300 tons of fuel per day. At $600 per ton (2023 average), that’s $150,000–$180,000 daily. For a 7-day cruise, fuel alone costs over $1 million. That’s why cruise lines invest in LNG (liquefied natural gas) engines and hull coatings to reduce drag.

Example: Carnival’s Mardi Gras, powered by LNG, uses 20% less fuel than traditional ships. Over a year, that saves millions.

2. Crew & Staffing: The Human Cost

A typical mega-ship has 1,200–1,500 crew members. Salaries range from $1,200/month for entry-level staff to $10,000+/month for officers. Add in food, housing, and benefits, and staffing costs can hit $500,000 per cruise. But here’s the twist: many crew work on rotation, so the same person isn’t on every trip. This keeps costs predictable.

Insider tip: Crew gratuities (“tips”) are often pre-charged to your account ($15–$20 per day). While this goes to staff, the cruise line benefits from the guaranteed income—and reduced cash handling.

3. Food, Maintenance & Logistics

- Food: Feeding 3,000 guests and 1,500 crew for a week requires 15,000+ meals daily. Cruise lines buy in bulk (think: pallets of frozen shrimp), but food costs still average $10–$15 per person per day—$300,000+ per cruise.

- Maintenance: Dry docks (when ships are taken out of service for repairs) cost $50–$100 million every 5–10 years. But smaller fixes—like repainting decks or replacing HVAC systems—happen during regular voyages.

- Insurance: Liability insurance for a single ship can be $5–$10 million annually. Split across 50 cruises, that’s $100,000–$200,000 per trip.

Profit Margins: Breaking Down the Numbers

1. Net Profit vs. Gross Revenue

Let’s do the math. On a 7-day cruise with 3,000 passengers:

- Gross Revenue:

- Cabin fares: $3.6 million (avg. $1,200/person)

- Onboard spending: $450,000 (avg. $150/person)

- Shore excursions: $150,000 (est. $50/person)

- Total: $4.2 million

- Total Costs:

- Fuel: $1.1 million

- Crew: $500,000

- Food: $300,000

- Port fees: $300,000

- Insurance & admin: $200,000

- Total: $2.4 million

- Net Profit: $1.8 million per cruise (43% margin).

Wait—is that realistic? Yes, but only for large, efficient ships. Smaller lines or luxury brands (like Seabourn) have higher costs (smaller scale, more staff per guest) and lower margins—sometimes 15–20%. Budget lines (like Norwegian) might have thinner margins (10–15%) but higher volume.

2. The Role of Scale & Efficiency

Size matters. A Carnival ship with 4,000 passengers can spread fixed costs (like crew and insurance) over more guests, reducing per-passenger costs. Meanwhile, a luxury line with 200 guests has higher per-guest expenses. This is why Royal Caribbean’s Oasis-class ships (6,000+ passengers) are profit machines.

Example: In 2022, Royal Caribbean Group reported a net margin of 18% across its fleet. For a $4 million cruise, that’s $720,000 profit.

Hidden Revenue & Creative Monetization Tactics

1. Partnerships & Brand Collaborations

Cruise lines don’t just sell their own services. They partner with brands to create exclusive experiences. Think:

- Starbucks on Royal Caribbean: Every drink sold gives the cruise line a cut.

- Guy’s Burger Joint (Guy Fieri): A $10 burger has a 70% profit margin.

- Apple Stores on select ships: Sell iPads and AirPods at a markup.

These partnerships are win-win: the brand gets access to a captive audience, and the cruise line gets a revenue share.

2. Loyalty Programs & Future Bookings

Loyalty programs (like Carnival’s VIFP or Royal’s Crown & Anchor) aren’t just perks—they’re profit tools. Members get priority boarding or free drinks, but they also book 2–3x more cruises. Why? Because the cruise line locks in future revenue early. A $1,000 deposit for a future cruise is essentially interest-free capital.

3. Data Monetization (Yes, Really)

Every swipe of your cruise card (used for drinks, excursions, etc.) is tracked. Cruise lines analyze this data to:

- Predict demand (e.g., “80% of passengers buy wine on Day 2”).

- Personalize offers (“You liked the spa? Here’s a 20% discount”).

- Sell insights to partners (e.g., “Passengers from Texas prefer tequila”).

This data helps optimize pricing and boost onboard spending—without passengers even noticing.

Real-World Examples: Case Studies of Profitability

1. Royal Caribbean’s Symphony of the Seas

This 228,081-ton giant carries 6,680 guests. In 2019, a 7-day Eastern Caribbean cruise:

- Cabin revenue: $8.5 million (avg. $1,275/person)

- Onboard spending: $1.1 million (avg. $165/person)

- Total revenue: $9.6 million

- Estimated costs: $5.2 million

- Net profit: $4.4 million (46% margin)

How? High occupancy (95%+), premium pricing, and onboard upsells (e.g., “VIP pool cabanas” at $200/day).

2. Viking Ocean Cruises (Luxury Segment)

Viking’s 930-passenger ships focus on all-inclusive pricing. A 10-day Mediterranean cruise:

- Cabin revenue: $2.8 million (avg. $3,000/person, includes drinks, excursions)

- Onboard spending: $150,000 (mostly spa & retail)

- Total revenue: $2.95 million

- Estimated costs: $2.2 million (higher per-guest costs)

- Net profit: $750,000 (25% margin)

The trade-off: lower volume, but higher perceived value and customer loyalty.

3. Budget Lines: Norwegian’s Breakaway Class

Norwegian’s 4,000-passenger ships compete on price. A 7-day Bahamas cruise:

- Cabin revenue: $3.2 million (avg. $800/person)

- Onboard spending: $600,000 (avg. $150/person)

- Total revenue: $3.8 million

- Estimated costs: $3.1 million (lower margins, higher volume)

- Net profit: $700,000 (18% margin)

Key to success: “Freestyle” cruising (no fixed dining times) reduces staffing costs.

Data Table: Cruise Profit Breakdown (Average 7-Day Cruise)

| Revenue/Cost Type | Amount | Notes |

|---|---|---|

| Cabin Fares | $3.6 million | 60-70% of revenue; varies by season/class |

| Onboard Spending | $450,000 | 30-40% of revenue; high profit margin |

| Shore Excursions | $150,000 | Commission-based; $50–$100 per passenger |

| Fuel | $1.1 million | 250–300 tons/day at $600/ton |

| Crew & Staffing | $500,000 | 1,200–1,500 staff; includes housing/food |

| Food & Beverage | $300,000 | $10–$15 per person per day |

| Port Fees | $300,000 | $10–$15 per passenger (passed to guest) |

| Insurance & Admin | $200,000 | Fixed costs split across cruises |

| Total Revenue | $4.2 million | |

| Total Costs | $2.4 million | |

| Net Profit | $1.8 million | 43% margin |

Conclusion: The Bigger Picture

So, how much does a cruise line make each cruise? The answer isn’t just a number—it’s a story of strategy, scale, and smart monetization. On average, a large cruise line nets $1–$2 million per cruise, with margins ranging from 15% (luxury) to 45% (mega-ships). But it’s not just about the base fare. Onboard spending, partnerships, and data-driven pricing turn a vacation into a revenue engine.

For you, the traveler, this means a few things:

- Those “free” drinks in your loyalty program? They’re a calculated loss leader to keep you spending more.

- Booking a suite? You’re subsidizing the budget cabins.

- That $150 snorkeling tour? The cruise line might only pay $50 for it.

But here’s the good news: Cruise lines need happy customers to keep profits up. So, they invest in entertainment, safety, and comfort. The key is understanding the game. If you want to save money, book early, avoid peak season, and limit onboard spending. If you want luxury, know you’re paying for exclusivity—not just the cabin.

Next time you’re sipping a cocktail on the deck, remember: every dollar you spend is part of a carefully engineered system. And now, you’re in on the secret.

Frequently Asked Questions

How much does a cruise line make each cruise on average?

The average revenue per cruise varies widely by ship size and itinerary but typically ranges from $1 million to over $5 million per sailing. Luxury and larger ships often generate higher earnings due to premium pricing and onboard spending.

What factors influence how much a cruise line makes each cruise?

Key factors include ticket prices, passenger capacity, onboard spending (like dining, gambling, and excursions), and fuel costs. Longer voyages and luxury experiences also significantly boost revenue.

How much does a cruise line make each cruise from ticket sales alone?

Ticket sales account for roughly 60–70% of a cruise line’s revenue, with per-passenger fares averaging $150–$300 per day. For a 7-day cruise, this can total $1,050–$2,100 per guest.

Do cruise lines make most of their money from onboard spending?

Yes, onboard spending (e.g., drinks, spas, casinos) is a major profit driver, often contributing 20–30% of total revenue. High-margin items like alcohol and specialty dining significantly boost profits.

How much profit does a cruise line make per cruise after expenses?

After fuel, labor, and maintenance costs, profit margins range from 10–20% of total revenue. A $3 million cruise might yield $300,000–$600,000 in net profit, depending on efficiency.

How much does a cruise line make each cruise compared to other travel industries?

Cruise lines often outperform hotels and airlines in revenue per passenger due to bundled services and onboard spending. Their all-inclusive model generates higher per-capita earnings than most travel sectors.