Featured image for how much are carnival cruise line stocks

Image source: media.zenfs.com

Carnival Cruise Line (CCL) stock is currently valued at approximately $18.50 per share, reflecting a volatile recovery shaped by post-pandemic travel demand and macroeconomic pressures. Investors should monitor key indicators like booking trends, debt levels, and fuel costs, as these heavily influence short-term price swings and long-term growth potential. With cruising demand rebounding, CCL presents a high-risk, high-reward opportunity in the travel sector.

Key Takeaways

- Check real-time prices: Use financial platforms for Carnival’s latest stock value.

- Monitor industry trends: Travel demand directly impacts Carnival’s stock performance.

- Review earnings reports: Quarterly results reveal financial health and growth potential.

- Assess debt levels: High leverage may affect long-term stock stability.

- Diversify investments: Balance cruise stocks with other sectors to mitigate risk.

- Watch fuel costs: Rising prices can squeeze Carnival’s profit margins.

📑 Table of Contents

- How Much Are Carnival Cruise Line Stocks Worth Today?

- Understanding Carnival Cruise Line: The Basics

- Current Stock Price and Market Performance (2024)

- Historical Stock Performance: A Rollercoaster Ride

- Factors That Influence Carnival’s Stock Price

- Is Carnival Stock a Good Investment Right Now?

- Data Snapshot: Carnival Stock at a Glance

- Final Thoughts: Should You Buy Carnival Stock?

How Much Are Carnival Cruise Line Stocks Worth Today?

Imagine you’re sipping a piña colada on the deck of a massive cruise ship, the sun setting over the ocean, and the sound of laughter filling the air. It’s easy to picture the magic of a Carnival Cruise Line vacation. But have you ever wondered what it’s like to own a piece of that magic—literally? That’s where Carnival Cruise Line stocks come in. Whether you’re a seasoned investor or just curious about how the cruise industry performs on Wall Street, this guide will break down everything you need to know about the current value of Carnival stocks, their history, and what the future might hold.

Stocks can be confusing, especially when they represent something as fun and tangible as a cruise line. But here’s the truth: investing in Carnival isn’t just about buying shares—it’s about understanding a company that’s weathered storms (literally and financially), adapted to global crises, and continues to sail forward. In this post, we’ll dive into the nitty-gritty of Carnival’s stock price today, explore what drives its value, and give you practical tips for making informed decisions. Think of this as your friendly, no-BS guide to answering the big question: How much are Carnival Cruise Line stocks worth today?

Understanding Carnival Cruise Line: The Basics

Who Is Carnival Corporation & PLC?

Carnival Cruise Line isn’t just a single company—it’s part of a much bigger family. Officially known as Carnival Corporation & PLC, it’s a dual-listed company, meaning it trades on both the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE). Founded in 1972, Carnival is the world’s largest cruise company, operating 10 major brands, including Carnival Cruise Line, Princess Cruises, Holland America Line, and Costa Cruises.

Visual guide about how much are carnival cruise line stocks

Image source: media.ycharts.com

Think of it like a cruise conglomerate. While the Carnival Cruise Line brand is what most people associate with fun, affordable vacations, the parent company’s portfolio is vast. This diversification is a key reason why investors look at Carnival Corp. (ticker: CCL) as more than just a single cruise operator.

How Stocks Work: A Quick Refresher

If you’re new to investing, here’s the simplest way to think about stocks: they’re tiny ownership shares in a company. When you buy a share of CCL, you own a fraction of Carnival Corporation. The value of that share—what we call the stock price—goes up and down based on supply and demand, company performance, and broader market trends.

For example, if Carnival reports strong quarterly earnings, more people might want to buy CCL, pushing the price up. If there’s bad news—like a hurricane disrupting sailings or a global health crisis—the price might drop. It’s like a seesaw: investor confidence on one side, real-world events on the other.

Why Carnival’s Stock Is Unique

Unlike tech stocks (hello, Apple or Tesla), Carnival’s value is heavily tied to consumer behavior and global travel trends. People don’t buy cruises like they buy iPhones—they plan vacations months in advance. This makes Carnival’s stock sensitive to things like:

- Economic conditions: When times are tough, families might skip a cruise.

- Weather and disasters: Hurricanes, pandemics, or geopolitical tensions can cancel sailings.

- Fuel prices: Cruise ships guzzle fuel, so high oil prices hurt profits.

But here’s the upside: when the economy is strong and people are eager to travel, Carnival can thrive. It’s a cyclical business—meaning it goes through ups and downs—but that also means there are opportunities for smart investors.

Current Stock Price and Market Performance (2024)

What’s the Price Today?

As of mid-2024, the price of Carnival Corporation stock (CCL) is hovering around $15–$18 per share. This might seem low compared to giants like Amazon or Nvidia, but it’s important to remember that stock price alone doesn’t tell the whole story. What matters more is the company’s value (called its market cap) and performance trends.

For context, here’s how CCL has performed recently:

- 52-week range: $12.50 (low) to $21.00 (high)

- Market capitalization: ~$25 billion

- Year-to-date return: +25% (as of June 2024)

The stock has been on a recovery path since the pandemic, but it’s still well below its pre-2020 highs (which peaked near $55 in 2018). This tells us two things: Carnival is bouncing back, but it’s not yet back to “normal.”

What’s Driving the Current Price?

Several factors are influencing CCL’s stock value today:

- Strong booking trends: In early 2024, Carnival reported record bookings for 2025 and 2026, signaling pent-up demand.

- Cost-cutting measures: The company has streamlined operations and reduced debt, which investors love.

- Fuel efficiency upgrades: Newer ships use less fuel, lowering operating costs.

- Global economic recovery: As inflation stabilizes and wages rise, more people can afford cruises.

But it’s not all smooth sailing. Challenges include:

- High debt load: Carnival took on billions in debt during the pandemic, and interest payments are a concern.

- Geopolitical risks: Tensions in the Middle East and Europe could disrupt itineraries.

- Seasonality: Cruise demand peaks in summer and winter holidays, so quarterly results can be uneven.

How to Check the Real-Time Price

If you want to see the exact price right now, here’s how:

- Open a free brokerage account (like Robinhood, E*TRADE, or Fidelity).

- Search for “CCL” or “Carnival Corporation.”

- Look at the “Last Sale Price” or “Current Price.”

- Check the “52-Week Range” to see how it compares to past highs and lows.

Pro tip: Set up price alerts! Many platforms let you get an email or notification if CCL hits a certain price (e.g., “Notify me if CCL drops below $14”).

Historical Stock Performance: A Rollercoaster Ride

The Golden Years (2000–2019)

Before the pandemic, Carnival was a Wall Street darling. From 2000 to 2018, CCL’s stock price more than doubled, peaking at around $55 in 2018. The company was expanding, adding new ships, and enjoying steady growth. Investors loved the consistent dividends (Carnival paid a quarterly dividend for decades) and the company’s global footprint.

Think of it like a cruise ship sailing smoothly—until the storm hit.

The Pandemic Crash (2020–2021)

In early 2020, everything changed. The COVID-19 pandemic shut down global travel. Cruise ships were stranded at sea, and bookings evaporated. By April 2020, CCL’s stock price had plummeted to under $8—a 75% drop from its peak. It was one of the hardest-hit sectors in the market.

During this time, Carnival:

- Suspend all sailings for over a year.

- Cut costs by laying off staff and selling older ships.

- Raised $25 billion in new debt to stay afloat.

- Paused its dividend (a big blow to income investors).

For investors, it was a nightmare. But for those who held on—or bought low—there was a silver lining.

The Recovery (2022–2024)

As the world reopened, Carnival slowly got back on its feet. By 2022, sailings resumed, and bookings surged. The stock price began a slow climb, reaching $15–$20 by 2023. In 2024, the momentum continued, driven by:

- Strong demand: People were eager to travel again.

- New ships: Carnival launched eco-friendly vessels like the Carnival Jubilee.

- Debt reduction: The company paid down $3 billion in debt in 2023.

But the road to recovery isn’t over. The stock is still far from its 2018 highs, and the debt load remains a concern.

Lessons from the Past

The takeaway? Carnival’s stock is volatile—it swings wildly with global events. But it also has a history of bouncing back. For long-term investors, this could mean opportunities to buy low and hold through the cycles.

Factors That Influence Carnival’s Stock Price

1. Consumer Demand and Booking Trends

The biggest driver of Carnival’s stock price is how many people want to cruise. The company releases booking updates quarterly, and these numbers are closely watched. For example:

- In Q1 2024, Carnival reported record bookings for 2025, with demand up 20% year-over-year.

- High demand = higher ticket prices = more revenue = a rising stock price.

Tip: Follow Carnival’s earnings calls (available on their investor website) to hear executives discuss booking trends in their own words.

2. Fuel and Operating Costs

Cruise ships burn a lot of fuel—up to 80,000 gallons per day for a large vessel! When oil prices rise, Carnival’s profits shrink. In 2022, high fuel costs hurt margins, but in 2023–2024, lower oil prices helped.

- Pro tip: Check the Brent crude oil price (a global benchmark). If it’s low, Carnival’s stock might get a boost.

3. Geopolitical and Environmental Risks

Carnival’s itineraries span the globe, so it’s exposed to risks like:

- Hurricanes: Canceling Caribbean sailings can cost millions.

- Political unrest: Tensions in the Red Sea have disrupted Middle East cruises.

- Climate change: Rising sea levels and stricter emissions rules could impact operations.

These risks don’t always affect the stock price immediately, but they’re important for long-term investors.

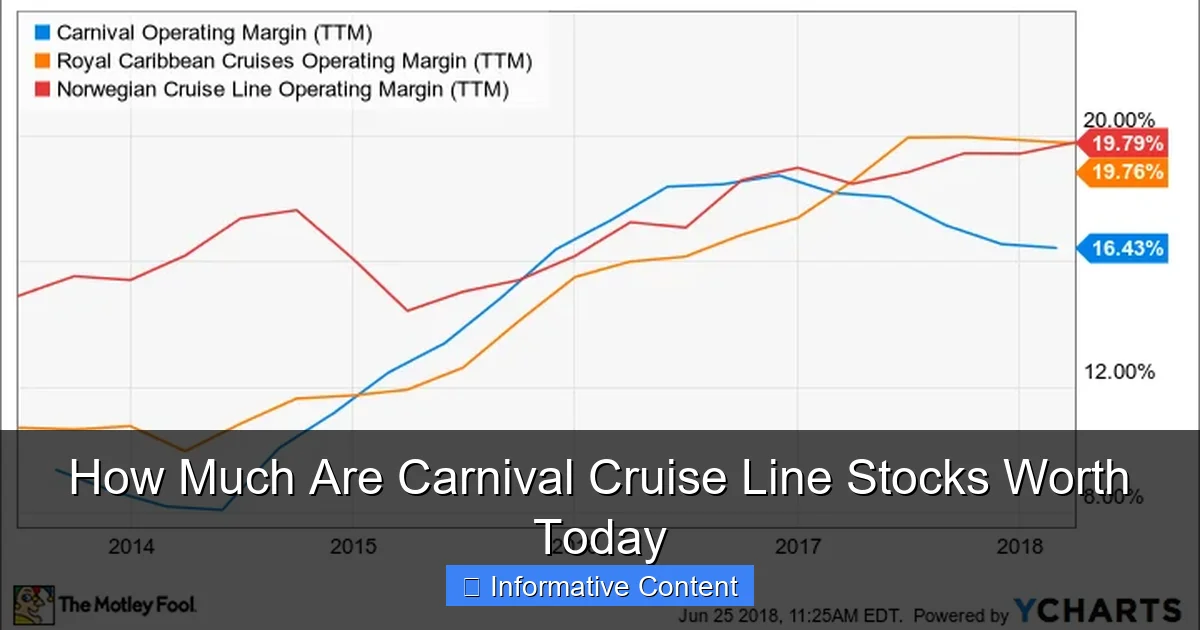

4. Competition and Industry Trends

Carnival isn’t the only cruise line. It competes with:

- Royal Caribbean (RCL)

- Norwegian Cruise Line (NCLH)

When one company innovates (like Royal Caribbean’s “Perfect Day at CocoCay” private island), others must follow. Carnival has responded with its own private destinations (like Half Moon Cay) and tech upgrades (like wearable “Medallions” for personalized service).

5. Investor Sentiment and Market Trends

Sometimes, stock prices move based on feelings, not facts. For example:

- If the economy is strong, investors might buy “recovery stocks” like CCL.

- If interest rates rise, high-dividend stocks (like Carnival used to be) might lose appeal.

Keep an eye on the broader market—Carnival rarely moves in isolation.

Is Carnival Stock a Good Investment Right Now?

Pros of Buying CCL Stock Today

Here’s why some investors are bullish on Carnival:

- Recovery potential: If the stock returns to $50, that’s a 200%+ gain from today’s price.

- High demand: People love cruising, and Carnival is the market leader.

- Dividend potential: The company has hinted at resuming dividends in 2025.

- Global diversification: With brands in Europe, Asia, and the Americas, Carnival isn’t tied to one economy.

Cons and Risks to Consider

Before you buy, be honest about the risks:

- High debt: Carnival still has over $30 billion in debt. Interest payments eat into profits.

- Volatility: The stock can drop 10% in a week if there’s bad news.

- Seasonality: Earnings are lumpy—great in summer, weak in winter.

- Regulatory risks: Environmental laws could force Carnival to retrofit older ships.

Who Should Invest in CCL?

Carnival stock isn’t for everyone. It might be a good fit if:

- You’re a long-term investor with a 5+ year horizon.

- You’re comfortable with higher risk for higher potential returns.

- You believe in the future of travel and want exposure to the cruise industry.

But if you’re risk-averse or need stable dividends, you might prefer other stocks.

Practical Tips for Buying CCL

- Start small: Buy 1–2 shares to test the waters.

- Dollar-cost average: Invest a fixed amount monthly to reduce risk.

- Set a price target: Decide in advance when you’ll sell (e.g., “I’ll sell if it hits $30”).

- Monitor earnings: Read Carnival’s quarterly reports (they’re free on their investor site).

Data Snapshot: Carnival Stock at a Glance

Here’s a quick look at key metrics for Carnival Corporation (CCL) as of mid-2024:

| Metric | Value |

|---|---|

| Stock Price (CCL) | $16.50 (approx.) |

| 52-Week Range | $12.50 – $21.00 |

| Market Cap | $25 billion |

| P/E Ratio | 22.5 (trailing) |

| Dividend Yield | 0% (suspended) |

| Debt-to-Equity Ratio | 2.1 (high) |

| Year-to-Date Return | +25% |

| Analyst Consensus | “Hold” (mixed ratings) |

Note: Prices and metrics change daily. Always verify with real-time data before investing.

Final Thoughts: Should You Buy Carnival Stock?

So, how much are Carnival Cruise Line stocks worth today? The answer isn’t just a number—it’s a story. A story of a company that survived a global shutdown, adapted to new challenges, and is now riding the wave of a travel rebound. At $15–$18 per share, CCL is still trading well below its historical highs, which could mean opportunity—or caution.

Here’s the bottom line: Carnival isn’t a “safe” stock. It’s cyclical, debt-heavy, and sensitive to global events. But if you believe in the enduring appeal of cruises, the company’s recovery plan, and the long-term growth of the travel industry, CCL could be a rewarding investment. Just don’t bet the farm. Start small, do your research, and keep an eye on the horizon.

And remember: investing is a marathon, not a sprint. Carnival’s stock won’t make you rich overnight. But if you’re patient, informed, and willing to weather the storms, you might just find yourself sailing toward financial freedom—one share at a time.

Frequently Asked Questions

How much are Carnival Cruise Line stocks worth today?

Carnival Cruise Line stocks (CCL) fluctuate daily based on market conditions. As of the latest trading session, the price can be checked on financial platforms like Yahoo Finance or Google Finance for real-time updates.

What factors influence the price of Carnival Cruise Line stocks?

The stock price is impacted by factors like travel demand, fuel costs, economic trends, and company earnings reports. Investor sentiment around the cruise industry also plays a significant role.

Where can I find the current value of Carnival Cruise Line stocks?

You can track Carnival Cruise Line stocks (CCL) on stock market websites like Bloomberg, CNBC, or brokerage platforms such as E*TRADE. These sites provide real-time quotes and historical data.

Is Carnival Cruise Line a good long-term stock investment?

This depends on market recovery and the company’s financial performance post-pandemic. Analysts often review its balance sheet, revenue growth, and industry trends to assess long-term potential.

How does Carnival Cruise Line’s stock price compare to competitors?

CCL is often compared to peers like Royal Caribbean (RCL) and Norwegian Cruise Line (NCL). Their stock performance reflects broader cruise industry trends, but individual metrics like debt levels and bookings can vary.

Can I buy fractional shares of Carnival Cruise Line stocks?

Yes, many brokerages like Robinhood and Fidelity allow fractional purchases of Carnival Cruise Line stocks (CCL). This is ideal for investors who want exposure without buying a full share.