Featured image for how many cruise line companies are there

Image source: shiplife.org

There are over 100 cruise line companies operating globally in 2024, catering to diverse budgets and travel styles—from luxury yachts to massive megaships. The industry is dominated by a few major players like Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings, which together control nearly 80% of the market, while dozens of smaller, niche lines offer unique itineraries and experiences.

Key Takeaways

- Over 50 major cruise lines operate globally in 2024, offering diverse itineraries and experiences.

- Top 3 companies dominate 70% of the market: Carnival, Royal Caribbean, and Norwegian.

- Luxury and niche lines are growing fastest, targeting high-end and adventure travelers.

- New entrants emerge yearly, driven by demand for unique, sustainable cruising options.

- Regional players thrive in Asia, Europe, and Alaska, catering to local preferences.

- Fleet sizes vary widely, from 100-passenger yachts to 7,000-guest mega-ships.

📑 Table of Contents

- The Vast World of Cruise Lines: A 2024 Overview

- Major Global Cruise Corporations: The Industry Titans

- Niche and Luxury Cruise Lines: Catering to the Discerning Traveler

- River Cruise Lines: Navigating Europe, Asia, and Beyond

- Regional and Niche Market Operators: The Hidden Gems

- Total Number and Industry Trends: The Big Picture in 2024

The Vast World of Cruise Lines: A 2024 Overview

The cruise industry, a dynamic and ever-evolving sector of global tourism, continues to captivate travelers with its blend of luxury, adventure, and convenience. As we navigate through 2024, the number of cruise line companies has expanded significantly, offering an unprecedented array of choices for every type of traveler—from budget-conscious families to high-net-worth individuals seeking ultra-luxury experiences. Whether it’s a short weekend getaway, a transatlantic journey, or an expedition to the polar regions, the modern cruise landscape caters to diverse preferences, budgets, and destinations. With over 30 million passengers expected to sail this year alone, the industry’s growth reflects both its resilience and adaptability in a post-pandemic world.

But just how many cruise line companies are there in 2024? The answer isn’t as simple as a single number. The cruise industry is a complex ecosystem composed of major corporations, regional operators, luxury niche brands, expedition specialists, and river cruise lines—each with unique offerings, business models, and target markets. Understanding this diversity is crucial for travelers, industry analysts, and investors alike. This comprehensive guide dives deep into the current state of the cruise industry, breaking down the major players, niche segments, and emerging trends shaping the number and structure of cruise line companies today. From global giants to boutique river operators, we’ll explore the full spectrum of options available in 2024 and provide practical insights to help you navigate this vast maritime world.

Major Global Cruise Corporations: The Industry Titans

The backbone of the cruise industry is formed by a handful of multinational corporations that own and operate multiple cruise line brands. These parent companies dominate the market, controlling a significant share of the global fleet, passenger capacity, and revenue. Their scale allows for economies of operation, global marketing reach, and innovation in ship design, sustainability, and guest experiences.

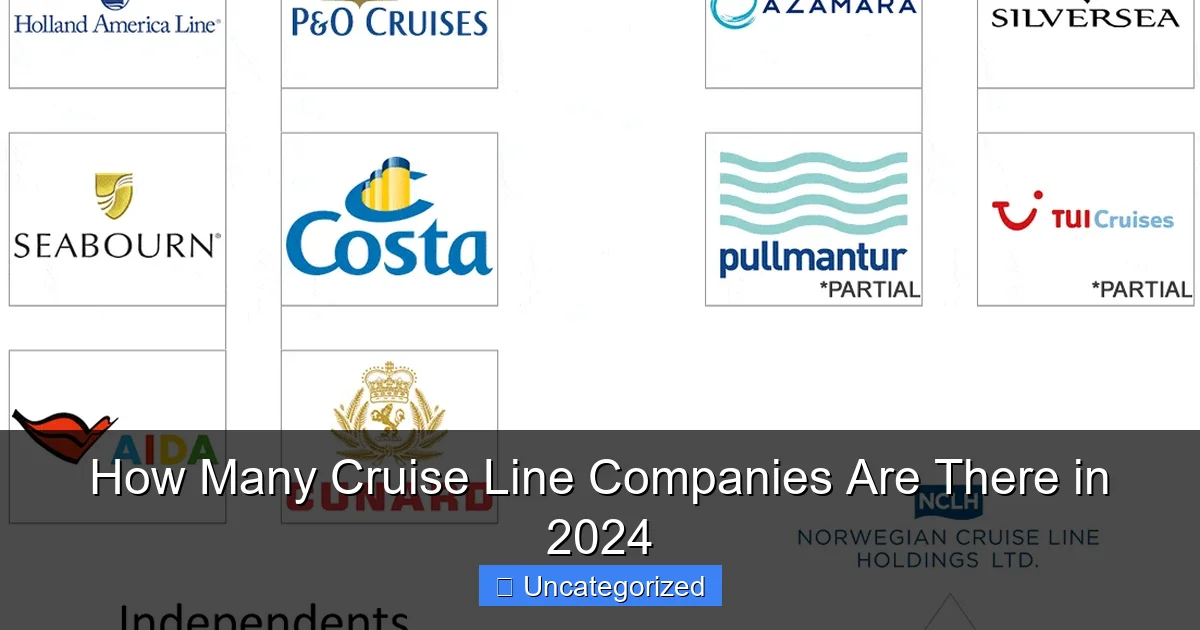

Visual guide about how many cruise line companies are there

Image source: cruzely.com

Carnival Corporation & plc: The World’s Largest Cruise Operator

With a fleet of over 90 ships and 10 distinct cruise brands, Carnival Corporation & plc remains the undisputed leader in the cruise industry. Headquartered in Miami, Florida, and London, UK, the company operates brands tailored to different markets and price points:

- Carnival Cruise Line – Known for fun, family-friendly, and value-driven vacations.

- Princess Cruises – Focuses on premium, destination-rich itineraries.

- Holland America Line – Offers classic, elegant cruising with a focus on enrichment.

- Seabourn – A luxury brand specializing in all-inclusive, intimate voyages.

- AIDA Cruises – A German brand with a vibrant, youthful onboard culture.

- P&O Cruises – Serves the UK market with traditional British cruising.

- Cunard Line – Famous for transatlantic crossings and British heritage.

- Costa Cruises – Targets Italian and European markets with Mediterranean flair.

- P&O Cruises Australia – Focused on the South Pacific and Australian travelers.

- Fathom – A short-lived social impact brand (now integrated into other lines).

Carnival’s strategy of brand segmentation allows it to capture a wide demographic, from budget travelers to luxury seekers, making it a dominant force in both mass-market and premium segments.

Royal Caribbean Group: Innovation and Scale

The second-largest player, Royal Caribbean Group, operates three major brands and is known for pushing the boundaries of cruise ship design and onboard experiences:

- Royal Caribbean International – The flagship brand, famous for mega-ships like Symphony of the Seas and Icon of the Seas, featuring water parks, surf simulators, and robotic bars.

- Norwegian Cruise Line (NCL) – Acquired in 2020, NCL is known for its “Freestyle Cruising” model, offering flexible dining, no set seating, and diverse entertainment.

- Silversea Cruises – A luxury, all-inclusive line specializing in small ships and expedition voyages.

Royal Caribbean Group has invested heavily in sustainability, with LNG-powered ships and waste-to-energy systems, and continues to lead in technological innovation, such as AI-powered concierge services and augmented reality experiences onboard.

Norwegian Cruise Line Holdings Ltd.: A Hybrid Giant

Though Royal Caribbean Group acquired NCL in 2020, the Norwegian Cruise Line Holdings Ltd. (NCLH) still operates as a separate entity with its own three brands:

- Norwegian Cruise Line – Continues to emphasize flexibility and freedom in cruising.

- Oceania Cruises – A premium line focused on gourmet cuisine, destination immersion, and mid-sized ships (600–1,200 guests).

- Regent Seven Seas Cruises – An ultra-luxury brand offering all-inclusive, six-star experiences with 100% suite accommodations.

NCLH has carved out a strong niche in the mid-to-luxury segment, particularly appealing to foodies and travelers seeking personalized service and cultural enrichment.

Tip: When comparing cruise lines, consider not just the parent company but the brand’s unique identity. For example, a Seabourn ship under Carnival may offer a very different experience than a Carnival Cruise Line ship, despite being under the same corporate umbrella.

Niche and Luxury Cruise Lines: Catering to the Discerning Traveler

Beyond the mass-market and premium brands, a growing number of cruise lines cater to niche markets—luxury, adventure, wellness, and cultural immersion. These smaller, specialized operators often command higher per-passenger revenue and boast exceptional guest-to-crew ratios.

Ultra-Luxury and All-Inclusive Operators

The ultra-luxury segment has seen a surge in popularity, driven by high-net-worth travelers seeking privacy, exclusivity, and personalized service. Leading players include:

- Seabourn (owned by Carnival) – Known for all-suite accommodations, fine dining, and expedition-style voyages to remote destinations.

- Regent Seven Seas Cruises – Offers all-inclusive pricing covering airfare, shore excursions, gratuities, and premium beverages.

- Oceania Cruises – Combines luxury with culinary excellence and destination-focused itineraries.

- Silversea Cruises – Operates small, all-suite ships with butler service and immersive cultural programming.

- Scenic Luxury Cruises & Tours – An Australian-based brand offering all-inclusive river and ocean voyages with private butler service and included excursions.

These brands often operate ships with fewer than 700 guests, allowing for greater flexibility and access to smaller ports.

Expedition and Adventure Cruise Lines

With growing interest in sustainable and immersive travel, expedition cruise lines have expanded rapidly. These companies focus on remote destinations like Antarctica, the Arctic, the Galápagos, and the Amazon:

- Lindblad Expeditions – Partnered with National Geographic, offering science-based voyages with onboard naturalists and photographers.

- Hurtigruten Expeditions – Norwegian-based, with a strong focus on eco-friendly practices and polar expeditions.

- Quark Expeditions – Specializes in Antarctic and Arctic travel, with ice-class vessels and expert guides.

- Silversea Expeditions – Combines luxury with adventure, offering Zodiac landings and expert-led excursions.

- Ponant – French-owned, with a fleet of sleek, ice-rated yachts and a strong emphasis on sustainability.

Tip: Expedition cruises often require early booking (12–18 months in advance), especially for polar regions, due to limited capacity and high demand.

Wellness and Boutique Cruise Operators

Emerging niche segments include wellness-focused and boutique cruise lines that emphasize mindfulness, fitness, and holistic experiences:

- Virgin Voyages – A “no kids, no buffets” brand targeting adults with a vibrant, music-driven onboard culture and wellness programming.

- Atlas Ocean Voyages – Focuses on luxury expedition cruising with wellness retreats and cultural immersion.

- UnCruise Adventures – Offers small-ship, active adventures in Alaska, Hawaii, and the Pacific Northwest.

These brands appeal to travelers seeking more than just relaxation—they want transformation, connection, and adventure.

River Cruise Lines: Navigating Europe, Asia, and Beyond

River cruising has evolved from a niche European pastime to a global phenomenon, with dedicated river cruise lines operating on major waterways worldwide. Unlike ocean cruises, river ships are smaller (typically 100–200 passengers), allowing access to historic city centers and scenic inland routes.

European River Cruise Giants

Europe remains the heart of river cruising, with companies like:

- AmaWaterways – Known for innovative ship designs (like twin balconies), wellness programs, and included excursions.

- Viking River Cruises – A dominant player with over 80 river ships, offering cultural enrichment and destination-focused itineraries.

- Uniworld Boutique River Cruise Collection – Operates luxury, themed ships with all-inclusive pricing and opulent interiors.

- Scenic – Offers all-inclusive, ultra-luxury river cruises with private butler service and included airfare.

- Avalon Waterways – Part of the Globus family, focusing on comfort and value with panoramic suite designs.

Expanding into Asia, Africa, and the Americas

River cruising is no longer limited to Europe. Companies are expanding into new markets:

- Emerald Cruises – Offers river cruises on the Danube, Rhine, and Mekong, as well as yacht-style ocean expeditions.

- American Cruise Lines – Operates small ships along U.S. rivers like the Mississippi and Columbia, with a focus on domestic tourism.

- Scenic Eclipse – A hybrid river/ocean luxury yacht that sails in the Amazon, Southeast Asia, and the Mediterranean.

- Aqua Expeditions – Specializes in luxury river cruises on the Amazon and Mekong, with eco-luxury design and expert naturalists.

Key Differences Between River and Ocean Cruising

- Ship Size: River ships are smaller, allowing access to narrow waterways and city docks.

- Itineraries: River cruises focus on daily stops at cultural and historical sites, while ocean cruises often include multiple sea days.

- Passenger Experience: River cruises emphasize destination immersion and cultural engagement.

- Pricing: River cruises are often all-inclusive (meals, excursions, drinks), while ocean cruises may have à la carte pricing.

Tip: For first-time river cruisers, consider a 7–10 day itinerary on the Danube or Rhine to experience the best of European river culture.

Regional and Niche Market Operators: The Hidden Gems

While global brands dominate headlines, a robust ecosystem of regional and niche operators fills gaps in the market, serving specific geographies, cultures, and traveler preferences. These companies often offer more authentic, localized experiences.

Asia-Pacific and Middle Eastern Cruise Lines

- Dream Cruises (Genting Hong Kong) – Targets the Asian market with ships based in China, Malaysia, and Singapore.

- Star Cruises – Another Genting brand, focusing on short cruises from Asian ports.

- MSC Cruises – Though global, MSC has a strong presence in the Middle East, with homeports in Dubai and Abu Dhabi.

- Costa Asia – Operates Costa ships in China and Southeast Asia, with localized menus and entertainment.

Specialty and Cultural Operators

- Paul Gauguin Cruises – Specializes in French Polynesia, with a single ship offering Polynesian culture, cuisine, and snorkeling.

- Windstar Cruises – Operates small, yacht-like ships with sail-assisted propulsion, focusing on the Caribbean, Mediterranean, and Tahiti.

- SeaDream Yacht Club – Offers ultra-intimate, yacht-style cruising with just 112 guests per ship.

- Compagnie du Ponant – French-owned, with a focus on French language, cuisine, and cultural voyages.

New Entrants and Startups

The cruise industry is seeing innovation from new players:

- Virgin Voyages – Already mentioned, but worth reiterating for its disruptive approach to adult-only, music-centric cruising.

- Blue World Voyages – A startup focused on wellness and adventure, though still in planning stages.

- Atlas Ocean Voyages – Launched in 2021, combining luxury with expedition-style travel.

Tip: Regional operators often provide more authentic experiences—e.g., a Costa Asia cruise will feature Chinese karaoke and dumplings, while a Ponant cruise will offer French wine tastings and onboard lectures in French.

Total Number and Industry Trends: The Big Picture in 2024

So, how many cruise line companies are there in 2024? While there’s no single official count, a comprehensive analysis reveals:

- Approximately 50–60 distinct cruise line brands operate globally.

- These brands are owned by 15–20 major parent companies or independent operators.

- The fleet includes over 400 active ocean and river cruise ships, with more under construction.

Breakdown by Segment (Estimated 2024)

| Segment | Number of Brands | Examples |

|---|---|---|

| Mass-Market / Mainstream | 8–10 | Carnival, Royal Caribbean, Norwegian, MSC |

| Premium / Mid-Luxury | 6–8 | Princess, Holland America, Oceania, Celebrity |

| Ultra-Luxury / All-Inclusive | 8–10 | Regent, Silversea, Seabourn, Scenic |

| Expedition / Adventure | 10–12 | Lindblad, Quark, Hurtigruten, Ponant |

| River Cruising | 15–20 | AmaWaterways, Viking, Uniworld, Avalon |

| Regional / Niche | 10–12 | Paul Gauguin, Windstar, SeaDream, Dream Cruises |

Key Industry Trends Shaping the 2024 Landscape

- Sustainability: Cruise lines are investing in LNG, hydrogen, and shore power to reduce emissions. Carnival and Royal Caribbean have pledged to achieve net-zero by 2050.

- Smaller, More Intimate Ships: Demand for personalized experiences is driving growth in expedition and boutique brands.

- Digital Innovation: AI, contactless check-in, and wearable tech are enhancing guest experiences.

- Destination Expansion: New itineraries in Africa, the South Pacific, and the Arctic are attracting adventurous travelers.

- Health and Safety: Post-pandemic protocols remain in place, with enhanced sanitation and medical facilities.

Future Outlook

The cruise industry is expected to grow at a CAGR of 5–7% through 2030. New entrants, especially in the luxury and expedition segments, will continue to emerge. Meanwhile, consolidation may occur among smaller operators facing rising costs. The number of cruise line companies may stabilize around 60, but brand diversity and specialization will increase.

Tip: Use cruise comparison websites like Cruise Critic, Cruiseline.com, or Vacations to Go to filter by brand, ship size, itinerary, and onboard features—making it easier to find the right fit.

In 2024, the cruise industry is more diverse and dynamic than ever. From the mega-ships of Royal Caribbean to the silent Zodiacs of Lindblad, there’s a cruise line for every dream, budget, and destination. Whether you’re counting brands or planning your next voyage, one thing is clear: the world of cruise travel is vast, vibrant, and ready to explore. With over 50 unique cruise line companies offering thousands of itineraries, the only limit is your imagination. So set sail, discover new horizons, and find the perfect cruise line for your next adventure.

Frequently Asked Questions

How many cruise line companies are there in 2024?

As of 2024, there are approximately 70 active cruise line companies operating globally, ranging from large corporations to small luxury and niche operators. This number includes both ocean and river cruise lines, with new entrants and consolidations shaping the industry each year.

Which major cruise line companies dominate the market?

Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings are the three largest players, collectively controlling over 70% of the global cruise market. These companies operate well-known brands like Carnival Cruise Line, Princess, and Oceania Cruises.

Are there different types of cruise line companies?

Yes, cruise line companies vary widely by size, focus, and service style. Categories include mass-market, luxury, premium, expedition, river, and ultra-luxury lines, each catering to different traveler preferences and budgets.

How many new cruise line companies launched in 2024?

Several new cruise line companies debuted in 2024, including niche and expedition-focused brands like Atlas Ocean Voyages and Heritage Expeditions. Industry innovation continues to drive growth, especially in the luxury and sustainability-focused sectors.

How many cruise line companies operate in the luxury segment?

There are around 15 dedicated luxury cruise line companies in 2024, including Regent Seven Seas, Seabourn, and Silversea. These lines emphasize all-inclusive experiences, smaller ships, and high-end amenities.

Has the number of cruise line companies changed due to mergers?

Yes, mergers and acquisitions have reduced the number of independent cruise line companies in recent years. For example, the acquisition of Holland America Group by Carnival Corporation and the integration of Silversea into Royal Caribbean Group reflect ongoing industry consolidation.