Featured image for how competitive is cruise line industry

Image source: imgv2-2-f.scribdassets.com

The cruise line industry in 2024 is fiercely competitive, driven by post-pandemic demand surges and aggressive fleet expansions from major players like Carnival, Royal Caribbean, and Norwegian. With record-breaking new ship launches, personalized guest experiences, and dynamic pricing strategies, brands are battling for market share in an increasingly experience-driven travel landscape. Sustainability initiatives and tech-driven innovations now serve as key differentiators in this high-stakes race for dominance.

Key Takeaways

- Market saturation is high: Major players dominate; new entrants must differentiate aggressively.

- Customer experience drives loyalty: Invest in personalized services to retain modern travelers.

- Tech innovation is critical: Adopt AI and digital tools to streamline operations and bookings.

- Sustainability sets leaders apart: Eco-friendly practices are now key competitive differentiators.

- Dynamic pricing boosts revenue: Use data analytics to optimize pricing strategies in real time.

- Global expansion opportunities exist: Target emerging markets to capture new demand.

📑 Table of Contents

- How Competitive Is Cruise Line Industry in 2024

- 1. Market Share and Dominant Players

- 2. Pricing Wars and Discount Strategies

- 3. Innovation and Unique Experiences

- 4. Sustainability and Environmental Pressures

- 5. Technology and the Digital Experience

- 6. The Impact of Global Events and Economic Factors

- Data Table: Cruise Line Market Share (2024 Estimates)

- Conclusion: The Never-Ending Race for Your Vacation Dollar

How Competitive Is Cruise Line Industry in 2024

The cruise line industry in 2024 is a fascinating world of glitz, glamour, and fierce competition. Picture this: you’re standing on the deck of a floating city, the ocean breeze in your hair, a cocktail in hand, and endless entertainment just a few steps away. Sounds dreamy, right? But behind the scenes, the cruise industry is a high-stakes battleground where companies fight tooth and nail to win over your vacation dollars. With over 30 million passengers expected to set sail this year, the demand is there—but so is the pressure to stand out in a crowded market.

From luxury liners to budget-friendly options, the cruise industry is a melting pot of brands, each trying to carve out a niche. But what makes this industry so competitive? Is it the race to build bigger, better ships? The push to offer unique experiences? Or is it the constant need to innovate in a world where travelers have more choices than ever? In this article, we’ll dive deep into the dynamics of the cruise line industry in 2024, exploring everything from market share and pricing wars to sustainability and tech innovations. Whether you’re a frequent cruiser or just curious about the business behind the buffets, this guide will give you a behind-the-scenes look at how these floating giants compete for your attention—and your wallet.

1. Market Share and Dominant Players

The Big Three: Carnival, Royal Caribbean, and Norwegian

When it comes to the cruise industry, three names dominate the conversation: Carnival Cruise Line, Royal Caribbean International, and Norwegian Cruise Line. Together, they control about 75% of the global market, making them the undisputed leaders in the industry. Carnival is the largest, with a fleet of over 90 ships and a focus on affordable, family-friendly vacations. Royal Caribbean, on the other hand, is known for its mega-ships like the Icon of the Seas, which boasts record-breaking amenities like the world’s largest waterpark at sea. Norwegian has carved out a niche with its “freestyle cruising” model, offering flexible dining and a more relaxed vibe.

Visual guide about how competitive is cruise line industry

Image source: bahamasmaritime.com

But dominance doesn’t mean complacency. These companies are constantly innovating to stay ahead. For example, Royal Caribbean’s Icon of the Seas (launched in early 2024) cost over $2 billion to build and features everything from a 17-deck-high slide to a 700-foot-long zip line. Carnival, meanwhile, is betting big on themed cruises, like its partnership with the Dr. Seuss brand for kid-friendly experiences. Norwegian is pushing the envelope with its Prima-class ships, which focus on open spaces and outdoor dining.

Emerging Challengers: Virgin Voyages and Others

While the Big Three dominate, new players are shaking things up. Virgin Voyages, backed by Sir Richard Branson, is a prime example. Launched in 2021, Virgin has quickly gained attention for its adults-only cruises, stylish design, and focus on sustainability. Its ships, like the Scarlet Lady, feature rooftop yoga studios, tattoo parlors, and a no-tipping policy. Other emerging brands like MSC Cruises (with its massive World-class ships) and Hurtigruten Expeditions (specializing in polar adventures) are also gaining traction.

These challengers are forcing the Big Three to up their game. For instance, Carnival recently announced a partnership with Blue Origin to offer space-themed cruises, while Royal Caribbean is experimenting with AI-powered concierge services. The lesson? In this industry, even the giants can’t afford to rest on their laurels.

2. Pricing Wars and Discount Strategies

How Cruise Lines Compete on Price

Price is a huge factor in the cruise industry. With so many options, companies are constantly slashing prices to attract customers. But it’s not just about offering the lowest fare—it’s about creating the illusion of value. For example, a $500 cruise might seem like a steal, but once you factor in port fees, gratuities, and onboard purchases, the real cost could double. To stand out, cruise lines use creative pricing strategies:

Visual guide about how competitive is cruise line industry

Image source: image2.slideserve.com

- Early-bird discounts: Booking months (or even years) in advance can save you hundreds.

- Last-minute deals: If a ship isn’t fully booked, companies often offer steep discounts 30-60 days before departure.

- Bundle packages: Some lines include airfare, excursions, or drink packages to sweeten the deal.

- Loyalty programs: Frequent cruisers get perks like free upgrades, priority boarding, and onboard credits.

<

Take Carnival’s VIFP Club (Very Important Fun Person), for example. Members get exclusive deals, free upgrades, and even surprise gifts like champagne or spa credits. Royal Caribbean’s Club Royale offers similar perks, but with a focus on personalized service. These programs aren’t just about rewarding loyalty—they’re about keeping customers coming back.

The Hidden Costs of “Cheap” Cruises

Here’s the catch: the cruise industry is a master of upselling. A $500 fare might seem like a bargain, but add in the cost of excursions, specialty dining, Wi-Fi, and spa treatments, and your total bill could easily top $2,000. Some lines, like Norwegian, include gratuities in the fare, while others, like Carnival, charge them separately. To avoid sticker shock, always read the fine print and budget for extras. Pro tip: book excursions through third-party vendors (like Viator or GetYourGuide)—they’re often cheaper than the cruise line’s offerings.

3. Innovation and Unique Experiences

Bigger, Better, Bolder: The Mega-Ship Race

The cruise industry loves a good arms race, and the latest battleground is ship size. Royal Caribbean’s Icon of the Seas is the current champion, weighing in at 250,800 gross tons and carrying 7,600 passengers. But competitors aren’t far behind. MSC Cruises’ World Europa (215,863 tons) and Carnival’s upcoming Excel-class ships (230,000+ tons) are giving Royal Caribbean a run for its money.

But size isn’t everything. The real competition is in amenities. Think of it like a theme park at sea: the more attractions, the better. Royal Caribbean’s Icon of the Seas features a 17-deck-high slide, a 700-foot-long zip line, and a 55-foot-tall climbing wall. Carnival’s Mardi Gras has the first rollercoaster at sea, while Norwegian’s Prima ships boast an open-air promenade with ocean views.

Specialty Cruises and Niche Markets

Not everyone wants a mega-ship experience. That’s why cruise lines are targeting niche markets with specialized itineraries. Examples include:

- Expedition cruises: Hurtigruten and Lindblad Expeditions offer polar voyages with onboard naturalists.

- Luxury cruises: Regent Seven Seas and Seabourn focus on all-inclusive, high-end experiences.

- Adventure cruises: UnCruise Adventures offers small-ship trips to remote destinations like Alaska’s glaciers.

- Themed cruises: Carnival’s Seuss at Sea and Royal Caribbean’s Star Wars cruises cater to families and fans.

These niche offerings are a smart move—they allow companies to charge premium prices while avoiding direct competition with the mega-liners.

4. Sustainability and Environmental Pressures

The Push for Greener Cruises

Sustainability is no longer optional in the cruise industry. With increasing scrutiny from regulators and travelers, companies are racing to reduce their environmental impact. Royal Caribbean, for example, is investing in LNG (liquefied natural gas) ships, which cut emissions by 20-30%. Carnival is testing biofuels, while Norwegian is experimenting with hydrogen fuel cells.

But it’s not just about fuel. Cruise lines are also focusing on waste reduction. MSC Cruises has banned single-use plastics, and Virgin Voyages uses reusable water bottles and compostable packaging. Some lines, like Hurtigruten, even have onboard scientists who educate passengers about conservation.

Greenwashing vs. Genuine Change

Here’s the problem: not all sustainability claims are equal. Some cruise lines have been accused of “greenwashing”—making vague promises without concrete action. For example, a ship might advertise “eco-friendly” excursions, but if the itinerary includes fragile ecosystems, the impact could be negative. To avoid greenwashing, look for certifications like Green Marine or EarthCheck, which verify a company’s environmental claims.

5. Technology and the Digital Experience

AI, Apps, and Onboard Tech

Technology is transforming the cruise experience. Royal Caribbean’s Royal Caribbean App lets you book dining, check schedules, and even unlock your stateroom with your phone. Carnival’s HUB App includes a chat feature for connecting with other passengers. Some lines, like Norwegian, are experimenting with AI-powered concierge services that can answer questions in real-time.

Onboard, tech is everywhere. Royal Caribbean’s Icon of the Seas has a “smart cabin” system that adjusts lighting and temperature based on your preferences. Carnival’s Mardi Gras has a facial recognition system for boarding, and Virgin Voyages uses wearable wristbands for payments and room access.

Virtual Reality and Future Innovations

The next frontier? Virtual reality. Imagine exploring a coral reef from your stateroom or attending a concert in a digital venue. Some cruise lines are already testing VR experiences, and it’s only a matter of time before they become mainstream. Other innovations to watch include:

- Autonomous ships: While still years away, companies like Rolls-Royce are developing self-piloting vessels.

- Blockchain for loyalty programs: A secure way to track points and rewards.

- Biometric security: Facial recognition for faster boarding and payments.

6. The Impact of Global Events and Economic Factors

Post-Pandemic Recovery and Demand Shifts

The cruise industry was hit hard by COVID-19, but it’s bouncing back. In 2024, passenger numbers are expected to exceed pre-pandemic levels, thanks to pent-up demand and new safety protocols. However, the recovery hasn’t been equal. Budget lines like Carnival are thriving, while luxury brands like Regent Seven Seas are still playing catch-up.

One big shift? Travelers are prioritizing flexibility. Many cruise lines now offer free cancellations or date changes, a response to the uncertainty of the past few years. Another trend: shorter cruises. With more people working remotely, 3-5 day itineraries are gaining popularity.

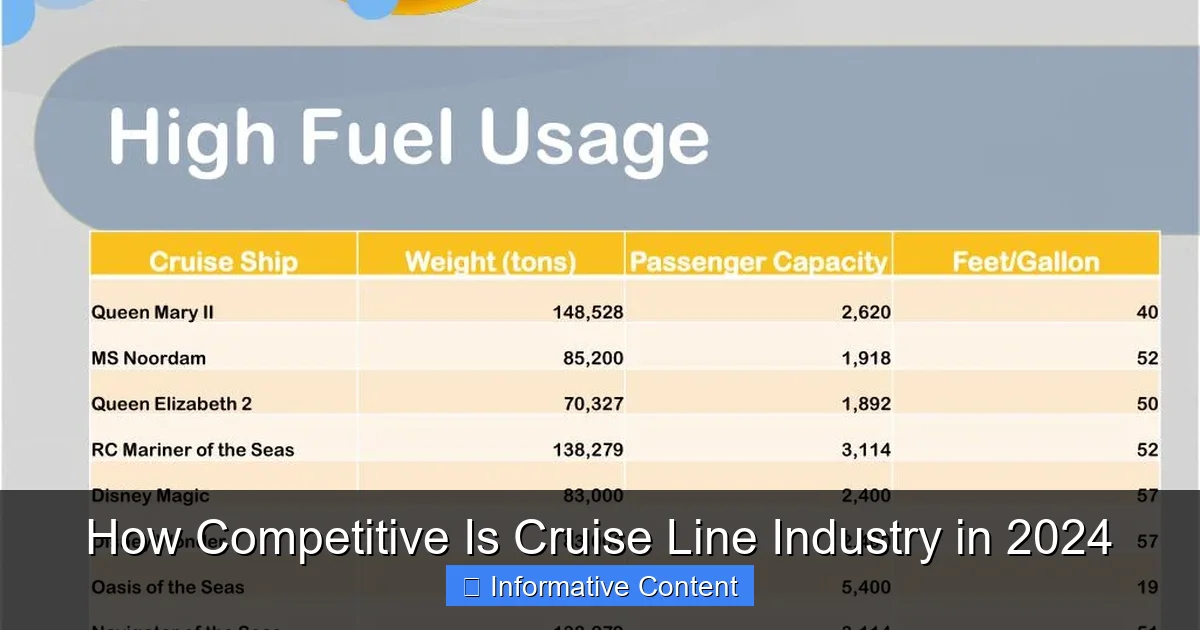

Economic Challenges: Inflation and Fuel Costs

The industry isn’t immune to economic headwinds. Rising fuel costs (up 30% since 2022) are squeezing margins, and inflation is making everything from food to labor more expensive. To cope, cruise lines are raising prices, cutting costs, and even shortening itineraries. For example, some lines are skipping less profitable ports to save on fuel.

Data Table: Cruise Line Market Share (2024 Estimates)

| Company | Market Share | Notable Ships/Features |

|---|---|---|

| Carnival Cruise Line | 40% | Mardi Gras (rollercoaster at sea), VIFP Club |

| Royal Caribbean International | 25% | Icon of the Seas (world’s largest cruise ship), Club Royale |

| Norwegian Cruise Line | 10% | Prima-class (open-air promenade), freestyle dining |

| MSC Cruises | 8% | World Europa (LNG-powered), MSC Foundation |

| Virgin Voyages | 5% | Scarlet Lady (adults-only), no tipping policy |

| Others (Hurtigruten, Regent, etc.) | 12% | Expedition cruises, luxury itineraries |

Conclusion: The Never-Ending Race for Your Vacation Dollar

The cruise line industry in 2024 is as competitive as ever. With the Big Three dominating the market, emerging brands pushing boundaries, and constant innovation in technology and sustainability, it’s a fascinating (and fast-changing) space. Whether you’re drawn to the mega-ships of Royal Caribbean, the budget-friendly fun of Carnival, or the niche experiences of Virgin Voyages, one thing is clear: the competition benefits you, the traveler.

So, what’s the takeaway? If you’re planning a cruise, don’t just focus on price—look at the whole package. Consider the ship’s amenities, the company’s sustainability efforts, and the flexibility of the booking terms. And remember: in an industry this competitive, the best deals and the most unique experiences are out there for those willing to look. Happy sailing!

Frequently Asked Questions

How competitive is the cruise line industry in 2024?

The cruise line industry in 2024 is highly competitive, with major players like Carnival, Royal Caribbean, and Norwegian dominating market share. Intense rivalry drives innovation in onboard experiences, sustainability efforts, and pricing strategies to attract post-pandemic travelers.

What makes the cruise line industry so competitive?

Key factors include capacity expansion, differentiated itineraries, and tech-driven amenities like app-based services and themed entertainment. Smaller cruise lines compete by offering niche experiences (e.g., luxury or expedition cruises), raising the bar for the entire industry.

How do cruise lines compete on pricing and value?

Cruise lines use dynamic pricing, bundled packages (e.g., free Wi-Fi or drink packages), and last-minute deals to stand out. Value-driven promotions, like inclusive fares, are critical in a market where consumers compare both cost and unique offerings.

Is the cruise line industry growing or saturated?

The industry is growing, with 35+ new ships launched in 2024, but competition is fierce as demand stabilizes post-pandemic. Smaller operators face challenges, while larger brands leverage economies of scale to dominate the cruise line industry.

How do sustainability efforts impact competitiveness?

Eco-friendly practices, like LNG-powered ships and waste reduction, are now key differentiators. Brands investing in green technology gain favor with environmentally conscious travelers, making sustainability a major battleground in the cruise line industry.

What role does customer experience play in cruise line competition?

Superior service, unique destinations, and immersive onboard activities (e.g., virtual reality or celebrity chef dining) are critical to retaining customers. In 2024, personalized experiences and loyalty programs are top tools to outshine rivals.