Featured image for how are cruise lines doing financially

Image source: miro.medium.com

Cruise lines are experiencing a strong financial rebound in 2024, with record-breaking bookings and revenue growth surpassing pre-pandemic levels. Fueled by pent-up demand, higher ticket prices, and expanded fleets, major players like Carnival, Royal Caribbean, and Norwegian are reporting robust earnings and improved balance sheets. Despite inflationary pressures and rising fuel costs, the industry’s outlook remains bullish, signaling a resilient recovery and bright future for ocean travel.

Key Takeaways

- Revenue rebounds strongly: Cruise lines report record bookings in 2024, signaling full recovery.

- Debt remains a challenge: High post-pandemic debt burdens continue to pressure cash flow.

- Premium pricing works: Higher ticket prices drive revenue despite reduced capacity.

- Onboard spending surges: Passengers spend more on extras, boosting profitability.

- New ships attract demand: Fleet modernization increases appeal and operational efficiency.

📑 Table of Contents

- The Financial Voyage: How Are Cruise Lines Doing in 2024?

- 1. Post-Pandemic Recovery: From Red Ink to Profitability

- 2. Revenue Drivers: Bookings, Pricing, and Ancillary Income

- 3. Debt Management: Balancing Survival with Sustainability

- 4. Operational Costs: Navigating Inflation and Supply Chain Pressures

- 5. Strategic Investments: New Ships, Sustainability, and Digital Transformation

- 6. Regional Performance and Market Diversification

- Conclusion: Sailing Toward a Brighter Horizon

The Financial Voyage: How Are Cruise Lines Doing in 2024?

The cruise industry, once seen as a resilient pillar of global tourism, has navigated turbulent waters over the past few years. From the unprecedented pause during the pandemic to a slow but determined recovery, 2024 marks a pivotal moment in the financial journey of cruise lines. After years of record losses, operational halts, and massive debt accumulation, the industry is now charting a course toward profitability—albeit with caution, innovation, and a renewed focus on sustainability and consumer demand. But the question on everyone’s mind remains: how are cruise lines doing financially in 2024?

This deep dive explores the current financial health of major cruise operators, analyzing revenue trends, debt management, booking patterns, and long-term strategies. With travelers returning in record numbers and new ships entering service, the industry is showing signs of strength. Yet, challenges such as rising fuel costs, geopolitical tensions, and evolving consumer expectations continue to shape the financial landscape. Whether you’re a frequent cruiser, an investor, or simply curious about the state of one of the world’s most dynamic travel sectors, this article provides a comprehensive, data-driven look at where cruise lines stand today—and where they’re headed tomorrow.

1. Post-Pandemic Recovery: From Red Ink to Profitability

The Pandemic Hangover: A Recap of 2020–2022

The cruise industry suffered one of the most severe financial downturns in modern history between 2020 and 2022. With global port closures and a complete halt to operations, major players like Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings reported staggering losses. Carnival, for example, posted a net loss of $10.2 billion in 2020, while Royal Caribbean lost $5.8 billion that same year. The industry collectively burned through billions in cash reserves, suspended dividends, and furloughed thousands of employees.

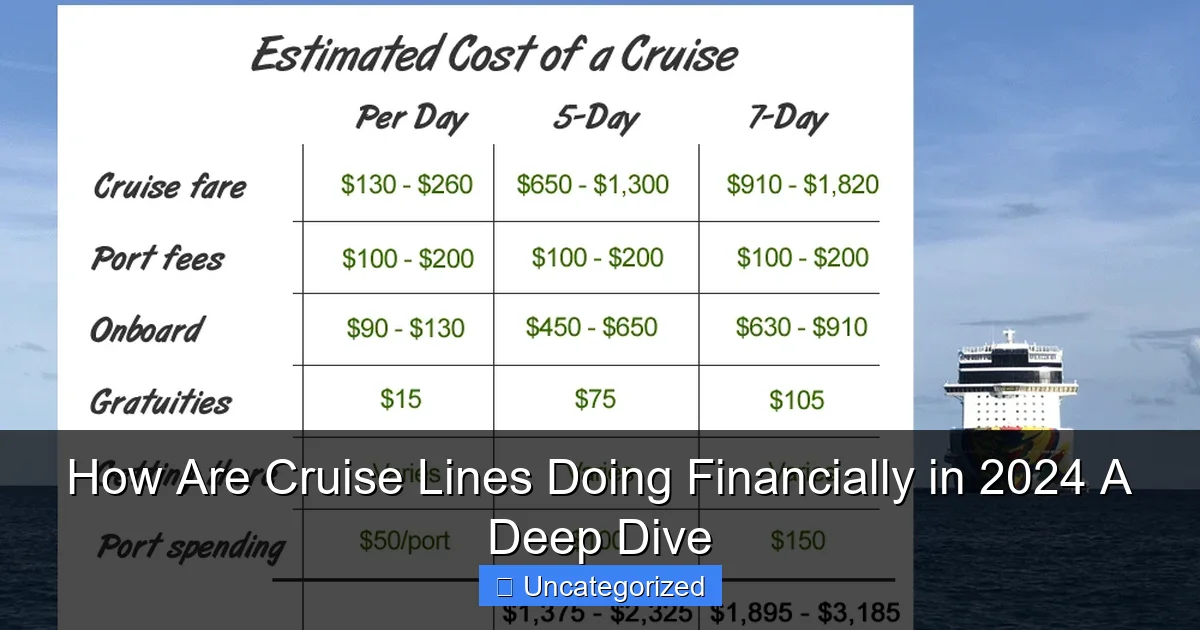

Visual guide about how are cruise lines doing financially

Image source: cruzely.com

To survive, cruise lines turned to emergency financing. They issued high-yield bonds, secured government-backed loans, and sold non-core assets. Norwegian Cruise Line, for instance, raised over $3.5 billion in capital through a mix of equity and debt offerings. While these measures prevented bankruptcy, they came at a cost: ballooning debt loads that would take years to pay down.

2023–2024: The Turnaround Begins

By 2023, the tide began to turn. With health protocols refined, vaccination rates high, and consumer confidence returning, cruise lines restarted operations across all regions. According to the Cruise Lines International Association (CLIA), global cruise capacity reached 85% of pre-pandemic levels by Q4 2023, with full recovery expected by mid-2024. This resurgence translated into improved financials.

In its Q1 2024 earnings report, Carnival Corporation reported a net income of $303 million, its first profitable quarter since 2019. Royal Caribbean Group followed suit, posting a net income of $361 million in the same period. Norwegian Cruise Line Holdings, though still reporting a loss of $152 million in Q1 2024, showed a 60% reduction in losses compared to Q1 2023. These figures signal a clear shift from survival to growth.

Practical Tip: For investors and analysts, tracking quarterly earnings reports and booking lead indicators (such as advance bookings and yield growth) is crucial. The 12–18 month booking window for cruises allows companies to forecast revenue with high accuracy, making forward-looking statements a reliable barometer of financial health.

2. Revenue Drivers: Bookings, Pricing, and Ancillary Income

Strong Demand and Premium Pricing

One of the most encouraging signs for cruise lines in 2024 is the strength of consumer demand. After years of pent-up travel desire, cruisers are booking longer, more expensive itineraries. According to CLIA’s 2024 State of the Industry report, 87% of past cruisers are planning to sail again within the next two years, with 35% opting for premium or luxury segments.

This demand surge has allowed cruise lines to implement aggressive pricing strategies. Carnival reported a 15% year-over-year increase in net revenue per passenger cruise day (RPC)** in Q1 2024. Royal Caribbean saw a 12% rise, driven by higher ticket prices and strong on-board spending. Norwegian Cruise Line reported a 10% increase in RPC, despite higher fuel and labor costs.

Notably, premium cruise lines like Viking and Regent Seven Seas are leading the charge in high-margin bookings. Viking, which went public in 2023, reported a 22% increase in average ticket price in 2024, with occupancy rates exceeding 95% on most voyages.

Ancillary Revenue: The Hidden Profit Engine

While ticket sales remain the primary revenue source, cruise lines are increasingly relying on ancillary income—spending on board ships. This includes specialty dining, spa services, excursions, alcohol, Wi-Fi, and retail. In 2023, ancillary revenue accounted for approximately 30% of total cruise revenue across major operators, up from 22% in 2019.

Royal Caribbean’s “Perfect Day” model—where guests pay for private beaches, water parks, and exclusive experiences—generated over $1.2 billion in 2023. Carnival’s “Carnival Adventures” program, which bundles excursions with premium dining and drink packages, saw a 40% uptake in 2024. Norwegian Cruise Line’s “Free at Sea” promotion, offering free drinks, Wi-Fi, and specialty dining, has boosted onboard spending by 18% year-over-year.

Practical Tip: For cruisers, understanding how ancillary packages work can save money. For example, buying a beverage package upfront often costs less than paying per drink on board. However, for cruise lines, these packages lock in revenue early and increase guest satisfaction, creating a win-win.

3. Debt Management: Balancing Survival with Sustainability

The Debt Mountain: A Lingering Challenge

Despite improved earnings, cruise lines still carry massive debt loads. Carnival’s total debt stood at $27.4 billion as of Q1 2024, down from a peak of $31 billion in 2022 but still far above its $12 billion pre-pandemic level. Royal Caribbean’s debt was $15.8 billion, and Norwegian’s reached $6.2 billion. These figures represent a significant financial burden, with interest expenses consuming a large portion of operating income.

In Q1 2024, Carnival paid $412 million in interest, Royal Caribbean $287 million, and Norwegian $118 million. While these numbers are down from 2022 peaks (Carnival paid $580 million in Q1 2022), they still represent a drag on profitability.

Refinancing and Debt Reduction Strategies

To address this, cruise lines are aggressively refinancing high-interest debt. Carnival, for example, issued $2.3 billion in new bonds in early 2024 at an average interest rate of 5.8%, replacing older debt with rates as high as 11%. This move is expected to save the company over $150 million in annual interest expenses.

Royal Caribbean has taken a more aggressive approach, using strong cash flow from operations to pay down debt. In Q1 2024, the company reduced its net debt by $600 million. Norwegian Cruise Line has focused on asset sales, including the sale of two older ships for $350 million, with proceeds used to reduce leverage.

Additionally, cruise lines are extending debt maturities. By pushing repayment deadlines to 2027–2030, they gain breathing room to reinvest in new ships and technology without immediate cash pressure.

Practical Tip: Investors should monitor debt-to-equity ratios and interest coverage ratios. A declining debt-to-EBITDA ratio (e.g., Carnival’s dropped from 18x in 2021 to 6.5x in 2024) is a strong indicator of improving financial health.

4. Operational Costs: Navigating Inflation and Supply Chain Pressures

Fuel, Labor, and Inflation: The Cost Triad

While demand is strong, cruise lines face rising operational costs. Fuel remains the largest expense, accounting for 10–15% of total costs. In 2024, average marine fuel (bunker) prices hover around $650–$700 per metric ton, up 12% from 2023. To mitigate this, operators are investing in fuel-efficient technologies. Royal Caribbean’s new Icon of the Seas, launching in 2024, features LNG propulsion, reducing carbon emissions by 20% and cutting fuel costs by 15% compared to conventional ships.

Labor costs are also rising. With a global crew shortage and increased demand for skilled staff, wages have climbed 8–10% across the industry. Carnival has launched a “Crew First” initiative, offering better pay, training, and career advancement to retain talent.

Inflation in food, supplies, and maintenance has added 5–7% to operating expenses. To offset this, cruise lines are renegotiating supplier contracts and adopting predictive maintenance systems to reduce downtime and repair costs.

Supply Chain Resilience and Onboard Efficiency

The pandemic exposed vulnerabilities in cruise supply chains. Delays in spare parts, food, and medical supplies disrupted operations. In response, companies are building regional distribution hubs. Carnival now operates logistics centers in Miami, Singapore, and Barcelona, reducing lead times by 30%.

Onboard, cruise lines are using data analytics to optimize inventory and staffing. Norwegian Cruise Line’s “Smart Ship” program uses AI to predict demand for restaurants, excursions, and housekeeping, reducing waste and improving guest satisfaction.

Practical Tip: For cruisers, understanding that higher prices may reflect genuine cost increases—not just greed—can help manage expectations. However, cruise lines must balance cost recovery with value to avoid alienating customers.

5. Strategic Investments: New Ships, Sustainability, and Digital Transformation

The New Ship Arms Race

Cruise lines are investing heavily in new vessels to attract customers and improve efficiency. In 2024, over 20 new ships are scheduled to launch, including Royal Caribbean’s Icon of the Seas (the world’s largest cruise ship at 250,800 GT), Carnival’s Celebration Key (a private island resort), and Norwegian’s Prima Plus-class ships.

These investments are not cheap. Icon of the Seas cost an estimated $2 billion. However, they offer long-term payoffs: higher capacity, better amenities, and improved fuel efficiency. Carnival’s Celebration Key is expected to generate $150 million in annual revenue from shore excursions and private island experiences.

Green Cruising: A Financial and Regulatory Imperative

Sustainability is no longer optional. The International Maritime Organization (IMO) has set a goal to reduce carbon emissions by 40% by 2030 and 70% by 2050. To meet these targets, cruise lines are investing in LNG, hydrogen fuel cells, and shore power connections.

Royal Caribbean has committed $2.5 billion to sustainability initiatives through 2025, including LNG-powered ships and zero-waste programs. Carnival’s “Green Cruising” strategy aims for net-zero emissions by 2050, with interim targets of 40% reduction by 2030.

These efforts are not just about compliance—they’re a selling point. A 2023 survey by Booking.com found that 73% of travelers prefer eco-friendly cruise options, even if they cost more.

Digital Innovation: Enhancing the Guest Experience

Cruise lines are embracing digital transformation to improve operations and guest satisfaction. Royal Caribbean’s “Wanderlust” app allows guests to book excursions, order food, and access real-time ship maps. Carnival’s “MedallionClass” uses wearable tech to enable touchless boarding, personalized service, and keyless stateroom entry.

These technologies reduce staffing needs, improve efficiency, and create new revenue streams. For example, targeted in-app promotions for spa services or specialty dining have increased onboard spending by 12–15%.

6. Regional Performance and Market Diversification

North America: The Recovery Engine

The North American market remains the largest and most profitable for cruise lines. In 2024, U.S. and Canadian ports accounted for 58% of global cruise capacity. The Caribbean, Bahamas, and Alaska are the top destinations, with Alaska bookings up 25% year-over-year due to renewed interest in nature-based travel.

Carnival’s U.S.-based brands (Carnival, Princess, Holland America) reported a 17% increase in revenue in Q1 2024. Royal Caribbean’s “Perfect Day at CocoCay” in the Bahamas has become a major profit center, with over 1 million guests in 2023.

Europe and Asia: Growth and Challenges

Europe is rebounding, with Mediterranean and Northern Europe routes seeing strong demand. However, geopolitical tensions (e.g., the Ukraine war, Red Sea conflicts) have disrupted itineraries. Royal Caribbean has rerouted ships from the Red Sea to the Caribbean, incurring $80 million in additional costs in Q1 2024.

Asia remains a mixed picture. While China’s borders have reopened, cruise demand is still below pre-pandemic levels. Norwegian Cruise Line has reduced its Asia deployment from 15% to 5% of capacity in 2024, shifting focus to North America and Europe. However, long-term growth potential in India, Southeast Asia, and South Korea is high.

Data Table: Regional Revenue Contribution (2024 Q1)

| Region | Revenue Share | Year-over-Year Growth | Key Markets |

|---|---|---|---|

| North America | 58% | +16% | Caribbean, Alaska, Bahamas |

| Europe | 25% | +11% | Mediterranean, Northern Europe |

| Asia-Pacific | 12% | +3% | Australia, Japan, South Korea |

| Other | 5% | +8% | South America, Middle East |

Conclusion: Sailing Toward a Brighter Horizon

The financial health of cruise lines in 2024 reflects a remarkable turnaround from the darkest days of the pandemic. With strong demand, rising prices, and improved operational efficiency, major operators are posting profits for the first time in years. Debt remains a challenge, but aggressive refinancing and cash flow generation are paving the way for long-term stability.

Looking ahead, the industry’s success will depend on its ability to balance growth with sustainability, innovation with affordability, and global reach with regional agility. The rise of digital tools, green technologies, and premium experiences suggests that cruise lines are not just recovering—they’re reinventing themselves for a new era of travel.

For consumers, the message is clear: cruising is back, and it’s better than ever. For investors, the sector offers cautious optimism, with valuations still below pre-pandemic highs and significant upside potential. And for the industry itself, 2024 may be remembered as the year the cruise ship finally turned the corner—navigating not just toward profitability, but toward a more resilient, responsible, and exciting future.

As we look to the horizon, one thing is certain: the financial voyage of cruise lines is far from over. But with the wind at their backs and a clear course set, they’re finally sailing in the right direction.

Frequently Asked Questions

How are cruise lines doing financially in 2024 compared to pre-pandemic levels?

Most major cruise lines, including Carnival, Royal Caribbean, and Norwegian, have returned to profitability in 2024, with revenues surpassing 2019 levels due to strong demand and higher ticket prices. However, lingering debt from pandemic-era borrowing continues to impact net margins.

Are cruise lines still struggling with debt after the pandemic?

Yes, many cruise lines are still managing high debt loads accumulated during the pandemic, though aggressive cost-cutting and refinancing have improved liquidity. For example, Carnival reduced its net debt by 15% in early 2024 through equity raises and asset sales.

What financial metrics show cruise line recovery in 2024?

Key indicators like occupancy rates (now averaging 105-110% for major lines), onboard spending, and yield growth confirm recovery. The keyword “cruise line financial recovery” reflects improving EBITDA margins, with Royal Caribbean reporting a 30% year-over-year increase.

How are rising fuel and labor costs affecting cruise line profitability?

Higher fuel and labor expenses have squeezed margins, but cruise lines are mitigating this with dynamic pricing, energy-efficient ships, and automation. These efforts have kept operating costs below 2022 peaks despite inflation pressures.

Which cruise lines are outperforming others financially in 2024?

Royal Caribbean and Norwegian lead in revenue growth and stock performance, while Carnival lags slightly due to higher debt costs. Luxury lines like Viking are also thriving with premium pricing strategies.

Is the cruise industry’s financial outlook positive for 2024-2025?

Analysts project sustained growth, with booking trends and new ship orders signaling confidence. The keyword “cruise line financial outlook” aligns with forecasts of 5-7% annual revenue growth through 2025, barring economic downturns.