Featured image for does norwegian cruise line pay dividends

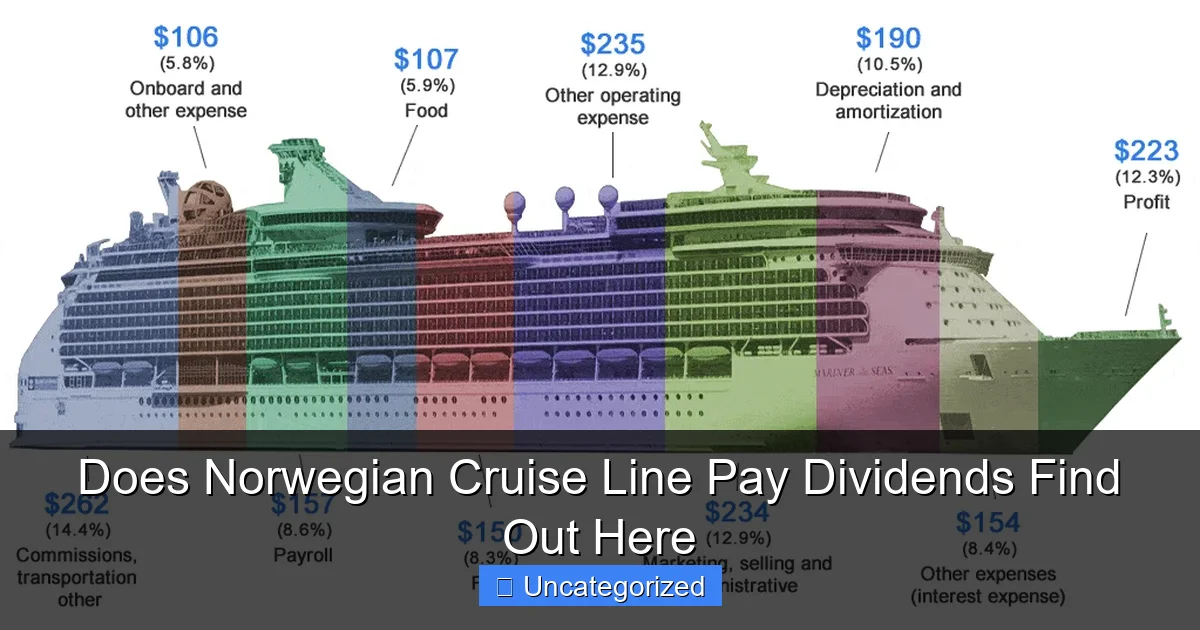

Image source: cruzely.com

Norwegian Cruise Line does not currently pay dividends, as the company has suspended its dividend program since 2020 to prioritize debt reduction and recovery post-pandemic. Investors seeking income may want to consider alternative cruise stocks, as NCL focuses on long-term growth and balance sheet strength over shareholder payouts.

Key Takeaways

- NCL suspended dividends in 2020 due to pandemic-related financial strain.

- No dividends paid since 2020 despite gradual recovery in operations.

- Reinstatement unlikely soon as NCL prioritizes debt reduction.

- Monitor earnings reports for signs of improved cash flow stability.

- Check investor presentations for management’s latest dividend outlook.

- Focus on long-term growth over short-term shareholder payouts now.

📑 Table of Contents

- Does Norwegian Cruise Line Pay Dividends? Find Out Here

- Understanding Norwegian Cruise Line’s Dividend History

- Current Financial Health and Dividend Capacity

- Norwegian Cruise Line vs. Industry Peers: Dividend Comparison

- When Might Norwegian Cruise Line Pay Dividends?

- Investor Strategies: Should You Wait for Norwegian’s Dividend?

- Conclusion: The Dividend Future of Norwegian Cruise Line

Does Norwegian Cruise Line Pay Dividends? Find Out Here

Norwegian Cruise Line Holdings Ltd. (NCLH), one of the world’s leading cruise operators, has long been a subject of interest for investors seeking exposure to the travel and leisure sector. With its fleet of innovative ships, global itineraries, and strong brand recognition, the company attracts attention not only for its operational performance but also for its potential to generate shareholder returns. One of the most common questions investors ask is: does Norwegian Cruise Line pay dividends? This question is especially relevant in today’s economic climate, where income-generating investments are increasingly sought after. While the company’s stock has shown volatility—particularly during global disruptions like the pandemic—understanding its dividend policy is essential for making informed investment decisions.

The cruise industry, including Norwegian Cruise Line, operates on a capital-intensive model, requiring substantial investment in new ships, maintenance, fuel, and labor. Historically, many cruise companies have prioritized reinvestment over dividend payouts to sustain growth and modernize their fleets. However, the financial health of Norwegian Cruise Line and its ability to generate free cash flow post-pandemic have reignited discussions about whether the company might resume or initiate dividend payments. In this comprehensive guide, we’ll explore Norwegian Cruise Line’s dividend history, current financial standing, future outlook, and how it compares to industry peers. Whether you’re a long-term investor, a dividend-focused portfolio manager, or simply curious about cruise line stocks, this article will provide the insights you need to understand the dividend potential of NCLH.

Understanding Norwegian Cruise Line’s Dividend History

A Look Back: Dividend Payments Before 2020

Norwegian Cruise Line Holdings Ltd., which operates the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands, has a complex dividend history. Unlike some mature companies that consistently reward shareholders with regular payouts, NCLH has never paid a traditional cash dividend to common stockholders since its IPO in 2013. Prior to the pandemic, the company focused on growth through fleet expansion, brand diversification, and market penetration. Instead of returning cash to shareholders via dividends, Norwegian Cruise Line reinvested its profits into new ships, onboard amenities, and technology upgrades.

Visual guide about does norwegian cruise line pay dividends

Image source: cruiseindustrynews.com

For example, in the years leading up to 2019, Norwegian invested heavily in its Pride of America refurbishments, the launch of the Norwegian Encore, and the development of its next-generation Prima-class ships. These capital expenditures, while essential for long-term competitiveness, limited the availability of excess cash for dividends. As a result, investors were primarily rewarded through capital appreciation rather than income. The stock price rose steadily from its 2013 IPO of $19 to over $50 in 2018, reflecting strong operational performance and investor confidence.

The Pandemic Pause: Dividends Suspended and Financial Strain

The onset of the global pandemic in 2020 brought unprecedented challenges to the cruise industry. With global sailings halted for over a year, Norwegian Cruise Line faced a severe liquidity crisis. The company suspended all operations, furloughed staff, and raised billions in debt and equity to survive. During this period, any discussion of dividends was effectively shelved.

In 2020 and 2021, Norwegian Cruise Line did not pay any dividends, nor did it issue any formal dividend policy. The company’s focus shifted entirely to survival, debt management, and securing government relief. For instance, in 2020, NCLH raised approximately $2.4 billion through a mix of convertible notes, preferred stock, and common stock offerings. These funds were used to cover operating expenses, debt service, and restart costs—not to return capital to shareholders.

Post-Pandemic Recovery and Dividend Speculation

As global travel resumed in 2022 and 2023, Norwegian Cruise Line began a robust recovery. The company reported record-breaking booking volumes, strong onboard spending, and improved revenue per passenger. Despite this recovery, the company has not resumed dividend payments as of mid-2024. In fact, management has consistently emphasized that capital allocation priorities remain focused on:

- Reducing leverage and strengthening the balance sheet

- Funding new ship deliveries and fleet modernization

- Maintaining operational flexibility in uncertain markets

This strategic focus suggests that dividends are not currently on the agenda. However, as profitability improves and debt levels decline, dividend discussions may resurface in investor calls and earnings reports.

Current Financial Health and Dividend Capacity

Revenue Growth and Profitability Trends

To assess whether Norwegian Cruise Line can pay dividends, it’s essential to evaluate its current financial health. As of Q1 2024, Norwegian Cruise Line reported total revenue of $2.2 billion, a 35% increase year-over-year. Adjusted EBITDA reached $420 million, and net income turned positive for the first time since 2019. These figures indicate a strong recovery in core operations and pricing power.

The company’s occupancy rates have rebounded to over 100% (due to onboard spending and premium cabins), and average ticket prices have increased by 15–20% compared to pre-pandemic levels. This pricing strength, combined with cost-saving initiatives, has improved margins. For example, net cruise costs (excluding fuel) decreased by 8% in 2023 due to operational efficiencies and digital transformation.

Debt Levels and Cash Flow Position

One of the biggest barriers to dividend payments is Norwegian Cruise Line’s high debt load. At the end of Q1 2024, the company had total debt of approximately $12.8 billion, with a debt-to-equity ratio of 5.3x—significantly higher than pre-pandemic levels. While this ratio has improved from a peak of over 10x in 2021, it remains a concern for dividend sustainability.

Free cash flow (FCF) is another critical metric. In 2023, Norwegian generated $1.1 billion in FCF, a dramatic improvement from a $3.2 billion cash burn in 2020. However, a large portion of this FCF is allocated to:

- Debt repayment (over $1.5 billion in 2023)

- Capital expenditures (~$1.8 billion for new ships and retrofits)

- Interest payments (~$600 million annually)

Given these commitments, only a small fraction of FCF is available for potential dividends. For instance, if Norwegian were to pay a modest $200 million dividend, it would consume nearly 18% of its 2023 FCF—without accounting for future capex needs.

Dividend Payout Ratio and Industry Benchmarks

While Norwegian Cruise Line has no dividend, it’s helpful to compare its financial metrics to companies that do pay dividends. A healthy dividend payout ratio (dividends as a percentage of net income) for stable companies is typically below 50%. For capital-intensive industries like shipping or transportation, payout ratios are often lower, around 20–30%.

Norwegian’s current net income (~$400 million in 2023) could theoretically support a $100–$150 million annual dividend (25–37.5% payout ratio). However, management has indicated that reinvestment and deleveraging take precedence. In earnings calls, CEO Harry Sommer stated: “Our primary goal is to restore financial flexibility and reduce leverage to pre-pandemic levels before considering any form of shareholder returns.”

Norwegian Cruise Line vs. Industry Peers: Dividend Comparison

Dividend Policies of Major Cruise Lines

To understand Norwegian Cruise Line’s position, it’s useful to compare its dividend approach with its two largest competitors: Carnival Corporation (CCL) and Royal Caribbean Group (RCL). Both companies have similar capital structures and faced identical pandemic challenges, but their dividend policies differ.

| Company | Dividend History | Last Dividend Paid | Current Dividend Yield | Debt-to-Equity (2024) |

|---|---|---|---|---|

| Norwegian Cruise Line (NCLH) | Never paid a cash dividend | N/A | 0.00% | 5.3x |

| Carnival Corporation (CCL) | Suspended in 2020; resumed in 2023 | Q1 2024 ($0.10/share) | 2.8% | 4.1x |

| Royal Caribbean Group (RCL) | Suspended in 2020; resumed in 2023 | Q2 2024 ($0.70/share) | 3.1% | 3.9x |

This table shows a clear trend: both Carnival and Royal Caribbean have resumed dividend payments in 2023–2024, with modest yields. Their lower debt-to-equity ratios (below 4.5x) suggest stronger balance sheets, enabling them to return capital to shareholders earlier than Norwegian.

Why Has Norwegian Lagged Behind?

Several factors explain why Norwegian Cruise Line has not followed suit:

- Higher leverage: NCLH’s debt-to-equity ratio remains above 5x, compared to ~4x for peers.

- Larger capex commitments: Norwegian is in the midst of a $5.5 billion shipbuilding program, including the Norwegian Prima and Aurora class vessels, due between 2024 and 2027.

- Preferred stock obligations: NCLH issued $1.1 billion in 9% cumulative preferred stock in 2020. These shares must be redeemed or paid dividends before common stockholders can receive any payout.

For example, the preferred stock accrues $99 million in annual dividends. Until these obligations are settled, Norwegian cannot legally pay dividends to common shareholders without breaching terms.

Investor Expectations and Market Perception

The absence of dividends has affected Norwegian Cruise Line’s appeal to income investors. While growth investors may still favor NCLH for its recovery potential, dividend-focused funds often overlook the stock. This is reflected in its lower institutional ownership (68%) compared to Carnival (72%) and Royal Caribbean (75%).

However, the lack of dividends has not deterred all investors. Some view Norwegian as a high-growth turnaround story with upside potential. If the company can reduce debt below 3x and generate consistent FCF, a dividend initiation could act as a powerful catalyst for stock revaluation.

When Might Norwegian Cruise Line Pay Dividends?

Management’s Stated Priorities

Norwegian Cruise Line’s executive team has been transparent about its capital allocation strategy. In recent earnings calls and investor presentations, management has outlined a three-phase recovery plan:

- Phase 1 (2020–2022): Survival and liquidity preservation

- Phase 2 (2023–2025): Profitability restoration and deleveraging

- Phase 3 (2026 and beyond): Strategic reinvestment and shareholder returns

According to CFO Mark Kempa, Phase 3 will include “a review of capital return options, including dividends and share buybacks.” This timeline suggests that dividend consideration is unlikely before 2026.

Key Milestones to Watch

Investors should monitor several indicators to assess dividend potential:

- Debt reduction: A debt-to-equity ratio below 3x would signal balance sheet strength.

- Preferred stock redemption: NCLH plans to redeem its 9% preferred stock by 2026. This would remove a major legal barrier to common dividends.

- Consistent FCF generation: Sustained free cash flow above $1.5 billion annually would provide flexibility for dividends.

- Earnings stability: Quarterly net income above $200 million for four consecutive quarters would demonstrate profitability.

For example, if Norwegian achieves $1.8 billion in FCF in 2025 and reduces debt to $9 billion, it could comfortably allocate 20% (~$360 million) to dividends while still funding capex and interest.

Potential Dividend Structure and Yield

If Norwegian initiates dividends, analysts speculate it may start with a modest quarterly payout of $0.10–$0.15 per share, translating to an annual dividend of $0.40–$0.60. At a stock price of $20, this would equate to a yield of 2–3%—in line with Carnival and Royal Caribbean.

Such a dividend would signal confidence in long-term profitability and attract income-focused investors. However, it would also need to be sustainable. Norwegian may adopt a progressive dividend policy, increasing payouts gradually as debt falls and margins expand.

Investor Strategies: Should You Wait for Norwegian’s Dividend?

Pros and Cons of Investing Without Dividends

Investing in Norwegian Cruise Line without dividends involves trade-offs:

Pros:

- High growth potential: The stock has rebounded from $5 in 2020 to over $20 in 2024, offering strong capital gains.

- Industry tailwinds: Rising demand for experiential travel and cruise vacations supports long-term growth.

- Future dividend upside: A dividend initiation could trigger a re-rating of the stock.

Cons:

- No current income: Investors seeking regular cash flow must look elsewhere.

- Execution risk: Delays in debt reduction or capex overruns could push dividend timelines further.

- Market volatility: Cruise stocks remain sensitive to economic cycles and fuel prices.

Tips for Dividend-Focused Investors

If you’re interested in Norwegian Cruise Line but prioritize income, consider these strategies:

- Pair with dividend stocks: Allocate a portion of your portfolio to Norwegian for growth and to dividend-paying cruise stocks (e.g., RCL, CCL) for income.

- Monitor earnings calls: Pay attention to management’s comments on capital returns. Phrases like “reviewing shareholder returns” or “assessing dividend feasibility” are positive signals.

- Set price alerts: If Norwegian announces a dividend, the stock may rally. Set alerts to avoid missing entry points.

- Consider preferred shares: While not common stock, Norwegian’s preferred shares offer a 9% yield, though with higher risk.

Long-Term Outlook and Portfolio Fit

Norwegian Cruise Line is best suited for growth-oriented investors with a 3–5 year horizon. The company’s recovery trajectory, brand strength, and fleet modernization position it well for long-term success. While dividends are not imminent, the potential for future payouts adds an extra layer of appeal.

For conservative investors, waiting for a clear dividend policy or a debt reduction milestone (e.g., debt-to-equity < 3x) may be prudent. For aggressive investors, buying now could offer both capital appreciation and eventual dividend income.

Conclusion: The Dividend Future of Norwegian Cruise Line

So, does Norwegian Cruise Line pay dividends? The straightforward answer is: not yet. As of mid-2024, Norwegian Cruise Line Holdings Ltd. has never paid a cash dividend to common shareholders, and there is no active dividend program in place. The company continues to prioritize balance sheet repair, debt reduction, and fleet investment over shareholder income.

However, the outlook is not entirely bleak. Norwegian’s strong recovery, improving profitability, and clear capital allocation roadmap suggest that dividends could become a reality by 2026 or 2027. The redemption of preferred stock, declining leverage, and sustained free cash flow will be key catalysts. When—and if—dividends are initiated, they are likely to start modestly, with a yield in the 2–3% range, aligning with industry peers.

For investors, the decision to buy Norwegian Cruise Line stock should not hinge solely on current dividend income. Instead, focus on the company’s long-term fundamentals: its brand appeal, operational efficiency, and growth potential. If management delivers on its deleveraging goals and maintains profitability, a dividend initiation could serve as a powerful endorsement of financial health and a magnet for new investors.

In the meantime, monitor Norwegian Cruise Line’s quarterly results, debt levels, and management commentary. The path to dividends may be slow, but for patient investors, the journey could be rewarding—both in terms of capital gains and, eventually, income. As the cruise industry sails into calmer waters, Norwegian may finally be ready to share its profits with those who believed in its comeback.

Frequently Asked Questions

Does Norwegian Cruise Line pay dividends to its shareholders?

No, Norwegian Cruise Line (NCLH) does not currently pay dividends. The company has suspended dividend payments since 2020, prioritizing debt reduction and recovery post-pandemic.

Why doesn’t Norwegian Cruise Line pay dividends right now?

NCLH halted dividends to conserve cash during the COVID-19 downturn, focusing on operational stability and reducing its heavy debt load. The cruise industry’s volatility makes dividend resumption unlikely in the near term.

Will Norwegian Cruise Line resume dividend payments in the future?

While possible long-term, there’s no official timeline for NCLH to reinstate dividends. Investors should monitor financial performance and industry recovery, as dividends depend on sustained profitability and cash flow.

What is the dividend history of Norwegian Cruise Line?

Norwegian Cruise Line paid its first and only dividend in 2019 (a $0.25 quarterly per share) before suspending it in 2020. The Norwegian Cruise Line dividend history reflects its focus on growth over shareholder returns.

How does NCLH compare to other cruise lines regarding dividends?

Unlike Carnival (CCL), which resumed token dividends in 2023, NCLH and Royal Caribbean (RCL) have not reinstated payouts. The Norwegian Cruise Line dividend policy aligns with peers prioritizing balance sheet repair.

Should I invest in Norwegian Cruise Line for dividend income?

NCLH is not a suitable choice for dividend investors currently, as it lacks active payouts. Consider the stock only for growth potential, given its high-risk, high-reward nature in the travel sector.