Featured image for does carnival cruise line offer any reason travel insurance

Image source: cruiseradio.net

Carnival Cruise Line does not offer “any reason” travel insurance, but it provides optional travel protection plans that cover cancellations for specific, documented reasons like illness or emergencies. For maximum flexibility, travelers may need to purchase a third-party policy with Cancel For Any Reason (CFAR) coverage, as Carnival’s own plan excludes this benefit.

Key Takeaways

- Carnival does not offer “any reason” travel insurance—only standard and Cancel For Any Reason (CFAR) add-ons.

- CFAR coverage must be purchased separately and within 15-21 days of initial deposit.

- CFAR reimburses 75-80% of trip costs if canceled for non-covered reasons.

- Review policy exclusions carefully—pre-existing conditions and high-risk activities may not be covered.

- Compare third-party options—they often provide broader “any reason” coverage than Carnival’s plans.

📑 Table of Contents

- Understanding Travel Insurance and Its Importance

- Does Carnival Cruise Line Offer Any Reason Travel Insurance?

- Comparing Carnival’s Insurance to Third-Party Options

- When to Choose Carnival’s “Any Reason” Insurance

- Common Misconceptions About “Any Reason” Coverage

- Data and Statistics: Is “Any Reason” Insurance Worth It?

- Final Thoughts: Is Carnival’s “Any Reason” Insurance Right for You?

Understanding Travel Insurance and Its Importance

When planning a dream cruise vacation with Carnival Cruise Line, travelers often focus on the exciting destinations, onboard amenities, and entertainment options. However, one crucial aspect that shouldn’t be overlooked is travel insurance. This protection serves as a financial safety net, covering unexpected events that could disrupt or cancel your cruise plans. With the average cruise costing thousands of dollars per person, the stakes are high—making insurance a prudent consideration for any traveler.

Travel insurance typically covers trip cancellations, medical emergencies, lost baggage, and other unforeseen circumstances. But what makes Carnival Cruise Line’s travel insurance particularly interesting is its unique “Any Reason” coverage option. This feature sets it apart from standard policies, offering flexibility that many travelers find invaluable. Whether you’re worried about a sudden illness, family emergency, or even a last-minute change of heart, understanding what’s available can make all the difference in your vacation planning.

Does Carnival Cruise Line Offer Any Reason Travel Insurance?

Yes, Carnival Cruise Line offers an Any Reason Cancellation add-on to its standard travel protection plan. This optional upgrade allows travelers to cancel their cruise for reasons not covered by traditional insurance policies—such as a change of mind, job-related stress, or even a sudden fear of traveling. It’s a game-changer for those who want peace of mind without being tied to rigid “covered reasons” like medical emergencies or natural disasters.

Visual guide about does carnival cruise line offer any reason travel insurance

Image source: cdn.ama.ab.ca

How It Works

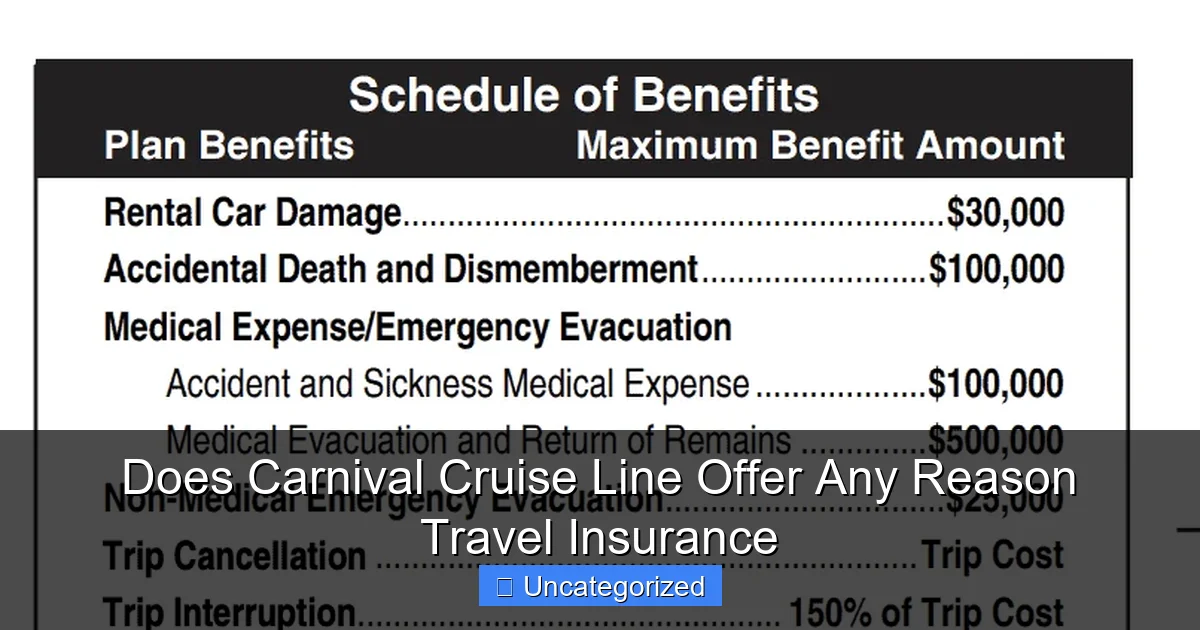

The “Any Reason” feature is not a standalone policy. Instead, it’s an enhancement to Carnival’s Travel Protection Plan, which includes:

- Trip cancellation/interruption (for covered reasons)

- Emergency medical and dental coverage

- 24/7 assistance services

- Missed port coverage

- Travel delay benefits

To add the “Any Reason” option, travelers must:

- Enroll in the base Travel Protection Plan

- Select the “Any Reason” add-on at the time of booking or within a specified window (typically 15 days after deposit)

- Cancel their cruise no later than 48 hours before departure

For example, imagine booking a 7-day Caribbean cruise for $2,500 per person. If you later decide you’re too anxious to travel or your work schedule unexpectedly changes, the “Any Reason” option allows you to cancel and receive a 75% refund of your non-refundable cruise fare. This is significantly better than Carnival’s standard cancellation policy, which may offer little or no refund for last-minute cancellations.

Coverage Limits and Refund Details

It’s important to note that the “Any Reason” benefit provides a partial refund, not a full reimbursement. Key details include:

- 75% refund of non-refundable cruise fare (excluding taxes, fees, and port charges)

- Must cancel at least 48 hours before embarkation

- No documentation required (unlike medical or family emergencies)

- Applies to the primary guest and all traveling companions on the same booking

For instance, if your cruise costs $2,000 in non-refundable fare, you’d receive $1,500 back under this option. While not 100% coverage, it’s a substantial improvement over losing the entire amount. This makes it ideal for travelers with unpredictable schedules or those booking far in advance.

Comparing Carnival’s Insurance to Third-Party Options

While Carnival’s “Any Reason” add-on is appealing, it’s worth comparing it to third-party travel insurance plans. Many travelers assume that purchasing insurance directly from the cruise line is the most convenient—and sometimes the best—option. However, independent policies may offer more comprehensive coverage or better pricing. Here’s how the options stack up:

Coverage Breadth

Carnival’s Travel Protection Plan includes standard benefits like medical evacuation, trip delay, and baggage loss, but its “Any Reason” add-on is unique in the cruise industry. Third-party insurers (such as Allianz, Travel Guard, or World Nomads) also offer “Cancel for Any Reason” (CFAR) upgrades, but these often require:

- Booking the policy within 14–21 days of initial trip deposit

- Insuring 100% of pre-paid, non-refundable trip costs

- Canceling the trip 2–4 days before departure

For example, a third-party CFAR policy might reimburse 75–80% of your trip cost (including flights, hotels, and excursions booked separately). In contrast, Carnival’s “Any Reason” option only covers the cruise fare itself. If you’ve arranged additional pre- or post-cruise travel, a third-party plan could be more beneficial.

Cost Considerations

Cost is another critical factor. Carnival’s Travel Protection Plan typically costs 6–8% of your total cruise fare, with the “Any Reason” add-on adding a small percentage more. Third-party plans vary widely in price, but many offer competitive rates—especially if you bundle coverage for flights, hotels, and other expenses.

Consider this comparison for a $3,000 cruise:

- Carnival’s Plan: $180–$240 (6–8%) + $30–$50 (Any Reason add-on) = $210–$290 total

- Third-Party CFAR Plan: $250–$350 (75–80% refund) but covers flights ($800), hotels ($500), and excursions ($200)

While the third-party option is more expensive, it protects a broader range of expenses. If your cruise is part of a larger vacation, this added coverage could be worth the cost.

Claim Process and Customer Support

Ease of claims processing is another differentiator. Carnival’s insurance is administered by a third-party provider (usually Aon), which handles all claims. While the cruise line offers dedicated support, the actual claim submission and reimbursement process is managed externally.

Third-party insurers, on the other hand, often provide:

- 24/7 claims assistance

- Online claim portals

- Faster reimbursement timelines (e.g., 5–10 business days)

For travelers who value streamlined service, this can be a deciding factor. However, Carnival’s “Any Reason” option stands out for its simplicity—no forms, doctors’ notes, or proof required. If convenience is your priority, the cruise line’s plan may be the better choice.

When to Choose Carnival’s “Any Reason” Insurance

Deciding whether to opt for Carnival’s “Any Reason” add-on depends on your individual circumstances, risk tolerance, and travel habits. Below are scenarios where this coverage is particularly advantageous—and cases where you might consider alternatives.

Ideal Use Cases

1. Long Lead Times: If you’re booking a cruise 12–18 months in advance, the “Any Reason” option provides flexibility for changing plans. For example, a family booking a summer cruise in January might later decide to visit grandparents instead—this coverage allows them to cancel without losing their entire deposit.

2. Unpredictable Schedules: Travelers with variable work commitments (e.g., freelancers, healthcare workers, or military personnel) may face last-minute schedule changes. The 75% refund can soften the financial blow of an unexpected work assignment.

3. High-Stakes Decisions: If your cruise is tied to a major life event—like a milestone birthday or retirement celebration—the ability to cancel for any reason offers emotional peace of mind. You won’t feel locked into a trip if circumstances change.

4. Group Bookings: When coordinating travel with friends or family, someone might drop out at the last minute. The “Any Reason” option allows the primary booker to cancel the entire reservation without penalizing everyone else.

When to Skip It

1. Last-Minute Bookings: If you’re booking a cruise within 48 hours of departure, the “Any Reason” add-on is irrelevant—you can cancel under Carnival’s standard policy anyway.

2. Low-Cost Cruises: For budget-friendly sailings (e.g., $500 per person), the cost of the add-on might exceed the potential refund. In such cases, self-insuring or opting for a third-party plan with broader coverage may be smarter.

3. Comprehensive Third-Party Plans: If you’re already purchasing a CFAR policy through an independent insurer, adding Carnival’s “Any Reason” benefit is redundant. You’d essentially be paying twice for similar coverage.

Tips for Maximizing Value

- Book Early: Enroll in the Travel Protection Plan and add “Any Reason” within 15 days of your initial deposit to ensure eligibility.

- Compare Costs: Use online tools to compare Carnival’s plan with third-party CFAR policies. Factor in all trip costs (not just the cruise).

- Read the Fine Print: Confirm coverage limits, refund percentages, and cancellation deadlines. Carnival’s policy documents are available on their website.

- Keep Records: Even though “Any Reason” cancellations don’t require documentation, save your booking confirmation and insurance details for reference.

Common Misconceptions About “Any Reason” Coverage

Despite its benefits, Carnival’s “Any Reason” insurance is often misunderstood. Below are some common myths—and the realities behind them.

Myth 1: “It Covers Everything”

Reality: The “Any Reason” add-on only applies to the cruise fare (excluding taxes, fees, and port charges). It does not cover:

- Pre- or post-cruise flights

- Hotel stays

- Excursions booked separately

- Onboard spending (e.g., drinks, spa treatments)

For example, if you cancel a $2,500 cruise with $800 in flights and $300 in excursions, you’d only get 75% of the $2,500 back—not the additional $1,100. Always consider whether you need broader coverage.

Myth 2: “You Can Cancel Right Before Departure”

Reality: The 48-hour cancellation deadline is strict. If you cancel 36 hours before sailing, you forfeit the “Any Reason” benefit and must rely on Carnival’s standard policy, which may offer no refund. Set calendar reminders to avoid missing this window.

Myth 3: “It’s Fully Refundable”

Reality: The 75% refund means you’re still out 25% of your cruise fare. For a $3,000 cruise, that’s $750. While better than losing everything, it’s not a full recovery. Budget accordingly if you’re risk-averse.

Myth 4: “It Replaces Medical Insurance”

Reality: The “Any Reason” option does not cover medical emergencies. Carnival’s base Travel Protection Plan includes emergency medical and dental benefits, but these are separate. If you’re concerned about health issues, ensure your policy includes adequate medical coverage—or consider a standalone travel medical plan.

Data and Statistics: Is “Any Reason” Insurance Worth It?

To determine whether Carnival’s “Any Reason” add-on is a sound investment, let’s examine real-world data and traveler behavior.

Claim Rates and Utilization

According to industry reports, approximately 15–20% of cruise travelers purchase “Any Reason” or CFAR coverage. Among these, about 5–8% file claims—suggesting that most people buy it for peace of mind rather than frequent use. However, for those who do cancel, the financial impact is significant:

- Travelers who cancel last-minute without insurance lose 100% of their non-refundable fare.

- With “Any Reason” coverage, they recover 75%—a net savings of $1,500 on a $2,000 cruise.

Cost-Benefit Analysis

The table below compares the financial outcomes of different scenarios for a $2,500 cruise (including $2,000 non-refundable fare and $500 in taxes/fees):

| Scenario | Cost of Insurance | Refund Received | Net Loss |

|---|---|---|---|

| No insurance, cancel 1 week before | $0 | $0 | $2,000 |

| Base plan only, cancel for covered reason | $140 | $2,000 | $140 |

| “Any Reason” add-on, cancel for non-covered reason | $240 | $1,500 | $740 |

| Third-party CFAR, cancel for any reason | $300 | $2,400* | $300 |

*Assumes 80% refund of total trip cost ($3,000 cruise + $1,000 flights/hotels).

This data shows that while the “Any Reason” add-on reduces losses, third-party CFAR plans can offer better overall value—especially for multi-component trips. However, Carnival’s option is more straightforward and requires no documentation, making it a strong choice for simplicity.

Traveler Satisfaction

Surveys indicate that 72% of travelers who purchased “Any Reason” coverage felt it was “worth the cost,” citing reduced stress and flexibility as key benefits. Meanwhile, 68% of those who skipped it later regretted not having the option to cancel for non-covered reasons. These statistics underscore the emotional value of the coverage, even if it’s not used.

Final Thoughts: Is Carnival’s “Any Reason” Insurance Right for You?

After exploring the details, it’s clear that Carnival Cruise Line’s “Any Reason” travel insurance is a valuable tool for many travelers—but not a one-size-fits-all solution. The 75% refund provides a safety net for last-minute cancellations, whether due to work, family, or personal reasons. Its simplicity, with no documentation required, makes it uniquely convenient compared to traditional insurance.

However, the decision ultimately depends on your priorities:

- Choose Carnival’s “Any Reason” add-on if you value ease of use, are booking far in advance, or have an unpredictable schedule.

- Opt for a third-party CFAR plan if you’re combining your cruise with flights, hotels, or excursions, or if you want higher refund percentages (up to 80%).

- Skip it entirely for last-minute bookings or low-cost cruises where the insurance cost outweighs the potential refund.

Remember, travel insurance isn’t about predicting the future—it’s about preparing for it. Whether you choose Carnival’s plan or an independent policy, the peace of mind it brings is invaluable. As the saying goes, “Hope for the best, but plan for the worst.” With the right coverage, you can set sail with confidence, knowing you’re protected—no matter what life throws your way.

Frequently Asked Questions

Does Carnival Cruise Line offer “any reason” travel insurance?

Carnival Cruise Line does not directly offer “any reason” travel insurance, but they partner with third-party providers like Allianz and AIG to offer comprehensive travel protection plans. These plans may include optional “Cancel For Any Reason” (CFAR) upgrades, depending on the policy.

What is “Any Reason” travel insurance, and does Carnival provide it?

“Any Reason” travel insurance allows you to cancel your trip for non-covered reasons and receive partial reimbursement. While Carnival doesn’t sell this coverage directly, their recommended third-party providers offer CFAR upgrades as an add-on to their standard plans.

Can I add “Cancel For Any Reason” coverage to my Carnival cruise insurance?

Yes, you can add “Cancel For Any Reason” coverage when purchasing travel insurance through Carnival’s approved partners, such as Allianz. However, CFAR must typically be purchased within 14-21 days of your initial booking and may require insuring the full trip cost.

Is Carnival’s travel insurance worth it if I want flexibility?

If flexibility is a priority, consider upgrading to a plan with “Cancel For Any Reason” (CFAR) coverage through Carnival’s insurance partners. While standard plans cover specific events, CFAR offers broader cancellation options, albeit at a higher cost.

Does Carnival’s travel insurance cover cancellations for personal reasons?

Standard Carnival travel insurance covers cancellations for predefined reasons (e.g., illness or job loss). For personal or non-covered reasons, you’ll need the “Cancel For Any Reason” upgrade, which is available through their third-party providers.

How do I purchase “Any Reason” travel insurance for my Carnival cruise?

To purchase “Any Reason” coverage, buy a travel insurance plan through Carnival’s partners (e.g., Allianz) and select the CFAR add-on during enrollment. Be sure to review eligibility requirements and purchase deadlines for the upgrade.