Featured image for did cruise lines get bailouts

Image source: globalforestcoalition.org

Cruise lines did not receive direct government bailouts during the pandemic, despite widespread rumors and media speculation. Instead, major companies like Carnival, Royal Caribbean, and Norwegian accessed capital through loans, bond offerings, and private financing—often at high interest rates—while smaller operators benefited indirectly from broader travel industry relief programs. The truth reveals a financial lifeline, not a taxpayer-funded rescue, reshaping the narrative around one of travel’s hardest-hit sectors.

Key Takeaways

- Cruise lines received indirect aid through broader pandemic relief programs, not direct bailouts.

- Taxpayer funds were not primary—most support came from loans and credit facilities.

- Government assistance was conditional, requiring job retention and financial transparency.

- Private financing played a larger role than public money in keeping cruise lines afloat.

- No major line avoided financial pain—restructuring and layoffs were widespread despite aid.

📑 Table of Contents

- The Great Bailout Debate: What You Need to Know About Cruise Lines and Government Aid

- 1. The Pandemic’s Impact on Cruise Lines: A Perfect Storm

- 2. Direct Bailouts vs. Indirect Assistance: The Legal and Financial Landscape

- 3. The Role of Tax Havens and Corporate Structures

- 4. International Aid: How Other Countries Supported Cruise Lines

- 5. The Aftermath: Recovery, Reforms, and Ongoing Scrutiny

- 6. The Bottom Line: Did Cruise Lines “Get” Bailouts?

The Great Bailout Debate: What You Need to Know About Cruise Lines and Government Aid

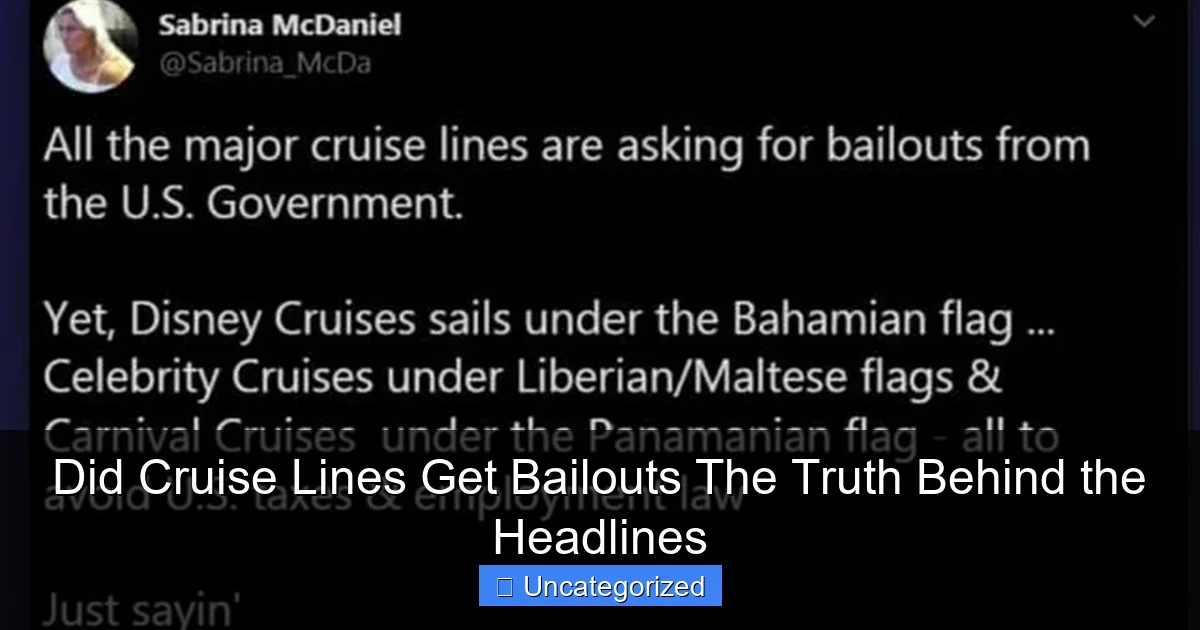

When the COVID-19 pandemic brought global travel to a screeching halt in early 2020, cruise lines found themselves in uncharted waters. With ships anchored indefinitely and billions in lost revenue, questions quickly arose: Did cruise lines get bailouts? The answer, like many aspects of the pandemic-era economy, is complicated. While cruise lines didn’t receive direct, industry-specific bailouts like airlines did, they benefited from broader relief programs, tax incentives, and indirect financial support that kept them afloat during one of the most challenging periods in their history.

This blog post dives deep into the truth behind the headlines, separating myth from reality. We’ll explore how cruise lines navigated the pandemic, the types of government assistance they accessed, and the controversies surrounding their financial survival. Whether you’re a curious traveler, a taxpayer wondering where your money went, or an industry observer, this comprehensive breakdown will equip you with the facts. By the end, you’ll understand why the answer to “Did cruise lines get bailouts?” isn’t a simple yes or no—it’s a nuanced story of survival, strategy, and public scrutiny.

1. The Pandemic’s Impact on Cruise Lines: A Perfect Storm

Financial Free Fall: Revenue Losses and Operational Shutdowns

The cruise industry, which generated $154 billion in global economic activity in 2019, faced a catastrophic collapse when the pandemic struck. By March 2020, the CDC’s No Sail Order grounded nearly all U.S.-based cruise operations, and international travel bans followed. Major players like Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings reported staggering losses:

Visual guide about did cruise lines get bailouts

Image source: imageproxy.ifunny.co

- Carnival Corporation: $10.2 billion loss in 2020.

- Royal Caribbean Group: $5.8 billion loss in 2020.

- Norwegian Cruise Line Holdings: $4 billion loss in 2020.

With ships idle and no revenue coming in, cruise lines faced existential threats. Unlike airlines, which could pivot to cargo operations, cruise ships had no alternative income streams. The industry’s reliance on high fixed costs—fuel, crew salaries, maintenance—made the shutdown financially devastating.

Public Relations Nightmares: Outbreaks and Evacuations

The pandemic also exposed the industry’s vulnerabilities. High-profile outbreaks on ships like the Diamond Princess (712 infected, 14 deaths) and Grand Princess led to global media coverage, eroding consumer confidence. Cruise lines were forced to evacuate thousands of passengers under chaotic conditions, further damaging their reputation. These events intensified public scrutiny, making any potential government aid politically sensitive.

Survival Strategies: Cost-Cutting and Debt Accumulation

To stay afloat, cruise lines took drastic measures:

- Furloughs and layoffs: Carnival laid off 12% of its U.S. workforce.

- Debt financing: Royal Caribbean raised $2.3 billion in bond offerings.

- Asset sales: Norwegian sold older ships to raise cash.

These steps bought time but didn’t address the core question: Would governments step in to help?

2. Direct Bailouts vs. Indirect Assistance: The Legal and Financial Landscape

Why Cruise Lines Didn’t Get “Traditional” Bailouts

Unlike U.S. airlines, which received $54 billion in direct payroll support under the CARES Act, cruise lines were excluded from most targeted aid. Why? Three key factors:

- Corporate structure: Major cruise companies are incorporated in foreign tax havens (e.g., Carnival is based in Panama, Royal Caribbean in Liberia). This made them ineligible for many U.S.-specific programs.

- Political optics: With outbreaks linked to cruise ships, direct aid risked public backlash.

- Industry lobbying: Cruise lines argued that aid should focus on workers, not corporations.

As a result, no cruise-specific bailout package was passed in the U.S. or most other major markets.

Indirect Relief: Accessing Broader Programs

However, cruise lines tapped into broader relief mechanisms:

- Paycheck Protection Program (PPP): U.S. subsidiaries of foreign cruise lines applied for PPP loans. While the SBA initially denied most applications, some small operators (e.g., river cruise companies) secured funding.

- Tax deferrals and credits: Companies deferred payroll taxes under the CARES Act and claimed employee retention credits.

- State and local aid: Ports and municipalities provided docking fee waivers (e.g., Miami-Dade County waived $30 million in fees).

- Export credit agencies: European governments (e.g., Germany’s KfW) guaranteed shipbuilding loans to prevent industry collapse.

Example: Royal Caribbean’s U.S. subsidiary, Royal Caribbean Cruises Ltd., deferred $1.2 billion in payroll taxes in 2020.

The Controversy: “Bailout by Any Other Name”

Critics argue that indirect aid functioned as a de facto bailout. When Carnival raised $6.4 billion in debt with government-backed guarantees from Italy’s SACE program, it sparked debates about “backdoor” assistance. Similarly, Norway’s $275 million guarantee for Hurtigruten’s loans drew scrutiny from EU regulators.

3. The Role of Tax Havens and Corporate Structures

Why Cruise Lines Incorporate Abroad

The cruise industry’s use of foreign incorporation is no accident. By registering in Panama, Liberia, or the Bahamas, companies:

- Reduce taxes: These nations charge minimal or no corporate income taxes.

- Simplify operations: They avoid U.S. labor and safety regulations (though ships must comply with international standards).

- Access global capital: Foreign incorporation makes it easier to attract international investors.

This structure, while legal, became a lightning rod during the pandemic. Critics accused cruise lines of exploiting loopholes to avoid U.S. taxes while still relying on American ports and workers.

The “Double Standard” Debate

When airlines (incorporated in the U.S.) received direct aid, but cruise lines (incorporated abroad) did not, many saw a double standard. Senator Bernie Sanders (I-VT) called cruise companies “corporate freeloaders” for avoiding taxes while seeking help. Conversely, industry leaders argued that foreign incorporation was necessary to compete globally.

Case Study: Carnival’s “Panama Paradox”

Carnival Corporation, headquartered in Miami but incorporated in Panama, became a focal point. In 2020, it paid 0% U.S. federal income tax despite receiving $2 billion in indirect aid (e.g., tax deferrals, port fee waivers). This sparked a CNBC investigation, highlighting the tension between tax avoidance and public support.

4. International Aid: How Other Countries Supported Cruise Lines

Europe: Guarantees and Grants

European governments took a more direct approach:

- Italy: Guaranteed €1.5 billion in loans for Fincantieri (shipbuilder for Carnival).

- France: Provided €1 billion in state-backed loans to Chantiers de l’Atlantique (builder of Royal Caribbean’s Wonder of the Seas).

- Germany: Backed €1.2 billion in loans for Meyer Werft (builder of Disney’s Wish).

These guarantees ensured shipyards stayed open, preserving jobs and the industry’s supply chain.

Asia: Targeted Support for Domestic Operators

Asian cruise lines faced unique challenges due to prolonged travel restrictions. Japan provided ¥10 billion ($93 million) in subsidies to domestic operators, while Singapore’s Tourism Board funded marketing campaigns to revive demand.

Data Table: International Cruise Line Support (2020–2021)

| Country | Type of Aid | Amount | Recipient |

|---|---|---|---|

| Italy | Loan guarantee | €1.5 billion | Fincantieri |

| France | State-backed loan | €1 billion | Chantiers de l’Atlantique |

| Germany | Loan guarantee | €1.2 billion | Meyer Werft |

| Norway | Loan guarantee | $275 million | Hurtigruten |

| Japan | Subsidy | ¥10 billion | Domestic operators |

Lessons from International Approaches

Europe’s focus on supply chain support (e.g., shipyards) proved more effective than direct aid to cruise operators. By keeping shipbuilders afloat, governments ensured the industry could rebound quickly when demand returned.

5. The Aftermath: Recovery, Reforms, and Ongoing Scrutiny

Rebounding Revenue: A Rocky Road to Recovery

By 2022, cruise lines saw a resurgence in demand. Carnival reported $12.1 billion in revenue (up 300% from 2021), and Royal Caribbean’s bookings surpassed pre-pandemic levels. However, the recovery was uneven:

- High ticket prices: To offset debt, lines raised prices by 20–30%.

- Staffing shortages: Labor costs rose 15% as lines competed for crew.

- Operational challenges: New health protocols increased costs by $200–$500 per passenger.

Regulatory Reforms: Stricter Oversight

The pandemic prompted reforms to improve safety and transparency:

- CDC’s Conditional Sail Order: Required lines to implement testing, vaccination, and ventilation upgrades.

- EU’s “Green Pass” rules: Mandated vaccine verification for Mediterranean cruises.

- U.S. Senate hearings: Investigated cruise lines’ pandemic response (e.g., Carnival CEO Arnold Donald testified in 2022).

Public Perception: Trust Issues Remain

Despite reforms, consumer trust hasn’t fully recovered. A 2023 AAA survey found that 42% of Americans remain hesitant to cruise due to health concerns. Cruise lines now invest heavily in marketing and PR to rebuild confidence.

6. The Bottom Line: Did Cruise Lines “Get” Bailouts?

Defining “Bailout” Matters

The answer depends on how you define “bailout”:

- No direct aid: Cruise lines received no industry-specific grants or loans (unlike airlines).

- Indirect support: They accessed tax breaks, port fee waivers, and supply chain guarantees worth billions.

- Debt financing: Government-backed guarantees enabled $20+ billion in private debt offerings.

In short, cruise lines survived through a mix of self-help (cost-cutting, debt) and indirect government support.

Lessons for the Future

The pandemic revealed three key takeaways:

- Corporate structures matter: Tax haven incorporation affects eligibility for aid.

- Supply chain resilience is critical: Supporting shipbuilders stabilized the industry.

- Public trust is fragile: Health crises require transparent, proactive responses.

What Travelers Should Know

If you’re planning a cruise, here’s how the bailout debate impacts you:

- Prices may stay high: Lines must repay pandemic debt.

- Health protocols are here to stay: Expect testing, vaccination checks, and improved air filtration.

- Research your line’s policies: Look for transparency in safety and financial practices.

The cruise industry’s pandemic survival story is a testament to resilience—but also a reminder that financial systems are deeply interconnected. While cruise lines didn’t get “bailouts” in the traditional sense, they leveraged every available tool to navigate the storm. As the industry charts a course for the future, the lessons learned will shape its approach to crises for decades to come.

Frequently Asked Questions

Did cruise lines get bailouts during the COVID-19 pandemic?

Yes, major cruise lines like Carnival, Royal Caribbean, and Norwegian received financial assistance through the CARES Act, primarily in the form of low-interest loans rather than direct grants. These funds were intended to help retain employees and maintain operations during the industry-wide shutdown.

Were cruise lines bailed out more than other travel industries?

Cruise lines faced unique challenges due to their global operations and prolonged shutdowns, but they received less direct aid compared to airlines. Most support came through loans tied to strict repayment terms and equity stakes for the U.S. government.

How much money did cruise lines receive in bailouts?

Exact figures vary, but Carnival alone secured over $7 billion in loans, while Royal Caribbean and Norwegian received billions more. The total bailout package for the industry exceeded $25 billion when including private financing and government-backed loans.

Did taxpayers fund cruise line bailouts?

Taxpayer dollars indirectly supported cruise line bailouts through federal loan programs like the CARES Act. However, these were repayable loans with interest, not outright grants, aiming to stabilize the economy while holding companies accountable.

Why did cruise lines need bailouts if they’re profitable?

Despite pre-pandemic profitability, cruise lines rely on continuous operations to generate revenue. The sudden halt in sailings erased income streams, forcing them to seek emergency financing to cover fixed costs like ship maintenance and payroll.

Are cruise lines still paying back their bailout money?

Most cruise lines are actively repaying their bailout loans, with some ahead of schedule due to strong post-pandemic demand. For example, Carnival and Royal Caribbean have repaid portions of their debt using cash flow from resumed sailings.