Featured image for are the cruise lines getting bailed out

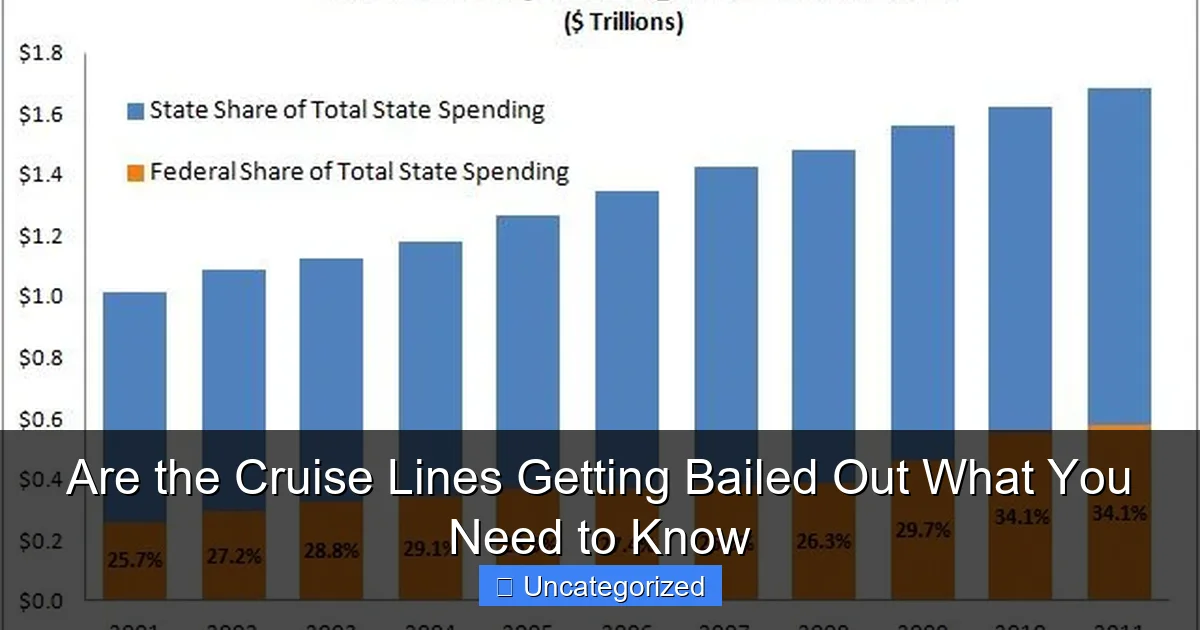

Image source: downsizinggovernment.org

Cruise lines are not receiving direct government bailouts, but they have benefited from broader pandemic relief programs and tax incentives that helped them stay afloat. Most financial support came in the form of loans, wage subsidies, and deferred taxes—not outright grants—meaning the industry is repaying much of the aid while navigating ongoing recovery challenges.

Key Takeaways

- Cruise lines received limited bailouts: Most aid came as loans, not direct cash infusions.

- Debt restructuring is key: Many lines refinanced debt to survive, not relying on government help.

- No blanket bailout: Aid varied by country and line, with strict repayment terms attached.

- Focus on liquidity: Government loans aimed to prevent collapse, not fund future expansion.

- Traveler protections matter: Some bailouts required refund policies or crew welfare improvements.

- Future risk remains: High debt levels could impact pricing and itineraries post-pandemic.

📑 Table of Contents

- The Great Cruise Comeback: Are Lines Getting Bailed Out?

- Government Bailouts: The Role of Public Funds

- Corporate Survival Tactics: How Cruise Lines Stayed Afloat

- Taxpayer Concerns: Is Your Money Funding Cruise Bailouts?

- Regional Disparities: Who Got Help, and Who Didn’t?

- The Future: Sustainability and Accountability

- Conclusion: Navigating the New Normal

The Great Cruise Comeback: Are Lines Getting Bailed Out?

The cruise industry, once synonymous with luxury and carefree vacations, found itself in uncharted waters when the COVID-19 pandemic hit. With ships stranded at ports, bookings canceled, and health protocols in flux, the future of this multi-billion dollar sector seemed uncertain. Fast forward to today, and the industry is making waves again – but not without controversy. As travelers return to the high seas, a pressing question lingers: Are cruise lines getting bailed out? This isn’t just about corporate survival; it’s about how taxpayer money, government policies, and industry strategies intersect to keep these floating resorts afloat.

From massive federal loans to creative financial maneuvering, the cruise industry’s recovery has been anything but smooth sailing. Whether you’re a potential cruiser, a concerned citizen, or a finance enthusiast, understanding the mechanisms behind this resurgence is crucial. This deep dive explores the truth behind bailouts, the role of governments, and what it means for you as a traveler or taxpayer.

Government Bailouts: The Role of Public Funds

What Constitutes a “Bailout” in the Cruise Industry?

A bailout refers to financial assistance provided by governments to prevent the collapse of a company or sector. For cruise lines, this could include direct loans, tax breaks, or guarantees. Unlike airlines, which received over $50 billion in U.S. payroll support during the pandemic, cruise companies faced stricter eligibility requirements due to their offshore registrations and complex ownership structures.

Visual guide about are the cruise lines getting bailed out

Image source: newswire.lk

- Example: In 2020, the U.S. CARES Act excluded most major cruise operators (Carnival, Royal Caribbean, Norwegian) because they are incorporated in foreign countries like Panama and Bermuda.

- Exception: Smaller U.S.-flagged lines, such as American Cruise Lines, qualified for Paycheck Protection Program (PPP) loans totaling $300+ million.

Indirect Support and Economic Relief

While direct cash injections were rare, cruise lines benefited from broader economic measures:

- Tax deferrals: Many governments allowed delayed tax payments, easing short-term liquidity crunches.

- Port fee waivers: Cities like Miami and Seattle suspended docking fees for idle ships.

- Health protocol funding: The CDC’s Conditional Sailing Order (CSO) program, though criticized, provided a roadmap for safe operations.

Tip: Always check a cruise line’s SEC filings (e.g., Carnival’s 10-K reports) for disclosures about government aid. Look for terms like “grants,” “forgivable loans,” or “tax credits.”

Corporate Survival Tactics: How Cruise Lines Stayed Afloat

Debt Restructuring and Private Financing

With limited access to public bailouts, cruise operators turned to creative financing:

- Bond issuances: Royal Caribbean raised $2.3 billion in high-yield bonds in 2020, despite credit downgrades.

- Asset sales: Carnival sold 13 ships (10% of its fleet) to raise $1.4 billion.

- Equity offerings: Norwegian Cruise Line sold $850 million in new shares, diluting existing shareholders.

These moves kept the lights on but came at a cost: interest expenses for the “Big Three” (Carnival, Royal, Norwegian) surged by 40% in 2021, per Bloomberg data.

Visual guide about are the cruise lines getting bailed out

Image source: media.phillyvoice.com

Partnerships and Alliances

Collaboration became a lifeline:

- Airline partnerships: Virgin Voyages partnered with Delta to offer bundled airfare deals, driving bookings.

- Port collaborations: The Cruise Lines International Association (CLIA) worked with ports to standardize health protocols, reducing operational chaos.

- Insurance innovations: Lines like MSC Cruises introduced “flexible cancellation” policies, backed by insurers, to rebuild consumer confidence.

Pro tip: If you’re booking a cruise, prioritize lines with strong partnerships – they often have better resources to handle disruptions.

Taxpayer Concerns: Is Your Money Funding Cruise Bailouts?

The Offshore Loophole

Major cruise lines register ships in foreign jurisdictions (Panama, Liberia, Bermuda) to avoid U.S. corporate taxes and labor laws. Critics argue this undermines claims for taxpayer aid:

- Example: Carnival, which reported $10.2 billion in revenue in 2022, paid an effective tax rate of just 1.3% due to offshore structures.

- Public backlash: When Carnival sought $150 million in U.S. port relief in 2020, Congress blocked it, citing “moral hazard.”

However, cruise lines counter that they support 1.2 million jobs globally (CLIA, 2023), justifying indirect support.

Environmental and Social Trade-offs

Bailout debates often ignore broader impacts:

- Environmental costs: Cruise ships are major polluters. Without government pressure, lines may delay green investments (e.g., LNG-powered ships).

- Labor issues: Crew wages remain low, and pandemic layoffs left many workers stranded. Bailouts rarely include worker protections.

Data point: Only 12% of cruise line bailout funds (where applicable) were tied to environmental or labor conditions, per a 2022 OECD report.

Regional Disparities: Who Got Help, and Who Didn’t?

U.S. vs. Europe: A Tale of Two Approaches

Government responses varied widely by region:

| Region | Direct Bailout? | Key Measures | Notable Exceptions |

|---|---|---|---|

| United States | Limited (only U.S.-flagged lines) | PPP loans, port fee waivers | Excluded Carnival, Royal Caribbean, Norwegian |

| European Union | Yes (via member states) | €2.5 billion in state aid to TUI, Costa Cruises | Conditions: 30% fleet reduction, crew protections |

| Asia | Indirect | Tax holidays, tourism vouchers | Genting Hong Kong collapsed despite aid |

The EU’s approach, while more generous, came with stricter environmental and labor requirements – a model the U.S. has yet to adopt.

Smaller Operators: The Forgotten Players

While megaships grabbed headlines, smaller lines faced existential threats:

- Example: Windstar Cruises (300-passenger ships) avoided bankruptcy by securing $100 million in private equity.

- Challenge: River cruise companies (e.g., Avalon Waterways) struggled with border closures, as their itineraries cross multiple countries.

Tip for travelers: Smaller lines often offer more personalized experiences and may be more transparent about financial health – ask about their pandemic-era funding sources.

The Future: Sustainability and Accountability

Green Financing and ESG Pressures

Post-pandemic, cruise lines face a new challenge: environmental, social, and governance (ESG) scrutiny. Investors now demand:

- Carbon-neutral goals: Royal Caribbean pledged net-zero emissions by 2050, backed by a $100 million green bond.

- Transparency: Carnival now publishes annual ESG reports, detailing emissions and crew welfare.

- Regulatory risks: The EU’s “Fit for 55” plan may tax cruise emissions, increasing costs.

Lines that secure “green loans” (e.g., Norwegian’s €1.5 billion sustainability-linked credit line) gain a competitive edge.

Consumer Power and Ethical Cruising

Travelers can influence industry practices:

- Support lines with strong ESG ratings: Check Cruise Critic or Sustainalytics for scores.

- Demand transparency: Ask about crew wages, waste disposal, and carbon offset programs.

- Choose destinations wisely: Over-touristed ports (e.g., Venice) may restrict cruise access – opt for emerging destinations like Alaska or the Galápagos.

Example: Hurtigruten, a leader in sustainable cruising, uses hybrid-electric ships and partners with local communities – a model for the future.

Conclusion: Navigating the New Normal

The cruise industry’s recovery is a story of resilience, innovation, and controversy. While direct taxpayer bailouts were minimal for major lines, indirect support through tax policies, port waivers, and global economic stimulus played a critical role. Meanwhile, corporate strategies like debt restructuring and partnerships kept the industry afloat – but at the cost of higher leverage and environmental trade-offs.

For consumers, the takeaway is clear: the days of “all-inclusive, no-strings-attached” cruising are over. As the industry evolves, travelers must weigh financial health, sustainability, and ethics when choosing a line. Whether you’re booking a Caribbean getaway or a Mediterranean voyage, ask the hard questions: How did this company survive the pandemic? What are they doing to protect the planet? And crucially, are they accountable to the communities they serve? The answer to these questions will shape the future of cruising – and determine whether the next “bailout” is truly worth it.

As the tides turn, one thing is certain: the cruise industry won’t sink easily. But with greater scrutiny and smarter choices, it might just sail toward a more sustainable horizon.

Frequently Asked Questions

Are cruise lines getting bailed out by the government?

While some cruise lines received indirect aid through broader pandemic relief programs, they were not granted direct bailouts like airlines. Most support came in the form of tax deferrals, loans, or access to credit markets rather than cash injections.

Why aren’t cruise lines getting a bailout like other industries?

Cruise lines are often incorporated in foreign countries for tax and regulatory reasons, limiting eligibility for U.S. federal bailouts. Additionally, public scrutiny over executive pay and safety concerns reduced political support for direct aid.

How have cruise lines survived without a full bailout?

Cruise lines have relied on private fundraising, debt restructuring, and cost-cutting measures (like pausing operations and selling ships) to stay afloat. Some also secured high-interest loans backed by their fleets as collateral.

Did any cruise lines get COVID-19 relief funds?

Indirectly, yes. While not labeled as “bailouts,” some companies accessed Paycheck Protection Program (PPP) loans or payroll support programs in certain countries. However, these were smaller compared to other travel sectors.

Are cruise lines getting bailed out through port fees or tax breaks?

Some ports and local governments have offered reduced docking fees or tax incentives to retain jobs and tourism revenue. These measures are more localized than federal-level bailouts but help lower operating costs.

Will taxpayers ever recoup losses from cruise line aid?

For indirect relief (like tax deferrals), repayment depends on individual cruise line performance. Direct loans with interest, such as those from export credit agencies, will be repaid over time, but full recovery remains uncertain.