Featured image for are the cruise lines getting a bailout

Image source: s.abcnews.com

Cruise lines are not receiving direct government bailouts, but they have benefited from broader pandemic relief programs like the CARES Act, which provided loans and tax credits to struggling industries. Taxpayer-funded aid has helped major cruise operators stay afloat, though they’ve also relied on private financing, cost-cutting, and resumed operations to stabilize finances.

Key Takeaways

- No direct bailouts: Cruise lines aren’t receiving government rescue funds like airlines.

- Debt refinancing: Many lines secured private loans to stay afloat during the pandemic.

- Tax relief: Some benefited from temporary tax deferrals or credits, not direct cash aid.

- Operational changes: Health protocols now drive costs, not bailout funds.

- Future risks: High debt levels may lead to higher ticket prices or service cuts.

- Investor reliance: Shareholder backing, not public funds, is sustaining most cruise companies.

📑 Table of Contents

- Are the Cruise Lines Getting a Bailout? What You Need to Know

- The Structure of the Cruise Industry: Why Bailouts Are Complicated

- Government Responses During the COVID-19 Pandemic: A Case Study

- Tax Relief, Loans, and Other Forms of Indirect Support

- Public Opinion, Ethics, and the Future of Cruise Industry Aid

- Data and Trends: A Snapshot of Cruise Industry Financial Support (2020-2023)

- Conclusion: Navigating the Bailout Debate as a Stakeholder

Are the Cruise Lines Getting a Bailout? What You Need to Know

The cruise industry, once synonymous with luxury, adventure, and carefree vacations, has faced unprecedented challenges in recent years. From global pandemics to economic downturns, the sector has weathered storms that would have sunk lesser industries. With headlines swirling about government bailouts, taxpayer-funded relief, and industry lobbying efforts, a critical question arises: Are cruise lines getting a bailout? For travelers, investors, and concerned citizens alike, the answer is far from straightforward. The cruise industry is a complex ecosystem involving multinational corporations, foreign-flagged vessels, and intricate legal frameworks that make direct government intervention a nuanced and often controversial topic.

Understanding whether cruise lines are receiving bailouts requires peeling back layers of policy, economics, and public perception. While some governments have offered financial support during crises, the nature of this support—whether it’s a direct bailout, tax relief, or targeted aid—varies widely. This article dives deep into the reality behind the headlines, separating fact from fiction. We’ll explore the legal and financial structures of cruise companies, examine government responses during key crises, analyze public sentiment, and provide practical insights for travelers and stakeholders. Whether you’re a vacation planner, a shareholder, or simply curious about the intersection of big business and public policy, this guide will equip you with the knowledge you need to navigate the murky waters of cruise industry bailouts.

The Structure of the Cruise Industry: Why Bailouts Are Complicated

Foreign-Flagged Vessels and Tax Avoidance

One of the most significant reasons the cruise industry’s relationship with bailouts is so complex lies in its corporate structure. Most major cruise lines—including Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings—are incorporated in the United States but operate ships under foreign flags, such as those of Panama, the Bahamas, or Bermuda. This practice, known as “flagging out,” allows companies to avoid U.S. corporate taxes, labor laws, and certain safety regulations. For example, Carnival Corporation, headquartered in Miami, operates under the British flag (Carnival UK) for many of its vessels.

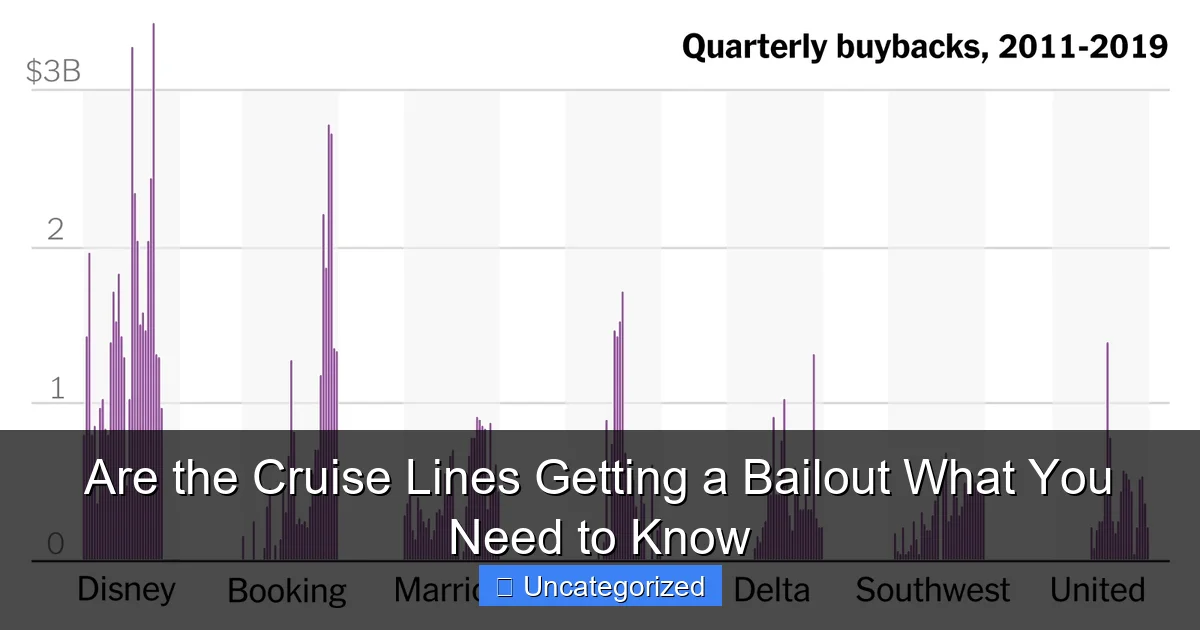

Visual guide about are the cruise lines getting a bailout

Image source: static01.nyt.com

Because these ships are legally registered in foreign countries, they fall under the jurisdiction of those nations, not the United States. As a result, when financial crises hit, U.S. taxpayers aren’t directly on the hook for rescuing foreign-flagged vessels. However, this doesn’t mean the U.S. government has no role. Cruise companies often maintain significant operations, headquarters, and employment within the U.S., creating a gray area where indirect support may still benefit American workers and the economy.

Corporate Subsidiaries and Legal Loopholes

Another layer of complexity stems from the use of corporate subsidiaries. Cruise lines frequently establish separate legal entities for different brands, regions, or vessel classes. For instance, Royal Caribbean Group owns Celebrity Cruises, Silversea Cruises, and TUI Cruises (a joint venture). Each of these entities may operate under different flags, tax regimes, and regulatory frameworks. This fragmentation allows companies to strategically access government aid in multiple jurisdictions.

- Example: During the 2020 pandemic, Royal Caribbean’s German subsidiary, TUI Cruises, received financial support from the German government, while the U.S.-based parent company lobbied for access to the CARES Act funds.

- Tip for Investors: When evaluating a cruise line’s financial health, analyze the geographic distribution of its subsidiaries and their exposure to local government aid programs.

This legal complexity means that while a cruise line may not receive a direct “bailout” from a single government, it can still benefit from a patchwork of international support mechanisms—raising ethical questions about fairness and accountability.

Government Responses During the COVID-19 Pandemic: A Case Study

The CARES Act and Cruise Line Exclusion

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed by the U.S. Congress in March 2020, allocated $2.2 trillion in economic relief, including direct loans, payroll support, and grants for industries severely impacted by the pandemic. However, cruise lines were notably excluded from the Paycheck Protection Program (PPP) and the airline-focused Payroll Support Program. Why?

Visual guide about are the cruise lines getting a bailout

Image source: i.insider.com

- Cruise companies were deemed ineligible because their foreign-flagged vessels meant they didn’t meet the “domestic operations” criteria.

- There was significant public and political opposition, with critics arguing that bailing out profitable multinational corporations would be unfair to small businesses and taxpayers.

Despite this exclusion, cruise lines found indirect pathways to support. For example, Carnival Corporation secured $6 billion in private financing through bond offerings and asset sales, while Norwegian Cruise Line Holdings raised $2.4 billion through a combination of equity and debt. These moves were facilitated by low interest rates and investor confidence, but they also relied on the perception of government support—such as the Federal Reserve’s corporate bond-buying program, which indirectly stabilized credit markets.

International Aid and Subsidies

While the U.S. withheld direct aid, other governments stepped in. The European Union approved state aid for cruise operators under its COVID-19 Temporary Framework, allowing member states to provide grants, loans, and tax deferrals. For instance:

- Italy: Provided €200 million in grants to Costa Cruises, a Carnival subsidiary.

- France: Offered €1 billion in loans to support shipbuilding contracts, indirectly benefiting cruise lines like MSC Cruises.

Additionally, some governments offered port fee waivers and tax holidays. In the Caribbean, nations like the Bahamas and Jamaica waived docking fees to encourage future bookings, effectively subsidizing the industry’s recovery.

Public Perception and Political Backlash

The disparity in aid sparked controversy. Critics, including U.S. Senators Elizabeth Warren and Bernie Sanders, argued that cruise lines had a history of tax avoidance and should not receive public funds. The #BailoutThePeopleNotTheCruiseLines campaign gained traction on social media, highlighting the irony of bailing out corporations while small businesses struggled. This backlash influenced policy decisions, reinforcing the U.S. government’s stance against direct bailouts.

Tax Relief, Loans, and Other Forms of Indirect Support

Tax Deferrals and Waivers

While direct cash injections were rare, many governments offered tax relief as a form of indirect support. For example:

- The U.S. IRS allowed cruise companies to defer payroll tax payments for 2020, with repayment spread over two years.

- Canada permitted deferral of customs duties on imported goods, including ship parts.

These measures provided short-term liquidity without requiring direct taxpayer funding. However, critics argue that tax relief disproportionately benefits large corporations with complex financial structures, as they can leverage deferred payments to invest in growth or shareholder dividends.

Low-Interest Loans and Loan Guarantees

Several governments and international institutions provided low-interest loans or loan guarantees to cruise operators. These instruments reduce borrowing costs and improve access to capital:

- U.S. Federal Reserve: Through the Municipal Liquidity Facility, the Fed indirectly supported port cities that rely on cruise tourism, stabilizing local economies and, by extension, the cruise industry.

- European Investment Bank (EIB): Offered €1 billion in loans to shipbuilders, ensuring the completion of new vessels for cruise lines like MSC and Norwegian.

Tip for Travelers: If you’re concerned about the ethical implications of cruise line financing, consider booking with companies that are transparent about their funding sources. For example, smaller operators like Lindblad Expeditions (which partners with National Geographic) are U.S.-flagged and pay full corporate taxes.

Port and Infrastructure Support

Ports and destinations also played a role. Many governments waived docking fees, reduced harbor maintenance taxes, or provided grants to upgrade infrastructure. For instance:

- Barcelona, Spain, allocated €50 million to modernize its cruise terminal, ensuring long-term viability.

- Miami, Florida, used federal pandemic relief funds to improve sanitation and safety measures at PortMiami, the world’s busiest cruise port.

This type of support is often overlooked but is critical for the industry’s recovery, as it ensures ports remain attractive to cruise lines and passengers.

Public Opinion, Ethics, and the Future of Cruise Industry Aid

Why Bailouts Are Controversial

The debate over cruise line bailouts centers on fairness and ethics. Key arguments against bailouts include:

- Tax Avoidance: Cruise lines pay minimal U.S. taxes despite generating billions in revenue.

- Executive Compensation: Top executives often receive multi-million dollar bonuses, even during crises.

- Environmental Impact: The industry has faced criticism for pollution, with ships contributing to carbon emissions and marine degradation.

For example, in 2020, Carnival’s CEO Arnold Donald earned $14.8 million in total compensation, while the company furloughed thousands of employees. This disparity fueled public outrage and reinforced skepticism about government aid.

Support for Conditional Aid

Proponents of bailouts argue that the cruise industry supports millions of jobs and drives economic growth in port cities. They advocate for conditional aid—financial support tied to:

- Job Retention: Requiring companies to maintain employment levels.

- Environmental Reforms: Mandating investments in cleaner technologies (e.g., LNG-powered ships).

- Tax Reform: Requiring cruise lines to pay a minimum effective tax rate.

The European Union’s approach exemplifies this model. Aid was granted only if companies committed to reducing emissions and improving labor conditions.

The Rise of “Green” Bailouts

As climate change becomes a global priority, some governments are linking financial support to sustainability initiatives. For example:

- The UK’s “Green Recovery Challenge Fund” offers grants to companies investing in eco-friendly technologies.

- Norway provides tax incentives for cruise lines that use electric or hydrogen-powered ferries.

This shift could redefine the future of industry aid, with bailouts becoming a tool for environmental transformation rather than mere corporate survival.

Data and Trends: A Snapshot of Cruise Industry Financial Support (2020-2023)

To illustrate the scale and scope of financial support, here’s a breakdown of key aid programs and their impacts:

| Country/Region | Type of Aid | Amount | Beneficiary | Conditions |

|---|---|---|---|---|

| Italy | Grants | €200 million | Costa Cruises (Carnival) | Job retention, fleet modernization |

| France | Loans | €1 billion | Shipbuilders (indirectly MSC Cruises) | Completion of new vessels |

| European Union | State Aid Framework | Variable | Multiple cruise lines | Employment, environmental reforms |

| U.S. | Tax Deferrals | Billions (indirect) | All cruise operators | Repayment over 2 years |

| Canada | Customs Duty Deferral | Undisclosed | Port operators, cruise lines | No specific conditions |

| Norway | Tax Incentives | €150 million | Electric/hydrogen ferries | Zero-emission vessels |

This table highlights the diversity of aid mechanisms, from direct grants to tax incentives, and underscores the trend toward conditional support. Notably, the U.S. provided no direct cash bailouts but offered indirect relief through tax and financial policies.

Conclusion: Navigating the Bailout Debate as a Stakeholder

The question “Are cruise lines getting a bailout?” doesn’t have a simple yes-or-no answer. Instead, the reality is a mosaic of direct aid, indirect support, and policy interventions across multiple jurisdictions. While the U.S. withheld direct taxpayer-funded bailouts due to legal and ethical concerns, other governments and institutions stepped in with grants, loans, and tax relief. Meanwhile, the industry’s complex corporate structure—featuring foreign flags, subsidiaries, and tax optimization—means that financial support often flows through indirect channels, blurring the lines between public and private funding.

For travelers, the key takeaway is to stay informed. If you’re booking a cruise, consider the ethical footprint of your choice. Support companies that are transparent about their operations, pay fair taxes, and invest in sustainability. For investors, monitor not just financial performance but also governance practices—companies with strong ESG (Environmental, Social, and Governance) profiles may be better positioned for future aid or regulatory changes. And for policymakers, the lesson is clear: future industry support should be conditional, transparent, and tied to broader societal goals, such as job creation, environmental protection, and fair taxation.

As the cruise industry rebounds from recent crises, the debate over bailouts will continue. But with greater awareness and accountability, we can ensure that financial support serves not just corporate interests, but the public good. Whether you’re setting sail on your next vacation or analyzing the next quarterly earnings report, remember: the tides of policy and perception are always shifting. Stay informed, stay critical, and navigate wisely.

Frequently Asked Questions

Are cruise lines getting a bailout from the government?

As of recent updates, major cruise lines have not received direct government bailouts like those during the 2020 pandemic. However, some have accessed loans or grants through broader economic relief programs. The industry remains largely self-funded through private financing.

Why would cruise lines need a bailout?

The cruise industry faced massive revenue losses during global shutdowns, with ships docked for months and refunds piling up. A bailout would help cover operational costs, crew wages, and fleet maintenance until demand recovers. Many companies also carry high debt loads from new ship construction.

Did cruise lines get bailout money in the past?

Yes, during the 2020-2021 pandemic, some cruise lines received indirect aid through payroll protection programs (e.g., the CARES Act). These funds were tied to keeping staff employed, not direct infusions to prop up corporate balance sheets.

Are taxpayers funding cruise line bailouts?

No evidence suggests current cruise line bailout efforts involve direct taxpayer subsidies. Past relief came with strict conditions (e.g., no stock buybacks), and most financial support now comes from private investors or debt restructuring.

Which cruise lines have accepted government aid?

Carnival Corp., Royal Caribbean, and Norwegian Cruise Line accessed U.S. Small Business Administration loans in 2020. These were part of industry-neutral programs, not cruise-specific bailouts. Most have since repaid these funds.

Will cruise prices drop if bailouts happen?

Unlikely. Bailouts (if they occurred) would prioritize stabilizing operations, not lowering fares. Pricing depends more on fuel costs, demand, and itinerary availability than government funding. Watch for seasonal promotions instead.