Featured image for are separate accounts needed for cruise line points

Image source: disneycruiselineblog.com

Yes, separate accounts are typically needed for cruise line points, as most cruise loyalty programs operate independently and do not share point systems with other travel providers. This ensures you maximize rewards specific to each cruise line’s perks and promotions, though some partnerships may allow limited point transfers or shared benefits.

Key Takeaways

- Separate accounts are often required to track points accurately across different cruise lines.

- Consolidating points is rare—most programs don’t allow transfers between brands.

- Always check terms first—some lines share loyalty programs under one account.

- Multiple accounts maximize perks by unlocking elite status with each line individually.

- Use a tracking tool to manage points, expiration dates, and benefits efficiently.

- Joint accounts are uncommon; individual sign-ups typically yield better rewards.

📑 Table of Contents

- The Allure of Cruise Line Points: A World of Travel Possibilities

- Understanding Cruise Line Points: How They Work

- Pros and Cons of Separate Accounts for Cruise Line Points

- How to Decide: Factors to Consider

- Data-Driven Insights: Comparing Cruise Line Programs

- Expert Tips to Maximize Your Cruise Line Points

- Conclusion: Making the Right Choice for Your Travel Goals

The Allure of Cruise Line Points: A World of Travel Possibilities

Imagine standing on the deck of a luxurious cruise ship, the sun setting over crystal-clear waters, as you sip a cocktail included with your cruise line points. For many travelers, accumulating points with cruise lines is a gateway to unforgettable experiences, from complimentary upgrades to free sailings across the globe. But as the popularity of cruise loyalty programs grows, so does the complexity of managing them. One question frequently arises: Are separate accounts needed for cruise line points? This seemingly simple query opens the door to a deeper discussion about how these programs work, how to maximize their benefits, and whether consolidation or separation is the smarter strategy.

Whether you’re a seasoned cruiser or planning your first voyage, understanding the nuances of cruise line points can make the difference between a good trip and an extraordinary one. Unlike airline or hotel loyalty programs, cruise lines often structure their points systems differently, with unique rules for earning, redeeming, and transferring points. Some programs allow pooling, while others require strict individual account management. In this comprehensive guide, we’ll explore the ins and outs of cruise line points, helping you navigate the decision of whether to keep accounts separate or combine them. Along the way, we’ll provide practical tips, real-world examples, and data-driven insights to ensure you get the most out of your cruising rewards.

Understanding Cruise Line Points: How They Work

The Basics of Cruise Loyalty Programs

Cruise line points—also known as loyalty points, rewards points, or tier points—are earned through various activities, including sailing, onboard spending, and partnerships with credit cards or travel brands. Unlike traditional airline miles, which are often transferable across alliances, cruise points are typically tied to a specific cruise line. For example, Royal Caribbean’s Crown & Anchor Society and Carnival’s VIFP Club are standalone programs with no direct partnerships with other cruise lines.

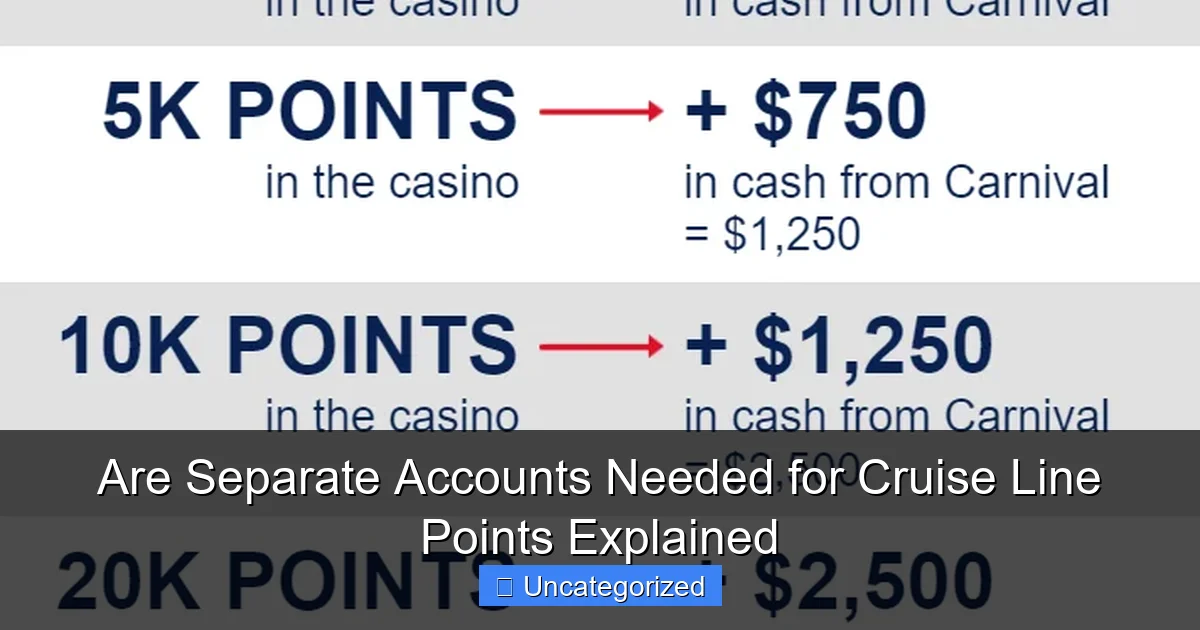

Visual guide about are separate accounts needed for cruise line points

Image source: thepointsguy.global.ssl.fastly.net

Points are usually earned based on the number of nights sailed, the stateroom category, and additional spending. For instance, a seven-night cruise in a balcony room might earn 200 points, while a suite could earn 500. Onboard purchases like spa treatments, shore excursions, and specialty dining can also contribute to your total. The key difference from other loyalty programs is that cruise points often serve dual purposes: they unlock tier status (e.g., Gold, Platinum, Diamond) and can be redeemed for future sailings or perks.

Redemption Rules and Limitations

Redeeming cruise line points comes with its own set of rules. Most programs allow you to use points for:

- Complimentary or discounted sailings

- Cabin upgrades

- Onboard credits (e.g., $100–$500 to spend during the cruise)

- Exclusive experiences (e.g., VIP events, private tours)

However, there are limitations. For example, Norwegian Cruise Line’s Latitudes Rewards requires a minimum of 1,000 points for a free seven-night sailing, while Princess Cruises’ Captain’s Circle may offer a free cruise after 100,000 points. Additionally, some programs have blackout dates or restrictions on peak-season sailings. Understanding these nuances is critical when deciding whether to keep accounts separate—especially if you plan to redeem across multiple lines.

Real-World Example: A Family of Four

Consider a family of four sailing with Carnival and Royal Caribbean. If they use a single account for both lines, they might earn 100 points with Carnival and 80 points with Royal Caribbean. But if Carnival requires 500 points for a free cruise and Royal Caribbean needs 1,000, their progress toward either goal is slower. Separate accounts, on the other hand, allow them to focus on one line’s rewards without diluting their efforts. This example highlights the trade-off between simplicity and optimization.

Pros and Cons of Separate Accounts for Cruise Line Points

Advantages of Keeping Accounts Separate

Maintaining separate accounts for each cruise line offers several benefits:

Visual guide about are separate accounts needed for cruise line points

Image source: hooverkrepelka.com

- Faster Tier Progression: By focusing on one line, you can reach elite status faster, unlocking perks like priority boarding, complimentary laundry, and exclusive lounges. For example, reaching Diamond status in Royal Caribbean’s Crown & Anchor Society requires 175 points—achievable in two to three cruises.

- Targeted Redemptions: If you have a dream cruise with a specific line (e.g., a Disney Cruise Line family voyage), separate accounts let you pool points toward that goal.

- Easier Tracking: Managing one account at a time reduces the risk of missing expiration dates or redemption opportunities.

Additionally, some cruise lines offer sign-up bonuses or first-time cruiser rewards that are only available if you don’t already have an account. Starting fresh with each line can maximize these opportunities.

Disadvantages of Separate Accounts

However, there are downsides to this approach:

- Fragmented Rewards: If you sail infrequently with each line, points may expire or lose value. For example, Carnival’s VIFP Club points expire after 24 months of inactivity.

- Increased Complexity: Managing multiple accounts means remembering login details, tracking expiration dates, and navigating different redemption portals.

- Missed Opportunities: Some programs allow points transfers or pooling with family members, which is harder with separate accounts.

For instance, if you and your spouse each have separate Carnival accounts but rarely sail, your combined 200 points might never reach the 500-point threshold for a free cruise. A joint account could solve this issue.

When to Combine Accounts

Combining accounts makes sense in these scenarios:

- Frequent Sailors: If you cruise 3–4 times per year with the same line, a single account accelerates your progress.

- Family Travel: Parents and children can pool points under one account (if the program allows it).

- Credit Card Partnerships: Some credit cards (e.g., Chase, American Express) let you transfer points to cruise lines, making a unified account more efficient.

For example, the Chase Ultimate Rewards program allows point transfers to Hyatt and United, but not directly to cruise lines. However, you can use points to book cruises through Chase’s travel portal, effectively consolidating rewards.

How to Decide: Factors to Consider

Your Cruising Frequency and Preferences

The most critical factor is how often you sail and with which lines. Use this framework:

- Infrequent Cruisers (1–2 times per year): Consider separate accounts to avoid dilution. Focus on one line per year to build status.

- Moderate Cruisers (3–4 times per year): A single account with your preferred line is ideal, but keep secondary lines separate for occasional use.

- Frequent Cruisers (5+ times per year): Combine accounts if you sail with multiple lines regularly, or maintain separate accounts if you’re chasing elite status with each.

For example, a couple who sails twice a year with Carnival but occasionally tries Norwegian might keep Carnival as their primary account and Norwegian as secondary.

Redemption Goals and Timelines

Ask yourself: What am I saving for? If your goal is a free cruise in the next 12–18 months, separate accounts can help you focus. But if you’re planning a bucket-list trip (e.g., a world cruise) in 5+ years, combining accounts might be better. Also, check each program’s expiration policy—some points expire after 12–24 months, while others never do.

Family and Group Travel Dynamics

Traveling with family or friends? Some programs allow you to:

- Link accounts (e.g., Royal Caribbean lets you add family members to your Crown & Anchor Society).

- Transfer points between members (e.g., Carnival’s VIFP Club allows transfers for a fee).

- Earn points for others’ sailings (e.g., Princess Cruises’ Captain’s Circle rewards referrers).

For instance, if your parents have 400 points with Holland America and you have 300, combining accounts could unlock a free cruise faster than keeping them separate.

Credit Card and Partnership Perks

Many cruise lines partner with credit cards or other brands to offer bonus points. For example:

- American Express: Offers 10,000 bonus points for new Carnival VIFP members.

- Barclays: Provides 5x points on Royal Caribbean bookings with the Royal Caribbean Visa.

- Bank of America: Partners with Norwegian Cruise Line for exclusive deals.

If you’re leveraging these partnerships, a single account simplifies tracking and maximizing bonuses.

Data-Driven Insights: Comparing Cruise Line Programs

To help you make an informed decision, here’s a comparison of major cruise lines’ loyalty programs, including their points systems and account management rules:

| Cruise Line | Program Name | Points Earned Per Night | Redemption Minimum | Account Sharing/Pooling | Points Expiration |

|---|---|---|---|---|---|

| Royal Caribbean | Crown & Anchor Society | 5–20 (based on stateroom) | 1,000 points (7-night sailing) | Yes (family members) | Never |

| Carnival | VIFP Club | 10–25 | 500 points (7-night sailing) | Yes (transfers for fee) | 24 months |

| Norwegian | Latitudes Rewards | 10–30 | 1,000 points (7-night sailing) | No | 36 months |

| Princess | Captain’s Circle | 10–50 | 100,000 points (7-night sailing) | Yes (family referrals) | Never |

| Holland America | Mariner Society | 10–40 | 1,000 points (7-night sailing) | Yes (linked accounts) | Never |

Key Takeaways:

- Royal Caribbean and Holland America are the most flexible for account sharing.

- Carnival has the lowest redemption threshold but stricter expiration rules.

- Princess Cruises requires the most points for redemption but never expires them.

Expert Tips to Maximize Your Cruise Line Points

1. Automate Account Management

Use tools like:

- Spreadsheets: Track points, expiration dates, and redemption goals.

- Travel Apps: Apps like TripIt or MaxRewards sync with cruise line accounts.

- Email Alerts: Set up reminders for points expirations or bonus offers.

2. Leverage Credit Card Bonuses

Apply for cruise line co-branded credit cards to earn:

- Sign-up bonuses (e.g., 10,000 points after first purchase).

- Accelerated earning (e.g., 2x points on cruise bookings).

- Exclusive perks (e.g., free upgrades, priority boarding).

For example, the Carnival World Mastercard offers 5x points on Carnival bookings and a 20% discount on shore excursions.

3. Combine Points Strategically

If a program allows transfers or pooling, do so during:

- Promotions: Some lines waive transfer fees during sales.

- Peak Seasons: Pool points for a high-demand sailing (e.g., Alaska in summer).

4. Focus on Tier Status First

Elite status often provides more value than points alone. For example:

- Royal Caribbean’s Diamond status offers free drinks and concierge service.

- Carnival’s Platinum status includes priority embarkation and a free spa treatment.

Prioritize reaching the next tier before redeeming points for sailings.

5. Monitor Expiration Dates

Set calendar reminders for programs with expiring points (e.g., Carnival, Norwegian). A quick onboard purchase or short cruise can reset the clock.

Conclusion: Making the Right Choice for Your Travel Goals

The question of whether separate accounts are needed for cruise line points doesn’t have a one-size-fits-all answer. It depends on your cruising habits, redemption goals, and willingness to manage complexity. For most travelers, a hybrid approach works best: keep a primary account with your preferred cruise line while maintaining separate accounts for occasional sailings with other lines. This strategy balances simplicity with optimization, ensuring you don’t miss out on elite status or redemption opportunities.

Remember, the ultimate goal of cruise line points is to enhance your travel experience—not complicate it. By understanding how each program works, leveraging data-driven insights, and applying expert tips, you can turn points into unforgettable voyages. Whether you’re dreaming of a Caribbean getaway or an Antarctic adventure, the right account structure will help you set sail with confidence. So, review your goals, crunch the numbers, and choose the path that aligns with your wanderlust. After all, every point brings you one step closer to the open sea.

Frequently Asked Questions

Do I need separate accounts to earn cruise line points with my travel partner?

Yes, most cruise lines require individual accounts to earn and track points separately. While some programs allow shared benefits (like cabin discounts), points are typically tied to the individual’s loyalty account.

Can I combine cruise line points from multiple accounts into one?

Generally, cruise line points cannot be merged across accounts due to program rules. Exceptions may exist for household members in select loyalty tiers—contact the cruise line directly to verify.

Why do cruise line points need separate accounts for families?

Cruise line points are earned based on individual spending (e.g., onboard purchases, stateroom bookings). Separate accounts ensure accurate tracking and prevent point forfeiture when multiple people travel together.

Is a separate account needed for cruise line points if booking through a third party?

Yes, you’ll still need your own loyalty account to earn points, even with third-party bookings. Ensure your account number is linked to the reservation during checkout.

Do children require separate accounts for cruise line points?

Most cruise lines only award points to adults, but some offer family-friendly programs where kids can earn points under their own accounts. Check the specific cruise line’s policy.

How do I manage cruise line points across separate accounts?

Use the cruise line’s online portal to track each account individually. Some programs offer “household” features to monitor points for family members in one dashboard.