Featured image for are cruise lines still going to hong kong

Image source: mappi.net

Yes, major cruise lines are still sailing to Hong Kong, with popular operators like Royal Caribbean, Princess Cruises, and Norwegian Cruise Line maintaining regular itineraries as of 2024. Hong Kong remains a key Asian cruise hub, offering seamless port access and vibrant cultural attractions despite regional travel fluctuations—making it a reliable destination for global cruisers.

Key Takeaways

- Verify schedules: Check with cruise lines for updated Hong Kong itineraries.

- Monitor policies: Entry rules and port operations change frequently—stay informed.

- Book refundable: Choose flexible bookings to adapt to sudden route changes.

- Alternative hubs: Consider nearby ports like Shenzhen if Hong Kong is unavailable.

- Local demand: Domestic cruises in Asia may replace international Hong Kong sailings.

- Future outlook: Hong Kong’s return depends on global travel recovery timelines.

📑 Table of Contents

- Are Cruise Lines Still Going to Hong Kong? Find Out Now

- 1. The Current State of Cruise Tourism in Hong Kong: A Reality Check

- 2. Which Cruise Lines Are Currently Sailing to Hong Kong?

- 3. Why the Shift? Understanding the Underlying Factors

- 4. Practical Information for Cruisers: What You Need to Know

- 5. The Future of Cruising in Hong Kong: Signs of Hope & Challenges

- 6. Making an Informed Decision: Is a Hong Kong Cruise Right for You?

Are Cruise Lines Still Going to Hong Kong? Find Out Now

For decades, Hong Kong has been a glittering gem in the crown of Asian cruise destinations. With its iconic skyline, world-class shopping, and rich cultural tapestry, it has drawn millions of cruisers eager to experience the “Pearl of the Orient.” But in recent years, the question on many travelers’ minds has shifted from “When can I visit?” to “Are cruise lines still going to Hong Kong?” The answer isn’t a simple yes or no. The cruise industry’s relationship with Hong Kong has evolved dramatically due to geopolitical shifts, infrastructure changes, and global travel trends.

This comprehensive guide will cut through the noise and provide you with the most up-to-date information on Hong Kong’s cruise scene. Whether you’re planning a future voyage, considering a repositioning cruise, or simply curious about the region’s maritime future, we’ll explore the current state of affairs, what major cruise lines are doing, and what you can realistically expect if you set sail for this dynamic city. We’ll examine the factors influencing cruise schedules, highlight key routes, and offer practical advice to help you make informed decisions about your next Hong Kong cruise adventure.

1. The Current State of Cruise Tourism in Hong Kong: A Reality Check

As of late 2023 and early 2024, Hong Kong’s cruise industry is undergoing a significant transition, not a complete shutdown. It’s crucial to understand the nuance: while the pre-2020 era of daily cruise ship arrivals has faded, Hong Kong remains an active cruise destination, albeit with notable changes in frequency, duration, and the types of ships calling.

Visual guide about are cruise lines still going to hong kong

Image source: blog.modes4u.com

From Daily Calls to Seasonal & Repositioning Hubs

Gone are the days of multiple cruise ships docking daily at the Kai Tak Cruise Terminal. The peak of 2019, with over 100 ship calls and 800,000 passengers, is a distant memory. The primary driver behind the shift isn’t just the pandemic, but a combination of factors:

- Geopolitical Climate: The 2019 social unrest and subsequent National Security Law have significantly impacted international perceptions and travel advisories. Many major cruise lines, particularly those based in the US and Europe, have become more cautious about scheduling regular, year-round calls due to concerns about passenger safety, potential disruptions, and reputational risk. This has led to a noticeable reduction in dedicated Hong Kong cruises (e.g., round-trip Hong Kong sailings or Hong Kong as a primary embarkation point).

- Shift in Focus to Repositioning Cruises: This is where Hong Kong’s current relevance lies. Instead of being a central hub, it’s now a key repositioning port on longer itineraries. Ships moving between the Indian Ocean and Southeast Asia, or between Australia and Northeast Asia, often include Hong Kong as a one- or two-night stopover. This allows lines to offer passengers a taste of the city without the commitment of a longer stay or the need for extensive local infrastructure.

- Competition from Regional Hubs: Singapore, with its world-class Marina Bay Cruise Centre and stable political climate, has become a dominant regional cruise hub. Bangkok (Laem Chabang) and Manila are also growing. Hong Kong now competes for a smaller slice of the regional pie, focusing on specific markets and itineraries.

- Infrastructure & Operational Challenges: While the Kai Tak Terminal is modern, some operational inefficiencies and the cost of docking in a high-cost city like Hong Kong have made it less attractive compared to alternatives for certain lines.

Example: In 2023, Carnival Corporation’s Princess Cruises operated several repositioning cruises that included a 2-night stop in Hong Kong as part of longer voyages from Australia to Japan. Royal Caribbean’s Spectrum of the Seas made limited calls in 2022-2023, primarily as a repositioning stop. These are the new norm: strategic, often longer, stops on trans-Asian routes, not the daily “hop-on, hop-off” model.

Data Snapshot: Ship Calls (2022-2024)

While exact figures fluctuate monthly, official data from the Hong Kong Tourism Board and port authorities shows a clear trend:

- 2022: ~15-20 cruise ship calls (mostly repositioning, some short regional cruises).

- 2023: ~30-40 cruise ship calls (a modest increase, still heavily weighted towards repositioning and short (2-3 night) regional itineraries from China, Japan, and Korea).

- 2024 (Projected): Estimates suggest 40-50 calls, with a continued focus on repositioning cruises and short regional voyages. Major lines like MSC Cruises, Norwegian Cruise Line, and Costa Cruises have scheduled limited calls, but not as regular fixtures.

This represents a significant drop from the 80-100+ calls annually pre-2020, confirming the shift in strategy. The “daily” cruise call is largely a relic of the past.

2. Which Cruise Lines Are Currently Sailing to Hong Kong?

Understanding which cruise lines are still going to Hong Kong is essential for planning. It’s not a blanket “yes” or “no” across all brands. The landscape is fragmented, with different strategies based on brand, market, and operational focus.

Visual guide about are cruise lines still going to hong kong

Image source: 4.bp.blogspot.com

Major International Lines: The Cautious Approach

For the largest international cruise corporations (Carnival, Royal Caribbean, Norwegian, MSC, TUI), the approach is highly selective and risk-averse:

- Repositioning Focus: As mentioned, their primary presence is through repositioning cruises. These are often part of longer itineraries (e.g., 14-21 nights) where Hong Kong is one stop among many. Think of cruises from Australia to Japan, Southeast Asia to Northeast Asia, or even longer trans-Pacific routes.

- Royal Caribbean: Limited calls by ships like Spectrum of the Seas and Anthem of the Seas on repositioning routes. No dedicated Hong Kong sailings.

- Norwegian Cruise Line (NCL): Occasional calls by ships like Norwegian Joy on repositioning voyages. Focus remains on other Asian hubs.

- MSC Cruises: Has scheduled calls by ships like MSC Bellissima on repositioning routes from Southeast Asia to Northeast Asia. More active than some, but still not a regular fixture.

- Carnival Corporation (Princess, Holland America, P&O): Princess Cruises is the most active, using Hong Kong as a key repositioning point. Holland America has made limited calls. Carnival’s main brand has minimal presence.

- Limited Dedicated Cruises: You will rarely see a cruise that starts or ends in Hong Kong, or has Hong Kong as a central port on a short (3-7 night) itinerary for these major brands. Their dedicated Asian cruises (e.g., from Singapore) often bypass Hong Kong entirely.

- Operational Factors: These lines often cite higher docking fees, potential for passenger visa issues, and the need for extensive security and ground operations as deterrents for regular, short calls.

Regional & Chinese Domestic Lines: The Growing Presence

Here’s where the story takes a different turn. While international giants are cautious, regional and Chinese domestic cruise lines are increasingly active:

- Focus on Short Regional Cruises: Lines like Dream Cruises (Genting, though now under restructuring), Carnival China, Star Cruises (historically), and smaller Chinese operators focus on 2-3 night “cruises to nowhere” or short voyages to nearby destinations like Macau or Hainan Island, often departing from or calling at Hong Kong.

- Example: Carnival China’s ship Costa Serena (operated in partnership with Costa) has run short cruises from Hong Kong to Macau and Hainan, catering to the Chinese domestic market. These cruises are often fully booked by local travelers.

- Target Market: These cruises primarily serve the Chinese domestic market, including Hong Kong, Macau, and Mainland China residents. They operate under different regulatory frameworks and face fewer geopolitical concerns for their primary clientele.

- Kai Tak Terminal Usage: The Kai Tak Cruise Terminal sees more regular use from these regional operators for short voyages than from the major international lines for long-haul cruises.

- Government Support: The Hong Kong government actively promotes these domestic and regional cruises as part of its strategy to revitalize the cruise sector and boost local tourism.

Key Takeaway: If you’re an international traveler looking for a cruise from Hong Kong or a cruise with Hong Kong as a major stop on a long international itinerary, your options are currently limited to repositioning cruises by major lines. If you’re open to shorter, regional cruises focused on the Chinese market, options exist but are niche and require specific booking channels.

3. Why the Shift? Understanding the Underlying Factors

The reduced presence of major cruise lines isn’t arbitrary. Several interconnected factors drive this strategic shift:

Geopolitical and Perception Challenges

This is the primary factor for international lines. The 2019 protests, the implementation of the National Security Law, and the resulting travel advisories from countries like the US, UK, Canada, and Australia have created significant headwinds:

- Passenger Safety & Liability: Cruise lines have a duty of care. Operating in a city with potential for civil unrest, even if localized, increases their liability and insurance costs. They must have robust contingency plans (e.g., emergency evacuations, ship diversions), which are complex and expensive.

- Travel Advisories: Government advisories (e.g., “Exercise Increased Caution,” “Reconsider Travel”) directly impact passenger bookings. Even if the situation is calm, the perception of risk can deter potential cruisers, especially those from Western countries.

- Reputational Risk: Being associated with a destination facing international scrutiny can damage a cruise line’s brand image, particularly in their core markets. Lines are sensitive to public relations.

- Visa & Immigration Complexity: For international passengers, navigating Hong Kong’s immigration procedures, especially with potential policy changes, adds an extra layer of complexity and potential delays for the cruise line.

Economic and Operational Realities

Beyond politics, hard economics play a role:

- High Docking Fees: Hong Kong is one of the most expensive ports in Asia for docking. For lines operating on tight margins, especially on short regional cruises, this cost is prohibitive compared to cheaper alternatives like Singapore or Shanghai.

- Ground Operations Cost: Providing shore excursions, transportation, and local support in a high-cost city like Hong Kong is significantly more expensive than in other regional ports.

- Competition from Air Travel: For short regional trips (e.g., Hong Kong to Macau, Hong Kong to Hainan), high-speed rail and short-haul flights are often faster, cheaper, and more convenient than a cruise, making dedicated short cruises less competitive.

- Infrastructure Utilization: The Kai Tak Cruise Terminal, built for massive ships and daily operations, is underutilized. This represents a significant sunk cost for the city, but cruise lines see the operational cost per call as high for the return they get.

The Rise of Regional Alternatives

Other Asian ports have capitalized on Hong Kong’s challenges:

- Singapore: With its stable political environment, excellent infrastructure, lower operational costs, and proactive government support, Singapore has become the undisputed cruise hub of Southeast Asia. Many itineraries that once included Hong Kong now use Singapore as the primary embarkation/disembarkation point.

- Bangkok (Laem Chabang): A major gateway to Thailand and Indochina, with lower costs and growing infrastructure.

- Manila: A growing hub for the Philippines and regional cruises.

- Shanghai & Tianjin: Major Chinese ports serving the domestic market and some international repositioning cruises, with significant government investment.

These ports offer similar or better infrastructure, lower costs, and fewer geopolitical concerns, making them more attractive for cruise lines seeking efficiency and stability.

4. Practical Information for Cruisers: What You Need to Know

If you’re considering a cruise that includes Hong Kong, here’s essential practical information to navigate the current landscape:

Booking Your Cruise: Finding the Right Itinerary

- For International Repositioning Cruises:

- Focus on Longer Voyages: Look for cruises of 14 nights or more that include Hong Kong as a stopover. Common routes: Australia (Sydney, Brisbane) to Japan (Tokyo, Yokohama), Southeast Asia (Singapore, Bangkok) to Northeast Asia (Busan, Shanghai), or trans-Pacific routes.

- Check the Itinerary Details: Scrutinize the exact duration of the Hong Kong stop. Is it 12 hours (a day visit) or 24-48 hours (allowing for overnight stays and more exploration)? A longer stop is crucial.

- Book Early & Confirm: Repositioning cruises sell out fast, especially those with desirable Asian stops. Book well in advance. Crucially, contact the cruise line directly *after* booking to confirm the Hong Kong call is still scheduled. Repositioning routes can be subject to last-minute changes due to port availability, weather, or operational issues. Don’t assume it’s locked in.

- Use a Travel Agent: A specialist cruise agent familiar with Asian itineraries can help you find the best repositioning options and understand the nuances.

- For Short Regional Cruises (Chinese Market):**

- Booking Channels: These are often booked through Chinese travel agencies, online platforms like Ctrip (Trip.com), or directly with the cruise line’s China division. English-language booking might be limited. You may need a local contact or use a travel agent who specializes in China travel.

- Target Audience: Be aware these cruises cater primarily to Chinese speakers. Onboard activities, dining, and announcements might be in Chinese. Shore excursions are often geared towards local tastes.

- Visa Requirements: Ensure you have the correct visa for Hong Kong (if required for your nationality) and understand entry rules for the other destinations (e.g., Hainan Island has different visa policies for cruise passengers).

Arrival & Departure: Navigating Hong Kong Port

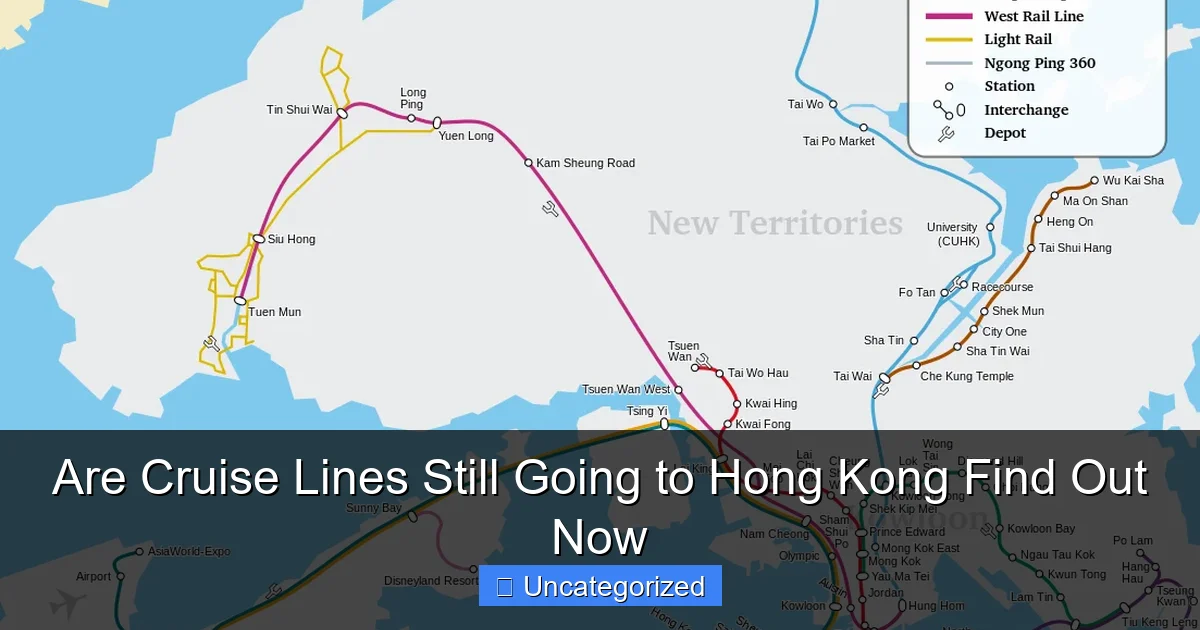

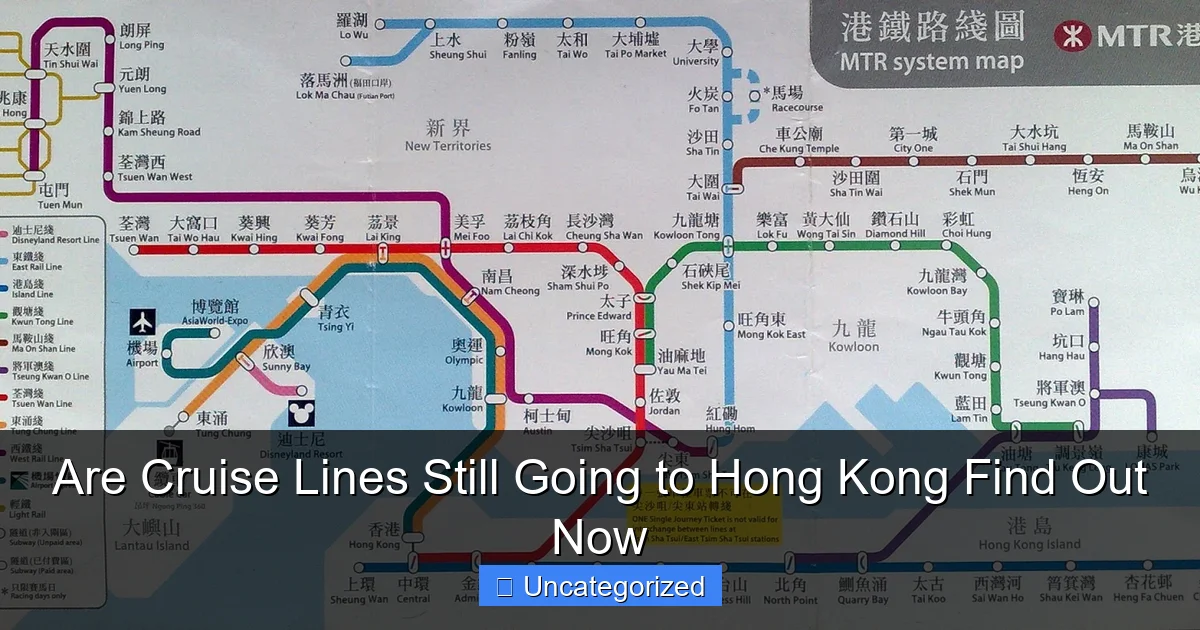

- Port of Arrival: Almost all cruise ships dock at the Kai Tak Cruise Terminal, located in Kowloon East. It’s a modern, well-equipped facility with good transport links.

- Transportation from Port:**

- Airport Express (MTR): The most efficient way to reach Central or the Airport. The station is a short walk from the terminal. Takes ~20 mins to Central, ~30 mins to Airport.

- Taxi: Readily available outside the terminal. More expensive but convenient for luggage. Takes ~15-30 mins to Central, ~30-45 mins to Airport.

- Hotel Shuttles: Some hotels offer shuttle services; check in advance.

- Public Bus: Several bus routes serve the area, but can be confusing for first-time visitors.

- Immigration & Customs:** Clearance is typically handled efficiently at the terminal. Have your passport and cruise documents ready.

- Wi-Fi & Connectivity:** Free Wi-Fi is available in the terminal. Consider a local SIM card or eSIM for use in the city.

Shore Excursions & Exploring Hong Kong

- Pre-Booking is Key:** Especially for repositioning cruises with limited time, book shore excursions online directly with the cruise line *before* your cruise. This guarantees your spot and often offers better value than buying onboard.

- Popular Excursions:** Look for tours covering:

- The Peak Tram & Victoria Peak

- Star Ferry to Tsim Sha Tsui & Avenue of Stars

- Ngong Ping 360 & Tian Tan Buddha (requires more time)

- Local markets (Temple Street, Ladies Market)

- Food tours (Dim Sum, Street Food)

- Historical sites (Wong Tai Sin Temple, Man Mo Temple)

- Independent Exploration:** If you’re comfortable, use the efficient MTR (subway) to explore independently. The Octopus card (reloadable smart card) is essential for seamless travel.

- Time Management:** Be acutely aware of your ship’s departure time and the time needed to return to the terminal. Build in a buffer for traffic or MTR delays. Don’t cut it close!

- Safety:** Hong Kong is generally safe for tourists. Exercise normal precautions, especially at night in crowded areas. Be aware of your surroundings.

5. The Future of Cruising in Hong Kong: Signs of Hope & Challenges

Is Hong Kong’s cruise future bleak? Not necessarily. While the immediate future is defined by repositioning cruises and regional focus, there are signs of potential revitalization, alongside persistent challenges.

Reasons for Optimism

- Government Investment & Strategy: The Hong Kong government is actively working to revive the cruise sector. This includes:

- Investing in the Kai Tak Cruise Terminal (upgrades, marketing).

- Offering incentives and subsidies to cruise lines for calls, especially for longer stays or homeporting.

- Developing “Cruise & Stay” packages to encourage longer visits.

- Promoting Hong Kong as a “gateway” to the Greater Bay Area (linking with Macau and Guangdong).

- Growing Chinese Domestic Market:** The demand for domestic cruises in China is massive and growing. Hong Kong is well-positioned to be a key hub for this market, especially for short voyages and “cruises to nowhere.” This provides a stable base of business.

- Repositioning Demand Remains:** The need for ships to reposition across Asia will continue. Hong Kong’s central location and excellent port facilities make it a logical stop, especially if geopolitical perceptions stabilize.

- Unique Selling Proposition:** Hong Kong offers a unique blend of East and West, modernity and tradition, that is hard to replicate. For cruise lines seeking diverse itineraries, it remains a compelling destination.

Persistent Challenges & The Path Forward

- Geopolitical Perception:** This is the biggest hurdle. For major international lines to return in force, there needs to be a sustained improvement in the geopolitical climate and a corresponding easing of international travel advisories. This is largely outside Hong Kong’s direct control.

- Cost Competitiveness:** Hong Kong needs to address the high operational costs. This might involve targeted subsidies for international cruise lines, negotiating lower docking fees for specific itineraries, or improving operational efficiency at Kai Tak.

- Competition:** Singapore’s dominance is a major challenge. Hong Kong needs to differentiate itself clearly, perhaps by focusing on its unique cultural offerings, shorter regional itineraries, or specific niche markets (e.g., luxury, cultural heritage).

- Infrastructure Utilization:** The Kai Tak Terminal needs to be used more efficiently. This might involve attracting more regional and domestic cruise traffic, hosting events, or diversifying its use.

- Marketing & Communication:** A concerted effort is needed to communicate the current reality (that Hong Kong is safe and open for cruise tourism) to international markets and travel agents, countering outdated perceptions.

The most likely future scenario is a hybrid model**:

- Continued strong presence of **regional and domestic Chinese cruise lines** operating short voyages from and to Hong Kong.

- Ongoing, but **selective, use of Hong Kong as a key repositioning port** for major international lines on trans-Asian routes.

- A **slow, cautious return of some dedicated international cruises** (especially longer voyages) if geopolitical perceptions improve and operational costs are addressed.

- Potential for **new niche cruise concepts** focused on cultural tourism, culinary experiences, or specific regional itineraries that leverage Hong Kong’s unique position.

Don’t expect a return to the 2019 “golden age” of daily international cruise calls in the near term. The future is more nuanced, focused on specific markets and strategic partnerships.

6. Making an Informed Decision: Is a Hong Kong Cruise Right for You?

So, are cruise lines still going to Hong Kong?** The definitive answer is **yes, but with significant caveats and changes** from the past. The decision of whether to book a cruise involving Hong Kong depends entirely on your priorities, travel style, and risk tolerance.

Consider a Hong Kong Cruise If…

- You’re on a Long Repositioning Cruise: This is the best and most reliable way to experience Hong Kong on a cruise right now. The longer voyage provides the time and context to appreciate the city as part of a broader Asian journey. Look for itineraries with 24+ hours in port.

- You’re Targeting the Chinese Domestic Market: If you’re open to shorter cruises (2-3 nights) focused on Macau, Hainan, or “cruises to nowhere,” and are comfortable with a primarily Chinese-speaking environment, the options exist and can be affordable.

- You Prioritize Unique Itineraries: Hong Kong’s central location allows for unique cruise combinations (e.g., Southeast Asia to Northeast Asia) that might not be possible from other hubs.

- You Understand the Context: You’ve researched the current situation, understand the reasons for the reduced frequency, and are comfortable with the potential for last-minute changes to repositioning routes.

- You Value the Kai Tak Experience: The modern terminal offers a smooth, efficient arrival and departure process, with excellent transport links to the city.

You Might Want to Consider Alternatives If…

- You Need a Dedicated Short Cruise: If you’re looking for a 3-7 night cruise that starts, ends, or is centered in Hong Kong with multiple calls, your options from major international lines are currently extremely limited or non-existent. Consider cruises based in **Singapore, Shanghai, or Tokyo** instead.

- You’re Risk-Averse About Geopolitics:** If you have concerns about the political climate or potential for disruption, and prefer destinations with universally positive travel advisories, Hong Kong might not be the best fit right now. Singapore, Japan, or South Korea offer excellent, stable alternatives.

- Cost is a Major Factor:** For short regional cruises, air travel might be cheaper and faster than a cruise, especially when you factor in the cost of the cruise itself, shore excursions, and potential visa fees.

- You Want a Predictable, High-Frequency Schedule:** If you’re looking for the convenience of choosing from multiple daily cruise options, Hong Kong currently doesn’t offer that for international lines.

Your Action Plan

- Define Your Goal:** Are you cruising *to* Hong Kong, *from* Hong Kong, or is it a stop on a longer journey?

- Research Specific Itineraries:** Use cruise line websites (Royal Caribbean, NCL, MSC, Princess, Carnival China) and search for “repositioning cruise Asia” or “short cruise from Hong Kong.” Filter by date, duration, and ports.

- Verify the Hong Kong Call:** For repositioning cruises, contact the cruise line directly to confirm the Hong Kong stop is confirmed and get the exact arrival/departure times.

- Check Travel Advisories:** Review the latest travel advice from your home country’s government (e.g., US State Department, UK FCDO).

- Book Shore Excursions Early:** Especially for repositioning cruises with limited time.

- Pack Accordingly:** Bring comfortable walking shoes, layers for varying temperatures, and any necessary medications. Consider a power adapter (Hong Kong uses UK-style plugs).

- Embrace the Reality:** Go with the understanding that the experience is different from pre-2020, but Hong Kong’s unique energy, culture, and skyline remain unforgettable.

The question “Are cruise lines still going to Hong Kong?” has a complex answer rooted in the current geopolitical and economic landscape. While the era of mass, daily international cruise calls is on hold, Hong Kong remains a vibrant, accessible, and strategically important port. It thrives as a key hub for **repositioning cruises** by major lines and as a growing center for **regional and domestic Chinese cruise tourism**. For the informed cruiser, especially those on longer voyages or open to niche markets, the “Pearl of the Orient” still offers a compelling and rewarding stop. The future may see a more diversified and resilient cruise sector, but for now, the opportunity to sail to this dynamic city, albeit in a transformed context, is very much alive. Do your research, understand the nuances, and you can still experience the magic of Hong Kong from the deck of a cruise ship.

Frequently Asked Questions

Are cruise lines still going to Hong Kong in 2024?

Yes, many major cruise lines like Royal Caribbean and Princess Cruises still include Hong Kong as a port of call in 2024 itineraries. However, schedules may vary depending on seasonal demand and regional events.

Why should I check if cruise lines are going to Hong Kong before booking?

Confirming Hong Kong’s inclusion ensures your trip aligns with your travel goals, as some repositioning cruises or shorter voyages may skip it. The keyword “cruise lines going to Hong Kong” is often searched for updates on port stability.

Has political unrest affected cruise lines going to Hong Kong?

While past protests caused temporary disruptions, most cruise lines have resumed normal operations in Hong Kong. Always check your cruise line’s advisory page for the latest updates before departure.

Which cruise lines go to Hong Kong regularly?

Celebrity Cruises, Norwegian Cruise Line, and Costa Cruises frequently feature Hong Kong in their Asia itineraries. Smaller luxury lines like Regent Seven Seas also include it for extended stays.

Are there any new cruise ports replacing Hong Kong?

Some lines are adding nearby ports like Shenzhen or Macau for diversity, but Hong Kong remains a top destination due to its iconic skyline and transit hub status. The keyword “cruise lines going to Hong Kong” reflects its enduring appeal.

Do I need a visa if my cruise stops in Hong Kong?

Most nationalities receive visa-free entry for short stays (typically 7-90 days) when visiting Hong Kong via cruise. Confirm requirements based on your citizenship with your cruise line or local embassy.