Featured image for are cruise lines profitable

Image source: cruzely.com

Cruise lines are profitable overall, but their financial success hinges on high passenger volumes, premium add-ons, and tight operational control. While industry giants like Carnival and Royal Caribbean consistently post billions in revenue, thin profit margins—often below 10%—reveal the intense cost pressures from fuel, labor, and global regulations. Post-pandemic recovery has boosted demand, yet profitability remains a delicate balance of pricing power and cost management.

Key Takeaways

- Cruise lines are profitable but rely on high passenger volume and onboard spending.

- Fuel and labor costs significantly impact margins; efficiency is critical.

- Premium pricing strategies boost revenue on luxury and themed cruises.

- Post-pandemic demand has rebounded, improving long-term profitability outlooks.

- Port fees and regulations add hidden costs; route planning is essential.

- Invest in sustainability to cut fuel costs and attract eco-conscious travelers.

📑 Table of Contents

- Are Cruise Lines Profitable? The Truth Behind the Numbers

- Understanding the Cruise Industry Business Model

- Financial Performance of Major Cruise Lines

- Challenges Impacting Cruise Line Profitability

- How Cruise Lines Boost Profitability: Strategies and Innovations

- Long-Term Outlook: Sustainability and Growth

Are Cruise Lines Profitable? The Truth Behind the Numbers

Few industries capture the imagination like the cruise industry. With massive floating resorts offering everything from gourmet dining and Broadway-style shows to rock climbing walls and ice skating rinks, cruise ships are often seen as symbols of luxury and indulgence. But behind the glitz and glamour lies a complex business model that begs the question: are cruise lines profitable? The answer isn’t as straightforward as you might think. While the industry has seen explosive growth over the past few decades, it’s also faced unprecedented challenges—from global pandemics to fluctuating fuel costs and environmental scrutiny.

To understand the profitability of cruise lines, we need to look beyond the surface. It’s not just about how many people book a vacation; it’s about the intricate balance of operational costs, revenue streams, and long-term sustainability. From ticket sales to onboard spending, marketing strategies to fleet modernization, the financial health of major cruise operators hinges on multiple moving parts. In this deep dive, we’ll explore the real numbers, dissect the business models of top players like Carnival Corporation, Royal Caribbean, and Norwegian Cruise Line, and uncover what it truly takes for a cruise line to turn a profit in today’s competitive and volatile market. Whether you’re a curious traveler, an investor eyeing maritime stocks, or a business enthusiast, this article will reveal the truth behind the numbers.

Understanding the Cruise Industry Business Model

Revenue Streams: More Than Just Ticket Sales

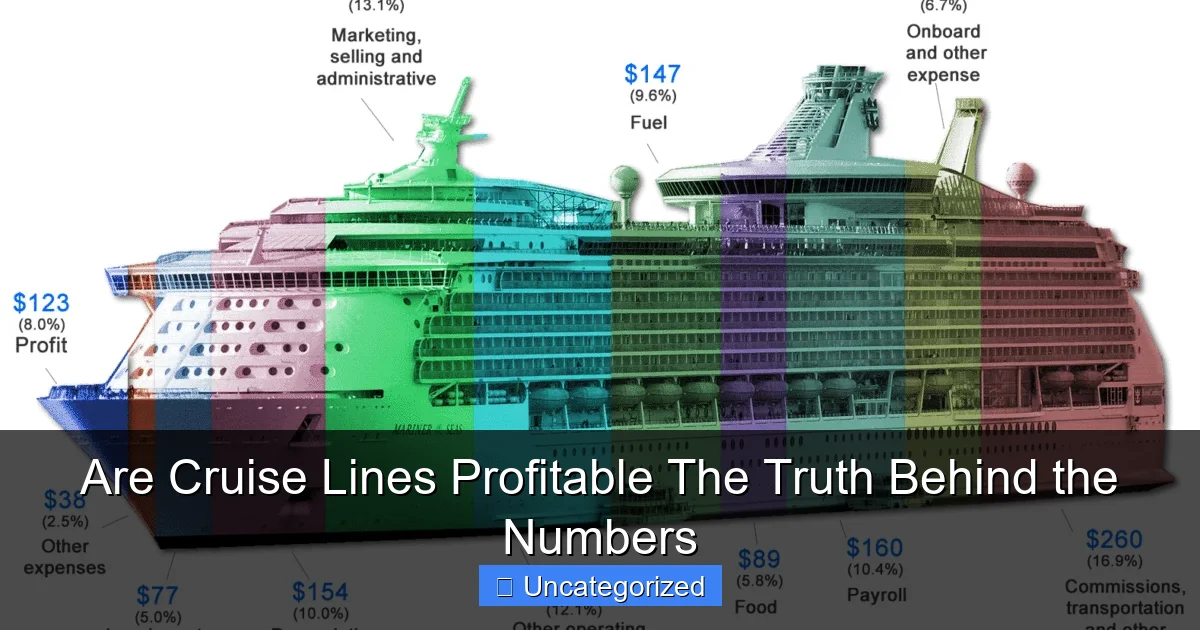

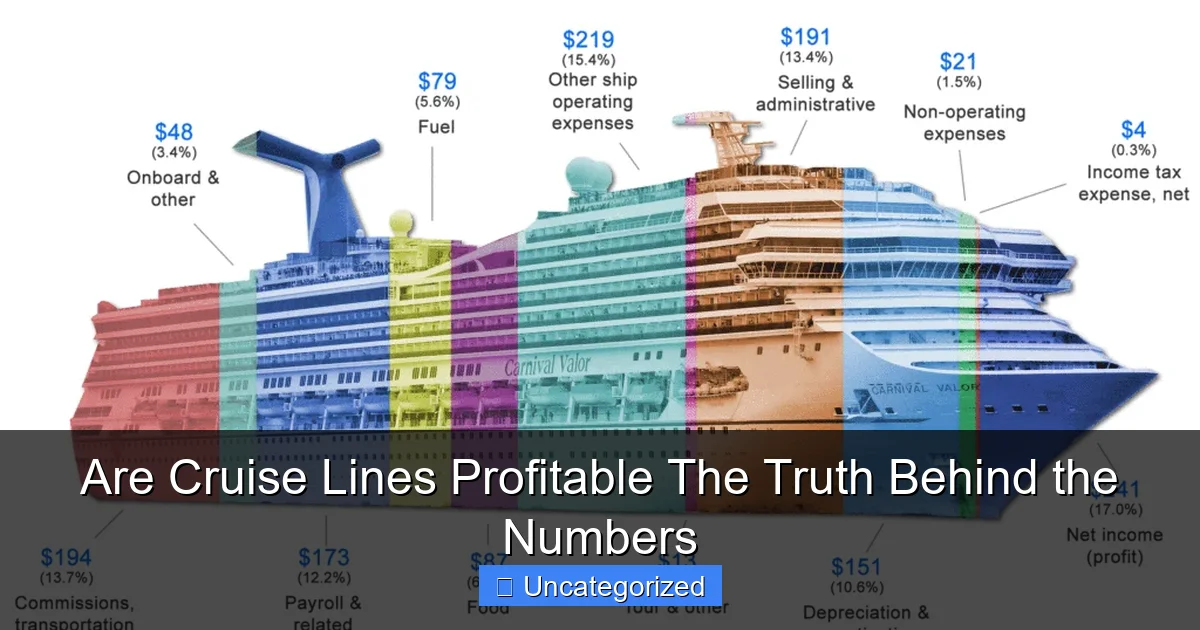

One of the biggest misconceptions about cruise lines is that their primary source of income is the base fare—the price passengers pay to board the ship. In reality, only about 60-70% of total revenue comes from ticket sales, according to industry reports from Cruise Lines International Association (CLIA) and company financial statements. The remaining 30-40% comes from what the industry calls onboard spending, and this is where cruise lines truly shine in profitability.

Visual guide about are cruise lines profitable

Image source: cruzely.com

Onboard revenue includes:

- Alcoholic beverages and specialty dining

- Spa and wellness services

- Excursions and guided tours

- Casino gaming

- Retail shops and duty-free purchases

- Wi-Fi packages and premium entertainment

For example, Royal Caribbean reports that the average passenger spends $250–$350 per sailing on onboard purchases. On a 4,000-passenger ship, that translates to over $1 million in additional revenue per cruise. This high-margin revenue is crucial because it often carries a gross profit margin of 70% or more, compared to just 20–30% for ticket sales after accounting for fuel, crew, and port fees.

Fixed and Variable Costs: The Hidden Expenses

While onboard spending boosts profitability, cruise lines face significant fixed and variable costs. A single new cruise ship can cost $1 billion or more to build, with construction timelines spanning 2–3 years. Once operational, ships require:

- Fuel (the largest operational expense, often 25–30% of total costs)

- Crew salaries (typically 15–20% of revenue)

- Port fees and docking charges

- Maintenance and dry-dock repairs every 5–7 years

- Marketing and customer acquisition

For instance, Carnival Corporation’s 2023 annual report showed that fuel expenses alone reached $1.8 billion, despite efforts to improve fuel efficiency through LNG-powered ships and hull coatings. Variable costs like food, entertainment, and excursion commissions also rise with passenger volume, making cost control a constant challenge.

Load Factors and Occupancy Rates

Profitability is heavily influenced by load factors—the percentage of cabins occupied. Most cruise lines operate at 100–110% occupancy due to double-occupancy cabins (e.g., two people in one room). However, even at full capacity, profitability isn’t guaranteed. The key is revenue per available passenger cruise day (RevPCD), a metric used to measure financial performance.

Royal Caribbean, for example, reported a RevPCD of $287 in 2023, up from $256 in 2019, indicating improved pricing power and onboard spending. But if a ship sails at only 80% occupancy, even with high onboard spending, overall revenue drops significantly. This is why cruise lines aggressively use dynamic pricing, early-bird discounts, and last-minute deals to fill ships.

Financial Performance of Major Cruise Lines

Carnival Corporation: The Industry Giant with a Rocky Road

Carnival Corporation, the world’s largest cruise operator with brands like Carnival Cruise Line, Princess Cruises, Holland America, and Costa, has faced a turbulent financial journey. In 2019, the company reported a net income of $2.9 billion. But the pandemic hit hard—2020 saw a staggering $10.2 billion net loss, followed by a $6.1 billion loss in 2021. Recovery began in 2022, with a reduced loss of $2.7 billion, and by 2023, Carnival posted a modest net income of $1.5 billion.

What changed? Carnival implemented several key strategies:

- Debt restructuring: Raised $25 billion in capital through equity and debt offerings to survive the pandemic.

- Fleet optimization: Retired 20 older, less efficient ships, reducing annual operating costs by $400 million.

- Premium pricing: Increased base fares and onboard spending through enhanced guest experiences.

Despite these efforts, Carnival’s debt-to-equity ratio remains high at 2.1, indicating ongoing financial strain. However, with 2024 bookings up 30% year-over-year, the outlook is improving.

Royal Caribbean Group: Innovation and Premiumization

Royal Caribbean, which owns Royal Caribbean International, Celebrity Cruises, and Silversea, has taken a different path. Focusing on premiumization—offering higher-end experiences at higher price points—the company has seen stronger recovery. In 2023, Royal Caribbean reported a net income of $2.1 billion, a dramatic turnaround from a $5.8 billion loss in 2020.

Key drivers of profitability include:

- New ship launches: The introduction of Icon of the Seas in 2024, costing $2 billion, is expected to generate $1 billion in annual revenue.

- Onboard revenue growth: RevPCD increased by 12% in 2023 due to expanded dining and entertainment options.

- Strategic partnerships: Collaborations with airlines and travel agencies to boost pre-cruise bookings.

Royal Caribbean’s debt load remains high ($17 billion), but its EBITDA margin of 22% in 2023 signals strong operational efficiency.

Norwegian Cruise Line Holdings: Niche Focus and Cost Discipline

Norwegian Cruise Line (NCL), with brands like Norwegian, Oceania, and Regent Seven Seas, emphasizes luxury and all-inclusive pricing. In 2023, NCL reported a net income of $520 million, recovering from a $2.3 billion loss in 2021. The company’s strategy includes:

- Premium pricing: Higher base fares due to inclusive packages (e.g., free drinks, excursions).

- Cost-cutting: Reduced SG&A expenses by 15% through digital marketing and streamlined operations.

- Fleet modernization: New ships like Norwegian Prima offer better fuel efficiency and higher onboard revenue potential.

NCL’s RevPCD rose to $275 in 2023, and its debt-to-EBITDA ratio improved from 12x in 2021 to 5.5x in 2023, showing improved financial health.

Challenges Impacting Cruise Line Profitability

Fuel and Environmental Costs

Fuel is the single largest expense for cruise lines, and with global oil prices fluctuating between $70–$100 per barrel, this remains a major profitability hurdle. In 2023, fuel costs accounted for 28% of Carnival’s operating expenses and 25% for Royal Caribbean. To mitigate this, cruise lines are investing in:

- Liquefied Natural Gas (LNG): Ships like Carnival Mardi Gras and Costa Smeralda run on LNG, reducing carbon emissions by 20% and fuel costs by 10–15%.

- Battery and hybrid systems: Royal Caribbean’s Icon-class ships use LNG and battery power for port operations.

- Hull coatings and air lubrication: Reduce drag and improve fuel efficiency by 5–10%.

However, these green initiatives require massive upfront investment. Carnival’s LNG fleet upgrade cost $2.5 billion, and while long-term savings are expected, the payback period is 8–10 years.

Regulatory and Environmental Pressures

As environmental concerns grow, cruise lines face increasing scrutiny. The International Maritime Organization (IMO) has set targets to reduce greenhouse gas emissions by 50% by 2050. This means cruise lines must comply with:

- IMO 2020 sulfur cap: Requires low-sulfur fuel or exhaust scrubbers.

- EU Emissions Trading System (ETS): Starting in 2024, ships docking in EU ports must pay for carbon emissions.

- Local port regulations: Some cities (e.g., Venice, Barcelona) are limiting cruise ship access to reduce pollution and overtourism.

For example, the EU ETS could add $10–$20 million in annual costs for a major cruise line. While some costs can be passed to consumers, price-sensitive travelers may choose alternative destinations, impacting load factors.

Pandemic Aftermath and Consumer Confidence

The COVID-19 pandemic exposed the vulnerability of cruise lines to global disruptions. While most lines have resumed operations, rebuilding consumer trust remains a challenge. A 2023 CLIA survey found that 65% of past cruisers are “very likely” to book again, but 35% cited health concerns as a barrier.

To address this, cruise lines have implemented:

- Enhanced sanitation protocols

- Flexible cancellation policies

- Health insurance partnerships (e.g., Royal Caribbean’s “Cruise with Confidence”)

These measures have helped, but they also increase operating costs. For instance, Carnival spends $150 million annually on health and safety compliance.

How Cruise Lines Boost Profitability: Strategies and Innovations

Dynamic Pricing and Revenue Management

Modern cruise lines use sophisticated revenue management systems to optimize pricing. Algorithms analyze:

- Booking pace (how fast cabins fill)

- Historical demand patterns

- Competitor pricing

- Seasonal trends

For example, Royal Caribbean uses AI-driven tools to adjust prices daily. If a 7-day Caribbean cruise isn’t selling well, the system may offer a “buy one, get one 50% off” deal or upgrade incentives. This dynamic pricing has helped increase RevPCD by 8–12% across major lines.

Onboard Experience and Premiumization

To boost onboard spending, cruise lines are investing in high-margin experiences. Royal Caribbean’s Icon of the Seas features:

- Seven distinct neighborhoods

- An indoor water park with 17 slides

- Over 20 dining venues, including Michelin-starred concepts

- Exclusive “Royal Suite Class” with private lounges and concierge

These premium offerings allow Royal Caribbean to charge 20–30% higher base fares and increase onboard spending by 15–20%. Similarly, Norwegian’s “Free at Sea” promotion (free drinks, excursions, Wi-Fi) has boosted RevPCD by 10% since 2020.

Digital Transformation and Personalization

Technology is playing a growing role in profitability. Cruise lines are using:

- Mobile apps: For booking excursions, ordering food, and accessing digital keys.

- AI chatbots: To handle customer inquiries, reducing call center costs.

- Data analytics: To personalize offers (e.g., spa discounts for passengers who visited the gym).

Carnival’s “OceanMedallion” wearable device, which tracks guest preferences and enables contactless payments, has increased onboard spending by 25% on Medallion-enabled ships.

Long-Term Outlook: Sustainability and Growth

Market Expansion and New Demographics

To sustain profitability, cruise lines are targeting new markets. Royal Caribbean is expanding in Asia, with dedicated ships like Spectrum of the Seas serving China. Norwegian is focusing on luxury travelers, with Regent Seven Seas offering all-suite, all-inclusive voyages.

Additionally, cruise lines are attracting younger travelers (35–50) with:

- Adventure cruises (e.g., Royal Caribbean’s “Adventure Ocean” for families)

- Themed cruises (e.g., music festivals, wellness retreats)

- Short 3–4 day itineraries for time-constrained professionals

This demographic shift is paying off. In 2023, 40% of new cruisers were under 50, up from 28% in 2019.

Fleet Modernization and Green Technology

The future of profitability lies in sustainable innovation. Carnival plans to have 11 LNG-powered ships by 2025, while Royal Caribbean aims for net-zero emissions by 2050. Norwegian is testing hydrogen fuel cells and wind-assisted propulsion.

These investments are costly but necessary. As carbon taxes rise and consumer demand for eco-friendly travel grows, green fleets will become a competitive advantage. Analysts predict that by 2030, ships with zero-emission technology could command 10–15% price premiums.

Global Economic Factors

Profitability is also tied to macroeconomic trends. In 2023, inflation and rising interest rates impacted consumer spending. However, cruise lines benefited from “revenge travel”—pent-up demand post-pandemic. CLIA forecasts a record 35 million passengers in 2024, up from 29 million in 2023.

Long-term, the industry’s growth depends on:

- Stable fuel prices

- Favorable exchange rates (many costs are in USD, but revenue is global)

- Geopolitical stability in key regions (Caribbean, Mediterranean, Asia)

| Cruise Line | 2023 Net Income (USD) | RevPCD (USD) | Debt-to-Equity Ratio | Key Profitability Driver |

|---|---|---|---|---|

| Carnival Corporation | $1.5 billion | $245 | 2.1 | Fleet optimization, premium pricing |

| Royal Caribbean Group | $2.1 billion | $287 | 1.8 | New ships, onboard revenue growth |

| Norwegian Cruise Line | $520 million | $275 | 1.5 | Luxury positioning, cost discipline |

So, are cruise lines profitable? The answer is a qualified yes. While the industry has faced massive losses during crises like the pandemic, the underlying business model—driven by high-margin onboard spending, premiumization, and operational efficiency—remains resilient. Major players have returned to profitability, with Royal Caribbean leading the pack, followed by Carnival and Norwegian. However, long-term success depends on overcoming challenges like fuel costs, environmental regulations, and consumer trust.

The future of cruise profitability lies in innovation. From LNG-powered ships to AI-driven revenue management, cruise lines are investing heavily to adapt. For travelers, this means better experiences and more value. For investors, it means a volatile but potentially rewarding sector. And for the planet, it means a race to sustainability that could redefine maritime tourism.

In the end, cruise lines are not just selling vacations—they’re selling a lifestyle. And as long as people dream of exploring the seas, there will be a market for floating resorts. But to thrive in the 21st century, cruise lines must balance profitability with responsibility, innovation with tradition, and luxury with sustainability. The numbers tell a story of recovery, resilience, and cautious optimism. The truth behind the numbers? The cruise industry is profitable—but only if it keeps sailing smart.

Frequently Asked Questions

Are cruise lines profitable in 2024?

Yes, most major cruise lines are profitable in 2024, with companies like Carnival and Royal Caribbean reporting strong post-pandemic recovery. Increased ticket prices, onboard spending, and high occupancy rates have driven revenue growth, though profitability varies by brand and region.

How do cruise lines make money beyond ticket sales?

Cruise lines generate significant revenue from onboard spending, including dining, drinks, spa services, and shore excursions. These high-margin extras often contribute over 30% of total profits, making them a critical part of the business model.

What factors impact cruise line profitability?

Fuel costs, labor expenses, and global economic conditions heavily influence profitability. Additionally, geopolitical instability and weather disruptions can force itinerary changes, affecting both costs and customer satisfaction.

Are smaller cruise lines profitable compared to major brands?

Smaller luxury or niche cruise lines often operate on thinner margins due to higher operating costs and lower economies of scale. However, their premium pricing and loyal customer base can sustain profitability in specialized markets.

How do cruise lines maintain profitability during low seasons?

To offset low-season dips, cruise lines offer discounts, repositioning cruises, and themed voyages to attract travelers. They also optimize costs by adjusting staffing and port schedules while maximizing onboard revenue streams.

Do environmental regulations affect cruise line profits?

Yes, stricter emissions rules and sustainability initiatives require costly upgrades to ships and operations. While this impacts short-term profits, compliance helps avoid fines and appeals to eco-conscious travelers, supporting long-term viability.