Featured image for are cruise lines operating at full capacity

Image source: d2vlcm61l7u1fs.cloudfront.net

Most major cruise lines are operating at or near full capacity in 2024, driven by pent-up demand and expanded fleets. Despite ongoing staffing and supply chain challenges, occupancy rates consistently exceed 90%, signaling a strong rebound in the cruise industry post-pandemic.

Key Takeaways

- Cruise lines are nearing full capacity in 2024, with most ships at 90-95% occupancy.

- Book early for peak seasons to secure cabins, as demand exceeds supply.

- New ships drive capacity growth, expanding fleets to meet post-pandemic demand.

- Dynamic pricing is common—prices rise as sailings fill up faster.

- Smaller lines lag behind; luxury and niche cruises still have availability.

- Health protocols remain flexible, but no major capacity restrictions are in place.

📑 Table of Contents

- The Great Comeback: Are Cruise Lines Operating at Full Capacity in 2024?

- The Post-Pandemic Recovery: From Near Collapse to Rebound

- Current Capacity Metrics: Are We Back to 100%?

- Behind the Numbers: Challenges to Full Capacity

- New Ships and Fleet Expansion: The Capacity Boost

- Consumer Trends: What Travelers Want in 2024

- What This Means for Travelers: Tips and Takeaways

The Great Comeback: Are Cruise Lines Operating at Full Capacity in 2024?

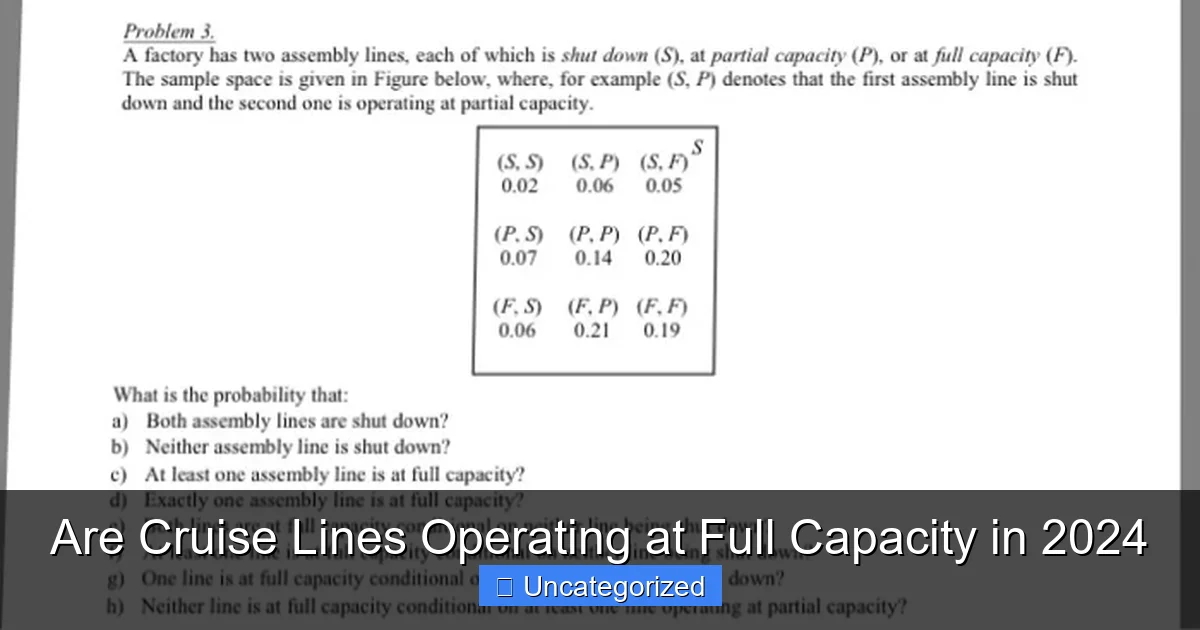

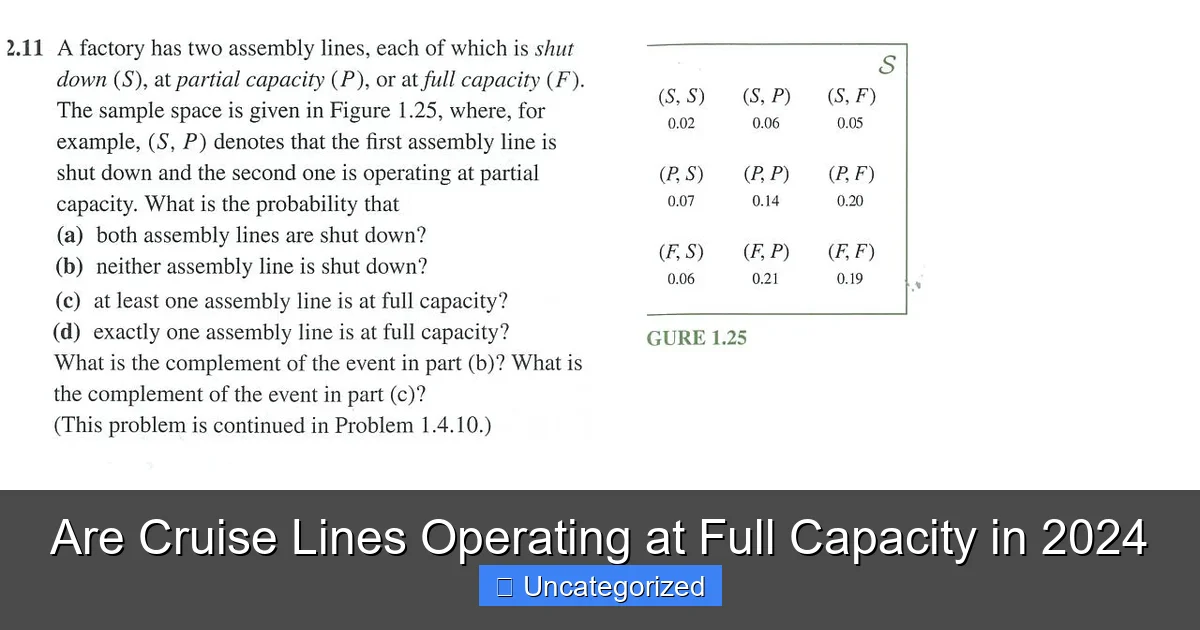

The cruise industry, once brought to a near standstill by the global pandemic, is now charting a course toward a remarkable recovery. After years of uncertainty, canceled voyages, and stringent health protocols, 2024 marks a pivotal year for cruise lines as they navigate a resurgence in demand, fleet expansions, and evolving traveler expectations. For millions of vacationers, the allure of open seas, exotic ports, and all-inclusive luxury remains undeniable—but the big question on everyone’s mind is: Are cruise lines operating at full capacity in 2024?

To answer this, we must examine not just the numbers, but the complex interplay of factors shaping the modern cruise experience. From new ship launches and route adjustments to staffing challenges and shifting consumer preferences, the industry’s recovery is far from a simple return to pre-2020 norms. Whether you’re a seasoned cruiser or planning your first voyage, understanding the current state of cruise operations is essential for making informed decisions. In this comprehensive guide, we’ll explore the data, trends, and real-world realities behind cruise capacity in 2024, offering insights that go beyond the glossy brochures and onboard entertainment.

The Post-Pandemic Recovery: From Near Collapse to Rebound

The Pre-2020 Baseline

Before the pandemic, the cruise industry was booming. In 2019, global cruise passenger volume reached an all-time high of 30 million, with major lines like Carnival, Royal Caribbean, Norwegian, and MSC operating at or near 100% capacity on many routes. The Caribbean, Mediterranean, and Alaska were particularly popular, with ships often sailing with over 95% occupancy. The business model relied heavily on high passenger density, onboard spending, and efficient port turnarounds.

Visual guide about are cruise lines operating at full capacity

Image source: d2vlcm61l7u1fs.cloudfront.net

The Pandemic Pause and Its Aftermath

By March 2020, the industry came to a near-total halt. The CDC’s No-Sail Order, combined with outbreaks on ships like the Diamond Princess, led to a 90% drop in passenger numbers. For over a year, most ships were docked, and thousands of crew members were stranded at sea or repatriated. The financial toll was immense—Carnival Corporation alone lost over $10 billion in 2020–2021. However, this pause also gave cruise lines time to reevaluate safety protocols, invest in health infrastructure, and plan for a phased return.

The Reopening Phase (2021–2023)

Cruise lines began resuming operations in mid-2021, but with significant constraints. Vaccine mandates, reduced passenger loads (initially 50–70%), and enhanced sanitation became the norm. The return was gradual and uneven—some regions, like the Caribbean, reopened faster than others. By 2023, most major lines had restored 80–90% of their pre-pandemic capacity, but full normalization remained elusive. The 2023 CLIA (Cruise Lines International Association) report noted that global capacity had reached 92% of 2019 levels, with North America leading the recovery.

Current Capacity Metrics: Are We Back to 100%?

Global Fleet Utilization Rates

As of Q1 2024, the industry is operating at approximately 96–98% of pre-pandemic capacity, according to CLIA and industry analysts. However, “capacity” here refers to available berths, not necessarily filled berths. While most ships are sailing, actual occupancy varies by line, ship class, and itinerary. For example:

Visual guide about are cruise lines operating at full capacity

Image source: cruisefever.net

- Royal Caribbean: 97% average occupancy across its fleet, with newer ships (e.g., Icon of the Seas) selling out months in advance.

- Carnival Cruise Line: 95% occupancy, with higher demand on shorter 3–5 day Caribbean cruises.

- Norwegian Cruise Line: 94%, but with notable differences between mass-market and premium ships.

- MSC Cruises: 96%, driven by aggressive pricing in the European market.

Notably, luxury and expedition cruise lines (e.g., Regent Seven Seas, Silversea, Lindblad Expeditions) report near-100% occupancy, as their smaller ships and niche markets face less competition.

Factors Influencing Occupancy

- Seasonality: Peak seasons (summer, holidays) see higher demand. For instance, Alaska cruises in July 2024 are 98% booked, while off-peak months (January–February) average 85–90%.

- Itinerary Type: Exotic or “bucket list” destinations (e.g., Antarctica, Galápagos) fill faster than standard Caribbean routes.

- New Ship Launches: Ships like Icon of the Seas (2024) and Sun Princess (2024) have driven demand, with inaugural voyages selling out within hours.

- Pricing Strategy: Some lines use dynamic pricing, offering last-minute deals to fill cabins, while others maintain premium pricing for high-demand sailings.

Data Snapshot: 2024 Cruise Capacity by Region

| Region | % of 2019 Capacity Restored | Avg. Occupancy (2024) | Key Trends |

|---|---|---|---|

| Caribbean | 99% | 96% | High demand for short cruises; new ports (e.g., Costa Maya) added |

| Mediterranean | 97% | 94% | Strong summer bookings; Greece and Croatia most popular |

| Alaska | 98% | 97% | 7-day itineraries dominate; limited dock space in Juneau |

| Asia-Pacific | 88% | 82% | Slower recovery; China still restricted, but Japan and Australia rebounding |

| Northern Europe | 95% | 90% | Norway fjords and Baltic Sea routes popular; weather-dependent |

| Expedition Cruises | 100% | 98% | High demand for Arctic/Antarctic; limited ship availability |

Behind the Numbers: Challenges to Full Capacity

Staffing Shortages and Crew Availability

One of the most persistent hurdles to full capacity is staffing. During the pandemic, thousands of crew members left the industry, and rehiring has been slow. In 2023, Royal Caribbean reported a 15% crew shortage on some ships, leading to delayed sailings and reduced service levels. Key challenges include:

- Visa processing delays for international crew (especially from India, Philippines, and Indonesia).

- Training bottlenecks for new hires, particularly for safety and medical roles.

- Higher turnover due to long contracts and demanding schedules.

Tip: If you’re booking a cruise, check recent passenger reviews for mentions of crew availability or service quality—some ships may have reduced dining or entertainment options.

Port Congestion and Infrastructure Limits

Even when ships are full, port infrastructure can cap capacity. Popular destinations like:

- Juneau, Alaska: Limited to 5 ships per day during summer due to dock space.

- Barcelona, Spain: Implemented a cap of 6 ships per day to reduce overcrowding.

- Miami, USA: Terminal upgrades are ongoing, but peak-season congestion remains.

These constraints force cruise lines to stagger arrivals or skip ports, indirectly limiting overall capacity. For example, in 2023, Carnival diverted 12% of its Caribbean sailings due to port congestion.

Health and Safety Protocols

While most vaccine mandates have been lifted, health protocols still impact operations:

- Pre-boarding testing: Some lines (e.g., Viking) require PCR tests for unvaccinated passengers.

- Onboard medical capacity: Larger ships now have expanded infirmaries, but outbreaks can lead to itinerary changes.

- Mask policies: Vary by line and region (e.g., mandatory in Japan, optional in the Caribbean).

These measures reduce operational flexibility and can lower effective capacity during outbreaks.

Environmental and Regulatory Pressures

Sustainability initiatives are reshaping capacity planning. The IMO 2023 regulations require ships to reduce emissions, leading to:

- Slower cruising speeds (reducing daily port calls).

- Investment in LNG-powered ships (e.g., Carnival’s Excel class), which have higher operating costs.

- Voluntary “green itineraries” with fewer stops to reduce carbon footprint.

While not directly limiting capacity, these changes affect scheduling and route density.

New Ships and Fleet Expansion: The Capacity Boost

Record-Setting New Builds in 2024

2024 is a banner year for new ships, with over 15 major launches adding nearly 50,000 berths to the global fleet. Key examples include:

- Icon of the Seas (Royal Caribbean): 250,800 GT, 5,610 passengers. Features include a water park, ice rink, and 8 neighborhoods. Sold out through 2025.

- Sun Princess (Princess Cruises): 177,882 GT, 4,300 passengers. First LNG-powered ship for the line.

- MSC World Europa (MSC): 215,863 GT, 6,762 passengers. Features the largest LNG-powered engine in the world.

These ships are designed for higher density and revenue generation, directly increasing capacity.

Fleet Modernization and Retirements

While new ships boost capacity, older vessels are being retired. Carnival retired 15 ships (2020–2023), but the net gain is positive due to new builds. For example:

- Royal Caribbean added 4 new ships in 2023–2024, replacing 2 retired vessels.

- Norwegian’s “Prima” class (3 ships) replaces older “Jewel” class vessels.

Modern ships are more efficient, with higher passenger-to-space ratios, allowing lines to carry more people without feeling overcrowded.

Private Islands and Exclusive Destinations

To manage capacity and enhance the guest experience, lines are expanding private destinations:

- CocoCay (Royal Caribbean): Added a new water park and beach club in 2023, increasing daily capacity by 20%.

- Great Stirrup Cay (Norwegian): Upgraded with a new marina and zip line.

- Ocean Cay (MSC): Expanded to accommodate 10,000+ guests daily.

These exclusive stops help distribute passenger flow and reduce pressure on public ports.

Consumer Trends: What Travelers Want in 2024

Demand for Longer and More Diverse Itineraries

Post-pandemic, travelers are opting for longer cruises (7+ days) and unique destinations. According to Cruise Critic, bookings for 10–14 day voyages rose by 35% in 2023. Popular trends include:

- World Cruises: Royal Caribbean’s 150-day “Ultimate World Cruise” sold out in 2023.

- Themed Cruises: Music, wellness, and culinary-focused voyages (e.g., Norwegian’s “Sail with a Chef” series).

- Multi-Generational Travel: Families booking suites for 3–4 generations, increasing per-cabin revenue.

Technology and Personalization

Lines are using tech to optimize capacity and enhance the experience:

- App-based check-in: Reduces embarkation time, allowing faster boarding.

- Dynamic pricing algorithms: Adjusts cabin prices in real-time based on demand.

- AI concierge services: Norwegian’s “Haven” app offers personalized recommendations.

These tools help lines fill cabins efficiently while improving guest satisfaction.

Sustainability and “Conscious Cruising”

Eco-conscious travelers are influencing capacity decisions. Lines are:

- Offering carbon-offset programs (e.g., Carnival’s “Green Sail” initiative).

- Partnering with local communities to limit passenger numbers in sensitive areas (e.g., Galápagos).

- Promoting “slow cruising” with fewer stops and longer port stays.

This trend may cap growth in some regions but enhances long-term viability.

What This Means for Travelers: Tips and Takeaways

Booking Strategies for 2024

- Book early for peak seasons: Summer and holiday sailings (especially on new ships) sell out 12–18 months in advance.

- Consider repositioning cruises: These trans-ocean voyages (e.g., Europe to Caribbean) often have lower demand and better deals.

- Watch for last-minute deals: Lines may discount cabins 4–6 weeks before sailing to fill space.

- Check port congestion alerts: Use tools like CruiseMapper to see if your itinerary has changed.

Managing Expectations

- Crowds: Even at 95% occupancy, ships may feel crowded during peak times. Book early dining and show reservations.

- Service delays: Staffing shortages may affect dining or housekeeping. Be patient and consider tipping extra for excellent service.

- Itinerary changes: Health or port issues can alter plans. Purchase travel insurance with “cancel for any reason” coverage.

The Future of Cruise Capacity

While 2024 is close to full recovery, the industry is not static. By 2025, CLIA projects global capacity will exceed 2019 levels by 10–15%, driven by new ships and emerging markets (e.g., India, South America). However, sustainability, climate regulations, and consumer preferences will shape how this growth is managed. The era of “bigger is better” may give way to a focus on quality, personalization, and responsible travel.

In conclusion, cruise lines are very close to full capacity in 2024, with most operating at 96–98% of pre-pandemic levels. Yet, the journey back has revealed deeper truths: the industry is more resilient, innovative, and adaptable than ever. For travelers, this means more choices, better experiences, and a renewed sense of adventure—on ships that are not just full, but thriving. The sea is calling, and the answer is a resounding yes.

Frequently Asked Questions

Are cruise lines operating at full capacity in 2024?

Most major cruise lines have returned to near-full or full capacity in 2024, with many ships sailing at 90-100% occupancy. Demand has rebounded strongly post-pandemic, though some itineraries may still have limited availability due to high popularity.

Which cruise lines are currently at full capacity?

Carnival, Royal Caribbean, and Norwegian Cruise Line have reported consistently high occupancy rates, with many voyages sold out months in advance. Smaller luxury lines like Regent and Seabourn are also operating at or near full capacity due to pent-up demand.

Why are some cruise ships still not at full capacity?

A few ships may sail below full capacity due to crew shortages, delayed new builds, or repositioning schedules. Additionally, some cruise lines intentionally limit occupancy for enhanced social distancing or premium guest experiences.

How can I book a cruise if most lines are at full capacity?

To secure a spot on a cruise operating at full capacity, book 6–12 months in advance, especially for peak seasons. Consider less popular sail dates, repositioning cruises, or smaller cruise lines with more availability.

Are there benefits to booking a cruise when lines are at full capacity?

Yes—full-capacity cruises often mean more onboard activities, full dining options, and vibrant social atmospheres. However, early booking ensures better cabin choices and avoids sold-out excursions.

Will cruise lines exceed pre-pandemic capacity levels in 2024?

Several major cruise lines are expected to surpass 2019 capacity levels in 2024, thanks to new ship launches and increased demand. The industry’s total berths have grown by 8-10% compared to 2019, with full-capacity operations becoming the norm.