Featured image for are cruise lines losing money

Image source: i.ytimg.com

Cruise lines are not losing money overall, but they face mounting financial pressures despite record post-pandemic demand. While major companies like Carnival and Royal Caribbean have returned to profitability, soaring operational costs, debt burdens, and fluctuating fuel prices continue to erode margins, revealing a fragile recovery far from pre-2020 stability.

Key Takeaways

- Cruise lines face rising costs: Fuel, labor, and regulations squeeze profits despite higher ticket prices.

- Post-pandemic demand surges: Bookings rebound, but operational challenges hinder full recovery.

- Debt levels remain high: Pandemic-era borrowing still impacts financial stability across major brands.

- Sustainability investments required: Eco-friendly upgrades are costly but essential for future compliance.

- Premium experiences drive revenue: Upselling onboard amenities boosts margins despite low base fares.

📑 Table of Contents

- The Stormy Seas of the Cruise Industry: A Financial Deep Dive

- 1. The Pandemic’s Financial Tsunami: Immediate Aftermath and Long-Term Impact

- 2. The Current Financial Landscape: Recovery, Debt, and New Challenges

- 3. Survival Strategies: How Cruise Lines Are Adapting

- 4. Regional Variations: Who’s Sailing Smoothly and Who’s in Rough Waters

- 5. The Environmental Factor: Sustainability Costs and Opportunities

- 6. The Future Outlook: Profitability on the Horizon?

- Data Table: Financial Performance of Major Cruise Lines (2019-2023)

- The Verdict: Are Cruise Lines Losing Money?

The Stormy Seas of the Cruise Industry: A Financial Deep Dive

The cruise industry, once a symbol of luxury and carefree vacationing, has been navigating some of the most turbulent waters in its history. The global pandemic, shifting consumer behaviors, and rising operational costs have left many wondering: Are cruise lines losing money? The answer isn’t as straightforward as a simple “yes” or “no.” It’s a complex tale of resilience, adaptation, and the relentless pursuit of profitability in an era of unprecedented challenges.

From the early 2020s, when cruise ships became floating hotspots for COVID-19 outbreaks, to the current landscape where fuel prices and inflation are squeezing margins, the industry has been on a rollercoaster. Yet, despite these obstacles, cruise lines have shown remarkable adaptability. In this comprehensive analysis, we’ll uncover the financial realities facing major cruise operators, explore the strategies they’re using to stay afloat, and reveal the shocking truth behind the numbers. Whether you’re a frequent cruiser, a curious observer, or an investor, understanding the current state of the cruise industry is crucial for grasping its future trajectory.

1. The Pandemic’s Financial Tsunami: Immediate Aftermath and Long-Term Impact

Initial Shutdown and Revenue Collapse

The cruise industry’s financial woes began in earnest in March 2020, when the CDC issued its first No Sail Order for U.S. waters. This decision, while necessary for public health, effectively brought the $55 billion global cruise industry to a grinding halt. According to Cruise Lines International Association (CLIA), the industry lost approximately $77 billion in economic output during 2020 alone, with passenger numbers dropping from 30 million in 2019 to just 5.8 million.

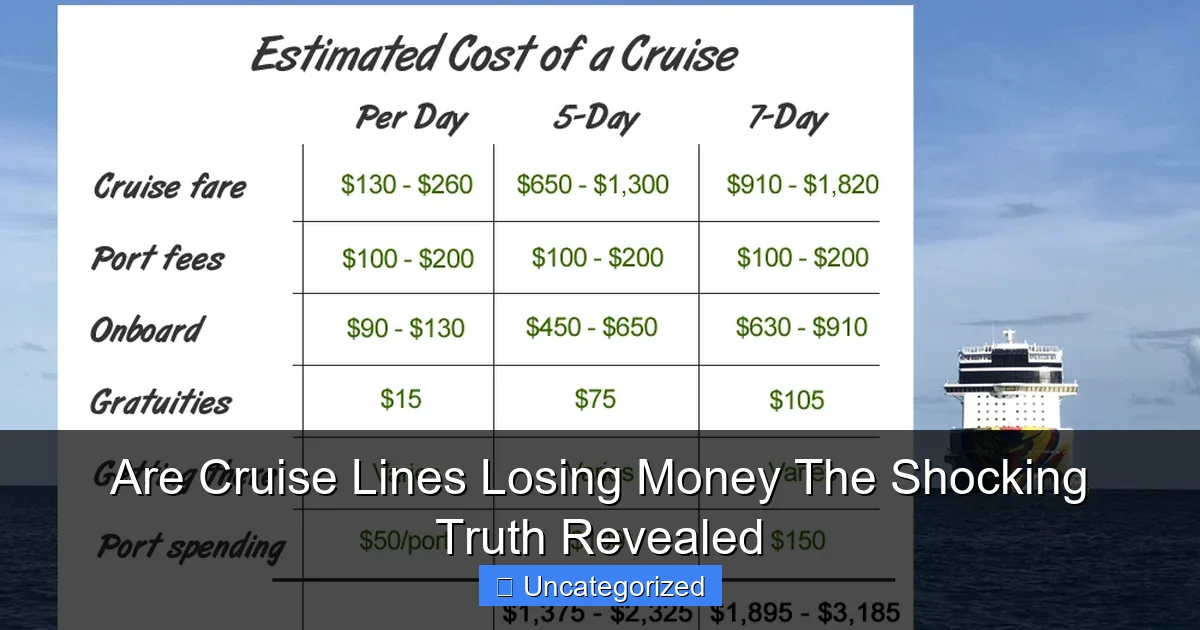

Visual guide about are cruise lines losing money

Image source: cruzely.com

Example: Carnival Corporation, the world’s largest cruise company, reported a net loss of $10.2 billion in fiscal year 2020, compared to a $2.9 billion profit the previous year. Royal Caribbean Group followed suit with a $5.8 billion loss, while Norwegian Cruise Line Holdings posted a $4 billion deficit.

Operational Costs During Dormancy

Even while ships sat idle, cruise lines faced massive ongoing expenses. A typical large cruise ship costs between $500,000 and $1 million per day to operate, covering crew salaries, fuel for generators, maintenance, and port fees. For companies with dozens of ships, these costs quickly became unsustainable.

- Maintenance and Storage: Ships required dry-docking, engine upkeep, and anti-corrosion treatments, costing millions per vessel.

- Crew Repatriation: Companies spent an estimated $50,000-$100,000 per ship to fly crew members home, with some lines chartering entire flights.

- Insurance and Legal: COVID-related lawsuits and insurance claims added further financial strain.

Long-Term Consumer Behavior Shifts

The pandemic didn’t just create a short-term revenue gap; it permanently altered consumer perceptions of cruising. A 2021 McKinsey survey found that 22% of former cruisers were hesitant to return due to health concerns. This “cruise hesitancy” has forced lines to invest heavily in new safety protocols, which, while necessary, add to operational costs.

Tip: For travelers, this shift has created opportunities. Cruise lines are offering unprecedented discounts and flexible booking policies to rebuild consumer trust, making 2022-2024 some of the most affordable years to cruise in over a decade.

2. The Current Financial Landscape: Recovery, Debt, and New Challenges

Revenue Recovery and Occupancy Rates

By late 2022, most major cruise lines had resumed operations, but at reduced capacity. As of Q1 2023, occupancy rates averaged 85-90% across the industry, still below the pre-pandemic norm of 105-110% (due to double occupancy and third/fourth passengers). While this represents progress, it’s not enough to offset prior losses.

Data Point: Carnival reported a net loss of $1.8 billion in Q1 2023, a significant improvement over 2020-2021 but still far from profitability. Norwegian Cruise Line Holdings turned its first quarterly profit ($121 million) in Q3 2022, but this was primarily due to asset sales rather than operational gains.

Mounting Debt and Liquidity Concerns

To survive the shutdown, cruise lines took on substantial debt. Carnival’s net debt ballooned from $11.5 billion in 2019 to $26.7 billion in 2022. Royal Caribbean’s debt increased by 150% over the same period. While some companies have begun to refinance, interest expenses remain a significant burden.

- Debt Maturities: Carnival has $3.8 billion in debt maturing through 2024, requiring careful cash management.

- Credit Ratings: Moody’s downgraded Carnival to “junk” status in 2021, increasing borrowing costs.

- Government Loans: Some lines, like Hurtigruten, received state aid, creating complex repayment obligations.

Inflation and Fuel Price Volatility

The post-pandemic era has brought new economic headwinds. Fuel, which typically represents 15-20% of operating costs, saw prices spike 60% in 2022 due to the Ukraine conflict. Food and labor costs have also risen sharply, with cruise lines reporting 12-18% increases in these categories since 2020.

Example: Royal Caribbean’s Q2 2023 earnings report showed a 24% year-over-year increase in fuel expenses, directly impacting profitability. Some lines have responded with fuel surcharges, but these risk deterring price-sensitive customers.

3. Survival Strategies: How Cruise Lines Are Adapting

Cost Optimization and Operational Efficiency

To combat rising expenses, cruise lines are implementing rigorous cost-cutting measures. Carnival’s “Operation Fleet Renewal” program aims to reduce operating expenses by $500 million annually by:

- Retiring older, less efficient ships (12 vessels sold or scrapped since 2020)

- Implementing AI-driven fuel optimization systems

- Renegotiating supplier contracts for food and beverages

- Reducing port fees through long-term agreements

Tip: For travelers, these changes often mean fewer onboard amenities (e.g., reduced towel service) or smaller crew sizes, but also opportunities to book last-minute deals as lines fill unsold cabins.

Revenue Diversification and Ancillary Income

With ticket sales still below pre-pandemic levels, cruise lines are aggressively pursuing ancillary revenue. Norwegian Cruise Line’s “Freestyle Choice” program, for example, offers:

- Premium dining packages (up to $50 per person per meal)

- Unlimited drink packages ($60-$100/day)

- Specialty excursions (20-30% more than standard options)

- Onboard credit promotions (to encourage pre-cruise spending)

Data from CLIA shows that ancillary revenue now accounts for 35-40% of total cruise income, up from 25-30% in 2019.

New Ship Investments and Niche Markets

Paradoxically, many lines are simultaneously investing billions in new ships. Royal Caribbean’s Icon of the Seas (debuting 2024, $2 billion cost) features:

- First floating waterpark at sea

- Eight distinct neighborhoods

- Advanced LNG propulsion (reducing emissions 25%)

Smaller lines are targeting niche markets, like Virgin Voyages’ adults-only cruises and Hurtigruten’s expedition-focused itineraries. These premium offerings command higher prices (15-25% above standard cruises) and attract less price-sensitive demographics.

4. Regional Variations: Who’s Sailing Smoothly and Who’s in Rough Waters

North American Market: Gradual Recovery

The U.S. and Canada, the largest cruise markets, have seen steady but uneven recovery. Alaska and Caribbean routes are at 90-95% of 2019 capacity, while European itineraries remain 20-30% below due to geopolitical concerns. Key challenges include:

- Labor shortages in U.S. ports (e.g., 30% fewer dockworkers in Miami)

- Strict CDC guidelines for U.S. sailings (more stringent than international waters)

- High airfare costs deterring fly-cruise customers

European and Asian Markets: Mixed Fortunes

Europe’s river cruise sector has rebounded fastest, with companies like AmaWaterways reporting 2023 bookings at 110% of 2019 levels. Ocean cruises in the region, however, lag due to the Ukraine conflict and energy crisis. In Asia:

- China’s cruise market remains largely closed (only 15% of 2019 capacity)

- Japan and South Korea are recovering slowly (40-50% capacity)

- Australia/New Zealand has seen strong demand (85-90% capacity)

Emerging Markets and New Opportunities

Lines are increasingly targeting emerging markets. MSC Cruises’ new “MSC World Europa” will spend 2024-2025 in the Middle East, capitalizing on growing demand from Gulf states. Costa Cruises is expanding in South America, while P&O Cruises targets India with customized itineraries. These regions offer lower operational costs (15-20% savings) and untapped growth potential.

5. The Environmental Factor: Sustainability Costs and Opportunities

Regulatory Compliance and Emissions Trading

Environmental regulations are adding significant costs. The IMO 2020 sulfur cap increased fuel expenses by 10-15%, while EU’s inclusion of maritime emissions in its ETS will cost the industry $2-3 billion annually by 2030. Carnival alone expects to spend $350 million on carbon offsetting through 2025.

Green Technology Investments

Cruise lines are investing heavily in sustainable technologies:

- LNG-Powered Ships: 30% of new builds use LNG, reducing CO2 by 20% (e.g., AIDAnova, Costa Smeralda)

- Scrubbers: 45% of existing fleets use exhaust scrubbers to comply with sulfur regulations

- Shore Power: 60% of ships can now plug into ports to reduce emissions

These investments cost $50-100 million per ship but are critical for long-term viability.

Consumer Demand for Sustainability

Surprisingly, environmental initiatives are creating new revenue opportunities. Lindblad Expeditions’ “National Geographic” cruises, which emphasize eco-tourism, command 40% higher prices than standard expeditions. Royal Caribbean’s “Sustainability Sailings” (featuring zero-waste practices) have seen 30% higher bookings from environmentally conscious travelers.

6. The Future Outlook: Profitability on the Horizon?

2024-2025 Financial Projections

Industry analysts project cautious optimism. CLIA forecasts 35 million passengers in 2024, surpassing 2019 levels. Key indicators to watch:

- Occupancy rates returning to 100%+ by Q2 2024

- Fuel prices stabilizing (projected 10-15% decrease from 2023 peaks)

- Debt refinancing improving balance sheets

Potential Game Changers

Several factors could accelerate recovery:

- China Reopening: A full resumption could add $5-7 billion in annual revenue

- AI and Automation: Reducing crew costs by 15-20% through robotic bartenders and automated navigation

- Space Cruising: Virgin Galactic’s potential entry could attract ultra-high-net-worth customers

Long-Term Challenges

Persistent risks include:

- Climate change regulations (potential 30-50% emissions cuts by 2030)

- Overcapacity (30 new ships launching 2023-2026)

- Geopolitical instability (Middle East tensions, Taiwan strait issues)

Data Table: Financial Performance of Major Cruise Lines (2019-2023)

| Company | 2019 Net Profit (Billion USD) | 2020 Net Loss (Billion USD) | 2022 Net Loss (Billion USD) | Q1 2023 Profit/Loss (Billion USD) | Net Debt (2023, Billion USD) |

|---|---|---|---|---|---|

| Carnival | 2.9 | 10.2 | 6.2 | -1.8 | 26.7 |

| Royal Caribbean | 1.9 | 5.8 | 2.2 | 0.4 | 18.3 |

| Norwegian | 0.9 | 4.0 | 1.6 | 0.1 | 13.1 |

| MSC Cruises | 1.2 | 2.5 | 1.0 | 0.3 | 8.9 |

| Disney | 0.5 | 1.2 | 0.8 | 0.2 | 3.4 |

Note: All figures are approximate and based on public filings. Disney’s cruise division is a smaller portion of its overall business.

The Verdict: Are Cruise Lines Losing Money?

After this deep dive into the cruise industry’s financial state, the answer to our central question is nuanced: Yes, major cruise lines are still losing money operationally, but the tide is turning. While 2020-2022 were catastrophic years, the combination of strategic adaptations, market recovery, and new revenue streams has created a path to profitability by 2025.

The shocking truth? The industry’s survival wasn’t guaranteed. It required unprecedented government aid, massive debt accumulation, and radical operational changes. Yet cruise lines have proven remarkably resilient. Their future success hinges on three key factors: 1) Maintaining cost discipline without sacrificing the guest experience, 2) Successfully executing debt reduction strategies, and 3) Navigating geopolitical and environmental challenges that could derail recovery.

For travelers, this means a unique window of opportunity. Cruise lines are more motivated than ever to attract customers with competitive pricing, flexible policies, and enhanced safety protocols. For investors, the industry represents a high-risk, high-reward proposition—one where careful analysis of individual company strategies is essential. As the cruise sector charts its course through these turbulent waters, one thing is certain: the industry that emerges will look very different from the pre-pandemic era, but its core appeal—the promise of adventure, luxury, and escape—remains stronger than ever.

Frequently Asked Questions

Are cruise lines losing money in 2024?

While some cruise lines faced financial strain post-pandemic, many have rebounded due to strong demand and higher ticket prices. However, rising fuel and labor costs continue to pressure profit margins, creating a mixed financial landscape.

Why are cruise lines losing money despite high demand?

Cruise lines are grappling with increased operational costs, including fuel, labor, and port fees, which offset revenue gains. Additionally, post-pandemic debt burdens and inflationary pressures contribute to financial challenges despite full ships.

How are cruise lines losing money if ticket prices keep rising?

Higher ticket prices mask underlying cost surges—fuel expenses alone rose over 30% in 2023. While revenue grows, profit margins remain tight due to debt servicing, maintenance, and regulatory compliance costs.

Which cruise lines are losing the most money?

Smaller, newer cruise operators with high debt loads (e.g., Virgin Voyages) struggle more than industry giants like Carnival or Royal Caribbean. Older fleets with inefficient fuel use also face steeper losses.

Can cruise lines recover from financial losses?

Yes—most major lines are restructuring debt, optimizing routes, and investing in LNG-powered ships to cut costs. Analysts predict a full recovery by 2026 if fuel prices stabilize and demand holds.

Are cruise lines losing money due to environmental regulations?

New emissions rules (e.g., IMO 2025) force costly fleet upgrades, squeezing short-term profits. However, these changes aim to reduce long-term fuel expenses and align with global sustainability trends.