Featured image for are cruise lines getting bailouts

Image source: globalforestcoalition.org

Cruise lines are not receiving direct government bailouts like during the pandemic, but they continue to benefit from indirect financial support and tax incentives. While headlines often exaggerate, the truth lies in creative financing, loan guarantees, and port fee deferrals that help major cruise companies stay afloat during economic downturns. This nuanced reality reveals how the industry leverages policy tools without the stigma of a traditional bailout.

Key Takeaways

- Cruise lines rarely receive direct bailouts but benefit from broader travel industry relief programs.

- Tax credits and loan guarantees are common indirect forms of financial aid to cruise companies.

- Employment retention programs helped cruise lines avoid mass layoffs during downturns.

- Port and infrastructure funding often supports cruise operations without direct company handouts.

- Always check source data—many “bailout” claims lack full financial context.

📑 Table of Contents

- The Financial Storm: Are Cruise Lines Getting Bailouts?

- Understanding the Cruise Industry’s Financial Structure

- Government Aid: Direct vs. Indirect Support

- Comparing Cruise Lines to Other Industries

- Public Perception and Political Backlash

- The Future of Cruise Industry Aid

- Conclusion: The Truth Behind the Headlines

The Financial Storm: Are Cruise Lines Getting Bailouts?

The cruise industry, once synonymous with luxury and carefree vacations, found itself in uncharted waters during the global pandemic. As ships idled in ports and revenue evaporated overnight, headlines blared about potential government bailouts for cruise lines—some of the world’s largest corporations. But what’s the real story behind the headlines? Are these massive, often foreign-flagged companies receiving taxpayer-funded lifelines, or is the narrative more nuanced than it appears? The answer lies in a complex web of economic realities, corporate structures, and government policies that have evolved over the past few years.

To understand whether cruise lines are getting bailouts, we must first unpack the term “bailout” itself. In economic terms, a bailout refers to emergency financial assistance provided by governments or institutions to prevent a company’s collapse. While some industries—like airlines—received direct aid during the pandemic, cruise lines faced a unique set of challenges: they are global enterprises with intricate tax structures, operate under international maritime law, and are often registered in countries with favorable tax and labor regulations. This complexity has made the question of bailouts far from straightforward, sparking debate among economists, policymakers, and the public. In this article, we’ll dive deep into the truth behind the headlines, separating fact from fiction and exploring how cruise lines have navigated financial turbulence.

Understanding the Cruise Industry’s Financial Structure

Corporate Ownership and Tax Strategies

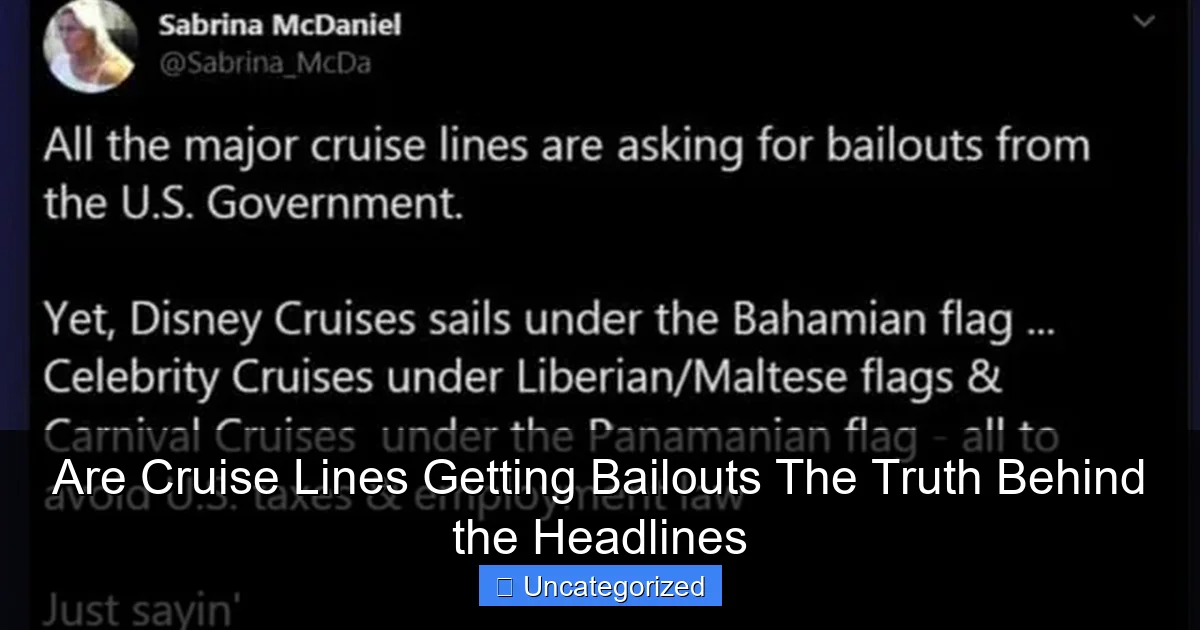

One of the key reasons the bailout debate is so contentious is the cruise industry’s unique financial and legal structure. Major cruise lines such as Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings are publicly traded companies headquartered in the U.S., but their operations span globally. For instance, Carnival Corporation is incorporated in Panama, registered in the UK, and has subsidiaries in the U.S., Germany, and Italy. This structure allows them to benefit from flagging practices—registering ships under “flags of convenience” in countries like the Bahamas, Bermuda, or Liberia, where regulations are more lenient and taxes lower.

Visual guide about are cruise lines getting bailouts

Image source: imageproxy.ifunny.co

This offshore registration has significant implications for taxation. In 2022, Carnival Corporation reported a net income of $1.2 billion, yet paid zero federal income tax in the U.S. due to international tax credits and deductions. Similarly, Royal Caribbean reported a $1.4 billion loss in 2020 but had paid minimal U.S. taxes in prior years. Critics argue that companies benefiting from U.S. ports, Coast Guard protections, and domestic tourism infrastructure should contribute more to public coffers—especially when seeking government aid.

Why Traditional Bailout Models Don’t Fit

Unlike industries such as airlines, which are heavily regulated by domestic governments and rely on national infrastructure, cruise lines operate as global entities. They don’t pay U.S. corporate taxes on international voyages, and their ships are not U.S.-flagged, meaning they aren’t subject to the same labor and safety standards as U.S. vessels. This creates a paradox: while cruise lines generate billions in revenue from American passengers and use U.S. ports, they are not legally required to contribute proportionally to U.S. tax revenues.

As a result, when the pandemic hit, cruise lines couldn’t access the same direct bailout programs available to airlines. The CARES Act of 2020, which allocated $25 billion to passenger airlines, explicitly excluded cruise lines due to their foreign registration and tax status. This exclusion sparked outrage among lawmakers and the public, with critics calling it a loophole for wealthy corporations. However, it also highlighted the industry’s structural differences—bailouts weren’t just a matter of political will; they were legally and fiscally constrained.

Practical Example: The Case of Carnival’s 2020 Debt Surge

When the pandemic halted operations in March 2020, Carnival Corporation’s stock plummeted by over 75%. To survive, the company raised $12.6 billion through a mix of debt and equity offerings. While this wasn’t a government bailout, it did involve government-backed credit markets. For example, Carnival issued $4 billion in bonds backed by the U.S. Federal Reserve’s Corporate Credit Facilities—a program designed to stabilize corporate borrowing during the crisis. Though not direct aid, this access to low-interest, government-supported debt effectively provided a financial cushion.

Tip for travelers: If you’re concerned about the ethics of indirect support, consider researching which cruise lines are U.S.-flagged or pay higher domestic taxes. Smaller operators like Viking Cruises (which pays U.S. taxes on domestic operations) may offer a more transparent financial footprint.

Government Aid: Direct vs. Indirect Support

Direct Bailouts: What the Data Shows

Contrary to popular belief, no major cruise line has received direct taxpayer-funded bailouts from the U.S. government. The CARES Act, Paycheck Protection Program (PPP), and other stimulus packages excluded cruise companies due to their foreign registration and tax avoidance strategies. However, this doesn’t mean the industry received no government assistance at all.

In 2020, the U.S. Treasury allowed cruise lines to participate in the Main Street Lending Program (MSLP), a Federal Reserve initiative aimed at mid-sized businesses. While Carnival, Royal Caribbean, and Norwegian applied, none were approved for MSLP loans. The program required borrowers to be U.S.-based and pay federal income taxes—conditions these companies couldn’t meet due to their offshore structures. This outcome underscored the limitations of traditional aid mechanisms for globally integrated industries.

Indirect Aid: The Hidden Lifelines

While direct bailouts were off the table, cruise lines benefited from indirect government support through several channels:

- Federal Reserve Liquidity Programs: As mentioned earlier, cruise companies accessed low-interest debt through Fed-backed bond markets. In 2020–2021, Carnival raised over $10 billion in debt, much of it at historically low rates due to government intervention in financial markets.

- State and Local Incentives: Some U.S. ports and municipalities provided financial incentives to retain cruise operations. For example, PortMiami offered $15 million in fee deferrals to cruise lines to keep them operating post-pandemic.

- International Aid: Cruise lines received aid from foreign governments. In 2021, Norwegian Cruise Line Holdings received a $500 million loan from the Norwegian government, which owns a 20% stake in the company. Similarly, Costa Cruises (a Carnival subsidiary) received €200 million in Italian state aid.

This indirect support allowed cruise lines to avoid collapse while still maintaining their global operations and shareholder dividends. Critics argue it’s a form of “bailout by proxy,” where governments stabilize financial markets, enabling corporations to survive without direct handouts.

Case Study: The Role of the CDC No-Sail Order

Another indirect form of support came from regulatory delays. The U.S. Centers for Disease Control and Prevention (CDC) issued a “No-Sail Order” in March 2020, halting all cruise operations. While intended to protect public health, the order also shielded cruise lines from liability for passenger outbreaks. Without the order, companies could have faced massive lawsuits from sick travelers. By extending the order for over a year (it wasn’t lifted until July 2021), the CDC effectively gave cruise lines time to restructure debt, renegotiate contracts, and prepare for a safe return to service—all without facing immediate financial collapse.

Tip for investors: Monitor cruise lines’ debt maturity schedules and interest coverage ratios to assess their long-term financial health. Companies with high leverage (e.g., Carnival’s debt-to-equity ratio of 2.5 in 2022) may still be vulnerable to economic downturns.

Comparing Cruise Lines to Other Industries

How Airlines Received Direct Aid

The airline industry’s experience during the pandemic provides a stark contrast to the cruise sector. In 2020, U.S. airlines received $54 billion in direct grants and loans under the CARES Act, with strict conditions: no layoffs, no stock buybacks, and no executive bonuses. Airlines like Delta, United, and American were required to maintain service to small communities and pay back loans with interest.

Why the difference? Airlines are U.S.-flagged, pay federal taxes, and rely on domestic infrastructure (airports, air traffic control). They also employ hundreds of thousands of U.S. workers, making them politically and economically significant. Cruise lines, by contrast, employ mostly foreign crews, pay minimal U.S. taxes, and operate outside U.S. territorial waters. This disparity in regulatory and tax status made direct aid politically untenable.

The Auto Industry Precedent

The 2008–2009 auto industry bailouts (e.g., GM and Chrysler) offer another comparison. These companies received $80 billion in federal loans during the Great Recession, but only after proving they were “too big to fail” and agreeing to major restructuring. Cruise lines, despite their economic impact (the industry supports over 430,000 U.S. jobs, according to CLIA), didn’t meet the same threshold for direct aid. Their global structure and tax practices weakened their case for U.S. taxpayer support.

Data Table: Government Aid to Major Industries (2020–2022)

| Industry | Direct Aid (U.S.) | Indirect Aid | Conditions |

|---|---|---|---|

| Airlines | $54 billion | Fed liquidity programs | No layoffs, no buybacks |

| Cruise Lines | $0 | Fed bond market support, state incentives | None |

| Automakers | $80 billion (2008–2009) | Fed auto supplier programs | Restructuring, job retention |

| Small Businesses | $800 billion (PPP) | State grants | Forgiveness for payroll use |

Public Perception and Political Backlash

The “Bailout” Label: Misleading or Justified?

The term “bailout” has become politically charged. While cruise lines didn’t receive direct taxpayer money, their access to government-backed financial markets and international aid has led to accusations of de facto bailouts. In 2021, Senator Elizabeth Warren criticized Carnival for paying $2.6 billion in dividends to shareholders while laying off U.S. workers and receiving indirect support. “You can’t claim you’re a U.S. company when you want bailouts, but act like a foreign corporation when it comes to taxes,” she stated.

Public opinion has been divided. A 2022 Pew Research survey found that 62% of Americans opposed using taxpayer funds to aid cruise lines, citing concerns about corporate greed and tax avoidance. However, 38% supported aid, arguing that the industry’s economic impact (e.g., port jobs, tourism revenue) justified assistance.

Media Narratives and Sensationalism

Headlines like “Carnival Gets $12 Billion Bailout” or “Taxpayers Fund Cruise Line Luxury” often conflate direct aid with market access. In reality, the $12 billion raised by Carnival was through private bond sales, not government grants. The Federal Reserve’s role was to ensure market liquidity—not to fund the company directly. This nuance is often lost in media coverage, fueling public anger.

Tip for readers: When evaluating news about cruise line aid, check the source of funding. Terms like “government-backed debt” or “Fed liquidity” indicate indirect support, not direct bailouts.

The Future of Cruise Industry Aid

Will Climate Regulations Change the Game?

As climate concerns grow, governments may tie future aid to sustainability goals. The EU’s Fit for 55 package, for example, requires cruise lines to reduce emissions by 55% by 2030. Companies investing in LNG-powered ships or carbon offsets may gain access to green grants—a new form of indirect aid. In 2023, MSC Cruises received €100 million in EU grants for eco-friendly vessel upgrades.

Potential U.S. Policy Shifts

Proposals to reform cruise line taxation are gaining traction. The “Cruise Accountability and Responsibility Act” (CARA), introduced in Congress in 2022, would require cruise lines to pay U.S. taxes on domestic voyages and ban “flags of convenience.” If passed, it could pave the way for future aid programs with stricter conditions.

Long-Term Financial Strategies

Cruise lines are adapting to a post-pandemic world by:

- Reducing debt: Carnival plans to cut its $30 billion debt by 2025 through asset sales and refinancing.

- Expanding domestic itineraries: Royal Caribbean now offers more U.S.-only cruises to avoid international complications.

- Investing in health infrastructure: Norwegian Cruise Line spent $200 million on medical facilities and air filtration systems.

Conclusion: The Truth Behind the Headlines

So, are cruise lines getting bailouts? The answer is nuanced: No, they haven’t received direct taxpayer-funded bailouts like airlines or automakers. However, they have benefited from indirect government support—access to low-interest debt, international aid, and regulatory delays that prevented immediate collapse. Their global structure, tax strategies, and political influence have shaped a unique path to survival, one that avoids the term “bailout” but achieves similar outcomes.

For travelers and taxpayers, the takeaway is clear: the cruise industry’s financial resilience relies on a mix of corporate strategy and government-enabled market stability. As climate regulations and tax reforms loom, the balance between public support and corporate accountability will remain a critical issue. Whether you view this as fair or flawed, one thing is certain—the next chapter in the cruise industry’s story will be shaped not just by profits, but by public trust and policy evolution. In the end, the truth behind the headlines is less about handouts and more about the complex interplay of global finance, governance, and the enduring allure of the open sea.

Frequently Asked Questions

Are cruise lines getting bailouts from the government?

While cruise lines have received some pandemic-related aid, such as loans and tax relief, they haven’t received direct “bailouts” like some industries. Most financial support was part of broader economic relief programs, not exclusive to cruise companies.

Why do people think cruise lines are getting bailouts?

Headlines often confuse pandemic-era loans, tax breaks, and port fee adjustments as “bailouts.” Cruise lines also lobbied for policy changes, fueling speculation about special treatment despite no direct cash injections.

Did major cruise lines like Carnival or Royal Caribbean get bailout money?

Major cruise lines accessed government-backed loans (e.g., the U.S. CARES Act) but repaid them with interest. Unlike airlines, they weren’t granted equity stakes or unconditional grants, distancing them from traditional bailout definitions.

Are cruise lines getting bailouts instead of paying taxes?

Cruise lines often use legal tax structures (like incorporating overseas) to minimize liabilities, but this isn’t a “bailout.” Some pandemic-era tax deferrals were temporary, not permanent write-offs.

How do cruise line bailout claims compare to other travel industries?

Airlines received more direct aid (e.g., payroll grants), while cruise lines relied on loans and market-driven financing. The perception gap stems from cruise lines’ high-profile lobbying and pre-pandemic profitability.

Will future cruise industry bailouts happen if another crisis hits?

Unlikely—governments now prioritize conditions like job retention or environmental reforms for aid. Cruise lines may face stricter scrutiny due to past controversies and industry-specific risks.