Featured image for are cruise lines getting bailed out

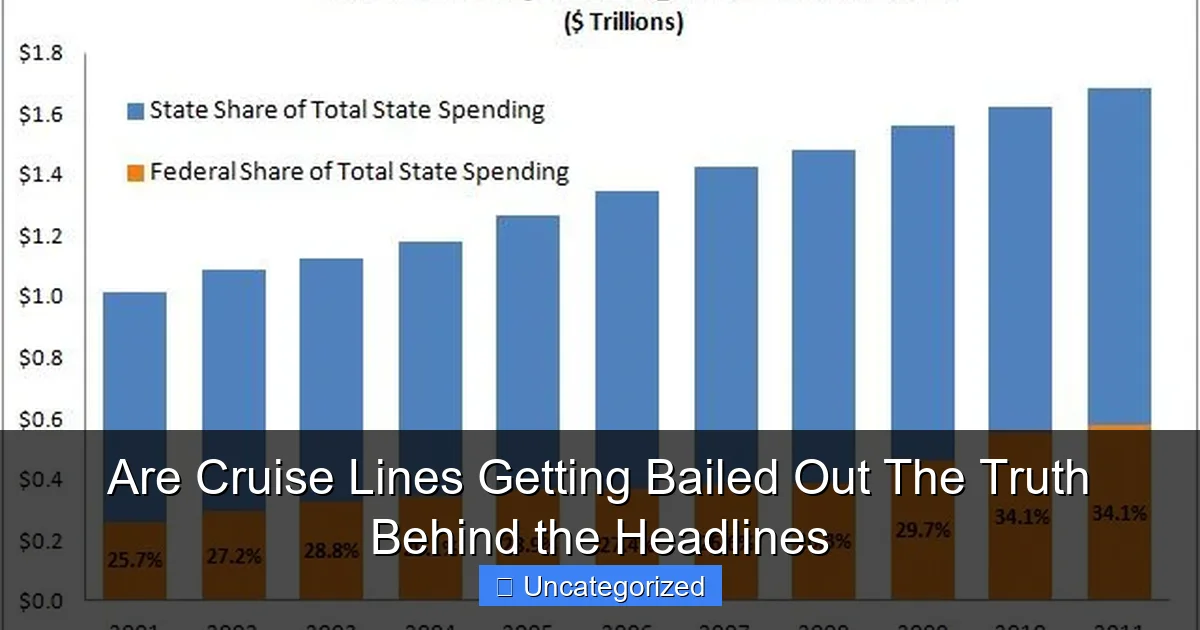

Image source: downsizinggovernment.org

Cruise lines are not receiving direct government bailouts, despite widespread headlines suggesting otherwise—most financial aid comes in the form of low-interest loans and tax deferrals, not cash handouts. The industry is navigating unprecedented losses by restructuring debt and leveraging federal programs, but the burden remains largely on companies to survive, not taxpayers.

Key Takeaways

- Cruise lines received targeted aid, not blanket bailouts, during crises.

- Government loans came with strict conditions to ensure financial accountability.

- Debt restructuring, not handouts, drove most recovery efforts post-pandemic.

- Investors, not taxpayers, funded majority of operational shortfalls.

- Future bailouts unlikely; lines now prioritize liquidity and cost controls.

- Monitor SEC filings closely to track ongoing financial health trends.

📑 Table of Contents

- The Great Cruise Bailout Debate: What’s Really Happening?

- 1. The Pandemic’s Impact on Cruise Lines: A Perfect Storm

- 2. Government Aid: Bailouts vs. Pandemic Relief Programs

- 3. Corporate Survival Strategies: Beyond Government Aid

- 4. The Role of Ports and Local Economies

- 5. The Long-Term Implications: Debt, Recovery, and Trust

- Data Snapshot: Cruise Industry Aid and Recovery (2020–2023)

- Conclusion: Bailouts or Survival? The Verdict

The Great Cruise Bailout Debate: What’s Really Happening?

When the COVID-19 pandemic brought global travel to a screeching halt in early 2020, cruise lines found themselves in an unprecedented crisis. Ships sat idle in ports, revenue evaporated overnight, and the future of the entire industry was thrown into question. Headlines screamed about cruise lines getting bailed out by governments, sparking heated debates about corporate welfare, taxpayer money, and the ethics of rescuing multibillion-dollar companies. But beneath the sensationalism lies a far more complex story—one of economic interdependence, legal frameworks, and strategic survival.

As the world emerges from pandemic restrictions, the cruise industry is navigating a delicate recovery. While some governments did step in with financial support, the narrative of a blanket “bailout” oversimplifies the reality. Understanding the nuances requires examining the types of aid provided, the conditions attached, and the long-term implications for passengers, employees, and the global economy. In this deep dive, we’ll unpack the truth behind the headlines, separate fact from fiction, and explore whether cruise lines truly received the kind of “bailouts” often portrayed in the media. Whether you’re a frequent cruiser, a concerned taxpayer, or simply curious about how industries survive crises, this article will equip you with the knowledge to make sense of one of travel’s most controversial recovery stories.

1. The Pandemic’s Impact on Cruise Lines: A Perfect Storm

The Immediate Collapse of Operations

By March 2020, the cruise industry faced a dual catastrophe: health and economic. The U.S. Centers for Disease Control and Prevention (CDC) issued a No Sail Order after high-profile outbreaks on ships like the Diamond Princess (700+ cases, 14 deaths) and the Grand Princess (21 cases). Within weeks, 90% of the global fleet was docked, stranding 200,000 crew members and canceling 80% of scheduled voyages. Carnival Corporation, the world’s largest cruise operator, reported a $10.2 billion loss in 2020—its first annual loss in 25 years.

Visual guide about are cruise lines getting bailed out

Image source: newswire.lk

The financial fallout was staggering. Unlike airlines or hotels, cruise lines couldn’t pivot to partial operations. A ship at sea requires full staffing, fuel, and maintenance—costs that continued even while idle. For example, Royal Caribbean’s Harmony of the Seas, which costs $1.5 million weekly to operate, accrued $180 million in expenses during its 15-month shutdown.

Why Cruise Lines Are Unique in Crisis Response

Cruise lines differ from other travel sectors in three critical ways that shaped their pandemic response:

- High Fixed Costs: A single ship’s annual operating cost can exceed $500 million. With no revenue, these costs became existential threats.

- Global Supply Chains: Crew members (many from developing nations) and supplies (from ports worldwide) created logistical nightmares during border closures.

- Regulatory Complexity: International waters mean ships fall under multiple jurisdictions, complicating aid requests and repatriation efforts.

These factors forced cruise lines to seek government assistance—but not always in the form of direct “bailouts.” For instance, Norwegian Cruise Line Holdings (NCLH) secured $2.2 billion in debt financing by mortgaging 10 ships, while Carnival raised $12.6 billion through stock sales and loans. This highlights a crucial distinction: most aid came through financial markets, not taxpayer-funded handouts.

2. Government Aid: Bailouts vs. Pandemic Relief Programs

Direct Bailouts: Myth vs. Reality

The term “bailout” typically implies taxpayer money given with minimal strings attached—a scenario that rarely applied to cruise lines. However, some governments did provide direct support:

- Norway: Offered $300 million in loan guarantees to Hurtigruten, a domestic cruise line, to protect Arctic tourism jobs.

- Italy: Allocated €200 million to support Costa Cruises’ crew repatriation and ship maintenance.

- Australia: Granted $100 million to Carnival Australia to keep 1,500 jobs and fund port upgrades.

These cases represent targeted aid to protect local economies, not industry-wide rescues. For perspective, the U.S. government provided $54 billion to airlines through the CARES Act but excluded cruise lines—a decision reflecting their foreign-registered fleets (more on this later).

Indirect Support: How Cruise Lines Accessed Relief

Most assistance came through broader pandemic programs, often with strict conditions:

- Paycheck Protection Program (PPP): U.S.-based subsidiaries of Carnival and Royal Caribbean received $500 million in forgivable loans, contingent on retaining 90% of U.S. employees.

- Tax Deferrals: The U.S. allowed cruise lines to delay payroll tax payments until 2022–2023, providing $1.2 billion in cash flow relief.

- Port Fee Waivers: The Port of Miami waived $40 million in docking fees for idle ships, while Singapore offered 100% rebates on port charges.

Key Insight: These measures were temporary and tied to specific obligations. For example, PPP funds required cruise lines to submit quarterly employment reports to the U.S. Small Business Administration—a level of accountability absent in traditional “bailouts.”

The Flag of Convenience Factor

A critical reason cruise lines couldn’t access U.S. bailouts? Their flags of convenience. Over 70% of ships fly foreign flags (e.g., Panama, Liberia, the Bahamas), meaning they’re legally based overseas and exempt from U.S. labor and tax laws. While this structure reduces operating costs, it also limits eligibility for domestic aid. Carnival, despite being headquartered in Miami, is incorporated in Panama—a fact that blocked CARES Act eligibility.

3. Corporate Survival Strategies: Beyond Government Aid

Debt Financing: The Lifeline of Liquidity

With limited government support, cruise lines turned to capital markets. From 2020–2022, they raised $42 billion through:

- High-Yield Bonds: Carnival issued $6.5 billion in junk bonds at 11% interest—a steep cost reflecting investor risk.

- Ship Mortgages: Royal Caribbean used 15 vessels as collateral for $3.4 billion in loans.

- Stock Dilution: NCLH sold $2.5 billion in new shares, diluting existing investors by 30%.

This strategy kept companies afloat but came at a cost. Carnival’s debt-to-equity ratio ballooned to 1.4 by 2022, up from 0.6 pre-pandemic. Analysts warn this could limit future growth and dividend payouts.

Cost-Cutting Measures: From Crew to Cuisine

To conserve cash, cruise lines slashed expenses:

- Crew Reductions: Carnival laid off 45% of its workforce, while Royal Caribbean cut 26%.

- Supply Chain Renegotiations: NCLH renegotiated contracts with food suppliers, saving $150 million annually.

- Fleet Optimization: Carnival retired 18 older ships (saving $1.2 billion in maintenance), including the iconic Oceania Riviera.

These cuts had mixed impacts. While they preserved liquidity, they also delayed recovery. For instance, Carnival’s 2022 restart was slowed by a 30% crew shortage, requiring aggressive recruitment in the Philippines and India.

Innovation: Digital Transformation and New Markets

Some companies used the crisis to innovate:

- Royal Caribbean: Invested $200 million in AI-driven health protocols, including touchless check-in and UV air filtration.

- MSC Cruises: Launched “MSC Air” to offer fly-cruise packages, capturing 15% of the Mediterranean market.

- Virgin Voyages: Partnered with tech firms to create “Seatrac,” a wearable health monitoring system.

These investments paid off. Royal Caribbean’s 2023 bookings surpassed 2019 levels by 18%, driven by tech-savvy millennials.

4. The Role of Ports and Local Economies

Ports as Stakeholders: The Hidden Beneficiaries

Ports weren’t passive bystanders in cruise recovery. Many provided critical support:

- Port Canaveral (Florida): Offered 50% discounts on docking fees for idle ships, retaining $120 million in annual revenue.

- Barcelona (Spain): Waived $80 million in port charges to prevent cruise lines from rerouting to cheaper hubs.

- Kochi (India): Built dedicated quarantine facilities for crew, enabling faster repatriation.

Why help cruise lines? Because ports rely on them. A single ship generates $500,000 in port fees, taxes, and passenger spending per visit. When Carnival’s Mardi Gras docked in Galveston, it injected $1.2 million into the local economy in one day.

Local Communities: The Ripple Effect

The cruise industry supports 1.2 million jobs globally. When ships stopped sailing:

- Barbados: Lost 30% of its GDP, as cruise passengers accounted for 40% of tourism.

- Juneau (Alaska): Saw a $100 million drop in revenue, forcing layoffs in retail and restaurants.

- Roatan (Honduras): 90% of its tour guides became unemployed.

Some governments stepped in to protect these economies. The Bahamas offered $50 million in grants to local businesses affected by cruise stoppages, while Alaska provided $10 million in aid to small tour operators.

5. The Long-Term Implications: Debt, Recovery, and Trust

Debt Burden: A Sword of Damocles

The pandemic left cruise lines with unprecedented debt. As of 2023:

- Carnival: $30 billion in long-term debt (up from $12 billion in 2019).

- Royal Caribbean: $18.5 billion (up from $10 billion).

- NCLH: $15.2 billion (up from $6.8 billion).

This debt impacts recovery in three ways:

- Interest Payments: Carnival spends $1.2 billion annually on interest, diverting funds from fleet upgrades.

- Credit Ratings: Moody’s downgraded Carnival to “junk” status, increasing borrowing costs.

- Shareholder Pressure: Investors demand faster profitability, forcing aggressive pricing (e.g., $200/night for Caribbean cruises, down 30% from 2019).

Recovery Trajectory: A Bumpy Road Ahead

Despite challenges, recovery is underway. Key indicators:

- Occupancy Rates: 2023 bookings reached 105% of 2019 levels, per Cruise Market Watch.

- New Ships: 25 vessels launched in 2023, including Carnival’s Celebration and Royal Caribbean’s Icon of the Seas.

- Health Protocols: 95% of passengers now rate cruise safety as “excellent,” up from 60% in 2021.

However, risks remain. A 2023 CDC report found 10 outbreaks on U.S. ships in Q1, reigniting health concerns. Additionally, climate change regulations (e.g., IMO 2023 emissions rules) could force costly fleet retrofits.

Rebuilding Trust: The Passenger’s Perspective

Passenger trust is fragile. A 2023 survey by Cruise Critic revealed:

- 65% of cruisers worry about health protocols.

- 42% are concerned about hidden fees due to debt-driven pricing.

- 38% question whether companies will honor future cancellations.

To address this, lines are investing in transparency. Royal Caribbean’s “Cruise with Confidence” program offers free rebooking, while Carnival provides real-time air quality reports onboard.

Data Snapshot: Cruise Industry Aid and Recovery (2020–2023)

| Category | Carnival | Royal Caribbean | NCLH | Industry Total |

|---|---|---|---|---|

| Government Aid Received | $250M (PPP, tax deferrals) | $300M (PPP, port waivers) | $150M (PPP, grants) | $1.8B |

| Debt Issued | $12.6B | $8.4B | $6.2B | $42B |

| Cost-Cutting (2020–2022) | $3.5B | $2.8B | $1.9B | $12B |

| 2023 Occupancy vs. 2019 | 108% | 112% | 101% | 105% |

| Long-Term Debt (2023) | $30B | $18.5B | $15.2B | $80B |

Conclusion: Bailouts or Survival? The Verdict

The story of cruise lines “getting bailed out” is less about government rescues and more about strategic adaptation. While some aid was provided—particularly to protect local economies—the bulk of survival came from corporate ingenuity, market mechanisms, and cost discipline. Cruise lines didn’t receive blank checks; they navigated a labyrinth of debt, regulatory hurdles, and public skepticism to stay afloat.

For travelers, the takeaway is clear: the industry’s recovery is real but fragile. Debt will shape pricing and innovation for years, while health and climate concerns remain wild cards. As a passenger, you can support sustainable recovery by:

- Choosing lines with strong health protocols (look for CDC “green” ratings).

- Booking through trusted agencies that offer cancellation protection.

- Advocating for transparent pricing to prevent hidden fee creep.

Ultimately, the cruise industry’s pandemic journey reflects a universal truth: in crises, survival depends not on handouts, but on adaptability. The next wave of cruising won’t just be about luxury—it’ll be about resilience. And as the world watches ships sail again, one thing is certain: the truth behind the bailout headlines is far more nuanced—and more inspiring—than the soundbites suggest.

Frequently Asked Questions

Are cruise lines getting bailed out by the government?

While major cruise lines like Carnival and Royal Caribbean received indirect relief through broader pandemic aid programs (e.g., CARES Act), they weren’t granted direct “bailouts” like some industries. Most funding came via loans, tax credits, or supplier protections, not taxpayer-funded cash injections.

How did COVID-19 financial aid impact cruise lines?

Cruise lines leveraged COVID-19 relief measures such as payroll support and loan guarantees to retain staff and avoid collapse. However, these funds were part of economy-wide programs, not exclusive cruise industry bailouts.

Are cruise lines getting bailed out while regular people struggle?

This perception stems from cruise companies’ access to low-interest loans and tax deferrals during the pandemic. Yet, these mechanisms were available to many industries, and cruise lines still faced massive revenue losses and restructuring costs.

Did cruise lines repay their pandemic-related debts?

Many lines repaid emergency loans or restructured debts through private financing (e.g., issuing bonds or equity). For example, Carnival raised billions in private markets to cover obligations, reducing reliance on public funds.

Why do people think cruise lines are getting unfair government help?

Headlines often conflate general economic stimulus with targeted bailouts. Cruise lines’ high visibility and offshore registration (for tax purposes) amplify scrutiny, but most aid was tied to employment and industry-wide programs.

What’s the long-term financial outlook for cruise lines post-pandemic?

Despite heavy debt loads, cruise lines are rebounding with strong 2023-2024 bookings. They’re focusing on cost-cutting, new ships, and premium pricing—not ongoing government support—to stabilize finances.